Found it, it wasn’t AI day but Autonomous Day:Ai day was rescheduled from beginning of August to sept 30th 2022. So same quarter. Curious about the passages in the book!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Gosh, makes a lot of sense the way you lay it out.Y'all still tracking events hoping for miracles?

One of my favourite tools to predict the future is fractals. Fractals are intricate (complex) setups on the chart that repeat themselves. This can happen on the same timeframe / wave degree or it can happen on different time frames / wave degrees. At first it gives you a vague deja vu feeling, but then the pieces keep falling into place and so for the next days or weeks you seem to be able to see the future, until the current setup starts deviating from the old one.

Right now, the current correction in TSLA is tracking the 217-152 correction earlier this year super closely. Eerie. So that's going to be my basis for levels and forecasts until it turns out to be grade A voodoo.

View attachment 977685

217-152 corrected the first leg up from 102 to 217. This time 298 - 185 is going to correct the entire 102-298 rally. Look at the 2 side by side, starting with the first leg down in yellow and how they both ended at anchored vwap running from 102

View attachment 977686

Then look at the big dead cat that came after. 1st spike. small consolidation. Break out. Big consolidation. Break out. Blow off top. Flush.

View attachment 977687

The 217-152 correction ended at the lower band of AVWAP. This time I'm betting it's going to do the same thing at 185-190.

View attachment 977688

251 is where short positions can be considered. 256 if mr. market is generous.

This means I have to be ready to sell my longs and +C150 12/2025 LEAPS when we hit $251-$256 and batten down the hatches for a dump to $185 where I can rebuy them. That’s around a $395k win (!) on 6,000 shares (~$66 per share) not to mention gains from rebuying the 8x +C150 12/2025 LEAPS down there.

Heck I may have enough gains from the ride down to be able to BTC my 60x -C500 12/25 which will have fallen from $42 to around $10 dollars @$185 and still have lots left over.

The major risk for this plan is a sudden price surge due to news or other surprise event.

Am I playing with fire or the R:R is reasonable?

This week did not go as planned. I had 30X 265 Puts expiring Friday, that I had rolled a month ago. I expected this week to be green, so I waited to roll them another month. This week, I have watched the roll go from $8, to $7, to $6, to less than $5. I was able to roll them for $5 on the afternoon recovery. So I made $15k for the month on the roll, instead of $24k. Ouch. I though there was a significant risk of assignment tonight, which is why I didn't wait another day.

Gosh, makes a lot of sense the way you lay it out.

This means I have to be ready to sell my longs and +C150 12/2025 LEAPS when we hit $251-$256 and batten down the hatches for a dump to $185 where I can rebuy them. That’s around a $395k win (!) on 6,000 shares (~$66 per share) not to mention gains from rebuying the 8x +C150 12/2025 LEAPS down there.

Heck I may have enough gains from the ride down to be able to BTC my 60x -C500 12/25 which will have fallen from $42 to around $10 dollars @$185 and still have lots left over.

The major risk for this plan is a sudden price surge due to news or other surprise event.

Am I playing with fire or the R:R is reasonable?

You are definitely playing with fire, but such is trading. I can't tell you how many times I've seen this stock trade in an irrational way over the last 5 years.

SebastienBonny

Member

Great! I suppose you won't be disappointed when (if) they ever get assigned, because you collected premiums rolling the contract a few times.This week did not go as planned. I had 30X 265 Puts expiring Friday, that I had rolled a month ago. I expected this week to be green, so I waited to roll them another month. This week, I have watched the roll go from $8, to $7, to $6, to less than $5. I was able to roll them for $5 on the afternoon recovery. So I made $15k for the month on the roll, instead of $24k. Ouch. I though there was a significant risk of assignment tonight, which is why I didn't wait another day.

Did you roll them one month?

SpeedyEddy

Active Member

Thank you for posting the passage @Jim Holder, and I read it a bit different. Elon was afraid to loose big investors in a heavily shorted market with no hope, so the goal (of autonomy day) was not directly influencing SP, but convincing shareholders why not to drop investments. Otherwise it would have made it impossible for Tesla to ever more expand on issuing shares or company loans/bonds. And yes that is an action that supports SP Attracting new investors. It was well thought of and executed over a longer timeframe other than (now) reacting on SP falling, in the next weekend.

