Are you saying you sold a juicy Jan '25 -c550, and after an SP drop could roll it to those 12/16/22 CC?Took profit closing 12/16 -c180. Taking @mongo Saturday post non-advice to not look at position but value, I used proceeds to close out Jan '23 -c210 so that I can re-deploy... that position wasn't going to deliver anything more. Thinking to move Jan '25 -c550 in to achieve the same; rather than close for full debit, roll in for half and expire early... but that's 12/16 -c187.5 ... nah.

EDIT: Sent half to 12/16 -c195, other half to same 12/16 -c200.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Thanks for brightening up my week. If we shoot up tomorrow I will sell CCs at the end of the day. Already made my weekly income today. So I am in no rush. Just want to avoid margin calls at $151I strongly advise against selling fresh CC's here. It looks to me we might have completed wave 2 of 3.

The risk : reward is terrible for opening fresh CCs.

If I'm wrong and we go down much further, most you're going to gain is ~ $1 per share

If I'm right and we shoot up with CPI tomorrow, you'll be looking at the biggest spike up within this sequence and there'll be no guarantee it will pullback at a certain level...

Early AM tomorrow will be when last week Tesla insurance registration in China comes out. Could be a catalyst - or not.

corduroy

Active Member

Elon: "Hold my beer"I just want the stock to go into capitulation mode so we can move on.

Hi all. I'm struggling with deciding whether or not to cancel my Roadster deposit so I can sell puts / buy shares. I made a thread on it here. I'd really appreciate the opinions of the minds in the greatest thread in this whole club.  . Cancel Roadster deposit to reinvest in TSLA/sell TSLA puts?

. Cancel Roadster deposit to reinvest in TSLA/sell TSLA puts?

Thank you!

Thank you!

intelligator

Active Member

No. It was a Jan '24 -c550 that I rolled to in March (was a 1650) that I already made good on (65% profit), just wanted to buy the contracts back by rolling down to this week expecting to close early, like today or by picking a strike that is probable to expire. The thought was that I may as well move the contracts and save a couple debit points along the way.Are you saying you sold a juicy Jan '25 -c550, and after an SP drop could roll it to those 12/16/22 CC?

