I’m mostly in the same boat, this aggressive position is just on a small $116 buy-write started a month ago.Nice trade. I’m looking forward doing these trades, but can’t rally do it 130 dollar below cost base.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

It could be they are ratcheting it up because of perceived risk coming with the 2022 Q4 financial release next week.I've had the same concentration for years, and Fidelity hasn't changed above 40% in years. I do have a TD Ameritrade account I don't use. I could see what they have and transfer everything to them.

SebastienBonny

Member

How is margin handled by your broker?

If I’m having 100K account (all stock), I can use 60% as margin, so 60K.

Of course you shouldn’t use 100% of it, cause could very fast result in margin call.

Are your brokers having another approach?

If I’m having 100K account (all stock), I can use 60% as margin, so 60K.

Of course you shouldn’t use 100% of it, cause could very fast result in margin call.

Are your brokers having another approach?

I called TD Ameritrade and they are also at 50%. So I will probably have to tap into my home equity loan and bring in more cash until I get the money from the sale of my plane in 1-2 months.

Exactly, I was able to use 60% of the value of my stock as margin (with 40% going to the shares themselves). They just decreased it to 50% of the value of the shares for margin use.

How is margin handled by your broker?

If I’m having 100K account (all stock), I can use 60% as margin, so 60K.

Of course you shouldn’t use 100% of it, cause could very fast result in margin call.

Are your brokers having another approach?

Exactly, I was able to use 60% of the value of my stock as margin (with 40% going to the shares themselves). They just decreased it to 50% of the value of the shares for margin use.

GrmMastrDoobie

Member

Fidelity has officially updated their margin requirements on the website after market close, and I will have a margin call Tuesday. I can either Buy to Close 30X April 125 CSP for a $50k loss to fix it, or bring money in from a home equity loan. The interest on the loan will cost less than taking the loss on the Puts, so I'm leaning towards that.

I’d go with bringing money from home equity loan that was my plan at some point if stock fell further to transfer money from margin from my real estate holding Co however my wife did not agree with that. She said she didn’t care if my Medical Co went bankrupt that she could pay for the house mortgage and all the daily living cost but to avoid expanding the loans.Fidelity has officially updated their margin requirements on the website after market close, and I will have a margin call Tuesday. I can either Buy to Close 30X April 125 CSP for a $50k loss to fix it, or bring money in from a home equity loan. The interest on the loan will cost less than taking the loss on the Puts, so I'm leaning towards that.

juanmedina

Active Member

I’d go with bringing money from home equity loan that was my plan at some point if stock fell further to transfer money from margin from my real estate holding Co however my wife did not agree with that. She said she didn’t care if my Medical Co went bankrupt that she could pay for the house mortgage and all the daily living cost but to avoid expanding the loans.

I was bringing money from other places and I regret it; in the end it was like digging a bigger hole. I feel confident that the stock will turn around and it seems like we found a bottom but who knows. I also regret buying puts to increase my margin becuase in the end it made things way worse. I lost some shares but I now sleep like baby. That's my take.

That’s how I feel throwing 2 years of salary right in my brockerage account just to avoid margin calls during the last year to finally sell everything at the bottom clear my margin at 100% and then convert all shares to puts.I was bringing money from other places and I regret it; in the end it was like digging a bigger hole. I feel confident that the stock will turn around and it seems like we found a bottom but who knows. I also regret buying puts to increase my margin becuase in the end it made things way worse. I lost some shares but I now sleep like baby. That's my take.

Criscmt

Member

(Cross-posting for making it easy for folks who don't spend as much time on main thread)

I hope you all had minimal impact due to the SP action in the last one year.

I am curious if some of you are interested in hedging against market capitulation event, and/or TSLA going to even crazy levels, I guess Elon was alluding to level that is below current SP.

Obviously, a separate thread would be better.

One example: If market stays crazy low for a while, asset prices go even lower, white collar job market loosens significantly, does LVHM continue to hold to current levels? (In a tough macro environment, it would be abnormal to have LVHM owner as richest person in the world).

Maybe traditional energy (XLE)? Just some examples. I am sure there will be plenty of ideas worth exploring.

On main thread, asked mods to create a separate thread, let's see.

I would advise keeping in mind that Fed has a very serious problem, run away inflation.

Big run up in equity, and/or housing markets I would think will be very detrimental to their efforts to contain the run away inflation.

JPowell was praising Volcker recently on how Volcker handled the run away inflation.

