i was literally thinking the SAME EXACT thing last night(!) during my review - take the Jan gains and decrease positions/risk before Q2 by reserving more cash.I closed 12/31 820/600s in my son's account for >95% profit. Surprisingly little value for 12/31 900s. I'm confident on a production beat and 900 holding on 1/7. I will probably open 1/7 600/900s for him on Monday. Timing will depend on early price action - I'm hoping for a little dip to increase the values, at which point I might even drop back to 850s of premiums are good enough. After we hit the ER in later January, I will back away from chasing premiums and focus more on being >20% OTM for the spring time drop.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Has anyone tried selling diagonal BPS? The same idea as using a DITM LEAP to sell CCs against, but instead using a FOTM long put to lower collateral needed to sell weekly short puts against.

It occurred to me that if already doing wide spreads with FOTM long puts, there's not much difference between buying say a 1/7 500p for $0.12 compared to a 1/21 500p for $0.35. But the 1/21 expiration means you could use the same long put to cover 3 weeks in a row of weekly short puts.

I think the main benefit would be that if you have to roll your short leg out a week, you just keep the same long leg - so you can roll it almost as if it was a naked put and actually free up as much margin as you can roll it down for, since the long put doesn't change. And if we get a black swan, a FOTM long put 3 weeks out will gain more than a FOTM weekly long put, which could still expire worthless and will need to be replaced with a now more expensive long put for the following week. And you save on commissions and bid-ask slippage with fewer transactions.

It occurred to me that if already doing wide spreads with FOTM long puts, there's not much difference between buying say a 1/7 500p for $0.12 compared to a 1/21 500p for $0.35. But the 1/21 expiration means you could use the same long put to cover 3 weeks in a row of weekly short puts.

I think the main benefit would be that if you have to roll your short leg out a week, you just keep the same long leg - so you can roll it almost as if it was a naked put and actually free up as much margin as you can roll it down for, since the long put doesn't change. And if we get a black swan, a FOTM long put 3 weeks out will gain more than a FOTM weekly long put, which could still expire worthless and will need to be replaced with a now more expensive long put for the following week. And you save on commissions and bid-ask slippage with fewer transactions.

This is the challenge - finding one. Anybody in the Portland, OR area know somebody?Now I need to find one that knows in and out of stocks/investing.

Live and learn. At least here there are others to learn with and from, rather than being out in the wilderness and need to figure it all out yourself, or read every book in sight on your own.I guess we learn over time.

I have thought about it. So far I haven't done it because I don't know what the SP will be in three weeks, and if I will be doing the same spread at that point. I also haven't tested to see if the margin requirement works out the same (but I assume it does).Has anyone tried selling diagonal BPS? The same idea as using a DITM LEAP to sell CCs against, but instead using a FOTM long put to lower collateral needed to sell weekly short puts against.

It occurred to me that if already doing wide spreads with FOTM long puts, there's not much difference between buying say a 1/7 500p for $0.12 compared to a 1/21 500p for $0.35. But the 1/21 expiration means you could use the same long put to cover 3 weeks in a row of weekly short puts.

I think the main benefit would be that if you have to roll your short leg out a week, you just keep the same long leg - so you can roll it almost as if it was a naked put and actually free up as much margin as you can roll it down for, since the long put doesn't change. And if we get a black swan, a FOTM long put 3 weeks out will gain more than a FOTM weekly long put, which could still expire worthless and will need to be replaced with a now more expensive long put for the following week. And you save on commissions and bid-ask slippage with fewer transactions.

Knightshade

Well-Known Member

I have thought about it. So far I haven't done it because I don't know what the SP will be in three weeks, and if I will be doing the same spread at that point. I also haven't tested to see if the margin requirement works out the same (but I assume it does).

yeah, spread width was my reservation about that too....

