Nio and Rivn up more than TSLA so far today.That could turn out to be a golden move. It's starting to look mighty squeezy.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

intelligator

Active Member

Always a good problem to have IMO. Now have similar good problem to have on the -C side as I have some 180CC/182.5CC to deal with. Will likely roll it to next week.

Are you comfortable at those strikes next week? I have similar moves to make.

EDIT: Should have asked how you feel about those strikes for next week, not whether you are comfortable.

EDIT2: Moved the $5 wide -C177.5 spread by widening and sending to 5/26 -C180/+C190 for a credit. That will give me good wiggle room to deal with it later. Seems we are retracting some, it'd be nice to close below $180 - will monitor through about 130pm or so before I action the $5 wide -C180 spread.

Last edited:

juanmedina

Active Member

Nio and Rivn up more than TSLA so far today.

Not anymore.

I need to prepare myself mentally to say good bye to most of my shares at $185 but I think I will be able to buy them back eventually at a little lower price.

I've subscribed to Bookmap on TOS for a month. Watching it and trying to learn. Found this interesting from this morning. The first screenshot is from 9:39ET this morning. The 180 wall was 208K. In my short time watching how these walls play out, a wall this big would take quite a while to chew through. The 2nd image is from 10:12am. The wall simply vanished. Was this a marketmaker mirage?

Someone here shared earlier that on a gamma squeeze it can chew through 1 million shares very rapidly.

Not anymore.

I need to prepare myself mentally to say good bye to most of my shares at $185 but I think I will be able to buy them back eventually at a little lower price.

Sorry about that!

Last edited:

I'm not sure when the contracts expire but if its today I think you are safe. I'm also short on these calls.Not anymore.

I need to prepare myself mentally to say good bye to most of my shares at $185 but I think I will be able to buy them back eventually at a little lower price.

juanmedina

Active Member

Sorry about that!

I am actually not that scared or worried yet and I am looking forward to selling puts. Elon said that this years is going to be rough so I am going to take him at his word.

I'm not sure when the contracts expire but if its today I think you are safe. I'm also short on these calls.

I have next week contracts.

I've subscribed to Bookmap on TOS for a month. Watching it and trying to learn. Found this interesting from this morning. The first screenshot is from 9:39ET this morning. The 180 wall was 208K. In my short time watching how these walls play out, a wall this big would take quite a while to chew through. The 2nd image is from 10:12am. The wall simply vanished. Was this a marketmaker mirage?

As I said the other day, this happens all the time during run-ups. Level 2 data on “walls” is not that reliable; they can disappear at a moment's notice.

Two things going on in markets now: debt limit talks hitting a snag, and Powell making comments about having to hold rates higher for longer.

Rolled 10x 5/26 -c175 to 10x 6/9/23 -c180 - just trying to stay ATM. Holding 8x 5/26 -c177.50.

Closed 2x 5/26 -p170 and 2x -p175 - looking to reopen 175s on any weakness today or next week.

Closed 2x 5/26 -p170 and 2x -p175 - looking to reopen 175s on any weakness today or next week.

EVNow

Well-Known Member

The "wall" is made up of people who have put in orders to sell. As the SP moves up - a lot of them are likely to move the order price up in the hope SP will get higher. That is what I or you would do to get a better price, right ?I've subscribed to Bookmap on TOS for a month. Watching it and trying to learn. Found this interesting from this morning. The first screenshot is from 9:39ET this morning. The 180 wall was 208K. In my short time watching how these walls play out, a wall this big would take quite a while to chew through. The 2nd image is from 10:12am. The wall simply vanished. Was this a marketmaker mirage?

Besides, today when SP broke through 180, the volume was 1.28 Million. That 208k is not insurmountable ...

Hard to imagine the SP above 185 next week. Not saying it can't go above but I still see room to roll up and out. Looks like the MM's are looking for just below 180 close today.Are you comfortable at those strikes next week? I have similar moves to make.

EDIT: Should have asked how you feel about those strikes for next week, not whether you are comfortable.

EDIT2: Moved the $5 wide -C177.5 spread by widening and sending to 5/26 -C180/+C190 for a credit. That will give me good wiggle room to deal with it later. Seems we are retracting some, it'd be nice to close below $180 - will monitor through about 130pm or so before I action the $5 wide -C180 spread.

intelligator

Active Member

Thanks for this perspective @EnzoXYZ . A close below would avoid a roll of the -C180 based spread. I'll scope out a roll to next week, same approach by widening to $10 , improve strike , deal with it then.

Tesla share price continues to rise. To be honest, I did not expect such a quick gain.Which gives me the following position:

1 Call June 170

-2 Call June 185

1 Call may 200

-2 Call may 220

1 Call may 240

Profit/loss:

+145

-253

+20

Investment USD 88.

