Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

thenewguy1979

"The" Dog

Thanks @dl003 - Would 235/237 be a safe bottom till earning or possible fall to 220 soon? Thanks.I don't know how high this dead cat can go. Depending on the news I guess, but I know it's a dead cat. So just stick to intraday resistance to sell 257.5+.

SpeedyEddy

Active Member

Yeah, convinced I won’t get caught with the ATM/ITM calls I wrote today, maybe after a roll or two (bringing in even more premium).The anatomy of a dead cat. Still aiming for a late January bottom.

View attachment 1007168

Depends on where we are in the dead cat. If it's close to the end, then I'd not sell puts. When I predicted bottom on Friday and called 235 to be the bottom, it was a good time to sell puts, and maybe there will be a few opportunities like that between now and ER, but overall, the trend is sideway -> down for the time being so be selective when you sell puts, especially if aiming for high premium.Thanks @dl003 - Would 235/237 be a safe bottom till earning or possible fall to 220 soon? Thanks.

thenewguy1979

"The" Dog

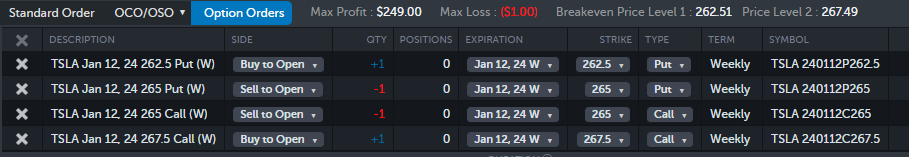

ever seen such a play? No way will be a winning hand as that required a closing at 265 Friday.

The farther out to the current SP the cheaper it get. More like a lottery play

The farther out to the current SP the cheaper it get. More like a lottery play

Updated tactical objectives for 2024:

- HODL shares

- Cap total $TSLA exposure by gradually harvesting in $50 increments beginning at $300

- Sell CC against 80% of shares

- 60% 10-11 DTE 12% OTM -- moderately cautious, continuous rolling

- 13% 270 DTE 25% OTM -- close at 50% gain and repeat (scalping)

- 7% 10-30 DTE 8%-10% OTM -- aggressive

- 20% uncovered for $300 and $350 sales

- 19Apr$300 --> 15March$270 (+$1.97, bringing a tranche rolled out from DITM down and in, targeting expiration)

- 20Sep$300 --> 21Jun$270 (+$0.83, same; 80% of tranche, hold 20%)

- sto 19Jan$265 (10-11 DTE 12% OTM, btc at 90% return)

- sto 20Sep$305 (~250 DTE 25% OTM, btc at 50% return asap and repeat)

Last edited:

Arul

Member

Arul

Member

Maximizing Wash-Sale losses from 2023 against options gains in 2024

[EDIT: See responses that followed this post. This idea doesn't really work except for a narrow window of 30-days before and after the turn of the year, and can be helpful only in very specific circumstances.]

Been percolating on my mind and today I put it to action. Maybe some of you do this already, maybe it's obvious, maybe it's stupid and will turn out to be a waste of time, but sharing in case it can be useful to others:

1) I exported all trades I made in 2023 in CSV format from my broker and brought the file into Excel

2) Deleted all non-option trades (i.e., straight shares) and kept any option trades that had DTE in 2024-2026

2) Sorted by loss/gains and deleted all those with gains

3) Sorted by date and deleted all trades with an expiration before 1/1/24

4) Combined the remaining trades of the same DTE and made a total of losses for that strike/DTE

5) Saves a list of those positions and DTE

Often we forgot which trades they were and they disappear in the ether without us benefitting from the carry-forward of losses which offset new gains on the same contracts opened and closed in 2024.

I can give preference to these trades when the opportunity comes and enjoy gains against the carried-over losses.

What do you mean by CB ? can you do CC specifically for leeps? and how ? ThanksA few musings about what I find guides my trades based on my experimenting:

1) Laddering! Big time helpful to me. 10-15 CC contracts at a time at local daily pops, most often during opening 15 minutes (this past summer/fall this pattern of pop/fade was exceptionally reliable). And closing when I see decent green. It annoys me to see green disappear as SP recovers. While I definitely leave money on the table during times when SP keeps going down further, I’m pulling in gains consistently while also removing risk by closing the CCs (!) and by watching the SP movement I gain the freedom of choosing new better, sometimes higher strikes (and often higher premiums on the same CCs I already closed) based on the data the unfolding day and week presents (this edge is underrated IMO). I haven’t needed to roll much if at all in months. I don’t know if this means I am too risk-adverse or just lucky. The money is good so I don’t really care

2) I choose strikes/DTE not more than 0.10-0.13 delta +TA UNLESS I expect a TA/EW dump between now and expiration (thanks @dl003) then I’ll chance even 0.20-0.30 +TA (like -C300 3/2024, expecting a dump in or around Feb, but likely not exceeding $300 anyway if not and time to fix if yes). Always prepared to roll up and out if surprised. And since I’ve laddered, only some will be in peril. The rest I can close for whatever gains they have, big or small. Yes, this means sometimes what I got $1.50 for I could have gotten $8.00 had I sold later after a major pop, but that doesn’t happen very often and meanwhile the consistency of income wins out for me.

3) I only choose strikes I’m okay my shares getting called away at (I have a tranche at $298 CB and a tranche at $358 CB). I take a bit more chances on closer DTE (7-10 days) when I have higher conviction that SP won’t exceed a certain level (like $270 recently).

4) I remain hyper-aware of the waves and trends, so when we finish a run, congest, and come off highs (like $265 recently), I give myself permission to become a bit more aggressive in selling more contracts and choosing closer strikes when selling CC’s. Same for the inverse, when we carve out a seeming low (like $235 now) I’m more careful and go higher out on strikes and increase short puts. If I mess up and can’t roll for credit I just rebuy or sell the shares that get called away or put to me, hopefully with not too much damage.

5) I don’t have the guts or nerves yet to sell ITM+near expiry CCs (and never -P) and do so only on rare occasions, like when we approached $300 I sold a ton of CC’s for $310 and with the high IV then it was a great sale. I was okay to let the shares go at that price, and was even more thrilled too when it never hit and I kept the shares and the premium. @dl003 does this well and I hope to learn more and try this over time as my trend-spotting gets better.

6) Like a pot of hearty soup always on the stove in the winter, in addition to my weekly scalps I always have on decent-sized exposure for large sudden swings up (-P LEAPS) and down (-C LEAPS), leaning heavier on each side depending where we are, a trough or top. I like LEAPS since they offer time to fix things if I made a bad choice and they move quite strongly on wide SP movement too. While I used to use far out LEAPS for these (2025/2026), @Max Plaid taught me the value of having some closer-dated LEAPS (like September 2024) which open up rolling opportunities and I add some closer in like this as well to great effect.

I’m still learning and experimenting and I’m sure there’s more I can add to the above. And I’m really no expert. Credit really goes to the team here and really @MikeC who taught me how to extricate myself from a mess I made in June 2023 and I’ve been building on the foundations I’ve learned from him during that debacle, and the great ongoing education here from @Max Plaid and @dl003 and the rest of you.

Bottom line for me is the extreme importance of effective risk-management and keeping greed and impatience in check as it underpins the success of any strategy.

Cost basisWhat do you mean by CB ? can you do CC specifically for leeps? and how ? Thanks

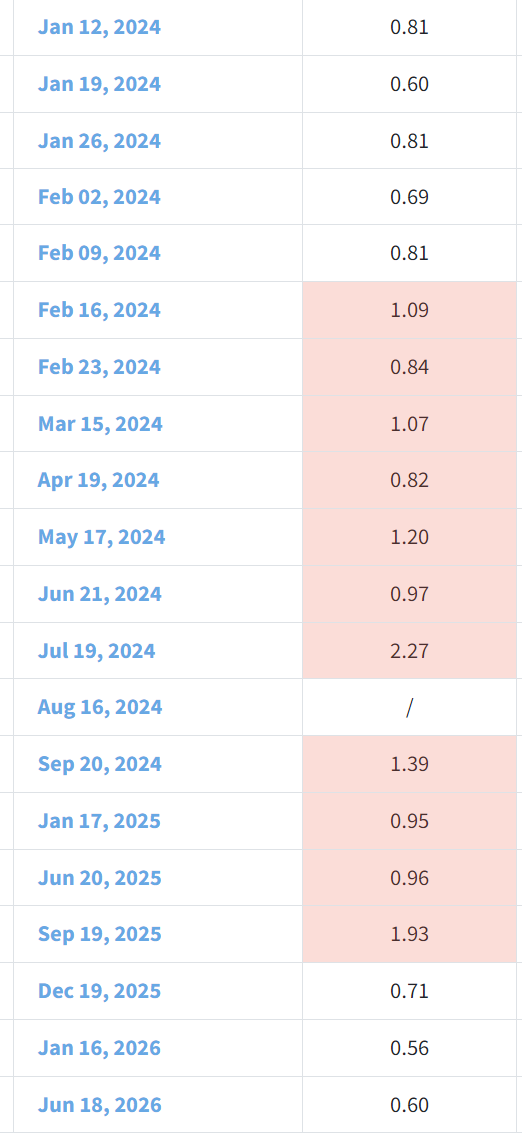

Current P/C ratio for the next few months

• Feb 0.84, Mar 1.07

• Have a look at May 1.20 and July 2.27

What's going on in July?

• Feb 0.84, Mar 1.07

• Have a look at May 1.20 and July 2.27

What's going on in July?

Last edited:

john tanglewoo

2012 Roadster Owner

Would you mind explaining this?

Price sensitivity due to 1% move in TSLA?

intelligator

Active Member

Would you mind explaining this?

Price sensitivity due to 1% move in TSLA?

What is Gamma Exposure (GEX)? | Quant Data Help Center

An explanation of what Gamma Exposure is and how it can be used.

This is my understanding.

The exposure MM have with a 1% move of the underlying in either direction. The MM will hedge accordingly by trading the underlying, supplying or accumulating. The long bars are the magnets, where price tends to stick, resulting from the anticipated need for balancing.

EDIT: spelling errors , that's the updates

If MMs are “long gamma,” they are buying as sp decreases (move up towards tall green walls) and selling as sp increases (move down towards tall green walls) especially around large OI.Would you mind explaining this?

Price sensitivity due to 1% move in TSLA?

If MMs are “short gamma,” they are buying as sp increases (move up towards tall red walls) and selling as sp decreases (move down towards tall red walls) especially around large OI.

You can use the screenshot to identify "groups of strikes" with tall gammas. TSLA tends to gravitate towards the strike(s) with the biggest exposures and will magnet to them.

Elevated exposure at groups is more indicative than one wall.

Last edited:

BTC all overnight CC's for +$3,700, up $5,400 for the week so far.

Will reopen some if we lose $234 and hold below.

Will reopen some if we lose $234 and hold below.

SpeedyEddy

Active Member

Just (BTC) closed -C235 and -C237.5, Rolled them up to (STO!)-C240, was getting a bit nervous on those wicks below the minute candles (so a bit to early in hindsight, but still earning more than 10%, so 50cts each -C, only some theta in fact)

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K