Like say I was targeting -900 for week 1, and I bought a 700 put per contract I wanna do... ok, great...but if the SP keeps climbing in weeks 2, 3, etc and I still want to do $200 spreads, I'm out of luck without rolling my long put up anyway.

If in week 2, 3, etc the SP keeps declining, and I still want to do $200 spreads, I'm out of luck without rolling my long put down anyway.

I guess if you're doing WAY OTM long puts, like +300/-$900 you may not need to roll the long leg as often if you're ok with the spread being 600 one week and either 500 or 700 the next or whatever and with the changes to margin or locked cash each time that comes with it, but otherwise not seeing the upside to not doing both on the same schedule.

It's very different from selling calls against LEAPs, because there's no margin or reserve cash needed at all for those....thus the width of the spread from week to week doesn't matter at all as long as your short leg is above your long one.

Put spreads the width directly impacts margin (or cash) lockup.

DaBoosterCali

Member

I learn so much from replies like this. Thank youNot-advice: BTO 500 1/7 Puts to cut your margin/cash requirements in half by making a spread, then double the # of 950 1/7s with equal number of purchased 500s. No problem rolling even with an SP drop to 800.

The last few weeks were very educational for me. I learned the power of BPS with wide spreads.

11/30 opened a 12/10 200 wide BPS at 950 @ 5.38 when SP was 1130, very low delta 0.07. Nice safe hands off trade. Then the month long Elon stock sale is announced.

12/6 when SP hit 960 rolled to 12/17 down at out to 920 @ 5.00 at delta .25, happy to make some money.

12/10 at SP 1000 rolled to 12/23 down and out to 910 @ 5.68, still making money but more nervous with increasing DTE.

12/14 at SP 955, rolled to 12/31 down and out to 900 @ 5.90 at delta 0.3, but increasing DTE.

12/17 at SP 900, rolled 1/7 down but no change to 900 @ 8.00, increasing DTE.

Then comes the drop 12/21/21 to <900.

Do I roll forward but continue to increase the DTE?

I choose to do nothing, watching my not advice mentors still holding 12/23 trades.

I have so much to learn.

11/30 opened a 12/10 200 wide BPS at 950 @ 5.38 when SP was 1130, very low delta 0.07. Nice safe hands off trade. Then the month long Elon stock sale is announced.

12/6 when SP hit 960 rolled to 12/17 down at out to 920 @ 5.00 at delta .25, happy to make some money.

12/10 at SP 1000 rolled to 12/23 down and out to 910 @ 5.68, still making money but more nervous with increasing DTE.

12/14 at SP 955, rolled to 12/31 down and out to 900 @ 5.90 at delta 0.3, but increasing DTE.

12/17 at SP 900, rolled 1/7 down but no change to 900 @ 8.00, increasing DTE.

Then comes the drop 12/21/21 to <900.

Do I roll forward but continue to increase the DTE?

I choose to do nothing, watching my not advice mentors still holding 12/23 trades.

I have so much to learn.

samppa

Active Member

A bit OT

Got the Holiday update yesterday for my Model Y. It was awesome!! Now we have live sentry and megaphone in Europe!

V11 is amazing! Really nicely designed new UI.

Things coming soon:

- Berlin and Austin opening

- q4 and FY2021 p&d

- er for q4 /fy2021

- new roadmap for products

It's looking really good for 2022. Gonna hold on to those assigned shares that were bought on margin for now.

Merry christmas gang, have a good new year!

Got the Holiday update yesterday for my Model Y. It was awesome!! Now we have live sentry and megaphone in Europe!

V11 is amazing! Really nicely designed new UI.

Things coming soon:

- Berlin and Austin opening

- q4 and FY2021 p&d

- er for q4 /fy2021

- new roadmap for products

It's looking really good for 2022. Gonna hold on to those assigned shares that were bought on margin for now.

Merry christmas gang, have a good new year!