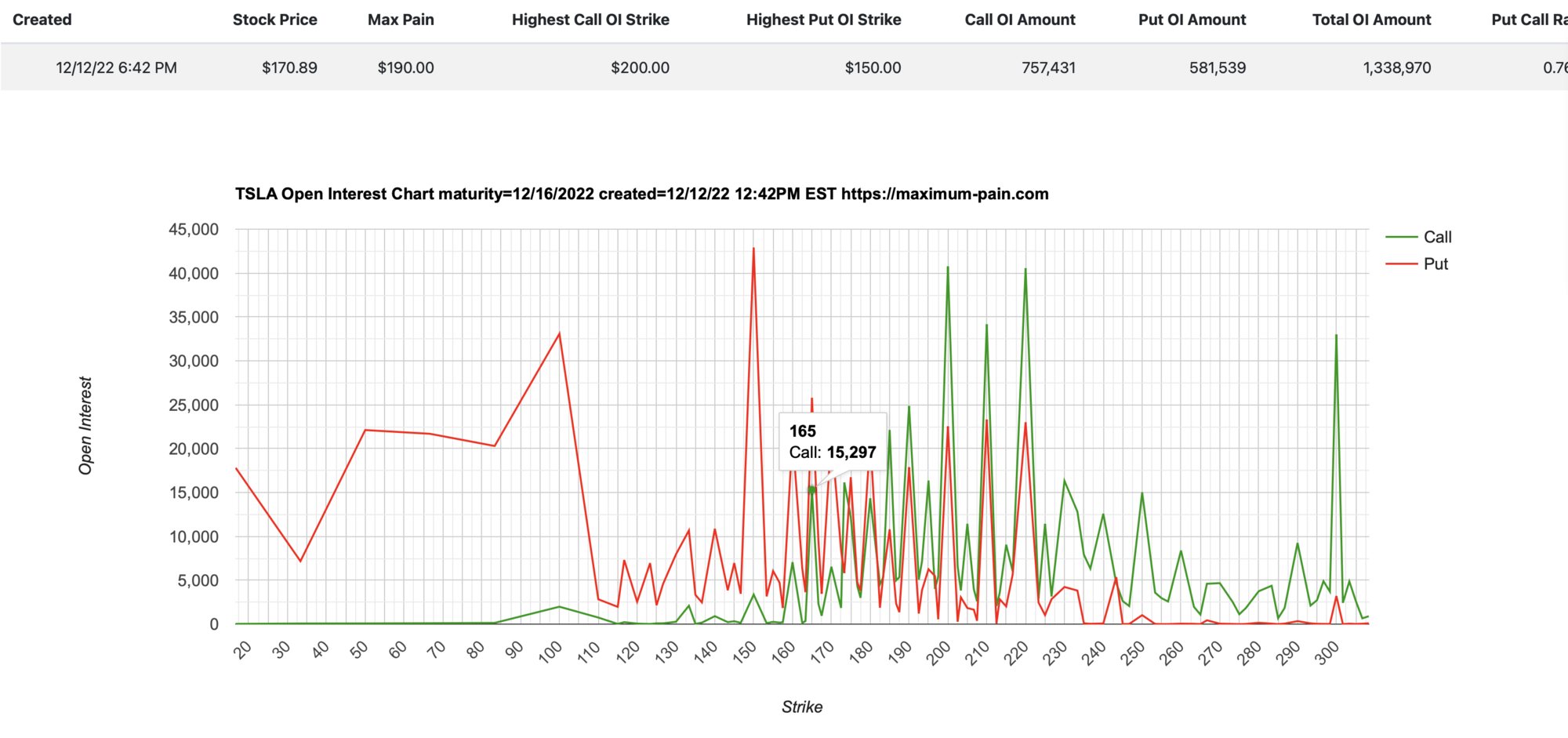

Triple-Witching OPEX on Friday with MP &t 190, so Hedgies could just be pushing it down as far as they can to cover a cold CPI print tomorrow that would spike stocks back up... that's one thing, however the first call-wall this week is -c165, and in recent history, Hedgies have done all they can to not pay out on calls while seeming to mostly ignore puts - which to me says they don't want to give away their shares and are happy to buy as many as they can down here - an doing it via puts doesn't cause the SP to rise...

I just closed mine, I feel a good CPI tomorrow!another wonderful day

I closed my cc's hoping that we get a bounce.

john tanglewoo

2012 Roadster Owner

Watching CPI numbers closely tomorrow, if we come in above 0.4-.5, I am likely buying February 100 puts simply to hedge against a catastrophic event.

I've been numb to the pain thus far, but the lower we keep going the more unpredictable the stock is getting. Would feel better to have some type of hedge in place.

I've been numb to the pain thus far, but the lower we keep going the more unpredictable the stock is getting. Would feel better to have some type of hedge in place.

I have been making so much money selling CCs. But I am at a point where it it not funny anymore seeing all the money I make going down everyday. Pretty depressing stock market.Watching CPI numbers closely tomorrow, if we come in above 0.4-.5, I am likely buying February 100 puts simply to hedge against a catastrophic event.

I've been numb to the pain thus far, but the lower we keep going the more unpredictable the stock is getting. Would feel better to have some type of hedge in place.

It is, but TSLA and Growth will eventually turn around, it always does. Patience!I have been making so much money selling CCs. But I am at a point where it it not funny anymore seeing all the money I make going down everyday. Pretty depressing stock market.

If you cancel your roadster reservation, I would also suggest selling your house, then invest everything in TSLA and buy something 10x bigger in 2030.Hi all. I'm struggling with deciding whether or not to cancel my Roadster deposit so I can sell puts / buy shares. I made a thread on it here. I'd really appreciate the opinions of the minds in the greatest thread in this whole club.. Cancel Roadster deposit to reinvest in TSLA/sell TSLA puts?

Thank you!

