No you read it right. If it reaches 217.5 it means I'm wrong and 202 was bottom. However, until that happens, default is still down.Yikes. I misread what you wrote just before. I thought you said if reaches $217.50 not to short it anymore.

Maybe I should have held the +P165 11/24 puts after-all. Is that what you're saying?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

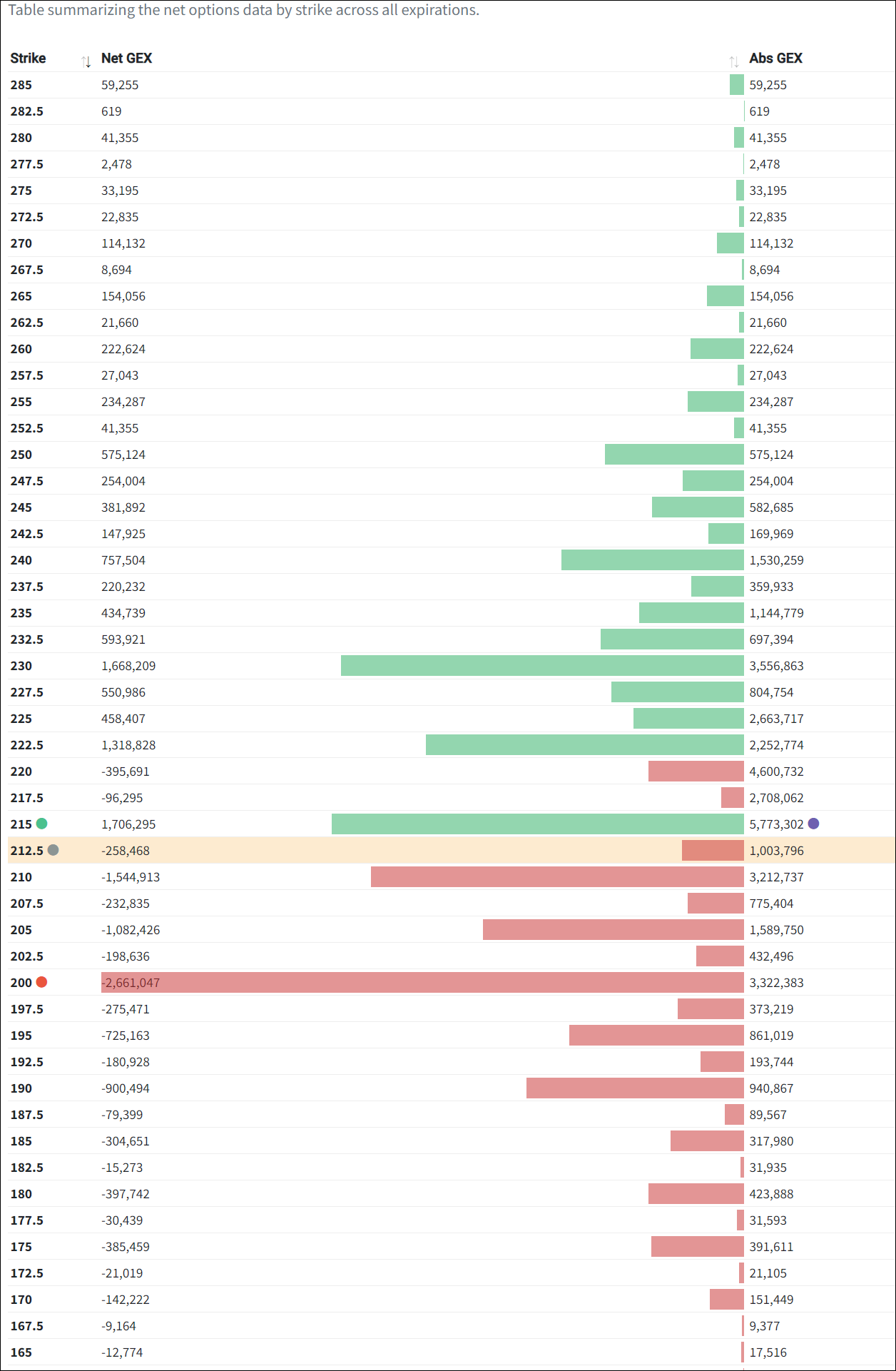

Net Options for next Friday (11/3)

$230 call wall shrinked quite a lot.

$200 put wall still strong and growing

$230 call wall shrinked quite a lot.

$200 put wall still strong and growing

It is a Put wall or a Put magnet? Put sellers need to start selling shares to hedge as the SP gets closer right?Net Options for next Friday (11/3)

$230 call wall shrinked quite a lot.

$200 put wall still strong and growing

View attachment 985255

That would be a reverse gamma squeeze I'd say, but not sure if there is a special name for it.It is a Put wall or a Put magnet? Put sellers need to start selling shares to hedge as the SP gets closer right?

It is a Put wall or a Put magnet? Put sellers need to start selling shares to hedge as the SP gets closer right?

I mean wall as in large size. I read somewhere that the MM's try to avoid getting down there to not have to pay out so much, in fact they try to run up the SP to get ppl out of their puts. Dunno if it's a conspiracy theory or true and if they really have the ability (as PoppaFox says they do).

