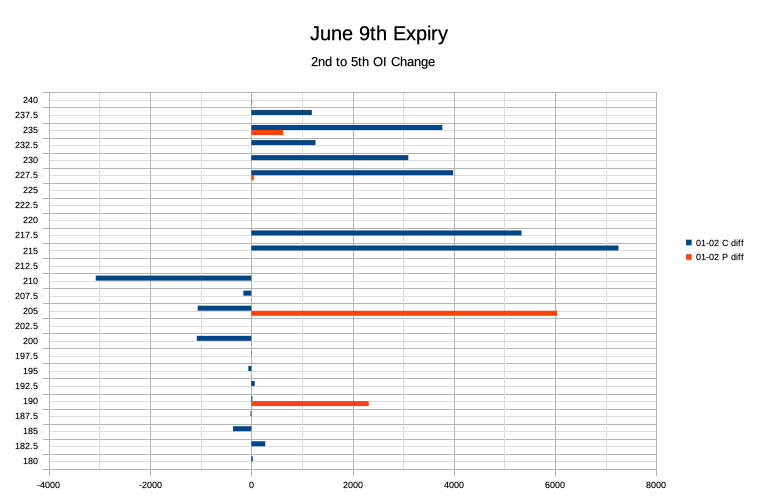

Since I bought 1100 shares at 215, and rolled up the 30 CSP to 215 to reduce the number of 215 CC to just 11, you are probably right.... In fact, probably back to 180....I wouldn't be surprised if we trade below 210 a day or two next week. The OI for 6/9 leaves a hole somewhere in the middle of the highest and lowest call and put strikes, I am seeing it near 202.5 and 207.5. Moves yesterday to today suggested that we'd.land between 210 and 212, not bad being off by a couple bucks. Can't wait to see Monday's pricing update of the shift from today's trades. While not a reliable read, still fun to explore.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

For those of us stuck with ITM CCs after the latest melt-up, would you still recommend a butterfly call strategy as a hedge against further upside? If so, any recommendations for which strikes to select at the current level?A butterfly call is a combination of 2 call spreads, 1 bullish & the other bearish

Buy 225/240 bull call spread

Sell 240/255 bear call spread

Maximum profit is realized if the stock closes exactly at 240 on 2/24. Partial profit is realized if the stock closes anywhere else between 225/255.

It's not too late to open these. This morning I opened them during the dip for $0 (including the short puts). They're now 0.48 each but if you are stuck with ITM CCs, this is the price to pay to somewhat have a chance at catching up.

intelligator

Active Member

Since I bought 1100 shares at 215, and rolled up the 30 CSP to 215 to reduce the number of 215 CC to just 11, you are probably right.... In fact, probably back to 180....

Don't sweat it, I did the same the last time we touched the 200's , happy just the same to have a couple hundred more shares

vwman111

Member

I have some June 24 300 Leaps. Is there a strategy around rolling these? Given how far they are OTM, how long should i hold on to them before rolling? I assumed i should roll at least 1 year out. What aobut position size and strike? Prioritize position size and go further OTM? Roll flat with less contracts? Or start fresh and look at where i want to be in terms of ATM strikes?

not-advice of courseI have some June 24 300 Leaps. Is there a strategy around rolling these? Given how far they are OTM, how long should i hold on to them before rolling? I assumed i should roll at least 1 year out. What aobut position size and strike? Prioritize position size and go further OTM? Roll flat with less contracts? Or start fresh and look at where i want to be in terms of ATM strikes?

I have a few ideas that I think germane.

The first is that time value decay accelerates as you get closer to expiration. 300 strike leaps exclusively hold time value. In other contexts, people pursuing more generalized option sale strategies look to sell 30-60 days out and close 2-3 weeks out. With the higher volatility / IV we have in TSLA we're more likely to be working with <2 week options, but the more general idea applies.

An approximate rule of thumb is that time decay accelerates around 3 months DTE. It's really accelerating every day, but for long DTE options the day to day increase in time decay is overwhelmed by share price and IV changes.

As a result I look to resolve my leaps by 6 months to go. You can estimate what that will look like with a glance at the Dec '23 or Jan '24 300 strike leaps - that's about how much time decay is coming. Keep going look at 3 month, 1 month, etc.. options. It's all approximates, but it gets you an idea.

Second idea is that I believe the proper way to look at rolls, especially on purchased contracts, is a close and realization of the current position, and an open of the new position. That is mechanically what is happening in the roll - the benefit is you pack the two transactions into a single trade ticket. There are circumstances (and I've been in them) where the roll ticket was necessary for me to move from 1 position to the next. I had sold cc against all shares and did not have the cash to buy out the calls in one ticket, and then sell new cc in a second ticket. But it was all the same backing, and the roll transaction ticket was able to make that happen.