EVNow

Well-Known Member

Same here - except I'm watching tweets by a particular person closely for signs of intelligenceWatching CPI numbers closely tomorrow, if we come in above 0.4-.5, I am likely buying February 100 puts simply to hedge against a catastrophic event.

I've been numb to the pain thus far, but the lower we keep going the more unpredictable the stock is getting. Would feel better to have some type of hedge in place.

TSLA on CPI DaysTSLA on CPI days: red or green?

in 2022,

- 70% chance red on the day of

- 70% chance red the next day

View attachment 872987

last month (2022-11-10) was green on Thur and also green next day Fri

Triple-Witching OPEX on Friday with MP &t 190, so Hedgies could just be pushing it down as far as they can to cover a cold CPI print tomorrow that would spike stocks back up... that's one thing, however the first call-wall this week is -c165, and in recent history, Hedgies have done all they can to not pay out on calls while seeming to mostly ignore puts - which to me says they don't want to give away their shares and are happy to buy as many as they can down here - an doing it via puts doesn't cause the SP to rise...

View attachment 884149

intelligator

Active Member

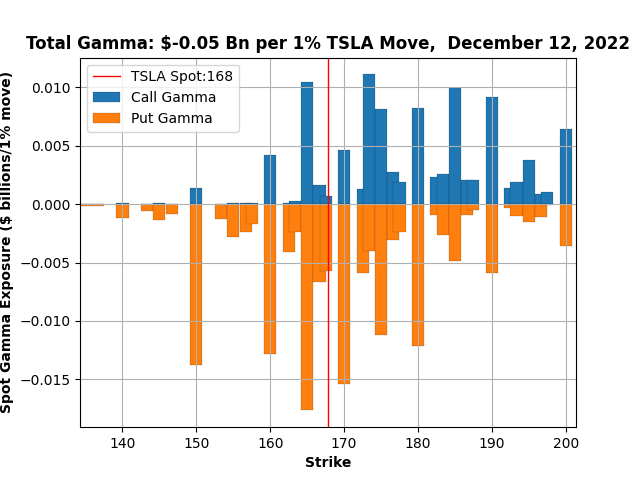

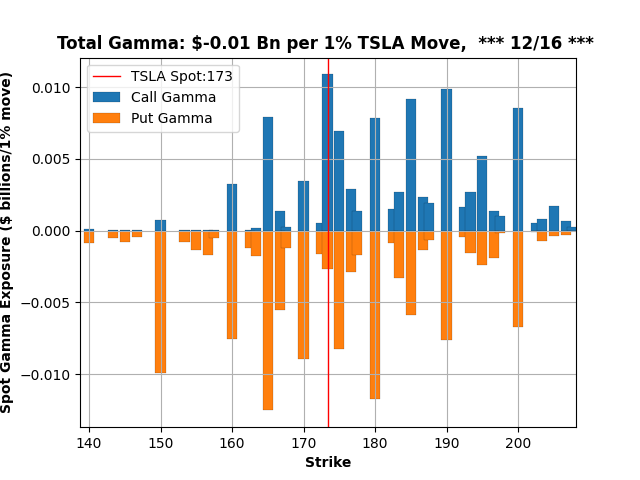

Gamma exposure lightly mimics the flow data. 160 is like 180 , 150 is just a distraction ... just look at all the confidence spanning 165 to 185

The 12/16 chart was from the options data last week for this week. Today's chart highlights some of the shift to the center of the overall range. We're gonna ride this baby out! GLTA!!!!

The 12/16 chart was from the options data last week for this week. Today's chart highlights some of the shift to the center of the overall range. We're gonna ride this baby out! GLTA!!!!

