AquaY

Member

For $290 that Dead cat would need to be made out of solid rubberThe stock

Does the dead cat have legs to like $290 by the end of next week? Need to start thinking about my 293.33/260 that expires next week.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

For $290 that Dead cat would need to be made out of solid rubberThe stock

Does the dead cat have legs to like $290 by the end of next week? Need to start thinking about my 293.33/260 that expires next week.

retirement acct temporary BW:retirement acct temporary BW: 10/14 -c242.50 +44%; ok to lose shares

retirement acct temporary BW:

- BTC 10/14 -c242.50 closed at +98%

- STO 10/21 -c250; ok to lose shares (edit: closed at MMD, +33% in 25 mins; reopening later)

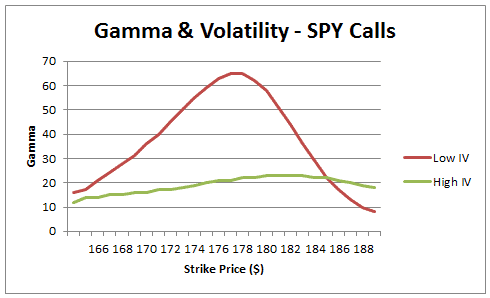

as of right now, highest gamma for 10/21 ~225is

Closed these for .17 , nice 1 DTE winToday I sold ATM 10/14 -225c for $2 , let the MM play their games. Either direction, can expire worthless, can roll if I need to or have the lesser cost shares called away.

If this is a short covering rally, we could end up where we started since it’s not supported by positive news (that I’m aware of). My guess would be the VWAP, which is $212 at the moment

uhmm, imma NEWBIE Trader!Can you please explain what this implies? Does that make $225 the "wall"?

At least you are still working and can fix your mistakes, and buy more shares with new money....Closed my 21/10 240CCs at 1.30 this morning for a +50% profit in 1 day.

Please make the stock rebound at the 52 week low and triple bottom

I can’t survive another streak of 10 red days

At least you are still working and can fix your mistakes, and buy more shares with new money....

Yes and I doubled my annual income with medicolegal expertises and starting replacing joints in a private clinique on November 25th because our public system has waiting list of 3 years. All this new money will be poured into TSLA and to back my underwater puts

Who likes a YOLO? (me!!!!!)

Wanted to buy some calls for next week as we are overdue for a bounce....

Wanted something under 10% away and $230 was just slightly out of it.

Wanted to do 25 contracts to make it worth while and "fun"

Went with the $227.50's at $3.05 each

Fooling around with other stuff like far OTM call sales for 100 contracts before making my purchase.........................

Schwab keeps the amount you have set and I'm dumb, so in for 100 $227.50 calls for next week.....

(please bounce, please bounce, please bounce)

That's a yolo for you!

(not financial advice)

Copied!I like the bet but not sure about YOLO. Given the macro situation it might be prudent to sell half if you get a bump going into earnings next week.

I actually did a 25X diagonal + Nov 22 250/- Jan 23 293.33 for a very small credit. If we get a recovery in the next few weeks my plan is to close out my long position and let 2500 shares called away in case TSLA rallies to 293.33 by Jan 23. Rest of my shares and LEAPS will thank me lol.