Big run ups in equities this time will likely end with large funds selling equities to retail and leaving them as bag holders.

Mar-2020 is very different from this time. Post covid there was a lot of liquidity the Fed injected into the system. This time, they are very serious about draining the money out of the system to fight inflation.

It's not just the Fed funds rate, there's Balance Sheet run-off, and likely active QT. These will have serious effects on risk-on assets.

The rise in mortgage rates in the last few weeks, as Fed stopped adding to their MBS holdings, is likely a sign of things to come.

Isn’t over stimulation, too much money in the hands of people, inflated assets, wealth effect, likely key reason for substantially over-normal demand, especially a time less was being produced, leading to this inflation?

Looks like significant part of people feel wealthy now, and spending more like on housing, all kinds of goods, services. Unfortunately, the others, especially poor, are suffering the pain.

Would love your thoughts, especially those who were experienced dot-com period in stocks

I am trying to understand current situation, and here's what I see:

A lot of money was pumped into the system post covid breakout (in fact even before covid, at least since QE-1), both Monetary policy (Interest rates, QE), and Fiscal policy. At a time when production went down, demand went up due to this extraordinary money supply, causing inflation.

Housing was pumped with explosive combination of all-time low mortgage rates (thanks to incremental MBS purchases until a few weeks ago), and high asset prices (high stock valuations) which made down payments easy for large many.

Now there's runaway inflation. For example, if we take housing, house prices go up, people take cash out and invest in buying more homes. Why? because house price are going up. This lead to the vicious cycle.

Is it the case that, (1) this money supply pumped into the system still being around, and (2) tens of millions of new “traders” (stock and options) is likely stopping the collapse of the market? Because, there's a lot of money on the put side too, both retail and institutional?

Do you share the view that for controlling the inflation, money needs to be sucked out, asset valuations must be brought down?

2006-2008 likely is not a similar situation, we didn't have so much money pumped into the system at that time?

I wasn't in stock market during Dot com bubble.

Was there such high money supply during that time? I read the asset valuations were high, likely even higher than now (not nominal)

If we take housing, looks like we will have a step-up inflation that will not be reversed, offset but will have to live with?

Home prices went up ~40% from Jan2019, and mortgage rates today are same as in Jan-2019. Incomes didn't grow anywhere close to that. This means, Fed robbed the opportunity of housing from millions, and that too from those who are already at the bottom of wealth pyramid. The only way this can be corrected is by bringing down house prices, because interest rates can’t be brought down with the current inflation?

Do you see strong parallels to Dot com period, on the risk front (asset devaluation)?

@Artful Dodger @StealthP3D @FrankSG @The Accountant @generalenthu @ZeApelido @bxr140

Thanks for your replies.

I am more interested in the cash levels during dot-com bubble. The kind of money that was pumped into the system the last two years, in fact even prior to that (QE post GFC), both Monetary, and Fiscal, seems unprecedented. Was there even nearly as much cash injection into the system, positive wealth effect, retail trading activity, going into dot-com bubble? Of course, I understand that inflation wasn't as high as it is now.

Not trying to boast that some of these things turned out as I was afraid back then. But quoting these to give background for this post.OT (Not sure if Macro related discussion would be allowed here by Mods)

Thought it's good to listen to the point of view of the folks on other side of the macro.

Sharing this here to learn from you all, what your view on these points is.

I understand markets are forward looking. Do you think this is all priced in in the market?

The vast amount of money injected into the system, the changes to consumer spending (including housing) due to this, the inflation exacerbated due to the horrible invasion of Ukraine?

Link to the Tweet thread

=================================================================

Over the past two years, the Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England collectively printed over US$11 trillion (about 26% of their GDP), more than double the amount which was printed after the GFC in half of the time.

These four central banks cut rates to (or below) zero. Money became literally free and enormous quantities of it were (and still are) floating around. Governments availed themselves of this free money and spent more in 2020-21 than at any time since World War II.

The combination has been explosive for economies and markets, particularly because the Fed can print money, but cannot control where it goes. All this is now reversing. Most central banks are already tapering their bond purchases or are about to.

A few have started raising rates – most recently the Bank of England. For its part, the Fed has started tapering quantitative easing (QE) purchases, expects to raise rates three times in 2022, and is even starting to discuss QT (quantitative tightening

, i.e. shrinking its enormous nearly $9 trillion balance sheet). Free money has been an elixir for markets. What happens when money is no longer free?

