Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

BTC -P167.50 5/19 at 169.75 spike today for $3.44 (from $1.46). Was too risky to my margin if I got assigned.

I’m keeping the -P165 5/19. My margin can handle assignment with TSLA all the way down to $103. The gains from this -P would offset the loss of the hasty -P167.50 and leave some modest gains. If it does exercise on Friday, I plan to sell ATM CC’s to get rid of them and capture quite decent gains.

What do some of you do when assigned and the stock price hovers around the same area, dump ASAP or go slightly OTM to be able to sell CC more than once? My carrying costs for the lot is about $3k/mo (TD Ameritrade interest 6.65%)

I’m keeping the -P165 5/19. My margin can handle assignment with TSLA all the way down to $103. The gains from this -P would offset the loss of the hasty -P167.50 and leave some modest gains. If it does exercise on Friday, I plan to sell ATM CC’s to get rid of them and capture quite decent gains.

What do some of you do when assigned and the stock price hovers around the same area, dump ASAP or go slightly OTM to be able to sell CC more than once? My carrying costs for the lot is about $3k/mo (TD Ameritrade interest 6.65%)

Last edited:

So... are we all selling puts or calls into investor day?

both? Gut feel is that Investor Day won't leak anything new.

So... are we all selling puts or calls into investor day?

I’m sitting it out. Got burnt trying to guess. What if Elon does step down or goes sideways.

Some bearish food for thought:

-Failure again to retake $170

-Why did Robyn Denholm suddenly put out a video last week speaking about the board’s stability. Prepping for change in Elon’s role?

-What were the huge selling blocks this morning, does someone know something?

Some bullish food for thought:

-TSLA held 165 so far (Edit: Somewhat…)

-Selling vol. for Q2-23 seems to be going well.

-Twitter CEO freeing up Elon to be “more at Tesla” though unclear how much.

Last edited:

I’m sitting it out. Got burnt trying to guess. What if Elon does step down or goes sideways.

Some bearish food for thought:

-Failure again to retake $170

-Why did Robyn Denholm suddenly put out a video last week speaking about the board’s stability. Prepping for change in Elon’s role?

-What were the huge selling blocks this morning, does someone know something?

Some bullish food for thought:

-TSLA held 165 so far

-Selling vol. for Q2-23 seems to be going well.

-Twitter CEO freeing up Elon to be “more at Tesla” though unclear how much.

For the uncertainty you’ve raised and with no clear trend going into the meeting, I’m staying on the sidelines for now. I’m still carrying my now 5/19 10x -c150s.

The stock is indeed looking weak compared to macros. It started on Friday after those rumours surfaced. We've lost 7% since then. Wall Street has always said they want a stable full-time CEO, with Elon in a more technical CTO-role. But now that it could become more than just a theory they suddenly get cold feet.

The stock is indeed looking weak compared to macros. It started on Friday after those rumours surfaced. We've lost 7% since then. Wall Street has always said they want a stable full-time CEO, with Elon in a more technical CTO-role. But now that it could become more than just a theory they suddenly get cold feet.

I’ll quibble with that - Wall Street wanted to have its cake and eat it too with Elon acting as a more stable CEO. There is a substantial Elon premium priced into the company - I’d expect a decent drop were he to step down.

I’ll quibble with that - Wall Street wanted to have its cake and eat it too with Elon acting as a more stable CEO. There is a substantial Elon premium priced into the company - I’d expect a decent drop were he to step down.

One fellow who works on Wall Street said if Elon steps down or goes sideways in his role, the p/e tolerance would drop in half to around 20, if that, with this meaning a 50% haircut on the share price. While this may be hyperbole, I don’t think Elon is willing to hurt his employees and other investors by allowing that to happen (but maybe he has other reasons that override...who knows?). So that might be a ray of hope that this may be legitimate but fear-talk. The fact that he didn’t categorically deny the rumor is not helping to put out the narrative. Maybe a whole bunch of noting but position for either eventuality.

All the massive 150-160 put buying today on TSLA is not helping the confidence or the SP.