I've noticed an interest in doing weeklies in this topic. I've been trying some setups on a quiet Saturday, but what I notice is that for a week with puts or calls 20% OTM, youre looking at low returns with high chances and high losses with low chances.Interesting setup.

I followed your suit, 5 -1250c +1390c gave me an interesting return within my margin.

How do some of you maximise returns? Sell multiple contracts? For instance 5x -855p (+455p)? This increases the possible profits, but also increases the possible losses.

I've done this 5x -1250c +1390c but am second guessing myself because I feel I've opened myself to a pretty big risk. Obviously, once dec 31 rolls around at 1100 I'd be very happy, but what if it doesn't

Correct. Spreads allow you to sell more contracts, but that increases the possible losses. That is why some of us think it is important to use wide spreads that give you more ability to roll.I've noticed an interest in doing weeklies in this topic. I've been trying some setups on a quiet Saturday, but what I notice is that for a week with puts or calls 20% OTM, youre looking at low returns with high chances and high losses with low chances.

How do some of you maximise returns? Sell multiple contracts? For instance 5x -855p (+455p)? This increases the possible profits, but also increases the possible losses.

I've done this 5x -1250c +1390c but am second guessing myself because I feel I've opened myself to a pretty big risk. Obviously, once dec 31 rolls around at 1100 I'd be very happy, but what if it doesn't

I have been badly burned with BCS because TSLA has a very high theoretical upper limit. $2000 or $3000 SP in the next year is possible. BPS are safer because any drop should be short lived and limited in degree given >50% growth rate and FSD in the near future.

I would add that I do change my strategy a little based on where we are in the quarter and what I am expecting. 12/31 BPS 20% below SP aren't paying out as well as I would like. I am confident in Q4 numbers, so I am going out an extra week right now. I will also be more aggressive, if the numbers are good, going into the ER in late January. After that I will become much more cautious with my BPS because we seem to drop in the spring no matter how good the Q4 numbers are.

I've noticed an interest in doing weeklies in this topic. I've been trying some setups on a quiet Saturday, but what I notice is that for a week with puts or calls 20% OTM, youre looking at low returns with high chances and high losses with low chances.

How do some of you maximise returns? Sell multiple contracts? For instance 5x -855p (+455p)? This increases the possible profits, but also increases the possible losses.

I've done this 5x -1250c +1390c but am second guessing myself because I feel I've opened myself to a pretty big risk. Obviously, once dec 31 rolls around at 1100 I'd be very happy, but what if it doesn't

Don't worry too much about those 5 x p1250 12/31 you sold. Still a long way to go: a 185 point rise in 5 days. And it needs to break ATH too. If the stock doesn't move much on Monday or Tuesday you can probably already close the position with 50% profit. But you can also let it run. In the unlikely case the stock goes to 1250 next week you can roll the position one week out to a higher strike. If necessary you can keep on rolling out. But I dont think it will be necessary. If you need advice, you can always send me a PM (as we talked about option strategies before).

Yeah, what you are saying is identically to what I was thinking: it's highly unlikely that next week we'd break through ATH again already.

My worry is more that in case it would happen, and I wouldn't close or roll, potential loss is high because it's the widest spread I've set up. And then x5'd because returns looked low.

I mean, seeing max loss (<1% chance) of +8000% is a lot, and then this cartoon comes to mind:

I mean, do I know what I'm doing or am I just greedy and think this can be free money?

I also went to double check because you mentioned p1250 but they're 5x -1250c +1390c.

I use IBKR and like the performance graphs to visualise risk vs reward.

My worry is more that in case it would happen, and I wouldn't close or roll, potential loss is high because it's the widest spread I've set up. And then x5'd because returns looked low.

I mean, seeing max loss (<1% chance) of +8000% is a lot, and then this cartoon comes to mind:

I mean, do I know what I'm doing or am I just greedy and think this can be free money?

I also went to double check because you mentioned p1250 but they're 5x -1250c +1390c.

