R

ReddyLeaf

Guest

Decently profitable week, closing out +p235/-p245/-c267.5/+c277.5 ICs for $0.01 (BPS) and $0.02 (BCS) sides. Unfortunately, it was an exceedingly frustrating week trying to mitigate issues with brokerage and ITM options rolled during the previous SP surge. My brokerage kept mis-pairing options while I was rolling BPS and BCS pairs separately. I was in BPS, BCS, IC, IB, inverted whatchies, and some short box spreads, things I didn’t even know existed. Ultimately, they somehow managed to create a naked short call and unpaired shares (all of this in a US IRA retirement account that doesn’t allow such positions). Of course, this locked up my account twice (Wednesday and Thursday), so I was unable to close out positions just like @Max Plaid. Fortunately, Friday morning they figured it out, and briefly allowed me to close the naked call, thus restoring internet trading access. I then proceeded to close the weird spreads, and about half the others, leaving just simple IC or IB spreads for 7/7, 7/14, 7/21, and 7/28. Still not entirely happy with the results, but will endeavor to only have a single spread in any one week, in each account.

Here are the current July positions:

IV crush play: 7/07 IC +p220/-p230/-c300/+c310 $0.90 cr

IV crush play: 7/07 IC +p225/-p235/-c300/+c310 $0.97 cr

7/07 IC +p245/-p255/-c270/+c280 $6.29cr (previous “fix”)

7/14 IB +p260/-p275/-c275/+c290 $11.68 cr (previous “fix”)

7/14 IB +p245/-p255/-c255/+c265 $8.57 cr (previous “fix”)

7/21 IC +p250/-p270/-c280/+c300 $14.37 cr (previous “fix”)

7/21 IB +p265/-p280/-c280/+c295 $10.22 cr (previous “fix”)

7/28 IC +p250/-p270/-c290/+c310 $13.34 cr (previous “fix”)

Definitely not happy with most of these positions, since they are attempts to fix previous trades that went bad (dITM). Problematic if the SP drops during a bear raid between P/D and Earnings, but will deal with each week as they get closer. Still have CCs at June 2024 -c225s, -c290s, -c300s, Jan2026 -c200s,-c260s, Mar2024 -c270s, and Oct2023 -c300s that will act as a hedge against a future bear raid (see Elon’s recent tweets about margin borrowing and cage fighting).