In the ten years before COVID-19 hit, U.S. and global stocks rose in one of the biggest and longest bull markets of the past century. But interestingly stocks did not show signs of generalized frothiness usually associated with long bull markets.

Then in the eighteen months following the COVID-19 low in March 2020, from a near standstill, most market participants caught the bid and pushed almost every measure of speculative enthusiasm to record levels: IPO funds raised went

from $32 billion annually from 2009 to 2019 to a record $262 billion in 2021 (nearly four times the 2000 record of $65bn).8 M&A activity went from $1.25 trillion annually in the last decade to $2.75 trillion in 2021. Inflows into equity mutual funds and ETFs

reached $1 trillion in 2021, more than the past twenty years combined and significantly exceeding 2000’s $312 billion. Margin debt has doubled from the average of the past five years to reach more than 2% of GDP, much higher than the 2000’s when it was 1.4% of GDP.

The meme stock craze of early 2020 has ebbed with many stocks down -50% from their peaks, but their market caps are still 10 to 20 times higher than pre-COVID-19 levels in 2019 despite revenues down 20 to 50% and no profits.

History shows that these speculative manias tend not to last much more than eighteen months, and are followed by market corrections greater than -40%, unwinding almost all of the bubble’s gains.

Highly speculative and expensive assets are most at risk: the crypto ecosystem, retail/ meme stocks, no-profits stocks, hypergrowth high-multiple stocks and probably growth stocks in general.

There are already indications that some of the bubbliest areas in the market have burst, though the overall market continues near all time highs, powered by an increasingly small number of mega-cap stocks. Possible catalysts for a more generalized market correction include

The End of Free Money, the fiscal cliff and Stagflation. Or it may just be that stock market optimism and expectations are so high that they are very unlikely to ever be met. (MS)

=================================================================

I hope you all had minimal impact due to the SP action in the last one year.

I am curious if some of you are interested in hedging against market capitulation event, and/or TSLA going to even crazy levels, I guess Elon was alluding to level that is below current SP.

Obviously, a separate thread would be better.

One example: If market stays crazy low for a while, asset prices go even lower, white collar job market loosens significantly, does LVHM continue to hold to current levels? (In a tough macro environment, it would be abnormal to have LVHM owner as richest person in the world).

Maybe traditional energy (XLE)? Just some examples. I am sure there will be plenty of ideas worth exploring.

On main thread, asked mods to create a separate thread, let's see.

I don't think Musk is predicting anything, he's just pointing out the absurdity of the FED's current path based on historical precedence. I see no reason for recession or market collapse. Those continually predicting it are pushing their own agenda - as are 99% of all media commentators/YouTubers/influencers... always bear that in mind(Cross-posting for making it easy for folks who don't spend as much time on main thread)

Not trying to boast that some of these things turned out as I was afraid back then. But quoting these to give background for this post.

I hope you all had minimal impact due to the SP action in the last one year.

I am curious if some of you are interested in hedging against market capitulation event, and/or TSLA going to even crazy levels, I guess Elon was alluding to level that is below current SP.

Obviously, a separate thread would be better.

One example: If market stays crazy low for a while, asset prices go even lower, white collar job market loosens significantly, does LVHM continue to hold to current levels? (In a tough macro environment, it would be abnormal to have LVHM owner as richest person in the world).

Maybe traditional energy (XLE)? Just some examples. I am sure there will be plenty of ideas worth exploring.

On main thread, asked mods to create a separate thread, let's see.

Some comments from my recent experience. I only visit this thread occasionally. Probably a costly mistake.Fidelity has officially updated their margin requirements on the website after market close, and I will have a margin call Tuesday. I can either Buy to Close 30X April 125 CSP for a $50k loss to fix it, or bring money in from a home equity loan. The interest on the loan will cost less than taking the loss on the Puts, so I'm leaning towards that.

E*trade messaged me (about 2 months ago) that my concentration in one stock was too high. This was followed by increasing margin ratios/reserves eventually to 66% at one point.

Eventually in December I sold more than 30% of my shares to reduce margin. This did not change my concentration really. I bought some MRK shares (on margin) however as they seemed unlikely to follow TSLA trading patterns. This reduced my concentration from 99.7% but not nearly down to 70% as E*trade prefers. Selling covered calls on MRK not very profitable BTW.

I was blindly thrashing about mostly but the continued falling in Tesla resulted in the MRK shares growing in percentage. At some point margin requirements dropped for reasons not clear to me.