Current GEX Levels (red attracts, green repels):

(Zoom in)

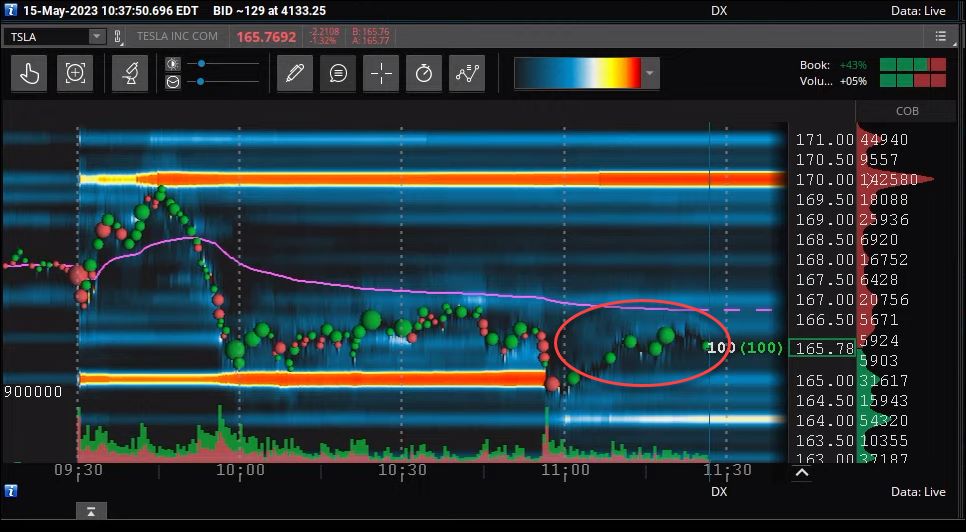

Bookmap showing buying around here (maybe dealers delta hedging against all the OTM puts rolling in?). There’s also 145k+ sell orders waiting at $170 making it a wall.

juanmedina

Active Member

One fellow who works on Wall Street said if Elon steps down or goes sideways in his role, the p/e tolerance would drop in half to around 20, if that, with this meaning a 50% haircut on the share price. While this may be hyperbole, I don’t think Elon is willing to hurt his employees and other investors by allowing that to happen (but maybe he has other reasons that override...who knows?). So that might be a ray of hope that this may be legitimate but fear-talk. The fact that he didn’t categorically deny the rumor is not helping to put out the narrative. Maybe a whole bunch of noting but position for either eventuality.

All the massive 150-160 put buying today on TSLA is not helping the confidence or the SP.

Current GEX Levels (red attracts, green repels):

View attachment 937875

(Zoom in)

That's nonsense. You have it both ways.. Elon the liability and Elon the premium.

That's nonsense. You have it both ways.. Elon the liability and Elon the premium.

I agree 100%

Like marriage lol.

It’s the investors and institutions that respond emotionally that can cause damage.

In that case they'd be selling, as they are at risk of the shares being put to themmaybe dealers delta hedging against all the OTM puts rolling in?

I am sitting on some $180P's sold Friday for $12 each - these are down right now but I am sticking with them.

Definitely do not think Elon is stepping down and there is movement to be had after the AGM - this was part of a Collar that included some $175C's that were bought and got stopped out on lost value at the 12% mark Friday.

Good luck to all - when there is no run up and in fact a sell off before an event - that to me is time for risk on.

At least IV is ticking up today

Definitely do not think Elon is stepping down and there is movement to be had after the AGM - this was part of a Collar that included some $175C's that were bought and got stopped out on lost value at the 12% mark Friday.

Good luck to all - when there is no run up and in fact a sell off before an event - that to me is time for risk on.

At least IV is ticking up today

In that case they'd be selling, as they are at risk of the shares being put to them

Oh, didn’t know that. I thought it was the other way, that they buy. Then it’s more curios who’s doing all that buying if the majority sentiment is that TSLA fell out of its upward channel, ran out of power, and is likely visiting gap below pretty soon. Unless that’s what wise investors do — buy when others are fearful.

Confusing spot.

Where are you looking to see IV? I've used this chart in the past from Market Chameleon, but you see on Friday it show IV as being very high, but I didn't get the impression this was the case...I am sitting on some $180P's sold Friday for $12 each - these are down right now but I am sticking with them.

