Something I've been trying lately with some success: for CCs and CSPs I'll set a STP buy order @ 2x opening price. My current position is that I'd rather lose last week's profit, than ever getting in the position again of having far ITM positions. Do you folks ever use automatic stops (instead of say, rolling)?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

intelligator

Active Member

I'm patiently waiting for the MMD, not seeing it form. Too much risk rolling to improve by $5 strike and don't want to touch earnings week or go so far out that I have this hanging around. I'm giving this until noon before proceeding to close -130/+135 BCS ... it's a loss I can deal with today, not one I want to kick down the road.

same -c130 B/W @3.6, ok to lose sharesPlaying chicken with the c130 wall: STO 26x -c130 @$3.1

Set that up before market open, realised it needed ~$128.50 to trigger, but was patient and waited

Effectively a double-dip as I sold 35x of these last week for the same price and bought them back @$1.35

Last edited:

SpeedyEddy

Active Member

same -cc130, but am counting on macro bad news (SPY 400 is a real resistance. A close above that will make me scratch my head for $TSLA)

Got a leftover -125 cc, that I will roll into -120 p (or something considered just safe) if SPYclose>400

Got a leftover -125 cc, that I will roll into -120 p (or something considered just safe) if SPYclose>400

Market is starting feeling toppy again so I closed my short TSLA 90P for a 40% profit. Still carrying 140 TSLA covered calls. I assume earnings will be below par.

Closed my long e-mini sp500 futures. Still carrying ~16% hedge via short micro e-mini sp500 futures but probably want to add to it. Possible debt limit drama won't help going forward.

Closed my long e-mini sp500 futures. Still carrying ~16% hedge via short micro e-mini sp500 futures but probably want to add to it. Possible debt limit drama won't help going forward.

intelligator

Active Member

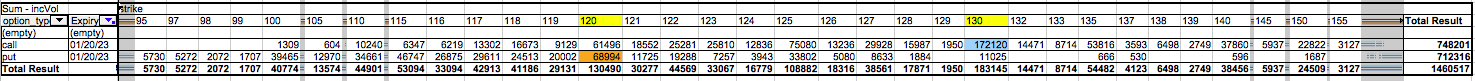

options volume is insane... the below was snapped at 11:45a, I removed many of the low flow columns to allow those with more interest to standout. Slightly more calls than puts traded.

This morning I rolled 40 x -c140 1/20 to -c150 1/27 for a net credit of $1.10. Teasing the stock to go higher. Depending on ER results I’ll roll higher or out, or I will let them get exercised and start a new round of The Wheel.

This morning I rolled 40 x -c140 1/20 to -c150 1/27 for a net credit of $1.10. Teasing the stock to go higher. Depending on ER results I’ll roll higher or out, or I will let them get exercised and start a new round of The Wheel.

The 1/20 to 1/27 rolls are quite favorable right now...

So here I am scrambling to deal with CCs.... all I can say is OK. I am OK with this.

May I forever be cursed scrambling to fix my CC troubles as the SP rockets. I have experienced the alternative and, yes, please let me deal with my troubled CCs until the end of time.

May I forever be cursed scrambling to fix my CC troubles as the SP rockets. I have experienced the alternative and, yes, please let me deal with my troubled CCs until the end of time.

Yeah, the earnings are being implied for a huge move. My belief is the MMs are loving this and that the stock may very well sell off even on good earnings based on the way we are going up now... only to recover for the impending investors day and the announcement of our next model!The 1/20 to 1/27 rolls are quite favorable right now...

scubastevo80

Member

I sold a 1/20 $135 CC this morning when we were up about 4% for $1.25. I guess we'll have to see how this holds up tomorrow. I put in a roll order to roll it to 1/27 $140 for another $2.50. We'll see if that hits or not.

I thought y'all might find this itneresting.

I had 135/115 put spreads end of the year / early this year, that I rolled out to Jan '25 because I'm comfortable with the strikes, but I wasn't comfortable with how low we could go, or how long it would take to recover. Taking it week by week was a bad idea for me.

They went about as deep as $18 on the $25 wide spread.

At today's share price around $130 they are trading at $10.50 or so. I would expect $12.50 when share price is around $125 (midpoint), so I think we're right in line.

These spreads won't go <$1 very fast as they have so much time value to decay. So I'm far from done with this position, either on a small loss or small gain basis, but I really like where I'm at for the moment.

Which is good, because I've also got 175/150s in Jan '25 out there that need even more recovery in the share price before I'll get out of them. I also like where I'm at with those (in terms of the $20 loss shrinking back down to a net small loss or small gain).

I had 135/115 put spreads end of the year / early this year, that I rolled out to Jan '25 because I'm comfortable with the strikes, but I wasn't comfortable with how low we could go, or how long it would take to recover. Taking it week by week was a bad idea for me.

They went about as deep as $18 on the $25 wide spread.

At today's share price around $130 they are trading at $10.50 or so. I would expect $12.50 when share price is around $125 (midpoint), so I think we're right in line.

These spreads won't go <$1 very fast as they have so much time value to decay. So I'm far from done with this position, either on a small loss or small gain basis, but I really like where I'm at for the moment.

Which is good, because I've also got 175/150s in Jan '25 out there that need even more recovery in the share price before I'll get out of them. I also like where I'm at with those (in terms of the $20 loss shrinking back down to a net small loss or small gain).