So I think the best question to ask yourself is what new long dated call position do you most want? Do you want to make the change now, do you want to start establishing the new position now while holding off on resolving the existing position?

Once you've decided what you want to do with the current position close, and the new position open, then you can decide of a roll transaction is the right and best way to get there.

I personally have some June '24 200 strike leaps. They're pretty deeply red right now and they're starting to get closer to expiration than I like. Order of magnitude I want to hold them no later than end of this year (6 months to expiration). Any new leaps that I've been purchasing are always the longest dated. I also tend to buy ITM calls as I'm trying to rely on these leaps being share replacements. To be share replacements they need to start pretty deeply ITM - something like a .80 to .90 delta.

Good luck!

Reposting, might have been missed, hoping for some advice:

I have 1,900 shares at $243 CB. Two weeks ago I sold -C240 and -C245 against them for 7/21 figuring they’ll for sure expire OTM or there’d be a dip where I could close them (of course STO way too early…they’re trading now at $9.39 from $2.34 ). I’m prepared for them to be called away as well. (Same for the 6/30 -C220’s, I have enough shares at 215 CB, but counting on derisking dip toward end of month to BTC or let exercise).

). I’m prepared for them to be called away as well. (Same for the 6/30 -C220’s, I have enough shares at 215 CB, but counting on derisking dip toward end of month to BTC or let exercise).

I’m also holding -C245 for 9/15 (from a repair roll I’m stuck with) which will likely be ITM beforehand, but who knows.

My question is, if the 1,900 shares are called away on 7/21 is the strategy to buy the 1,900 shares again in the 240’s (if it’s trading there) to hold to cover the -C245 9/15, or is there something else that can be done to salvage the 9/15 -C240 contracts in case TSLA is trading at say $260 by then?

(And any suggestions for the -C360 @ 1/19? My plan with that one was to BTC on a dip in the 180’s but it got away from me. I have enough shares at $360 to cover it, though I doubt TSLA will be close to that in 6 months. The only downside is I could’ve gotten a lot more premium had I waited for TSLA to be in the 240’s to STO instead of 184.)

TIA

I have 1,900 shares at $243 CB. Two weeks ago I sold -C240 and -C245 against them for 7/21 figuring they’ll for sure expire OTM or there’d be a dip where I could close them (of course STO way too early…they’re trading now at $9.39 from $2.34

I’m also holding -C245 for 9/15 (from a repair roll I’m stuck with) which will likely be ITM beforehand, but who knows.

My question is, if the 1,900 shares are called away on 7/21 is the strategy to buy the 1,900 shares again in the 240’s (if it’s trading there) to hold to cover the -C245 9/15, or is there something else that can be done to salvage the 9/15 -C240 contracts in case TSLA is trading at say $260 by then?

(And any suggestions for the -C360 @ 1/19? My plan with that one was to BTC on a dip in the 180’s but it got away from me. I have enough shares at $360 to cover it, though I doubt TSLA will be close to that in 6 months. The only downside is I could’ve gotten a lot more premium had I waited for TSLA to be in the 240’s to STO instead of 184.)

TIA

Last edited:

I have 1,900 shares at $243 CBReposting, might have been missed, hoping for some advice:

I have 1,900 shares at $243 CB. Two weeks ago I sold -C240 and -C245 against them for 7/21 figuring they’ll for sure expire OTM or there’d be a dip where I could close them (of course STO way too early…they’re trading now at $9.39 from $2.34). I’m prepared for them to be called away as well. (Same for the 6/30 -C220’s, I have enough shares at 215 CB, but counting on derisking dip toward end of month to BTC or let exercise).

I’m also holding -C245 for 9/15 (from a repair roll I’m stuck with) which will likely be ITM beforehand, but who knows.

My question is, if the 1,900 shares are called away on 7/21 is the strategy to buy the 1,900 shares again in the 240’s (if it’s trading there) to hold to cover the -C245 9/15, or is there something else that can be done to salvage the 9/15 -C240 contracts in case TSLA is trading at say $260 by then?

(And any suggestions for the -C360 @ 1/19? My plan with that one was to BTC on a dip in the 180’s but it got away from me. I have enough shares at $360 to cover it, though I doubt TSLA will be close to that in 6 months. The only downside is I could’ve gotten a lot more premium had I waited for TSLA to be in the 240’s to STO instead of 184.)

