Could you explain how you use the chart of options gammas? I've tried charting it myself before, and the only pattern I noticed is that it biases negative on days when TSLA is down, and biases positive when TSLA is up; so it works as a trend indicator? Would be interesting to see how it compares to a simple moving average, or something like a MACD.

OK... *THIS IS MY UNDERSTANDING AND HOW I USE THE CHARTS*

How to use the chart, probably best to find material describing gamma exposure and delta hedging to form your own understanding.

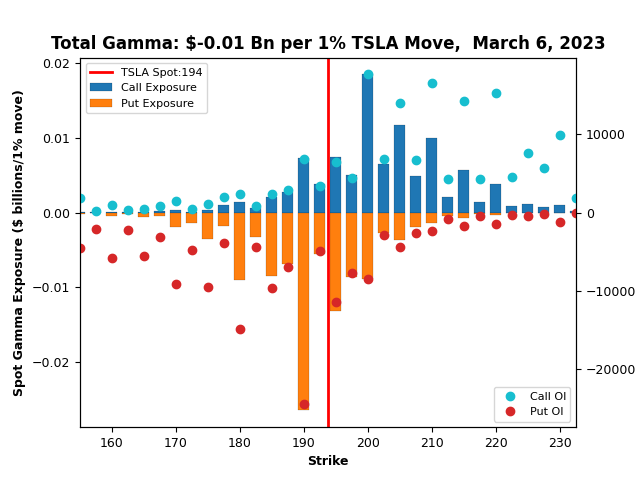

True, the gamma +/- does tend to lean with the trend. TSLA price movement seems to be driven by options trades. The chart bars are based on a calculation that takes open interest , IV, DTE and the gamma greek measure for each strike to imply where the most exposure is put and call side. Gamma is highest at and near the money, forming a bell shape curve, positive and negative. You can find write ups on this... when we have negative gamma, market makers are providing liquidity through buying of shares when most are shedding. The put side bars extend further to the lower end of the gamma scale, outweighing the call bars, hence negative gamma. Similarly, positive gamma occurs when there's more OI to the call side, the call bars extend to the positive end of the gamma scale. Market makers are selling shares accumulated when demand is greater than supply. Today we are -0.01 , about even. When the numbers are published in the morning, I'll post another chart. Comparing that to todays, we'll get a sense of where the shifts in OI occurred, getting a read of the day perhaps.

Am I reading anything into this and basing my trades on the same? Not really. It's just one data point I look at. I use the chart more of a visual to spot the strong boundaries, clustering, or generally flat characteristic-less bars to imply how narrow or how broad price movement *might* occur. No tea leaf read here ... nothing that I can attribute to successful trades by this data only.

EDIT: I couldn't add to the other post, timed out. Here's the same bars with gamma overlays to correspond with the bell shape curve I described. Thanks for asking. Anyone that can add to this or right the wrong, please do. I am learning as well.