With fewer shares, CC selling brings in less at the same time margin interest is rising. Interesting times.

I guess, should TSLA recover toward 150 or so, I will have to decide what to do with the MRK shares. Lots of moving parts to my investment life lately. YMMV

SebastienBonny

Member

It’s weekend so time to think about strategies.

Share count: 200 (you don’t want to lose, certainly not as these levels).

You could sell 2 CC’s weekly, but if the stock moons, you could be out of option trading for a while.

That feels like putting your chances at one side of the table as well.

Additionally you also have enough cash for a CSP, but at the moment you don’t want the extra shares assigned.

You want to preserve that cash position because it gives you 100% of margin.

Would it make sense to sell 1 CC (SP + 10) and 1 CSP (SP - 10) to be at either side?

Scenarios:

Flat SP

Both sides win.

Rising SP

Sold put wins, sold call needs management (you don’t want assignment).

You could roll up and add another contract (you have 200 shares) or roll up and out without adding.

Falling SP

You don’t want assignment, so you can only roll down (debit) or out (and down).

Sold call wins of course.

In the event of assignment: sell the 100 shares asap cause you want the shares gone and your money back.

Or wheel it but if stock goes lower you lose even more money you don’t want to lose.

The reason I’m asking some non-advice is because I feel we’re at a point SP won’t go a lot lower considering price action when “bad” news hits and selling both sides (put/call) seems like spreading your risks at this point.

Share count: 200 (you don’t want to lose, certainly not as these levels).

You could sell 2 CC’s weekly, but if the stock moons, you could be out of option trading for a while.

That feels like putting your chances at one side of the table as well.

Additionally you also have enough cash for a CSP, but at the moment you don’t want the extra shares assigned.

You want to preserve that cash position because it gives you 100% of margin.

Would it make sense to sell 1 CC (SP + 10) and 1 CSP (SP - 10) to be at either side?

Scenarios:

Flat SP

Both sides win.

Rising SP

Sold put wins, sold call needs management (you don’t want assignment).

You could roll up and add another contract (you have 200 shares) or roll up and out without adding.

Falling SP

You don’t want assignment, so you can only roll down (debit) or out (and down).

Sold call wins of course.

In the event of assignment: sell the 100 shares asap cause you want the shares gone and your money back.

Or wheel it but if stock goes lower you lose even more money you don’t want to lose.

The reason I’m asking some non-advice is because I feel we’re at a point SP won’t go a lot lower considering price action when “bad” news hits and selling both sides (put/call) seems like spreading your risks at this point.

@Criscmt

During a bear market, some stocks considered as risky assets like crypto and growth stocks can be sold off and bottom out before the non risky assets.

A lot of smart money as been leaving value secure ETFs in the last week and growing back into crypto Bitcoin Ethereum and back into QQQ more volatile risk on assets. You can see NFLX bottomed out couple months ago and growing back, same thing for META. The same thing could have happened to TSLA. Even if the SPY crashes another 20% for deep recession cyclic deleveraging reasons from people unable to afford their mortgages if the raise hikes continue for a while, it doesn’t necessarily mean all the stocks who already went down need to bottom more. Maybe it will go further down ir maybe we have see the bottom, nobody knows but the time to buy massive quantity of OTM puts was 1 year ago.

During a bear market, some stocks considered as risky assets like crypto and growth stocks can be sold off and bottom out before the non risky assets.

A lot of smart money as been leaving value secure ETFs in the last week and growing back into crypto Bitcoin Ethereum and back into QQQ more volatile risk on assets. You can see NFLX bottomed out couple months ago and growing back, same thing for META. The same thing could have happened to TSLA. Even if the SPY crashes another 20% for deep recession cyclic deleveraging reasons from people unable to afford their mortgages if the raise hikes continue for a while, it doesn’t necessarily mean all the stocks who already went down need to bottom more. Maybe it will go further down ir maybe we have see the bottom, nobody knows but the time to buy massive quantity of OTM puts was 1 year ago.

corduroy

Active Member

Just my opinion, and we still could go lower, but selling calls when we are still at 5 year lows of RSI does not look like a good idea.It’s weekend so time to think about strategies.

Share count: 200 (you don’t want to lose, certainly not as these levels).

You could sell 2 CC’s weekly, but if the stock moons, you could be out of option trading for a while.

That feels like putting your chances at one side of the table as well.

Additionally you also have enough cash for a CSP, but at the moment you don’t want the extra shares assigned.

You want to preserve that cash position because it gives you 100% of margin.