Because, now there is not any risk to cashflow at the moment, Tesla does not need more investors or raise capital in another way, so no plan to unfold the future is needed. The opposite is true. To maintain competitive advantage you don’t tell the audience what the plan is, only if you need to. Tesla forces the competition to follow, thus increasing the speed of enrolling sustainability. Politics could play a roll here because as they present it, a Republican presidency will not help the ultimate goal of Tesla. So the sustainability-train must roll fast enough to not being able to be stopped, crashing Oil-funded railblocks on it’s path. Only fast expansion and cheaper cars can make this possible because (in the US) sticker-pricing below ICE can convince the anti EV mainstream. So that will be announced soon enough to withstand and convince any presidency.

Manufacturing of the future cars and stationary mainly within the USA is or will be part of this plan.

Because, now there is not any risk to cashflow at the moment, Tesla does not need more investors or raise capital in another way, so no plan to unfold the future is needed. The opposite is true. To maintain competitive advantage you don’t tell the audience what the plan is, only if you need to. Tesla forces the competition to follow, thus increasing the speed of enrolling sustainability. Politics could play a roll here because as they present it, a Republican presidency will not help the ultimate goal of Tesla. So the sustainability-train must roll fast enough to not being able to be stopped, crashing Oil-funded railblocks on it’s path. Only fast expansion and cheaper cars can make this possible because (in the US) sticker-pricing below ICE can convince the anti EV mainstream. So that will be announced soon enough to withstand and convince any presidency.

Manufacturing of the future cars and stationary mainly within the USA is or will be part of this plan.

Last edited:

SpeedyEddy

Active Member

I will be doing so too, because the way I approached it end of 2022 was totally wrong. I told y’all that I would take this (in my eyes last) opportunity to do it all over and hope to end up holding a lot of leaps ands shares bought in oversold territories lying ahead. I will be all in on that and I will make mistakes, miss tops and bottoms but hopefully not as bad, blinded by the tricks like last time. Thinking opposite is important as is being active in both directions, sometimes daytrading the obvious waves. For today and tomorrow I will follow the path layed out yesterday, so go less long again on a buy the rumour run, because yesterday’s pricing-in of a P&D “miss” in that case would be neutralised. Consensus has already been played down, so the ”miss” will be smaller than projected earlier.You are definitely playing with fire, but such is trading. I can't tell you how many times I've seen this stock trade in an irrational way over the last 5 years.

I will be doing so too, because the way I approached it end of 2022 was totally wrong. I told y’all that I would take this (in my eyes last) opportunity to do it all over and hope to end up holding a lot of leaps ands shares bought in oversold territories lying ahead. I will be all in on that and I will make mistakes, miss tops and bottoms but hopefully not as bad, blinded by the tricks like last time. Thinking opposite is important as is being active in both directions, sometimes daytrading the obvious waves. For today and tomorrow I will follow the path layed out yesterday, so go less long again on a buy the rumour run, because yesterday’s pricing-in of a P&D “miss” in that case would be neutralised. Consensus has already been played down, so the ”miss” will be smaller than projected earlier.

Any tips on how you plan to manage the process of selling and getting back in?

For me with such a nice pay day if it works out I feel like it’s okay to spend some money to protect myself while doing this but unsure how.

I will be doing so too, because the way I approached it end of 2022 was totally wrong. I told y’all that I would take this (in my eyes last) opportunity to do it all over and hope to end up holding a lot of leaps ands shares bought in oversold territories lying ahead. I will be all in on that and I will make mistakes, miss tops and bottoms but hopefully not as bad, blinded by the tricks like last time. Thinking opposite is important as is being active in both directions, sometimes daytrading the obvious waves. For today and tomorrow I will follow the path layed out yesterday, so go less long again on a buy the rumour run, because yesterday’s pricing-in of a P&D “miss” in that case would be neutralised. Consensus has already been played down, so the ”miss” will be smaller than projected earlier.

Another option than selling $250-255 is to sell on a close below $231 which signals a more serious breech. But it’ll sure be great to get out higher.