The SP has closed damn near exactly on max pain too many times for it to be a coincidence. I suppose it could be simple market dynamics but it's far too easy for the market makers to move money around to manipulate share prices.I mean wall as in large size. I read somewhere that the MM's try to avoid getting down there to not have to pay out so much, in fact they try to run up the SP to get ppl out of their puts. Dunno if it's a conspiracy theory or true and if they really have the ability (as PoppaFox says they do).

Closed 10x -c220 and opened 20x -c220 for next week. Still have -c200/-c210/-c215/-c220/-c222.50 and -p215/-p225 for Friday.

thenewguy1979

"The" Dog

Meta beat earning but SP movement has been sputtering at 3%. Overall Macro AH been flat.

Tomorrow would be an interesting day as big tech are not pushing up the market as in previous Qrter.

Got some 205p for end of the week.

Tomorrow would be an interesting day as big tech are not pushing up the market as in previous Qrter.

Got some 205p for end of the week.

tivoboy

Active Member

Decent to good earnings with a pop and then a pull back mean lower lows in the near term. Be ready - whites of their eyes.Meta beat earning but SP movement has been sputtering at 3%. Overall Macro AH been flat.

Tomorrow would be an interesting day as big tech are not pushing up the market as in previous Qrter.

Got some 205p for end of the week.

my prediction, we’ll break 4000 on the S&P in the next 30 days, extrapolate that out appropriately for any positioning, macro or sector.

If you like stocks to buy, track their 200’s as targets for options or entries. Gawd help us if AMZN reports poor rev/earnings/AWS growth - again (although I do think AWS will turn positive from what MSFT reported)

Last edited:

thenewguy1979

"The" Dog

Tesla SP hitting 210 going to 209 AH. Guess everyone was waiting for big Tech to the rescue. Hang on as the ride just got a lot bumpier.

Tesla SP hitting 210 going to 209 AH. Guess everyone was waiting for big Tech to the rescue. Hang on as the ride just got a lot bumpier.

gabeincal

Active Member

Yep, I'm still sitting on 23 x -135c's, currently mid-Nov and mid-Dec expiries. Maybe it's heading my direction and I can start assembling a plan again after rolling them for $1 credits for about 7 months now.....

intelligator

Active Member

-c230/+c250 will ripen nicely by the morning, I'd like to sell a set for next week on any rise. Where is next downward support?

gabeincal

Active Member

Wasn’t it around 175ish for a long time before the rise above 270?-c230/+c250 will ripen nicely by the morning, I'd like to sell a set for next week on any rise. Where is next downward support?

Last edited:

thenewguy1979

"The" Dog

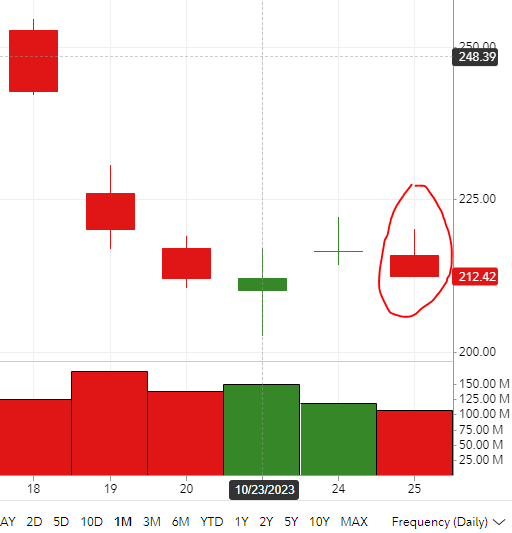

Daily chart for the day. Shooting Star. AH hitting 206 soon.

Once it sliced 202 not much of resistant hitting 190. Big Tech Macro supports gone.

Big Economic data Friday.

Good luck guys. Just 2 more wild days to go.

Once it sliced 202 not much of resistant hitting 190. Big Tech Macro supports gone.

Big Economic data Friday.

Good luck guys. Just 2 more wild days to go.

Yep, I'm still sitting on 23 x -135c's, currently mid-Nov and mid-Dec expiries. Maybe it's heading my direction and I can start assembling a plan again after rolling them for $1 credits for about 7 months now.....

That adds up to a lot of money compared to just holding the uncovered shares. I’m really thinking about just selling a lot of 200c for next week, then being happy to roll them week to week for small credit even if they don’t expire. My 200c from this week will get $2+ credit for a straight roll, that really adds up week to week.

The risk would be that the stock takes off and the roll premiums get smaller and smaller until the shares are called away, of course, but it sure doesn’t feel like that’s going to happen soon.

-c230/+c250 will ripen nicely by the morning, I'd like to sell a set for next week on any rise. Where is next downward support?

This from today may be a bit helpful for extra data.

Basically under $222.47/$217.50 TSLA can fall more and more. Below $209 can see $202 and close below $202 can see $186 and below that retest of $102 in a few months

gabeincal

Active Member

How’s your margin, Sir?Jeeze. We were at 220 this morning. Will we see below 185 by Friday? I have +165/-185 as part of an iron condor....

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K