Would it make sense to sell 1 CC (SP + 10) and 1 CSP (SP - 10) to be at either side?

Scenarios:

Flat SP

Both sides win.

Rising SP

Sold put wins, sold call needs management (you don’t want assignment).

You could roll up and add another contract (you have 200 shares) or roll up and out without adding.

Falling SP

You don’t want assignment, so you can only roll down (debit) or out (and down).

Sold call wins of course.

In the event of assignment: sell the 100 shares asap cause you want the shares gone and your money back.

Or wheel it but if stock goes lower you lose even more money you don’t want to lose.

The reason I’m asking some non-advice is because I feel we’re at a point SP won’t go a lot lower considering price action when “bad” news hits and selling both sides (put/call) seems like spreading your risks at this point.

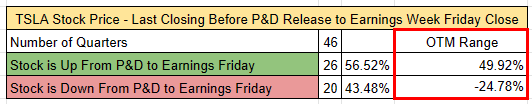

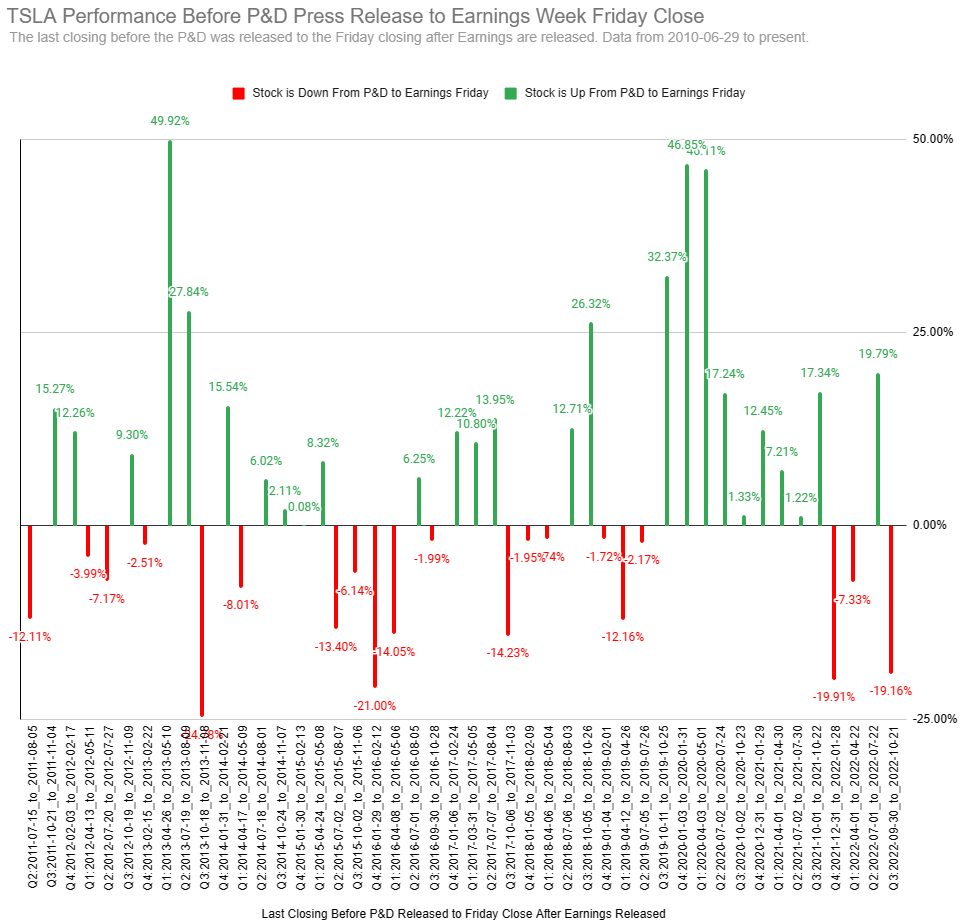

TSLA Performance Before P&D Press Release to Earnings Week Friday Close

we are currently at -0.63% OTM (Dec 30 Close 123.18 to today 122.40), fingers crossed - could swing violently to -/+20% as per past 4 quarters

we are currently at -0.63% OTM (Dec 30 Close 123.18 to today 122.40), fingers crossed - could swing violently to -/+20% as per past 4 quarters

Last edited:

I have updated my wave count here

Sorry for not updating this thread in a while, between catching the flu and trying to mitigate the impact of the crash on my account, I've not had the chance to sit down and look at the wave structure in a while.