I am planning / preparing for something like this.Yeah, the earnings are being implied for a huge move. My belief is the MMs are loving this and that the stock may very well sell off even on good earnings based on the way we are going up now... only to recover for the impending investors day and the announcement of our next model!

II remind myself that I'm already leveraged plenty high for a big move upwards. I'm only going to add to that leverage if we see something under $100. (EDIT: to be clear - leverage via Jan '25 options that are fully owned / cash backed. I can wait out any share price between now and then. I might not be in a survivable state after that, but I can at least see the next 2 years through).

I'm also not doing any short term income positions until after earnings. Definitely not this week with the big monthly expiration, as I see those big option expirations making this week effectively independent of both macro and company news. Just too much volatility and inability to assess what it will do, to get in the way.

Last edited:

dc_h

Active Member

So should we expect a sell off on the 26th, or just a volatility crush following earnings? I'm still selling 1-20 CC's at 135, 138 and 140. Any pain I suffer is made up for by 2-17 calls. I feel like I should sell half my calls on the 24th as volatility will max out, but the stock could shoot up if earnings beat. I can afford to roll out half the calls, but I either have to roll way up or spend a lot to roll out 120 calls at this point.

If we hit 135, I may sell 145 calls, but start to wonder if we go nuclear from here?

If we hit 135, I may sell 145 calls, but start to wonder if we go nuclear from here?

SebastienBonny

Member

After 130 was crossed for the second time, I rolled 130 CC to 140 for next week for pennies.

I see a lot of talks about IV crush after earnings.

Does this mean, if you’re like 20% OTM and stock rises 10% after earnings, your CC could be worth the same (or sort of)?

I see a lot of talks about IV crush after earnings.

Does this mean, if you’re like 20% OTM and stock rises 10% after earnings, your CC could be worth the same (or sort of)?

SpeedyEddy

Active Member

Nuclear not before 140 (I even say 150) which is 40-50% off the (afterward declared) bottom. For now still in the dead-cat-bounce-area (imho)So should we expect a sell off on the 26th, or just a volatility crush following earnings? I'm still selling 1-20 CC's at 135, 138 and 140. Any pain I suffer is made up for by 2-17 calls. I feel like I should sell half my calls on the 24th as volatility will max out, but the stock could shoot up if earnings beat. I can afford to roll out half the calls, but I either have to roll way up or spend a lot to roll out 120 calls at this point.

If we hit 135, I may sell 145 calls, but start to wonder if we go nuclear from here?

(BOUNCING REALLY HIGH THOUGH..)

willow_hiller

Well-Known Member

Could someone please check my understanding of trailing stops?

I think it will operate as such:

1. As soon as the order is sent, it will record the mark price of the option. (Let's say 1.67)

2. The limit is set at 1.67 less 20% (1.336)

3. If the limit is hit, the trailstop turns into a limit order and tries to fill at 1.336

4. If the mark ever increases higher than 1.67, the limit also increases, and the process begins again from step 2.

Is that roughly correct? Thanks in advance.

I think it will operate as such:

1. As soon as the order is sent, it will record the mark price of the option. (Let's say 1.67)

2. The limit is set at 1.67 less 20% (1.336)

3. If the limit is hit, the trailstop turns into a limit order and tries to fill at 1.336

4. If the mark ever increases higher than 1.67, the limit also increases, and the process begins again from step 2.

Is that roughly correct? Thanks in advance.

R

ReddyLeaf

Guest

The 1/20 to 1/27 rolls are quite favorable right now...

Similar. -c125s 1/20 to -c130s 1/27 for $1 or so. Also, sold -p132s at $7.50 for inverted strangle and to earn some extra premium. I’m still expecting a drop back to $120-$125, remember lots of Fed speeches this weekThis morning I rolled 40 x -c140 1/20 to -c150 1/27 for a net credit of $1.10. Teasing the stock to go higher. Depending on ER results I’ll roll higher or out, or I will let them get exercised and start a new round of The Wheel.

EVNow

Well-Known Member

Sold -145/+150 calls. Haven't sold any put spreads. May be if the SP comes down a bit tomorrow ...

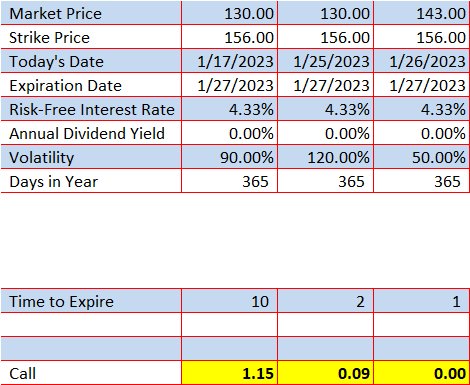

Like this ?

Its a bit difficult to calculate as the IV crush happens gradually and depends on SP price action as well. If SP is raising, IV may not crash as much, until SP raise reverses. Anyway, 10% OTM with 1/2 days left @ 50% IV will mean near zero premium.

Does this mean, if you’re like 20% OTM and stock rises 10% after earnings, your CC could be worth the same (or sort of)?

Like this ?

Its a bit difficult to calculate as the IV crush happens gradually and depends on SP price action as well. If SP is raising, IV may not crash as much, until SP raise reverses. Anyway, 10% OTM with 1/2 days left @ 50% IV will mean near zero premium.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K