Right there with you. I was hoping to get out of 100 shares @ $900+. I figured I'd write an 850c for Friday on a pop over $900 at the open today. I didn't want to run the risk of a big selloff and at end of the week and not get called away. Now I'm sitting here contemplating selling a $900 for $10. #losing?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

juanmedina

Active Member

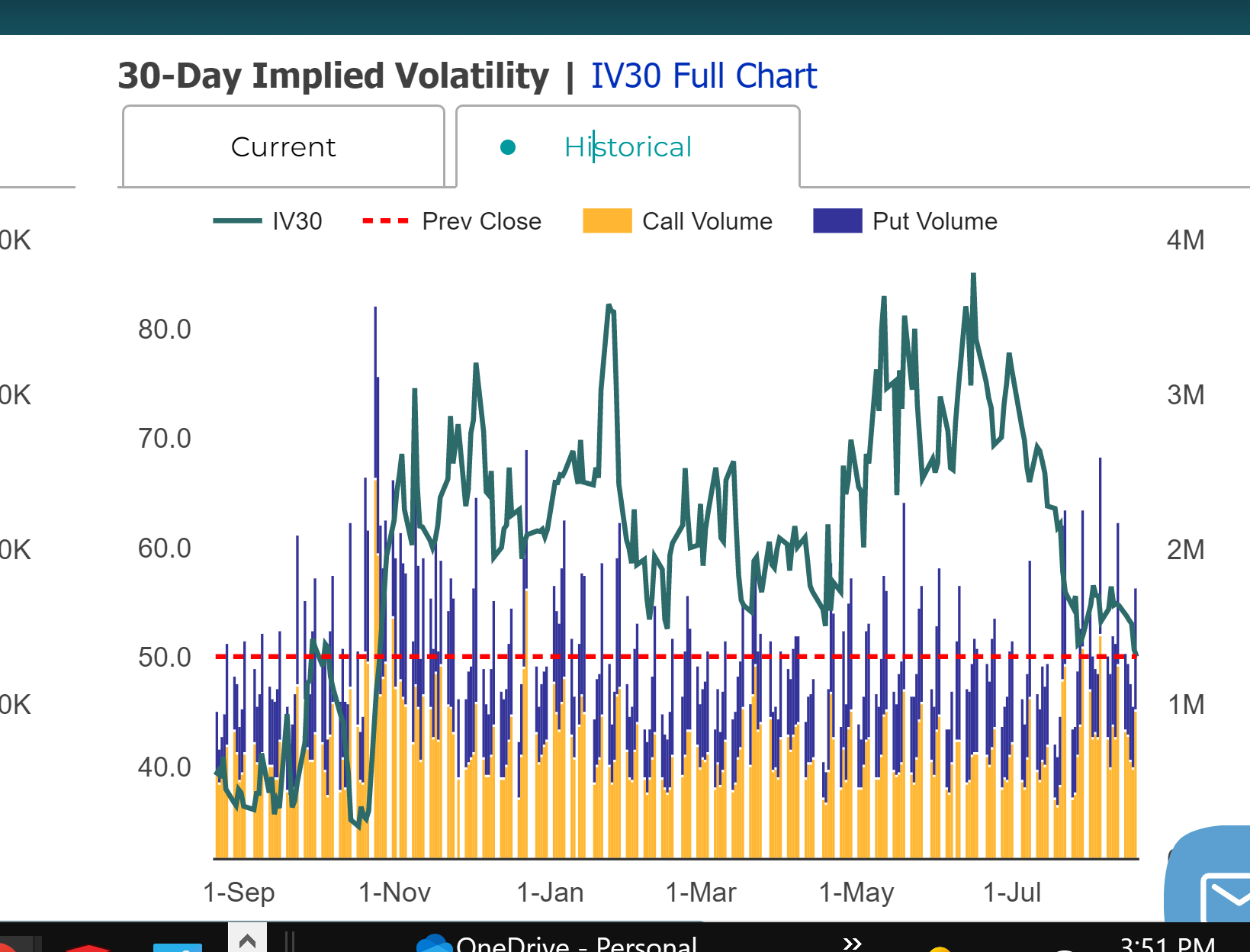

IV seems to be its lowest point for the year  :