TIA

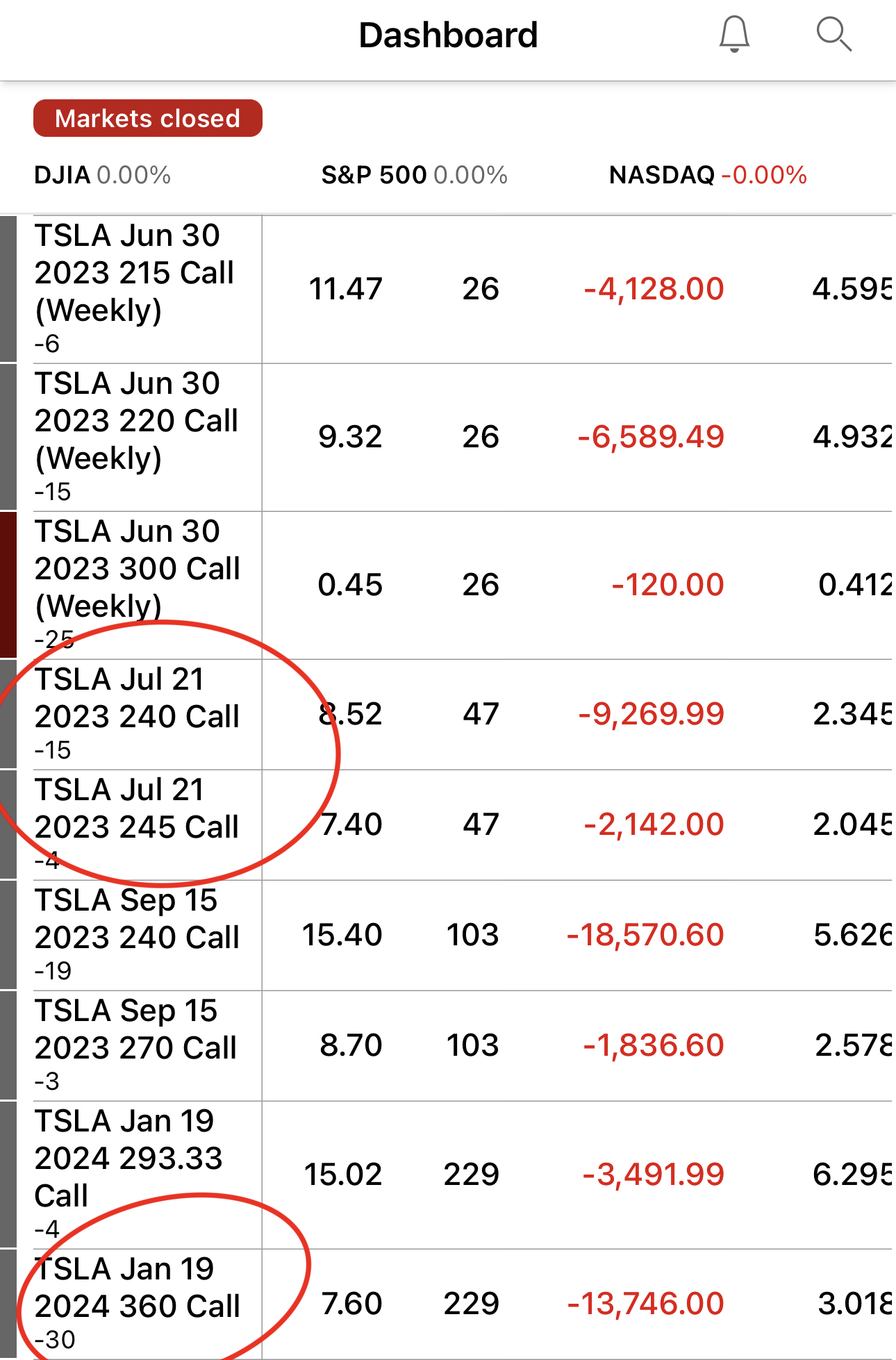

View attachment 943934

I suppose you bought 1,900 shares USD 243 per share? (I am not familiar with the American abbreviations so I don't know what CB means).

It stands for “Cost Basis.”I have 1,900 shares at $243 CB

I suppose you bought 1,900 shares USD 243 per share? (I am not familiar with the American abbreviations so I don't know what CB means).

I was put 1,900 shares last year during “the plunge” for 19x CSP I sold for 12/16/22 $260 strike. I got $45k for it so my ultimate CB for the lot was $243. It was harrowing since it used nearly 55% margin at the time as TSLA was barreling toward $100 and I had to buy sugar puts just to keep the account from blowing up. Ironically those puts brought in decent money and eventually I survived with the account intact and no margin call.