Profit is gaining. Slow pace of course but that's inherent to the position. Risk is low. But for me the profit counts.

May series expiring today. That means also that, in order to cap the margin, I need to buy a call to secure the upside. Due to the fact that the share price rose sharply these days I choose to buy a June 2 210 call for 38 cent instead of a June 16. I am not expecting this rally to continue.

That makes my position:

1 Call June 170

-2 Call June 185

1 Call June 2 210

Invested USD 88 and bought for 38 USD the June 2 Call 210. That makes that I spend USD 126 on this position.

EVNow

Well-Known Member

But what is the difference between delta based probability and the "correct" way to calculate it ? Instead of 20% ... would it be 21% or 50% ? I bet closer to 21%.Just for hygiene in our thinking (not calling out anyone), actual price outcomes in the stock market do not follow a classic bell curve distribution (though delta, AFAIK is calculated based on a Gaussian normal distribution). If you plot the outcomes, the histogram has fatter tails than a normal bell curve. If someone wants to go down that rabbit hole, Fooled by Randomness - Wikipedia

So for us this means that delta, if calculated based on a Gaussian normal distribution, underrepresents extreme outcomes to the left and to the right.

When making decisions, you need a quick and easy way to figure out the probability - no reason to go down the rabbit hole

Last edited:

intelligator

Active Member

Thanks for this perspective @EnzoXYZ . A close below would avoid a roll of the -C180 based spread. I'll scope out a roll to next week, same approach by widening to $10 , improve strike , deal with it then.

Or... I just wait for a pullback and close these out at 50% profit... DONE. Amazing how a fixation on a risky and potentially consequential roll to safety can mask the more sensible solution !!!

I don't agree with your suggestion that delta implicates a probability of getting ITM.Here is a rule of thumb. Look at the Delta. That is the probability the option will be ITM at expiry. Lot of option sellers target a particular delta to sell. That along with support/resistance levels can give you a good idea about what is comfortable for your risk profile.

For eg. 5/26 C185 has a delta now of 0.19, so about 20% probability of ITM. 6/2 160p is about 16%.

To explain, a June 175 call is 100% ITM, still the delta is far from 100.

EVNow

Well-Known Member

Pls see my earlier posts on this. I've provided provided multiple references.I don't agree with your suggestion that delta implicates a probability of getting ITM.

To explain, a June 175 call is 100% ITM, still the delta is far from 100.

EVNow

Well-Known Member

Closed 182.5 and 185 calls for 1 cent. Will look to STO on Monday.I hope I can close 182.5 easily tomorrow. Will wait for Monday to STO.

To clarify - delta is a quickie, reasonably accurate, measure of the probability of the option finishing ITM. Clearly the current state is whatever it is.I don't agree with your suggestion that delta implicates a probability of getting ITM.

To explain, a June 175 call is 100% ITM, still the delta is far from 100.

Prob.ITM is probability of being ITM at expiration time, not at any point along the way. I've encountered an idea of "touch" - that can be estimated as 2x Prob.ITM (or delta) and would be what you wrote - probability of going ITM at some point along the way. I haven't seen the idea of "touch" beyond the 1 source, and I haven't seen it being used by anybody as a component of a trading strategy.

R

ReddyLeaf

Guest

I was a bit share-heavy after buying back most of my calls, and had some extra cash after closing out my Iron Condors (yup, @adiggs was correct, selling the BCS side was not profitable and not compatible with the possible stratospheric nature of TSLA). So, decided to try a single 0DTE straddle at 180 (CC, CSP) for $1.20. Certainly didn’t time the trade and could have easily received $2-$3 if I had thought of the idea earlier.  Anyway, a fun little experiment that resulted in the put expired and the call exercised. I will probably just write another put next week, but might try a buy write, ( both around $4-$4.50) or maybe 10x +p160s/-p170s BPS (currently priced at $0.75) for about twice the premium.

Anyway, a fun little experiment that resulted in the put expired and the call exercised. I will probably just write another put next week, but might try a buy write, ( both around $4-$4.50) or maybe 10x +p160s/-p170s BPS (currently priced at $0.75) for about twice the premium.