:

Maybe I will add some calls and puts

Maybe I will add some calls and puts

dc_h

Active Member

So good time to roll my 9/16 LEAPS out to December or next year!IV seems to be its lowest point for the year:

View attachment 843868

Maybe I will add some calls and puts

Tough call, isn't it? I'm letting my Friday -c900's run, at least until they're 90% profitable. Maybe they expire, maybe they assign, don't care too muchnot-advice

I'm starting to think that the macro story has overtaken the possibility of a short squeeze or the Tesla story dominating the share price in the short term (next couple of weeks). I've been expecting the latter to dominate at least this week and probably next, but I'm starting to think its going to take some more overwhelmingly good financial results for the Tesla story to again be the dominant driver of the share price.

My plan was to more or less wait for the split to happen and see where we stood - maybe close out early if we had a really nice run into the split. We don't have the nice run into the split, but I'm sticking with the original plan and sitting on my hands / waiting for the split.

I did break the sitting on my hands thing, and sell some 900 strike calls on Friday for this week expiration. They're ahead about $10 ($20 in, $10 currently); I lean towards taking the early close / 50% gain in 1 day rather than continuing to hold for later in the week.

EDIT to add: I did it. No need to watch the last hour of trading, I realize a week of income from a 1 day trade, and I'm back to sitting on my hands. So painful. I'm afraid that I'm leaving ~$10 on the table that I'd be earning tomorrow; I really want to be wrong about that.

My bigger picture outlook for this quarter and probably next isn't changed - the macro will be more important to the share price than the Tesla story. The hard thing with this point of view is that if I'm right, then I need to sell at least some of the shares / leaps I own with a plan to buy back when the shares are back in the 700s.

I was faced with this choice a few months back with shares in the 1100s. I made a decision one day to sell at 1130. Instead of selling I sold 1100 strike cc for $48. That cc expired ~worthless when the shares dropped back below 1100. Great result on the cc - if I'd just sold though then I'd have been able to repurchase those shares in the 800s or 700s (I wouldn't have waited for the opportunity to buy in the 600s).

The current decision would be a lot easier if the shares were 1060 instead of 860

What is a little concerning is the risk of holding a large number of $TSLA shares with the potential for more market downside - depends which narrative you subscribe to: bear market is over and this is a retest of support OR the bear market is just beginning

Whichever it is, I'm still very bullish on $TSLA right now, I think the 2nd half of the year will be tremendous for the fundamentals, whether these they buried in the macro noise, remains to be seen

My strategy from here is to keep selling -c900's as long as they give some decent premium, or exercise, after which I'll switch to puts. If the SP dumps into the 700's then I'll continue selling calls but roll down the strike a bit - I have a weekly target from here to hit and can manage that with 30x covered calls without flying too close to the sun. Worse case if we get a sudden rise, I just need to be able to roll back to -c900 or above without losses, as long as I don't sell the shares lower than the face-value purchase price, I'm fine

If, on the other hand, I can anticipate the SP taking-off and ride the shares up, I'll try to do that too - 30th September expiry is perfectly placed for the P&D on the following Monday

Not advice, eh...

I am shocked.

I wanted to sell CCs this morning with a 1000 strike price. I could have gotten 1.50 at around 10 AM when I had the time to look. At the end of the day, when the stock price was relatively similar and I decided to go through, the premium was down to $0.65

now, that’s some IV crush or concerning low interest for call.

I ended up selling CCs for a strike of 960 for the same premium.

looks like we will be retesting some support before moving up again.

I wanted to sell CCs this morning with a 1000 strike price. I could have gotten 1.50 at around 10 AM when I had the time to look. At the end of the day, when the stock price was relatively similar and I decided to go through, the premium was down to $0.65

now, that’s some IV crush or concerning low interest for call.