I will be doing so too, because the way I approached it end of 2022 was totally wrong. I told y’all that I would take this (in my eyes last) opportunity to do it all over and hope to end up holding a lot of leaps ands shares bought in oversold territories lying ahead. I will be all in on that and I will make mistakes, miss tops and bottoms but hopefully not as bad, blinded by the tricks like last time. Thinking opposite is important as is being active in both directions, sometimes daytrading the obvious waves. For today and tomorrow I will follow the path layed out yesterday, so go less long again on a buy the rumour run, because yesterday’s pricing-in of a P&D “miss” in that case would be neutralised. Consensus has already been played down, so the ”miss” will be smaller than projected earlier.

I lost about half of my shares in 2022 thanks to selling too many puts into... well we all know what happened.

I rode a bunch of LEAPs back up to recent highs and gradually sold them over the last few weeks.

Currently I'm in 50% in cash, 50% in TSLA and waiting to get back all in and, with some luck, end up with more shares than I started. I find myself hoping for a big dip again. Fingers crossed.

intelligator

Active Member

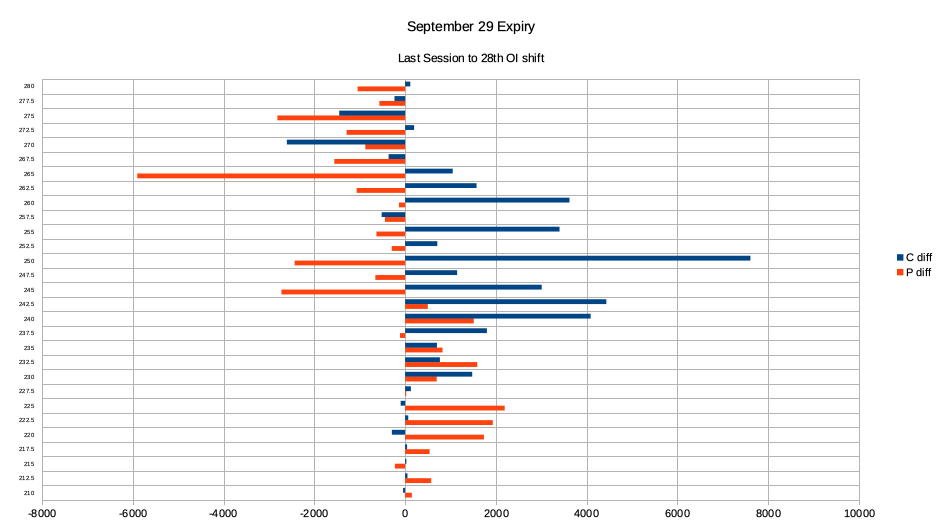

max-pain dropped to 245, put call ration .63 ...

p265 OI dropped by 6k , c250 (highest call OI) increased by 7.5k , 235 to 230 saw common interest, while p240 and p220 are now the highest put interest.

I only opened the put side of the IC yesterday. Today will try again for now a 2DTE -c250 or -c255 to raise cash.

p265 OI dropped by 6k , c250 (highest call OI) increased by 7.5k , 235 to 230 saw common interest, while p240 and p220 are now the highest put interest.

I only opened the put side of the IC yesterday. Today will try again for now a 2DTE -c250 or -c255 to raise cash.