So I’m okay letting the 1,900 shares go and can rebuy them if needed to ride up some more.

But meanwhile I’m looking for advice for best practices for managing my current open positions.

OK, thx for explaining.It stands for “Cost Basis.”

I was put 1,900 shares last year during “the plunge” for 19x CSP I sold for 12/16/22 $260 strike. I got $45k for it so my ultimate CB for the lot was $243. It was harrowing since it used nearly 55% margin at the time as TSLA was barreling toward $100 and I had to buy sugar puts just to keep the account from blowing up. Ironically those puts brought in decent money and eventually I survived with the account intact and no margin call.

So I’m okay letting the 1,900 shares go and can rebuy them if needed to ride up some more.

But meanwhile I’m looking for advice for best practices for managing my current open positions.

But if I were you I wouldn't be so anxious about your 7/21 sold calls. Your main concern might be when the SP will go lower.

I’d love it to go lower (they’re not on margin anymore) so I could BTC the short calls for gains, free up the shares, and resell them closer to the money for closer DTE. I’m learning that anything more than 2-3 weeks out doesn’t work out worth it in a bull run (where you can STO for much more premium NTM as the share price rises. Case in point see the 7/21 -C240 and 1/21 -C360).OK, thx for explaining.

But if I were you I wouldn't be so anxious about your 7/21 sold calls. Your main concern might be when the SP will go lower.

You have 1,900 shares at USD 243. How much calls 240 and 245 you sold?I’d love it to go lower (they’re not on margin anymore) so I could BTC the short calls for gains, free up the shares, and resell them closer to the money for closer DTE. I’m learning that anything more than 2-3 weeks out doesn’t work out worth it in a bull run (where you can STO for much more premium NTM as the share price rises. Case in point see the 7/21 -C240 and 1/21 -C360).

You have 1,900 shares at USD 243. How much calls 240 and 245 you sold?

It’s all in my post above. I also have some lots at $215, $270, $290, and the largest lot at $358 (of course

I see, 47 on 47 yes? That makes 94 calls OTM short and 1,900 shares long.It’s all in my post above. I also have some lots at $215, $270, $290, and the largest lot at $358 (of course).

I would say, no panic. SP now at 214. If SP reaches 230 then you may think. Actually, you may hope SP reaches 230.

[

If your shares are called away, the SP won’t be in the 240s to buy back your shares - or you would have just been able to close them out or roll them instead of letting them get called away.

But if your 7/21s are called away, you will have a lot of cash to sell puts. I’m planning to try to rescue my ITM short calls by flipping some to puts using the proceeds from exercised short calls - you could salvage some or all of your 9/15s by doing that. That would then shift your risk to the downside but you might be able to roll the puts back down a bit if that were to happen.

You could also just sell farther OTM puts to raise the strike on your calls without buying them back completely.

Also, note that selling weeklies in front of a big run up isn’t any better than selling monthlies because you’ll need to be closer to the money for the weeklies so you can get run over just as quickly.

Reposting, might have been missed, hoping for some advice:

I have 1,900 shares at $243 CB. Two weeks ago I sold -C240 and -C245 against them for 7/21 figuring they’ll for sure expire OTM or there’d be a dip where I could close them (of course STO way too early…they’re trading now at $9.39 from $2.34). I’m prepared for them to be called away as well. (Same for the 6/30 -C220’s, I have enough shares at 215 CB, but counting on derisking dip toward end of month to BTC or let exercise).

I’m also holding -C245 for 9/15 (from a repair roll I’m stuck with) which will likely be ITM beforehand, but who knows.

My question is, if the 1,900 shares are called away on 7/21 is the strategy to buy the 1,900 shares again in the 240’s (if it’s trading there) to hold to cover the -C245 9/15, or is there something else that can be done to salvage the 9/15 -C240 contracts in case TSLA is trading at say $260 by then?

(And any suggestions for the -C360 @ 1/19? My plan with that one was to BTC on a dip in the 180’s but it got away from me. I have enough shares at $360 to cover it, though I doubt TSLA will be close to that in 6 months. The only downside is I could’ve gotten a lot more premium had I waited for TSLA to be in the 240’s to STO instead of 184.)

TIA

View attachment 943934

If your shares are called away, the SP won’t be in the 240s to buy back your shares - or you would have just been able to close them out or roll them instead of letting them get called away.