However, I'm happy to say I'm not deviating from my previous wave count, which is an impulse leg down from 314.61 in August. The difference is, instead of ending at 177 without any of the fubar year-end delivery issues and EV tax credits, like this...

View attachment 895708

the chart has morphed into an extended wave 5, like this..

View attachment 895709

which means, we are at the end of the end of this correction. While we might still make another low, the chance of TSLA shooting up is way higher than crashing down. A good trader won't try to chase wave 5 down on any stock because:

a/ Wave 4 is shallow which means one could overlook it.

b/ The potential strength of wave 5, and thus the reward for catching it, is much smaller than that of wave 3.

It could go like this and put the end target inside the 85-98 rangeView attachment 895711

or it could go like this, which means the bottom is already in at 102

View attachment 895712

Big picture, TSLA is getting support from the 0.764 all-time retracement at 98 while being capped by the 0.236 retracement from 198 to 102. The magnet seems to be 120, which is the 100 monthly EMA. This is somewhat the last old guard, having marked the infamous June 2019 bottom in TSLA. It is crucial we end January above 120 and I'm betting on we do. The inflection point will be 140. If we can close above 140 on a daily timeframe, it means the bottom is in at 102. That means bears will defend this level at all costs and they may succeed at least once if we have a very negative ER. So, the closer we get to 140, the higher the risk of another crash, which should mark the end of this correction. However, it is very different to go from 140 to 95 than it is to go from 115 to 95. The closer we get to 140, the more crucial it is that we hedge IF in danger of margin calls.

R

ReddyLeaf

Guest

It’s weekend so time to think about strategies.

Maybe it will go further down ir maybe we have see the bottom, nobody knows but the time to buy massive quantity of OTM puts was 1 year ago.

Just my opinion, and we still could go lower, but selling calls when we are still at 5 year lows of RSI does not look like a good idea.

All great thoughts above, so tagging everyone. FYI, I was looking at the options chain and see that calls are more expensive than puts going out February and beyond. Example, for LEAPS the two premiums are equal at SP + $20-$30, so the market is expecting TSLA to go up in price from here. Also, as expected IV is very high for earnings week, so there’s an obvious IV crush play there, probably best right before the release. Finally, wanted to say that yesterday I sold DITM May -c80s on AAPL and bought 5x puts as a small amount of protection. Yes, obviously this would have been the thing to do last January, but the YouTuber that I’ve posted several times still sees recession and the SPY lower starting in February. Fortunately, TSLA is the one stock that he thinks will go against the trend.

I closed half my CCs (still have those pesky 1/20 -c110s that I will buyback at the next chance). Rolled -p120s to 1/20 and will just keep that up, daring the market to put me shares every week, probably raising the strike $5/wk avg. BTW, tried a few BPS/BCS/IC spreads on TSLA and LCID last week, risking just a few $K. Wow, that was stressful. I don’t know how people did that on large numbers. Probably not the best time to be selling calls, so be careful there. I may just stick to CSPs for awhile. GLTA and stay safe out there.

EVNow

Well-Known Member

Considering a number of us have assigned puts with high CB (my shares in the taxable account are > 300), I was wondering how best to atleast not pay a lot of taxes on income we get from writing options.

Here are the options (as applicable to US). Assumption is that, there is enough cash/margin in the account. Both options below take 62 days to execute.

A. Don't write puts or buy calls for 31 days. Then, sell stock, buy an equivalent ETF to cover any upward movement and then sell ETF & buy back stock after 31 days.

B. Buy LEAPS that are equivalent to # of stocks / Delta of leaps. Don't write puts or buy calls for 31 days. Then, sell stock - pay off margin loan. LEAP will cover any upward movement. Sell LEAPS and buy back stock after 31 days.

I'll explain the above further with examples and simulation once I work those out - any other ideas ?

Here are the options (as applicable to US). Assumption is that, there is enough cash/margin in the account. Both options below take 62 days to execute.

A. Don't write puts or buy calls for 31 days. Then, sell stock, buy an equivalent ETF to cover any upward movement and then sell ETF & buy back stock after 31 days.

B. Buy LEAPS that are equivalent to # of stocks / Delta of leaps. Don't write puts or buy calls for 31 days. Then, sell stock - pay off margin loan. LEAP will cover any upward movement. Sell LEAPS and buy back stock after 31 days.

I'll explain the above further with examples and simulation once I work those out - any other ideas ?

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K