I use IBKR and like the performance graphs to visualise risk vs reward.

Last edited:

Yeah, what you are saying is identically to what I was thinking: it's highly unlikely that next week we'd break through ATH again already.

My worry is more that in case it would happen, and I wouldn't close or roll, potential loss is high because it's the widest spread I've set up. And then x5'd because returns looked low.

I mean, seeing max loss (<1% chance) of +8000% is a lot, and then this cartoon comes to mind:

View attachment 748316

I mean, do I know what I'm doing or am I just greedy and think this can be free money?

I also went to double check because you mentioned p1250 but they're 5x -1250c +1390c.

I use IBKR and like the performance graphs to visualise risk vs reward.

If these are naked calls (not covered by shares), then in theory your loss could be 5 x $14,000, but for that to happen we need to go to 1390 within a week. That’s extremely unlikely. But if we get close to 1250 and you expect expiry on Friday to be above 1250, you could buy back the calls for a much smaller loss. That would be painful. But you could also roll the position one week out to a higher strike. Why wouldn’t you?

Since you are new to this and need to get a feel for it, my suggestion for your next trade would be to sell just 1 or 2 contracts, preferably puts, and choose strikes that are 25 to 30% OTM. When you gain experience, you can always increase the number of contracts and go less far out.

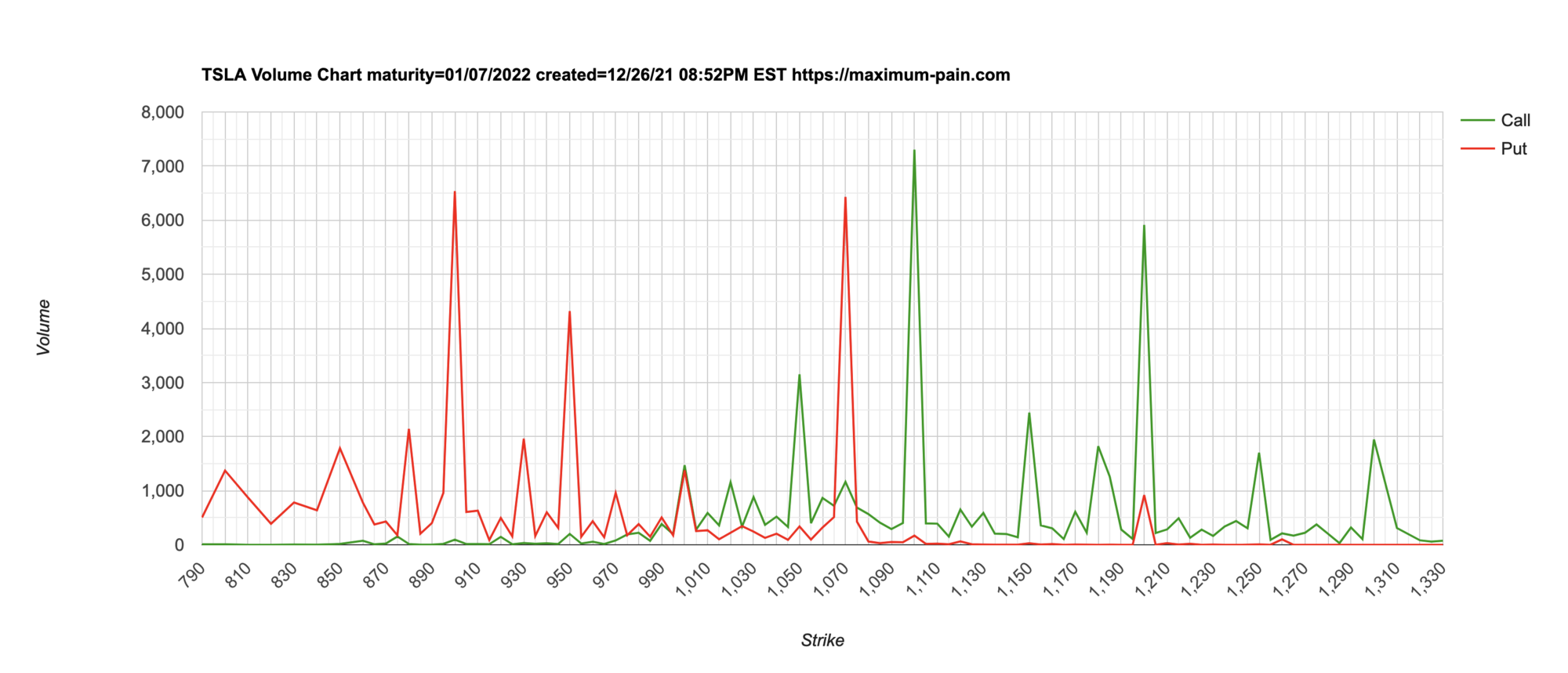

1/7 -p950/+p750 looking pretty safe based on Thursday's data but always fearful defining a safe put on a green day...

You really can't tell anything from the volume chart. (You can't know if those are opens or closes. The highest volume could be a wash and change nothing from the open interest chart.)1/7 -p950/+p750 looking pretty safe based on Thursday's data but always fearful defining a safe put on a green day...

View attachment 748712

We won't have this data until tomorrow morning.

I had 10x 1055cc expiring last Friday that I flip rolled to Puts Friday morning when the stock price reached 1020. I bought back my contracts for $2.50 and sold 1010p for $2.60. That was my first time flipping a call to a put and of course the stock rose to over $1060 and those put expired worthless and I kept the premium and salvaged a losing position. I was ready to roll my 10x 1080cc to next week but babysat them closely and my trigger was $1075.I've noticed an interest in doing weeklies in this topic. I've been trying some setups on a quiet Saturday, but what I notice is that for a week with puts or calls 20% OTM, youre looking at low returns with high chances and high losses with low chances.