But if your 7/21s are called away, you will have a lot of cash to sell puts. I’m planning to try to rescue my ITM short calls by flipping some to puts using the proceeds from exercised short calls - you could salvage some or all of your 9/15s by doing that. That would then shift your risk to the downside but you might be able to roll the puts back down a bit if that were to happen.

You could also just sell farther OTM puts to raise the strike on your calls without buying them back completely.

Also, note that selling weeklies in front of a big run up isn’t any better than selling monthlies because you’ll need to be closer to the money for the weeklies so you can get run over just as quickly.

R

ReddyLeaf

Guest

Similar advice to @MikeC above. I would either roll out weekly or accept assignment and then sell weekly puts at the same/similar strikes (again rolling weekly if wrong). As I’ve said before to others, I prefer strangles/straddles because I cannot predict the SP direction. Right now I “believe” we are overbought (slightly) and ready for a pullback, but the market may not be ready for that, and might continue on another +10% run. In either case, I’m waiting until Wednesday and only selling 2-DTE options. Selling longer-dated options is too much risk for me.Reposting, might have been missed, hoping for some advice:

I have 1,900 shares at $243 CB. Two weeks ago I sold -C240 and -C245 against them for 7/21 figuring they’ll for sure expire OTM or there’d be a dip where I could close them (of course STO way too early…they’re trading now at $9.39 from $2.34). I’m prepared for them to be called away as well. (Same for the 6/30 -C220’s, I have enough shares at 215 CB, but counting on derisking dip toward end of month to BTC or let exercise).

I’m also holding -C245 for 9/15 (from a repair roll I’m stuck with) which will likely be ITM beforehand, but who knows.

My question is, if the 1,900 shares are called away on 7/21 is the strategy to buy the 1,900 shares again in the 240’s (if it’s trading there) to hold to cover the -C245 9/15, or is there something else that can be done to salvage the 9/15 -C240 contracts in case TSLA is trading at say $260 by then?

(And any suggestions for the -C360 @ 1/19? My plan with that one was to BTC on a dip in the 180’s but it got away from me. I have enough shares at $360 to cover it, though I doubt TSLA will be close to that in 6 months. The only downside is I could’ve gotten a lot more premium had I waited for TSLA to be in the 240’s to STO instead of 184.)

TIA

View attachment 943934

intelligator

Active Member

Looks like the 7am and 7:30am bots woke up  ... the thought of trading below 210 look slimmer. Friday OI moves for 6/9 show an increase at C215, C217.5, P205, decrease C210. Highest Call/Put OI 230/205 , nearing 2:1 for calls to puts. With this trajectory, my -C210/+C220 spread will be a problem.

... the thought of trading below 210 look slimmer. Friday OI moves for 6/9 show an increase at C215, C217.5, P205, decrease C210. Highest Call/Put OI 230/205 , nearing 2:1 for calls to puts. With this trajectory, my -C210/+C220 spread will be a problem.

All,

Keep in mind next week is one of the two "Quad Witching" events for the year. Meaning we expirations for -

Yearly Leap

Quarterly Leap

Monthlies

Weeklies

This only happens twice a year - with the December and June expirations as they are the first to open for Leap purchases.

Right now the Max Pain is set for $175 and I am not sure how that shapes up next week.

Not sure how it's going to happen this time, and MM should be well delta hedged in advance - but we have seen a big run come to a screeching halt and move to close to max pain in the past on these Quads.

I of course will try and be out by Friday of next week - just posting for info and food for thought.

Keep in mind next week is one of the two "Quad Witching" events for the year. Meaning we expirations for -

Yearly Leap

Quarterly Leap

Monthlies

Weeklies

This only happens twice a year - with the December and June expirations as they are the first to open for Leap purchases.

Right now the Max Pain is set for $175 and I am not sure how that shapes up next week.

Not sure how it's going to happen this time, and MM should be well delta hedged in advance - but we have seen a big run come to a screeching halt and move to close to max pain in the past on these Quads.

I of course will try and be out by Friday of next week - just posting for info and food for thought.

Yes. I'd try to go about $15 out every week. The distance between the body to each wing of the butterfly.For those of us stuck with ITM CCs after the latest melt-up, would you still recommend a butterfly call strategy as a hedge against further upside? If so, any recommendations for which strikes to select at the current level?

so +220/-230/+240 for Jun9 expiration? That's $1.23 debit pre-market. Could pay for it with a -200P for same expiration.Yes. I'd try to go about $15 out every week. The distance between the body to each wing of the butterfly.

I'd go 220/235/250 and take some risk with the short puts.so +220/-230/+240 for Jun9 expiration? That's $1.23 debit pre-market. Could pay for it with a -200P for same expiration.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K