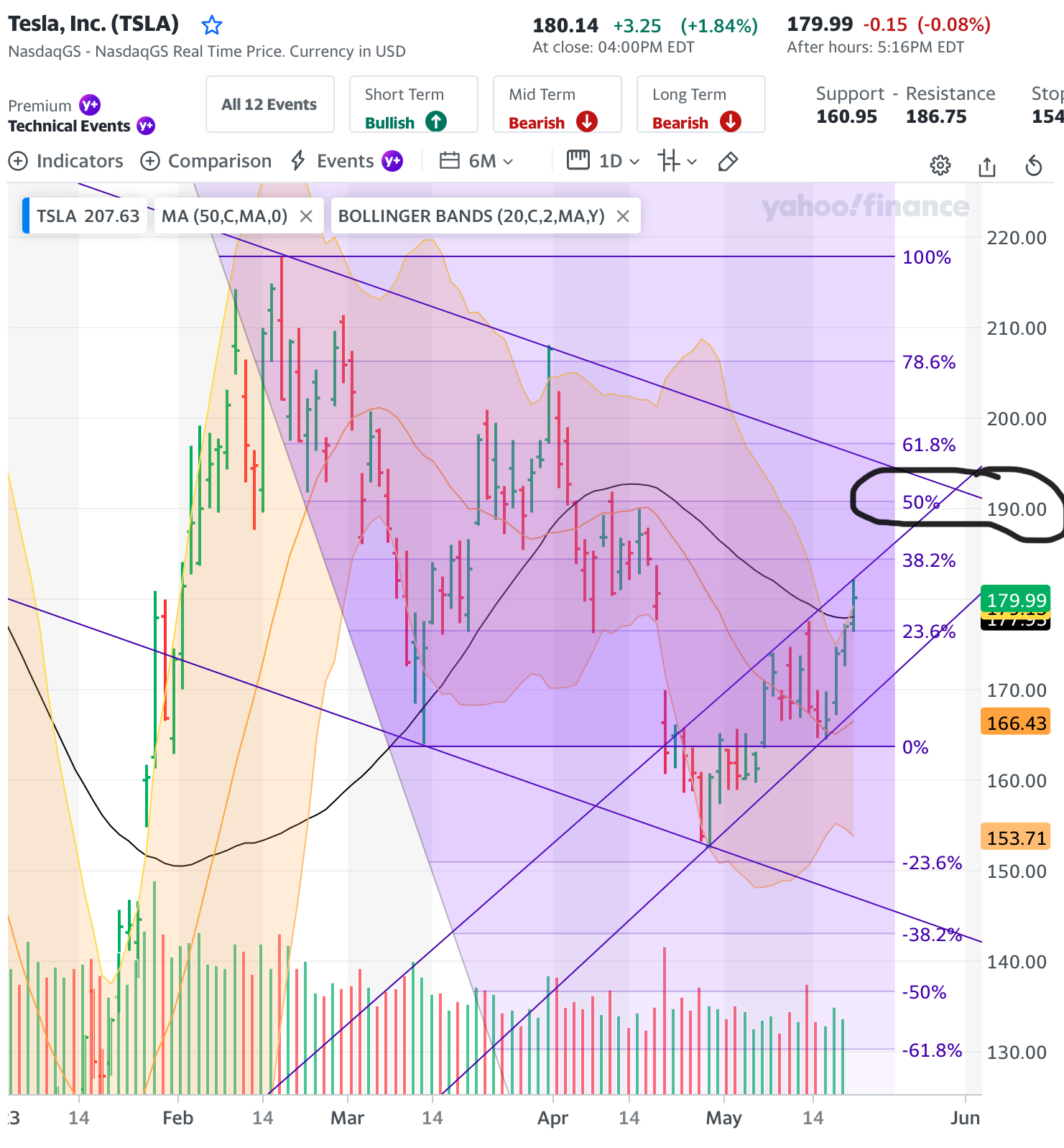

Lots of indicators that TSLA will continue to run a bit more. Closing above $180, 50d SMA, upper BB, 0.236 Fibonacci, all seem bullish. Add in some very bullish options trades this week, and it looks like some whales are trying to accumulate before EOQ. Continued retracement to $190 likely, and possibly even $208 or $220 is possible by July. I’m taking @dl003 ’s prediction seriously and expect to continue learning from his helpful posts for years. We haven’t seen so many green days in a row for quite awhile, that I expect a pullback sometime next week. Will try to practice patience on selling those puts or BPS. GLTA and have a great weekend.

Lots of indicators that TSLA will continue to run a bit more. Closing above $180, 50d SMA, upper BB, 0.236 Fibonacci, all seem bullish. Add in some very bullish options trades this week, and it looks like some whales are trying to accumulate before EOQ. Continued retracement to $190 likely, and possibly even $208 or $220 is possible by July. I’m taking @dl003 ’s prediction seriously and expect to continue learning from his helpful posts for years. We haven’t seen so many green days in a row for quite awhile, that I expect a pullback sometime next week. Will try to practice patience on selling those puts or BPS. GLTA and have a great weekend.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K