Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

He might not be far wrong on the automotive side, but I expect Energy revenue to come in a lot higher

thenewguy1979

"The" Dog

Market may have already priced in the ER. The forecast for 2024 would be the deal breaker.He might not be far wrong on the automotive side, but I expect Energy revenue to come in a lot higher

That and Elon having a bad day.

Netflix ER is stellar. Hitting almost 10% AH.

That may help Macro and Tesla get an early morning pump tomorrow.

thenewguy1979

"The" Dog

Back to the posturing theory. Let see if it play out tomorrow.

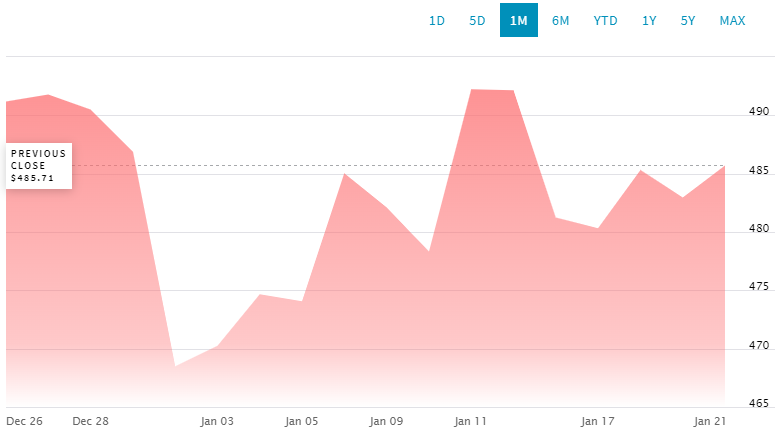

Below is Netflix 1 month before ER

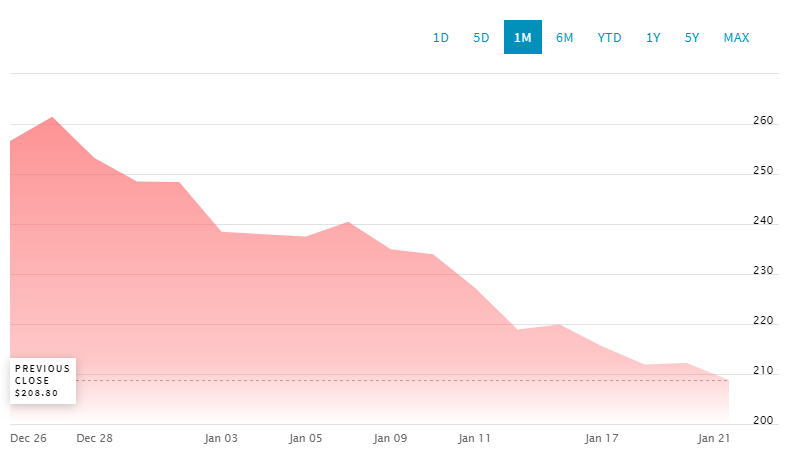

Below is Tesla 1 month before ER

Below is Netflix 1 month before ER

Below is Tesla 1 month before ER

EVNow

Well-Known Member

So, 6 out of last 8 earnings have seen higher actual moves compared to implied. But all within 10%.

TSLA, RIVN, NIO, XPEV charts all look similar. All oversold on RSI. EV FUD has had a broad effect. Might be the next segment to take off again....

Attachments

tivoboy

Active Member

Uh, are we looking at the same data?So, 6 out of last 8 earnings have seen higher actual moves compared to implied. But all within 10%.

Update:… ok, I see what I think you mean.. the move was more extreme, but not technically ”higher”

I have seen 2 estimates at 0.7 and two for 0.73 tomorrow. I don't think ER is going to be a large beat.

I might go all in selling 240CC tomorrow.

The fact that sentiment has been so bad going into the call is what is keeping me away. I just have no feel for how the market is going to react.