How do some of you maximise returns? Sell multiple contracts? For instance 5x -855p (+455p)? This increases the possible profits, but also increases the possible losses.

I've done this 5x -1250c +1390c but am second guessing myself because I feel I've opened myself to a pretty big risk. Obviously, once dec 31 rolls around at 1100 I'd be very happy, but what if it doesn't

I started 2 months ago with 1-2 contracts first and learned to manage losing positions, ramping up to 5 contracts 5%-10%OTM on the put side, 10 contracts 10%-15% OTM and keeping the bigger contracts 30% OTM. I suggest you start with smaller contracts first to learn to salvage losing position by rolling them.

Total not advice from a non expert.

I think some early experience with losing positions would be good newbie "not advice". Winning right out of the gate is the most dangerous part of options trading in my experience. Humility in your trades is probably a good skill to learn right away! Speaking from (negative) experience.I had 10x 1055cc expiring last Friday that I flip rolled to Puts Friday morning when the stock price reached 1020. I bought back my contracts for $2.50 and sold 1010p for $2.60. That was my first time flipping a call to a put and of course the stock rose to over $1060 and those put expired worthless and I kept the premium and salvaged a losing position. I was ready to roll my 10x 1080cc to next week but babysat them closely and my trigger was $1075.

I started 2 months ago with 1-2 contracts first and learned to manage losing positions, ramping up to 5 contracts 5%-10%OTM on the put side, 10 contracts 10%-15% OTM and keeping the bigger contracts 30% OTM. I suggest you start with smaller contracts first to learn to salvage losing position by rolling them.

Total not advice from a non expert.

STO 1325/1525 BCS and 1350/1550 for 12/31. Will sell more if there is more of climb and they go up in value.

Edit: Calls is where all my big losses come from, so I'm happy to make $1 if there is very low risk of ending ITM.

Edit: Calls is where all my big losses come from, so I'm happy to make $1 if there is very low risk of ending ITM.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K