Definitely do not think Elon is stepping down and there is movement to be had after the AGM - this was part of a Collar that included some $175C's that were bought and got stopped out on lost value at the 12% mark Friday.

Good luck to all - when there is no run up and in fact a sell off before an event - that to me is time for risk on.

At least IV is ticking up today

intelligator

Active Member

I have -c167.5/+c157.5 for Friday that I'd sold last week , if movement is sideways, I'll hold until Friday before taking action. It's too early to speculate anything, IMO.

EVNow

Well-Known Member

How many times is Elon going to mention FSD and how it will increase the value of the car ? 5 and over is bearish, otherwise is bullish.So... are we all selling puts or calls into investor day?

Edit: I meant annual shareholder meeting

Closed -152.50/+145 put spread for this week expiration. In ~.60, out at .28.

I feel that it most likely would have expired worthless, and that I therefore could have held out and earned a lot of that remaining .28. I also do not like the debt ceiling stare down or the news I continue to encounter regarding the regional banks.

The specific dynamic I see with the regional banks is a wounded gazelle type situation, where the short sellers see an entire industry that they can short into oblivion. The bank sector has the added bonus for the short sellers that they can be shorting the business on Friday, and see it liquidated, shareholders wiped out, and be back in business on Monday as a new company. With shareholders holding nothing. I can't think of another business category where short sellers have a reasonable possibility of a max gain over the weekend

Therefore given my own situation I decided to snag my 50% gain. I'm not planning to sit it out, but I'll be choosy about re-entering.

Sitting out means that I'll miss out on the relief rally when the debt ceiling is raised. It also means I'll miss the paper losses on any short term positions if we get too close, or even breach, the time when bills are due.

My concern this time around is that the democrats decide to let the children have their tantrum as there is a life lesson that needs to be learned. Doing so will get us that much closer to the brink, and like the rest of the world I don't have any real idea of just how the world will change given a default on even a single US treasury or federal government obligation.

I feel that it most likely would have expired worthless, and that I therefore could have held out and earned a lot of that remaining .28. I also do not like the debt ceiling stare down or the news I continue to encounter regarding the regional banks.

The specific dynamic I see with the regional banks is a wounded gazelle type situation, where the short sellers see an entire industry that they can short into oblivion. The bank sector has the added bonus for the short sellers that they can be shorting the business on Friday, and see it liquidated, shareholders wiped out, and be back in business on Monday as a new company. With shareholders holding nothing. I can't think of another business category where short sellers have a reasonable possibility of a max gain over the weekend

Therefore given my own situation I decided to snag my 50% gain. I'm not planning to sit it out, but I'll be choosy about re-entering.

Sitting out means that I'll miss out on the relief rally when the debt ceiling is raised. It also means I'll miss the paper losses on any short term positions if we get too close, or even breach, the time when bills are due.

My concern this time around is that the democrats decide to let the children have their tantrum as there is a life lesson that needs to be learned. Doing so will get us that much closer to the brink, and like the rest of the world I don't have any real idea of just how the world will change given a default on even a single US treasury or federal government obligation.

How many times is Elon going to mention FSD and how it will increase the value of the car ? 5 and over is bearish, otherwise is bullish.

Here’s the Bingo card:

1) FSD coming this year. I know, I know…but it will. Oh, and depending on local regulatory approval, so it’s not really up to us and not our fault if it’s not allowed in your jurisdiction.

2) FSD will unlock billions of dollars for Tesla, more value than selling the car itself by an order of magnitude.

3) We aren’t focused on margins right now, we are solely focused on market penetration.

4) While I’ll be spending more time at Tesla over the next few months, I’ll be leaving most day-to-day management in the capable hands of Zack and others. I’ll still be Technoking but as Tesla has matured, I am pleased by where it’s at. And as the past year demonstrated, Tesla can function without me there every day.

5) The share price is too high

6) Stay off of margin in the current financial uncertain environment

7) We will get through this and be stronger for it.

EVNow

Well-Known Member

Even if poorerWe will get through this and be stronger for it.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K