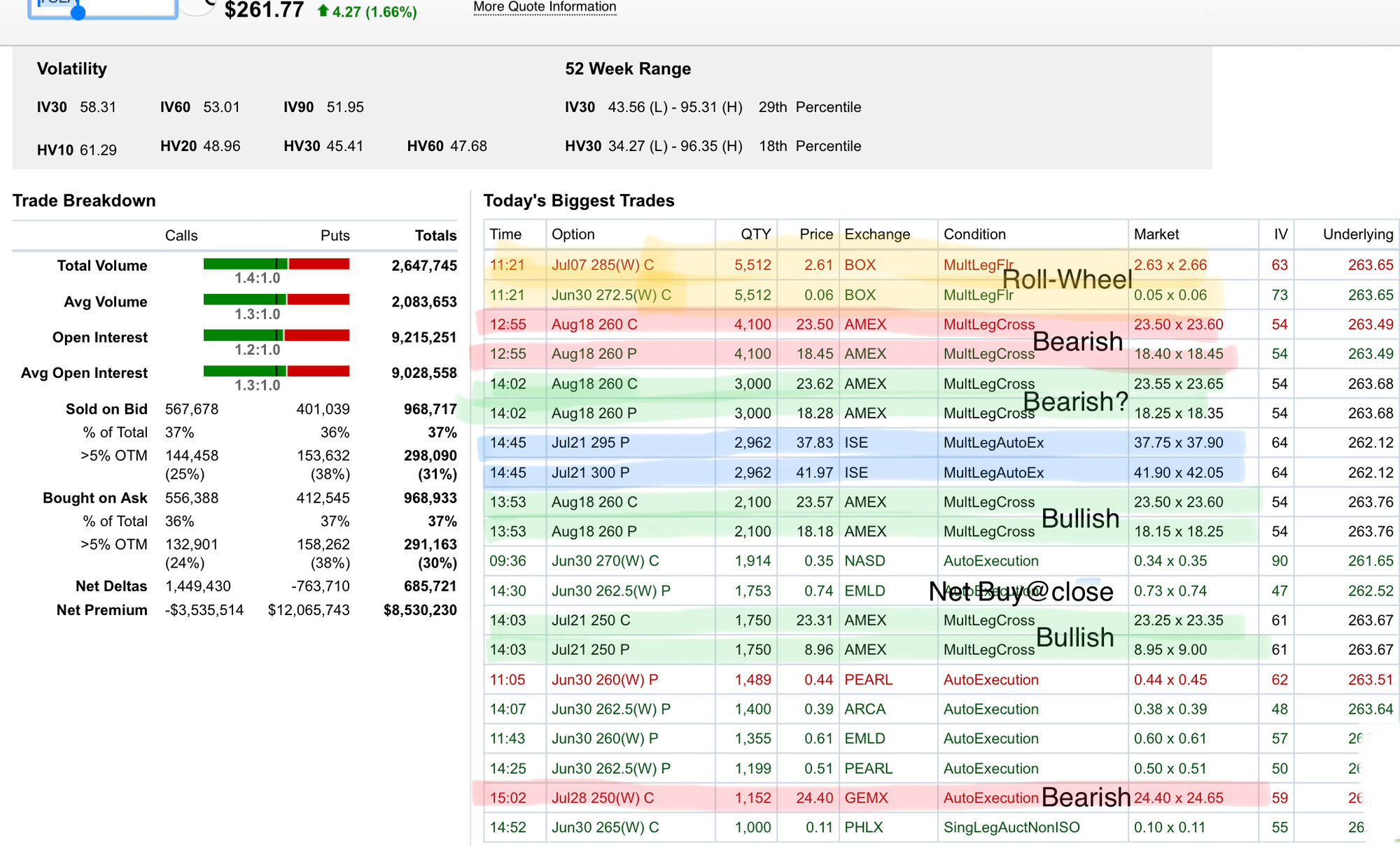

In more useful news, note Friday’s largest trades; rolls, bullish and bearish spreads, about 50:50. I can’t tell from the prices whether the blue highlighted spread is bearish or bullish. From net delta, it looks like more call buying than puts.

Edit: still waiting/expecting the bears to close that $235 gap at the 0.618 Fibonacci level.

Here are the current July positions:

IV crush play: 7/07 IC +p220/-p230/-c300/+c310 $0.90 cr

IV crush play: 7/07 IC +p225/-p235/-c300/+c310 $0.97 cr

7/07 IC +p245/-p255/-c270/+c280 $6.29cr (previous “fix”)

7/14 IB +p260/-p275/-c275/+c290 $11.68 cr (previous “fix”)

7/14 IB +p245/-p255/-c255/+c265 $8.57 cr (previous “fix”)

7/21 IC +p250/-p270/-c280/+c300 $14.37 cr (previous “fix”)

7/21 IB +p265/-p280/-c280/+c295 $10.22 cr (previous “fix”)

7/28 IC +p250/-p270/-c290/+c310 $13.34 cr (previous “fix”)

Definitely not happy with most of these positions, since they are attempts to fix previous trades that went bad (dITM). Problematic if the SP drops during a bear raid between P/D and Earnings, but will deal with each week as they get closer. Still have CCs at June 2024 -c225s, -c290s, -c300s, Jan2026 -c200s,-c260s, Mar2024 -c270s, and Oct2023 -c300s that will act as a hedge against a future bear raid (see Elon’s recent tweets about margin borrowing and cage fighting).

In more useful news, note Friday’s largest trades; rolls, bullish and bearish spreads, about 50:50. I can’t tell from the prices whether the blue highlighted spread is bearish or bullish. From net delta, it looks like more call buying than puts.

Edit: still waiting/expecting the bears to close that $235 gap at the 0.618 Fibonacci level.

Last edited by a moderator: