Well his note is on the side of "no sh!t sherlock". Who knew stock would recover if Tesla stop missing earnings...He already downgraded it a couple weeks ago with another note. This seems to try to assuage concerns and paint a rosier picture “if Tesla can get with it.”

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I like those strikes even better. Those are already at my guard rails, or really close, and wouldn't need as much of a roll should either be pressured.Just sold 197.5 puts and from Friday 240 CCs, rolled from 220.

I guess I'm a little more conservative than you but not as much as @BornToFly

I have long said (like a decade worth) that part of Elon's brilliance is that he doesn't expend energy trying to tell people what they should want, or need. This being but 1 of many examples - it seems like the green / climate change crowd are too wrapped up in telling people what they should want, and not nearly wrapped up enough in making stuff economic and what people actually want.OT, but I just found this little gem, straight from the mind of Peter. Gosh, how did I not short this stock at 60.

View attachment 988477

He's been busy providing what people want, rather than building something green and trying to tell people its what they should get. People want fast chargers - telling people that they should want slow chargers is, as you're alluding to, worse than a waste of time. It's a pretty big disconnect between the manufacturer and their customers.

@tivoboy New video from SpotGamma echos and supports your mid- to late Nov + OPEX on 11/17 weakness thesis as you‘ve said in reviewing the option flow:

(Short 3-min video)

(Short 3-min video)

EVNow

Well-Known Member

For back testing manually I just use my crusty old Black Sholes spread with some assumptions.I'm not aware how to get historical options prices, but I guess a good practice could be to take a snapshot of the options ladder over the weekend, then see how it would have turned out the following Friday...

I don't know any free price downloads, there are some Excel plugins, but they're quite expensive, I'm going to start taking some screenshots each weekend of the coming 4 weeks premiums and see if it gives any insight

I daresay @Yoona has such data, shame she's not around still

IIRC, Yoona mostly gave stats on the SP rather than options. I don't think they had any more info than what you can get from Yahoo.

Sounds good, but I'm seeing breaking news on X that Tesla may have a deal to build a factory in India. Combine that with possible good China delivery numbers in the morning, and things can turn around real fast....@tivoboy New video from SpotGamma echos and supports your mid- to late Nov + OPEX on 11/17 weakness thesis as you‘ve said in reviewing the option flow:

(Short 3-min video)

Just a personal note here:

My Model Y is at the Montreal service center for BMS voltage problems.

The model Y loaner they gave me has FSD, had to bring my oldest son to the downtown rink at 6:30PM in rain and full bike traffic. Just realized how Montreal with erased line, people sharing the same small line une to turn left and one to continue straight made FSD completely useless on 25% of the turns.

FSD must be a charm everywhere in the US where road are large and painted, it was the most unpleasant experience ever today.

On another note, if I buy AAPL put tomorrow at open, it’s guaranteed money right?

My Model Y is at the Montreal service center for BMS voltage problems.

The model Y loaner they gave me has FSD, had to bring my oldest son to the downtown rink at 6:30PM in rain and full bike traffic. Just realized how Montreal with erased line, people sharing the same small line une to turn left and one to continue straight made FSD completely useless on 25% of the turns.

FSD must be a charm everywhere in the US where road are large and painted, it was the most unpleasant experience ever today.

On another note, if I buy AAPL put tomorrow at open, it’s guaranteed money right?

Attachments

Let’s hope so, though those factories take time to be built and don’t show up on the bottom line for a while. We also need macro to participate and not give back the recent gains, pulling our TSLA piñata along.Sounds good, but I'm seeing breaking news on X that Tesla may have a deal to build a factory in India. Combine that with possible good China delivery numbers in the morning, and things can turn around real fast....

chillerjt

Member

14k China weekly numbers. Multiple posts on X. Very strong numbers.

juanmedina

Active Member

Sounds good, but I'm seeing breaking news on X that Tesla may have a deal to build a factory in India. Combine that with possible good China delivery numbers in the morning, and things can turn around real fast....

Also Tesla is supposed to increase prices for the Model Y in China on the 9th and Cybertruck pricing should be out very soon.

Hawkish comments from one of the FEDiots this morning spooked pre-markets, often these get shrugged-off after a few hours until the next "speaker" gets trundled out...

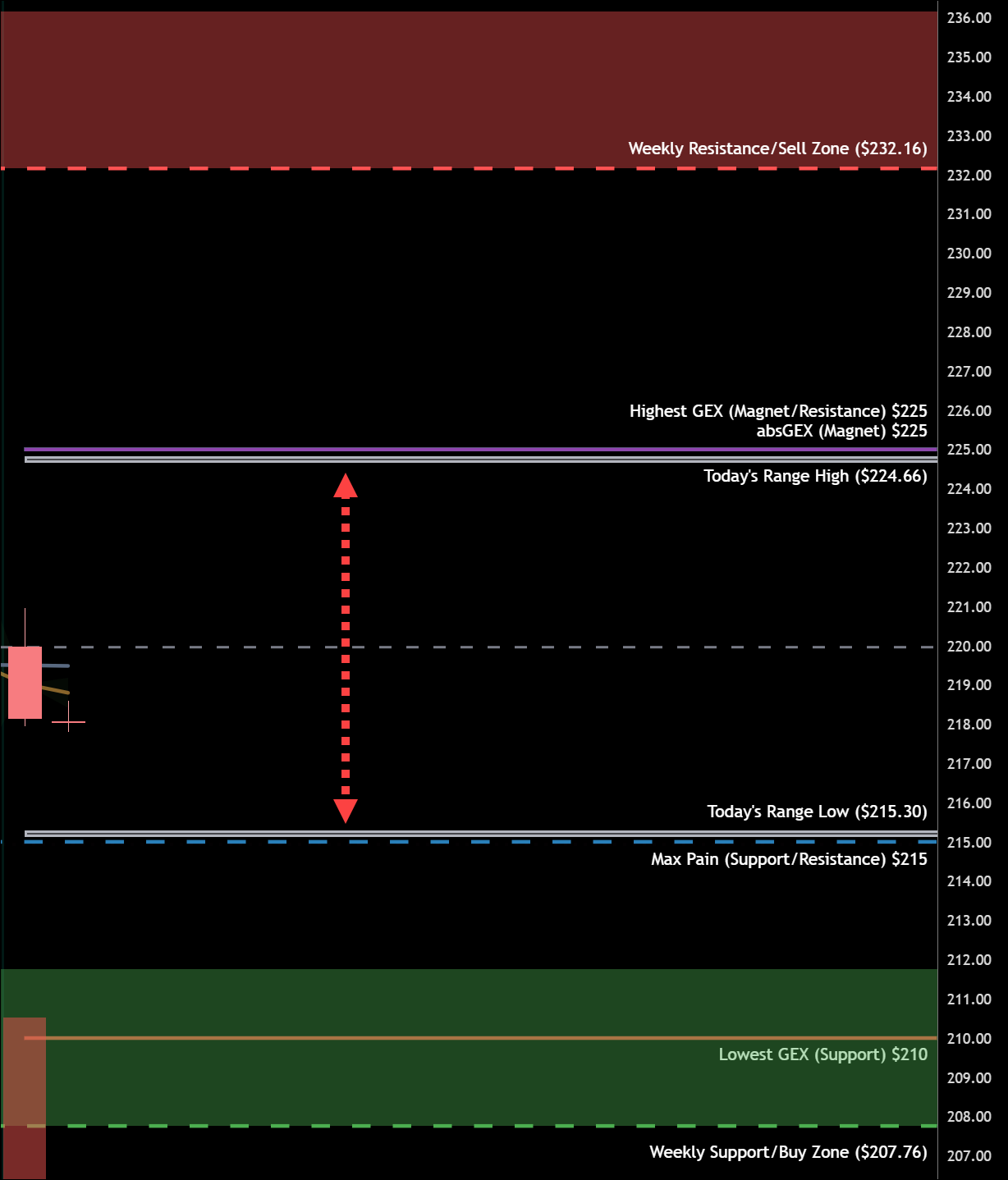

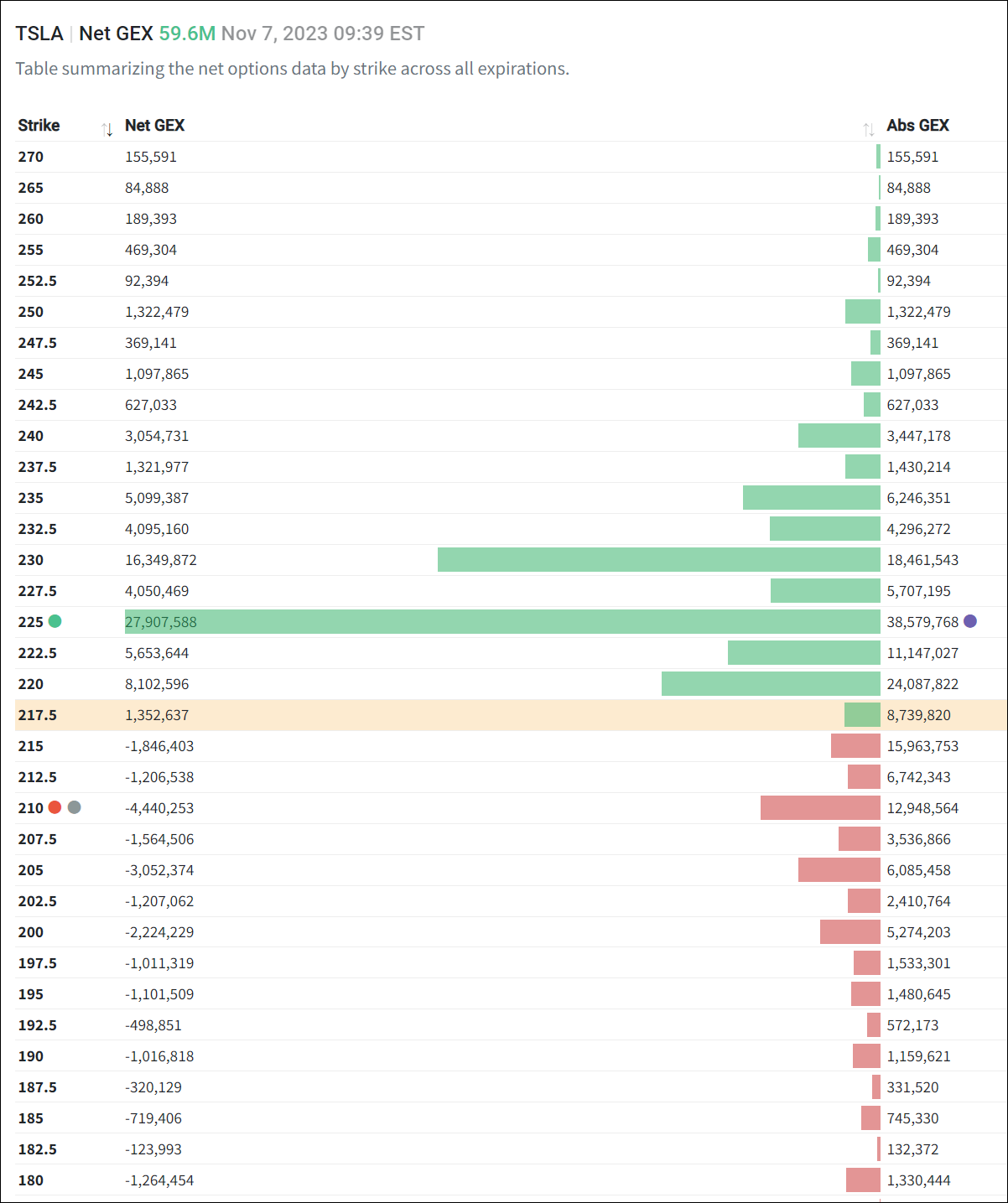

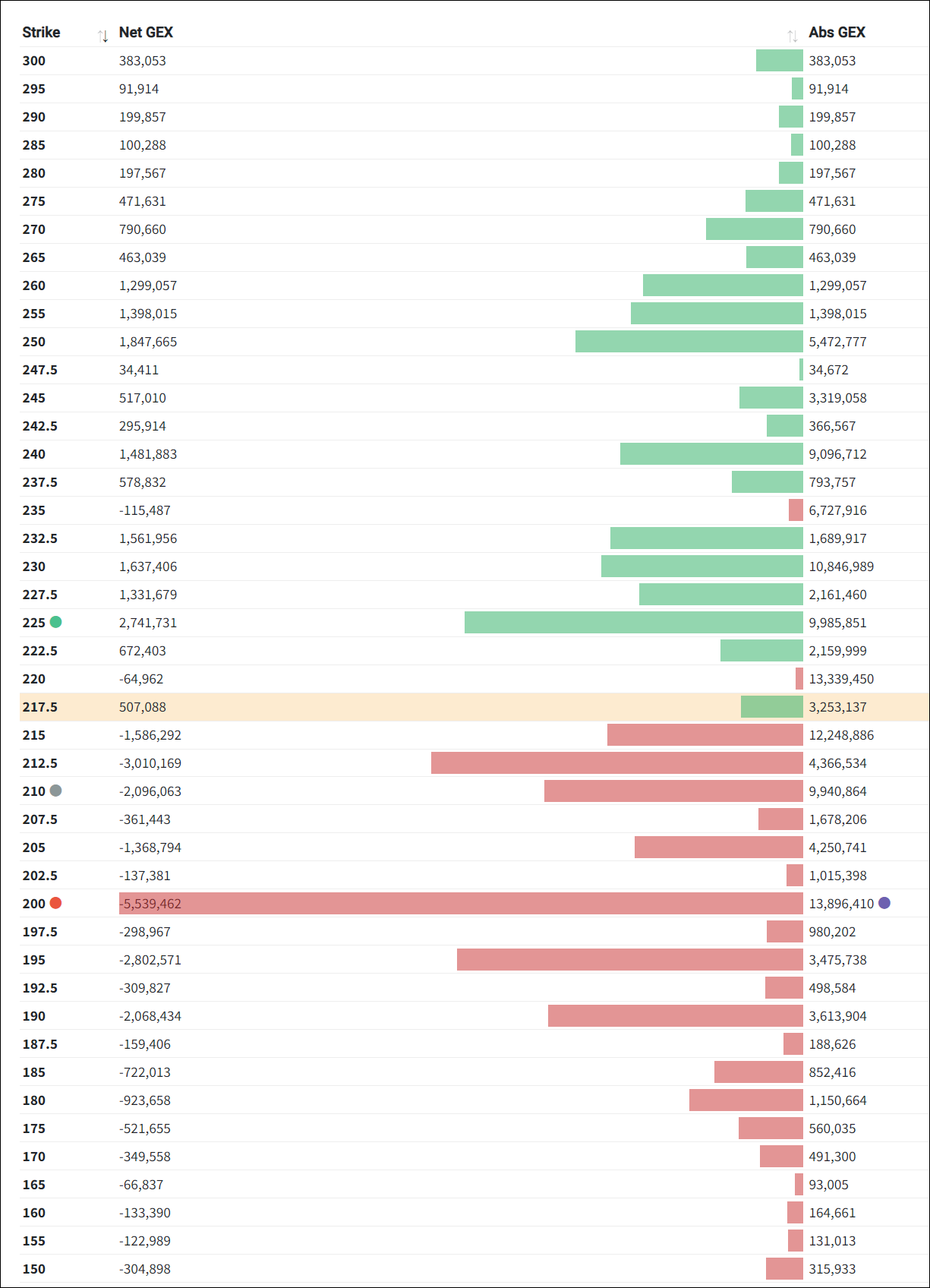

Meanwhile, as noticed already yesterday, there's a nice c225 wall between the SP and our -c230's

Meanwhile, as noticed already yesterday, there's a nice c225 wall between the SP and our -c230's

QTA Levels for Today

11/10

11/17 -- clear as mud

11/10

11/17 -- clear as mud

I set a buy order for -c230's @45c when the SP his 215's, so of course now it goes up...

tivoboy

Active Member

Look at all those scaredy cats at $230…;-)

intelligator

Active Member

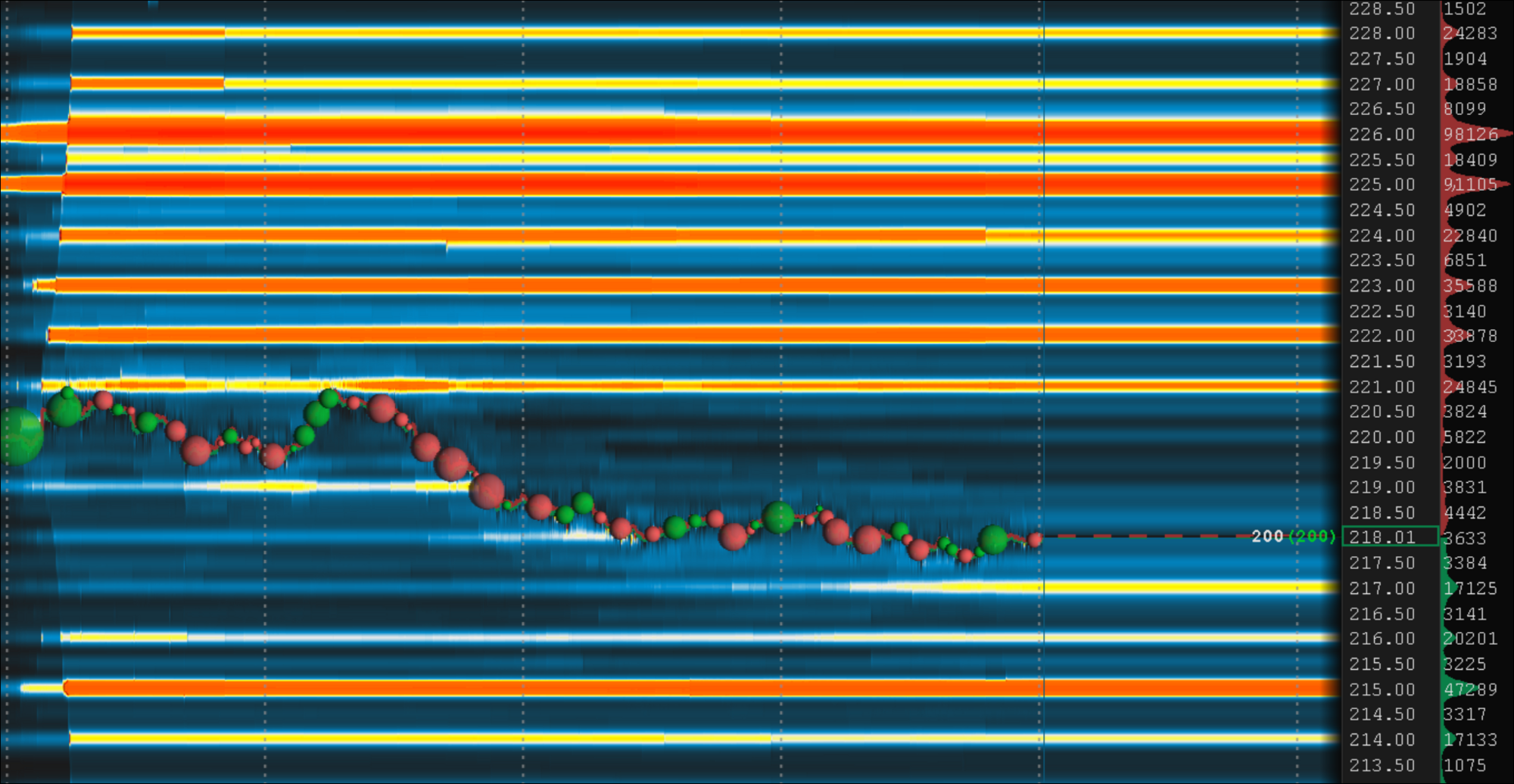

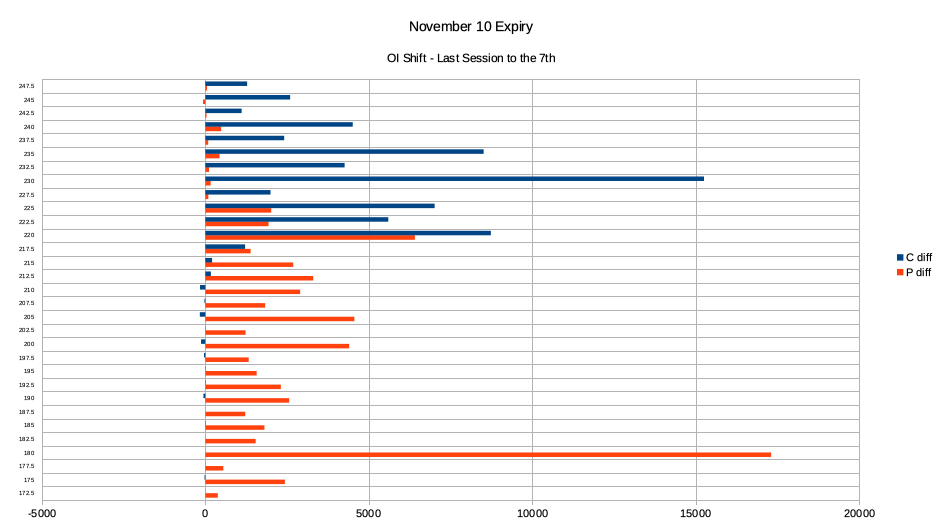

Late to post, OI increased greatest at p180, c230, c220, c235, tug of war at 217.5 and 220.

I'm wanting to expire 11/17 -c235/+c255 by rolling back to this week same width, -c230 ... bad idea? Either that or I close it out altogether, work the debit back to a credit with a better position once direction is set. Thoughts? It'd be a wash from initial position , two rolls to where I sit now.

I'm wanting to expire 11/17 -c235/+c255 by rolling back to this week same width, -c230 ... bad idea? Either that or I close it out altogether, work the debit back to a credit with a better position once direction is set. Thoughts? It'd be a wash from initial position , two rolls to where I sit now.

My thought is that this price action today makes no sense whatsoever, other than the desire of some parties to keep the stock below 220Late to post, OI increased greatest at p180, c230, c220, c235, tug of war at 217.5 and 220.

I'm wanting to expire 11/17 -c235/+c255 by rolling back to this week same width, -c230 ... bad idea? Either that or I close it out altogether, work the debit back to a credit with a better position once direction is set. Thoughts?

View attachment 988626

Other tech is green, macro is flat - which may go up or down as we're in a resistance zone on the indices

So if they let their foot off the break can go up fast IMO

I'm also considering straddling some -c220's with the -p220's, but waiting to see if we get a reversal from here

I posted a chart before ER.For those eyeing AAPL 11/24 +P175, they’re below a dollar now (~$0.90)

Just sayin’

PS those bearish on APPL what’s the reasoning?

I posted a chart before ER.

Are you adding to your put position here, if yes, what DTE/Strike?

172.5/170P 11/24Are you adding to your put position here, if yes, what DTE/Strike?

Competition is coming.PS those bearish on APPL what’s the reasoning?

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K