I ended up selling CCs for a strike of 960 for the same premium.

looks like we will be retesting some support before moving up again.

scubastevo80

Member

Its a good point - we're all in limbo wondering if macro takes over and drags us lower, or folks start realizing that 50% growth YoY is actually worth something. Market cap and the P in P/E are psychological factors hindering a higher valuation in the current environment IMO.Tough call, isn't it? I'm letting my Friday -c900's run, at least until they're 90% profitable. Maybe they expire, maybe they assign, don't care too much

What is a little concerning is the risk of holding a large number of $TSLA shares with the potential for more market downside - depends which narrative you subscribe to: bear market is over and this is a retest of support OR the bear market is just beginning

Whichever it is, I'm still very bullish on $TSLA right now, I think the 2nd half of the year will be tremendous for the fundamentals, whether these they buried in the macro noise, remains to be seen

My strategy from here is to keep selling -c900's as long as they give some decent premium, or exercise, after which I'll switch to puts. If the SP dumps into the 700's then I'll continue selling calls but roll down the strike a bit - I have a weekly target from here to hit and can manage that with 30x covered calls without flying too close to the sun. Worse case if we get a sudden rise, I just need to be able to roll back to -c900 or above without losses, as long as I don't sell the shares lower than the face-value purchase price, I'm fine

If, on the other hand, I can anticipate the SP taking-off and ride the shares up, I'll try to do that too - 30th September expiry is perfectly placed for the P&D on the following Monday

Not advice, eh...

My portfolio is about 60% TSLA through long shares (90%) and Jan'24 $400 LEAPS (10%). I sold my $1080 covered calls today for less than half of what I got for them 2 weeks ago. Over time, I want it below 50% but given what's going on in the world right now, I think TSLA is the safest "growth" stock to be in. What am I doing about that? If we have a quick run up to $1000 I'll likely sell covered calls and/or sell the LEAPS to reduce exposure. If we drop back into the $700s, I'll add LEAPs. I'll also take a look at the RSI to see if we're oversold/overbought and factor that in. IV is too low right now for me to be a short-term seller of options so I'm looking more at medium-term positioning.

TheTalkingMule

Distributed Energy Enthusiast

not-advice

I'm starting to think that the macro story has overtaken the possibility of a short squeeze or the Tesla story dominating the share price in the short term (next couple of weeks). I've been expecting the latter to dominate at least this week and probably next, but I'm starting to think its going to take some more overwhelmingly good financial results for the Tesla story to again be the dominant driver of the share price.

My plan was to more or less wait for the split to happen and see where we stood - maybe close out early if we had a really nice run into the split. We don't have the nice run into the split, but I'm sticking with the original plan and sitting on my hands / waiting for the split.

I did break the sitting on my hands thing, and sell some 900 strike calls on Friday for this week expiration. They're ahead about $10 ($20 in, $10 currently); I lean towards taking the early close / 50% gain in 1 day rather than continuing to hold for later in the week.

EDIT to add: I did it. No need to watch the last hour of trading, I realize a week of income from a 1 day trade, and I'm back to sitting on my hands. So painful. I'm afraid that I'm leaving ~$10 on the table that I'd be earning tomorrow; I really want to be wrong about that.

My bigger picture outlook for this quarter and probably next isn't changed - the macro will be more important to the share price than the Tesla story. The hard thing with this point of view is that if I'm right, then I need to sell at least some of the shares / leaps I own with a plan to buy back when the shares are back in the 700s.

I was faced with this choice a few months back with shares in the 1100s. I made a decision one day to sell at 1130. Instead of selling I sold 1100 strike cc for $48. That cc expired ~worthless when the shares dropped back below 1100. Great result on the cc - if I'd just sold though then I'd have been able to repurchase those shares in the 800s or 700s (I wouldn't have waited for the opportunity to buy in the 600s).

The current decision would be a lot easier if the shares were 1060 instead of 860

In other words, the market action has convinced you it's safe to sell covered calls? I can think of someone who wants that thought in your head!

Billionaire Ken Griffin’s timeline on assembling his $450-million estate, Palm Beach’s largest

Billionaire Ken Griffin of Citadel spent years and $450 million assembling his 25-acre estate in Palm Beach. Here's how he did it. And what's next?

www.palmbeachpost.com

intelligator

Active Member

Today's flat trading formed a broad shallow spread of put gamma topped with slightly tighter and deeper call gamma, net is near zero, tie score. I'm considering a +760/-790 short leg BPS coupled with a -955/+985 BCS tomorrow. Premium wise, +7.4% on the capitol, the paired spreads (IC) end up being delta neutral as well.

Last edited:

With one minor exception I was uncovered this morning. Having closed that one exception today (50% gain) I am now fully uncovered and am planning to wait out at least the split and probably into next week to see the reaction to the split, before I return to selling cc. No change on the plan to wait out the split, despite not liking the way that the week has started.In other words, the market action has convinced you it's safe to sell covered calls? I can think of someone who wants that thought in your head!

Billionaire Ken Griffin’s timeline on assembling his $450-million estate, Palm Beach’s largest

Billionaire Ken Griffin of Citadel spent years and $450 million assembling his 25-acre estate in Palm Beach. Here's how he did it. And what's next?www.palmbeachpost.com

I'm currently overweight shares / leaps from where I'd like to be. Something like 90% shares/leaps instead of the 60% I'd rather be - very much tilted towards a move up. I'm just also starting to see, yet again, a repeat of the many times over the years where all signs point towards "up, up, and away" while the shares don't actually go anywhere, or even go down.

Damn I better watch out, he could get even richer buying my far OTM weeklies. Maybe we should start doing that and we can become billionaires. Lol jk jkIn other words, the market action has convinced you it's safe to sell covered calls? I can think of someone who wants that thought in your head!

Billionaire Ken Griffin’s timeline on assembling his $450-million estate, Palm Beach’s largest

Billionaire Ken Griffin of Citadel spent years and $450 million assembling his 25-acre estate in Palm Beach. Here's how he did it. And what's next?www.palmbeachpost.com

With pre-market down ~$20 at 6:30 ET, thinking to close remaining 9/2 DITM covered calls at market open, and resell later in the week up to 6 months out to recoup the closing costs and get these back OTM (expecting at least some rise through Wednesday’s split). Severely limits income opportunity on these shares, but I took income forward by selling ~ATM in the 700s, and expecting some rolls for credit. Also, possibility to roll down on dips over the period.

Executed early this morning with limit orders about 5% below market open - a large cash requirement hopefully just for a few days.

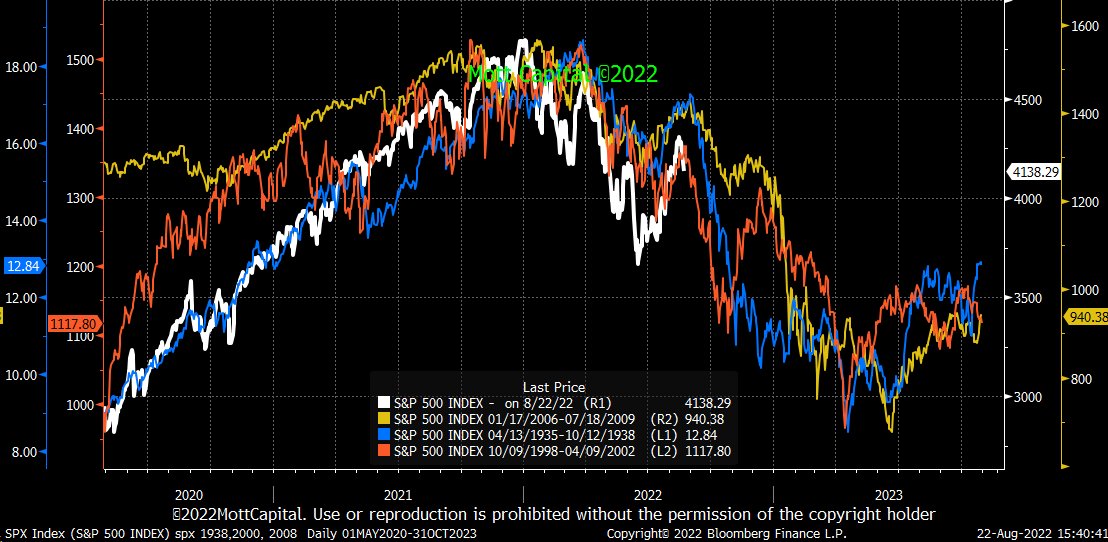

With macros having a big influence on TSLA I keep thinking about this chart.