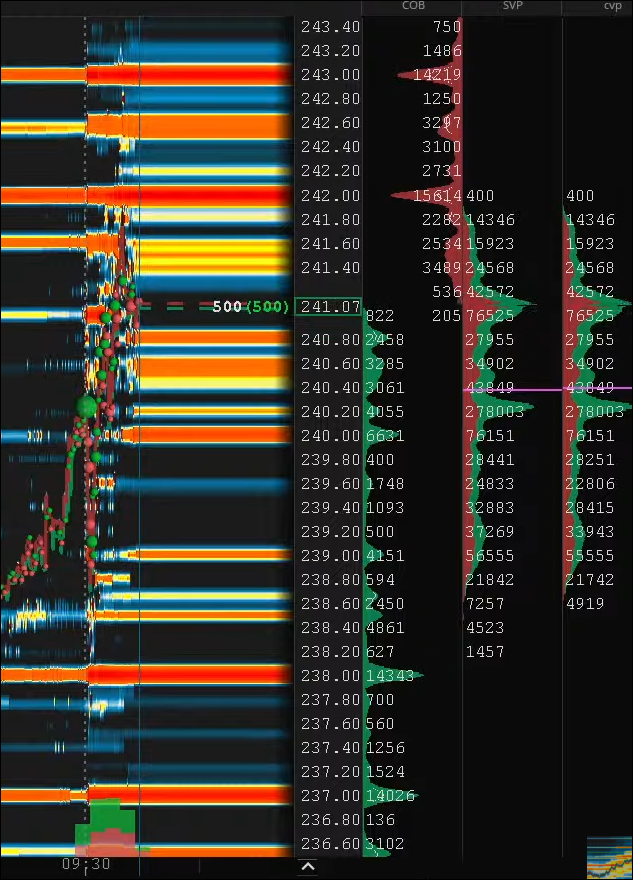

QTA generated levels for today:

Bookmap

Bookmap

About the same for me. I murdered it in LEAPs from 2019-2021 and then dramatically underestimated the depth and length of the Fed dip. I hit the rise from 100 fairly well but started to sell as we approached 300. Now I'm keeping a chunk of core shares, and 1/3 cash that I use to play calls on clear upswings and puts on the downs. 2 steps forward one 1 step for sure but it's slowly working.I lost about half of my shares in 2022 thanks to selling too many puts into... well we all know what happened.

I rode a bunch of LEAPs back up to recent highs and gradually sold them over the last few weeks.

Currently I'm in 50% in cash, 50% in TSLA and waiting to get back all in and, with some luck, end up with more shares than I started. I find myself hoping for a big dip again. Fingers crossed.

If I can time a possible dump down to sub 200 and then ride it back up in 2024 I'll probably be whole or close enough. Good luck all!

juanmedina

Active Member

You are definitely playing with fire, but such is trading. I can't tell you how many times I've seen this stock trade in an irrational way over the last 5 years.

I agree. I would only sell some of my shares but not everything because if I am wrong I don't want to be really wrong. I would only consider selling everything when the stock gets to a price that I am happy with selling and maybe the stock will tank after and get more shares that way. I also lost half of my shares in my after-tax account thanks to selling too many puts

SpeedyEddy

Active Member

I only can tell you what I do and that was already selling a bit of stock today, cautiously plus STO a few C250 for next week with intention to hold. I am hesitant to close my 510 LEAPS jan '26 with a loss, but am waiting for a possible sp $250 today to do so, and then will also close my C280 dec23, which would leave me totally naked (only -250 calls left (besides some day-trading action, which I open and close very fast, not worth mentioning)Any tips on how you plan to manage the process of selling and getting back in?

For me with such a nice pay day if it works out I feel like it’s okay to spend some money to protect myself while doing this but unsure how.

SpeedyEddy

Active Member

I also think to buy (a lot of) cheap puts tomorrow into the close, I think the monthlies for october or a week prior, to at least double the value, and maybe hit the jackpot wit those. Maybe in a staggered way, for instance 1 P200, 5 p180 10 P170 and 100p150.

[edit] and the challenge (als always with me) will be to sit on my hands after covering by selling 1 or 2 of them. The rest would be free gambling money. But first let's not be wrong on the move on Monday, in which case the money will be greatly gone on day one.[/edit]

[edit] and the challenge (als always with me) will be to sit on my hands after covering by selling 1 or 2 of them. The rest would be free gambling money. But first let's not be wrong on the move on Monday, in which case the money will be greatly gone on day one.[/edit]

Last edited:

I also think to buy (a lot of) cheap puts tomorrow into the close, I think the monthlies for october or a week prior, to at least double the value, and maybe hit the jackpot wit those. Maybe in a staggered way, for instance 1 P200, 5 p180 10 P170 and 100p150.

[edit] and the challenge (als always with me) will be to sit on my hands after covering by selling 1 or 2 of them. The rest would be free gambling money. But first let's not be wrong on the move on Monday, in which case the money will be greatly gone on day one.[/edit]

This is a visual of the +P200 10/20:

SpeedyEddy

Active Member

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K