CrunchyJello

Member

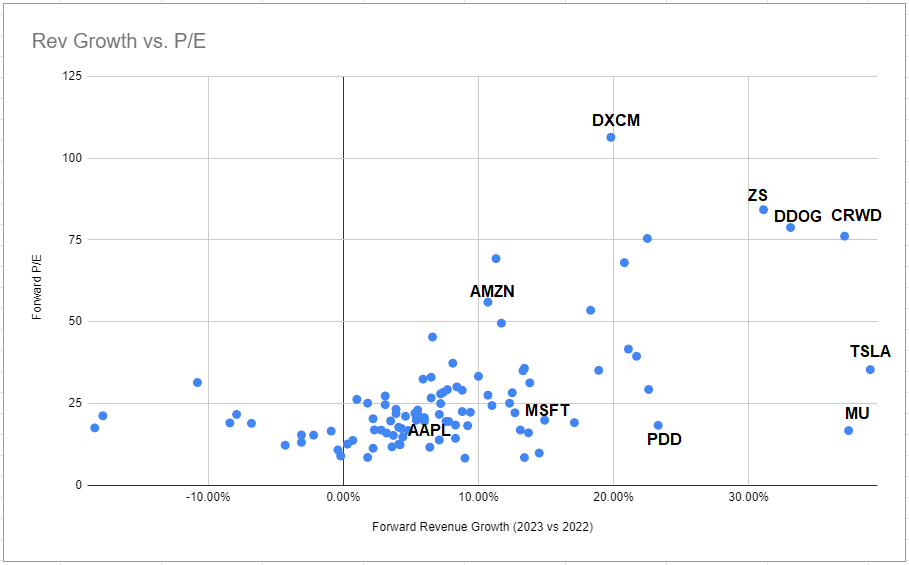

From https://twitter.com/freshjiva

TSLA currently ranks #1 in the entire Nasdaq-100 in terms of forward revenue growth (FY '23 vs FY '22) of +39% while trading significantly cheaper on fwd P/E than other companies growing at a similar pace at only 35x.

TSLA currently ranks #1 in the entire Nasdaq-100 in terms of forward revenue growth (FY '23 vs FY '22) of +39% while trading significantly cheaper on fwd P/E than other companies growing at a similar pace at only 35x.

NEWS RELEASES

CPI for all items rises 0.1% in November as shelter and food increase12/13/2022

In November, the Consumer Price Index for All Urban Consumers increased 0.1 percent, seasonally adjusted, and rose 7.1 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.2 percent in November (SA); up 6.0 percent over the year (NSA).

HTML | PDF | RSS | Charts | Local and Regional CPI

NEXT RELEASE

December 2022 CPI data are scheduled to be released on January 12, 2023, at 8:30 A.M. Eastern Time.That’s some game changing newsNEWS RELEASES

CPI for all items rises 0.1% in November as shelter and food increase

12/13/2022

In November, the Consumer Price Index for All Urban Consumers increased 0.1 percent, seasonally adjusted, and rose 7.1 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.2 percent in November (SA); up 6.0 percent over the year (NSA).

HTML | PDF | RSS | Charts | Local and Regional CPI

NEXT RELEASE

December 2022 CPI data are scheduled to be released on January 12, 2023, at 8:30 A.M. Eastern Time.

Now I am happy I closed my CCs yesterday. Don’t know if I should sell new ones today or tomorrow. That’s the question. Will Powell crash markets after good CPI numbers

SebastienBonny

Member

I closed the short term, but left the long term open.That’s some game changing news

Now I am happy I closed my CCs yesterday. Don’t know if I should sell new ones today or tomorrow. That’s the question. Will Powell crash markets after good CPI numbers

Not such a big deal yet and those long term CC's are easily manageable.

Short term I would only reopen when we see 185 to sell 200+ for next week.

I usually don't sell CC's with same week expiry.

Powell is unpredictable. He could say their work is not over yet and more hikes are in play... But he could also say they will consider .25 next year.

Saved by the CPI!

(I almost sold more shares yesterday in a last hail Mary to save my account from further drop).

I have 185CC in my mom's account, and 190 in mine for Friday. I'm happy to manage those tomorrow if necessary.

(I almost sold more shares yesterday in a last hail Mary to save my account from further drop).

I have 185CC in my mom's account, and 190 in mine for Friday. I'm happy to manage those tomorrow if necessary.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K