AquaY

Member

I’ve done it and it worked well but if the stock drops the long leg becomes expensive when rolling.Luckily I kept plenty of capital in reserve and widened the spread as I rolledi am curious if anyone intentionally opens near-ATM super wide BPS (that behaves like CSP)

for ex,

8/26 -p900 x2 is 25 credit, total $5000 income, margin 90k

8/26 +p500/-p900 x3 is 25 credit, total $7500 income, margin 112k, spread 400 wide

50% more income for just slightly more margin

"if i am rolling a CSP forever anyway, why not roll a wide BPS instead? the 700 midpoint is 22% OTM"

Interesting. Comparing WW II, 2008 housing and 2000 dotcom crash to now.

But good cutoff of the COVID-rebound on the left.

Should be on Spurious correlations

willow_hiller

Well-Known Member

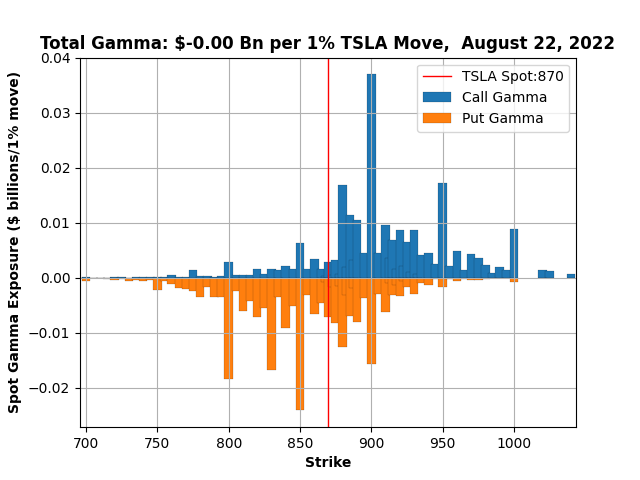

does anyone know how to interpret this chart? TIA!

It's the derivative of the chart right above it, Delta, with respect to the underlying. So if you wanted to know where the change delta was the steepest, the highest point in the gamma curve tells you that inflection point.

As far as practical purposes, it might be useful for delta hedging. If you were right on that gamma inflection point, a small change in the underlying could cause a relatively large change in delta, which means you might need to adjust your position faster than if you were further away from that gamma inflection point.

But it doesn't seem to reveal much information, as peak gamma seems to occur at the SP.

yes. What do you want to know?

They display it in an awful way. It is the same information as the posts from above:

(only that here it is not rounded to 3 decimal places & puts are "flipped" below the axis).

Edit: they really seem to calculate it as a derivative of the delta-graph - but you can get it from the options & open-interest directly..

Sold an $890 for $13.62. #Bullish

Hopefully these shares go into the light on Friday. I'm mega bullish on TSLA but nervous about macros and so the responsible thing is probably to have some cash on hand. I Hate being responsible.

Hopefully these shares go into the light on Friday. I'm mega bullish on TSLA but nervous about macros and so the responsible thing is probably to have some cash on hand. I Hate being responsible.

You're welcome. Nothing breaks the backs of MMs like me selling calls.Sold an $890 for $13.62. #Bullish

Hopefully these shares go into the light on Friday. I'm mega bullish on TSLA but nervous about macros and so the responsible thing is probably to have some cash on hand. I Hate being responsible.

strago13

Member

In the future, you and I should coordinate our sells, since whenever I sell a put, the stock falls off a cliffYou're welcome. Nothing breaks the backs of MMs like me selling calls.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K