I watched the video from Access-A-Trader. He said there hasn't been much institutional Put buying ahead of earnings....

Maybe we need to be a little careful on the Call selling after all. It might just go up a lot if there is just no bad news....

Maybe we need to be a little careful on the Call selling after all. It might just go up a lot if there is just no bad news....

thenewguy1979

"The" Dog

Here a nice weekly candle graph showing stock movement in relation to ER.

That 200 resistance/support does seem quite strong.

edit: nagging feeling - what if this is just a big Bear Trap??

That 200 resistance/support does seem quite strong.

edit: nagging feeling - what if this is just a big Bear Trap??

ChiefRollo

Member

Sold some puts committing to below $200 buying, something I’m okay with.I watched the video from Access-A-Trader. He said there hasn't been much institutional Put buying ahead of earnings....

Maybe we need to be a little careful on the Call selling after all. It might just go up a lot if there is just no bad news....

Love the weekly graph with the ERs listed. There was only one ER with 4 weekly Red candles before it and it was followed by two Green weeks. Now we have had 5 Red weekly candles going into the ER....Here a nice weekly candle graph showing stock movement in relation to ER.

That 200 resistance/support does seem quite strong.

edit: nagging feeling - what if this is just a big Bear Trap??

View attachment 1011630

You can never call a movement before earnings a trap because there is always the risk of something like Elon saying we plan to grow 0% This year while we ramp. In which case no trap. And NVDA last year where they just blasted up 20% after a sick earnings even though it had gone up so much already.Here a nice weekly candle graph showing stock movement in relation to ER.

That 200 resistance/support does seem quite strong.

edit: nagging feeling - what if this is just a big Bear Trap??

View attachment 1011630

TSLA switched to Sell the rumour, buy the news?I watched the video from Access-A-Trader. He said there hasn't been much institutional Put buying ahead of earnings....

Maybe we need to be a little careful on the Call selling after all. It might just go up a lot if there is just no bad news....

Interesting take:

allllsevensnewsletter.beehiiv.com

allllsevensnewsletter.beehiiv.com

“TSLA has the highest level of institutional interest out of any stock. When you look at the monthly chart, it’s as clear as ever that institutional money is buying this stock. Why is it struggling so bad to trend up? Why is this low volume rejection every single high? Well, there’s a lot of uncertainty around TSLA stock at the moment. Controversy even. This isn’t what short-term focused retail investors want to see. The long-term institutional investors don’t care. They know the uncertainty and controversy will clear up in a decade. This is why I believe the upcoming earnings report could be very critical to whether or not this six month candle can rally into the summer. Short-term sentiment needs to be shifted! Uncertainty needs to be unveiled. So, how likely is it that this earnings report is extremely positive and shifts the current downtrend into an uptrend? Well it’s inherently unlikely because this is a pretty much random news event, but I have been collecting lots of data on this stocks price action and options flow and I have to lean to the long side…” (continued in the link)

Tesla, Inc. & Intel Corporation

A long-term & short-term perspective headed into important earnings reports.

allllsevensnewsletter.beehiiv.com

allllsevensnewsletter.beehiiv.com

“TSLA has the highest level of institutional interest out of any stock. When you look at the monthly chart, it’s as clear as ever that institutional money is buying this stock. Why is it struggling so bad to trend up? Why is this low volume rejection every single high? Well, there’s a lot of uncertainty around TSLA stock at the moment. Controversy even. This isn’t what short-term focused retail investors want to see. The long-term institutional investors don’t care. They know the uncertainty and controversy will clear up in a decade. This is why I believe the upcoming earnings report could be very critical to whether or not this six month candle can rally into the summer. Short-term sentiment needs to be shifted! Uncertainty needs to be unveiled. So, how likely is it that this earnings report is extremely positive and shifts the current downtrend into an uptrend? Well it’s inherently unlikely because this is a pretty much random news event, but I have been collecting lots of data on this stocks price action and options flow and I have to lean to the long side…” (continued in the link)

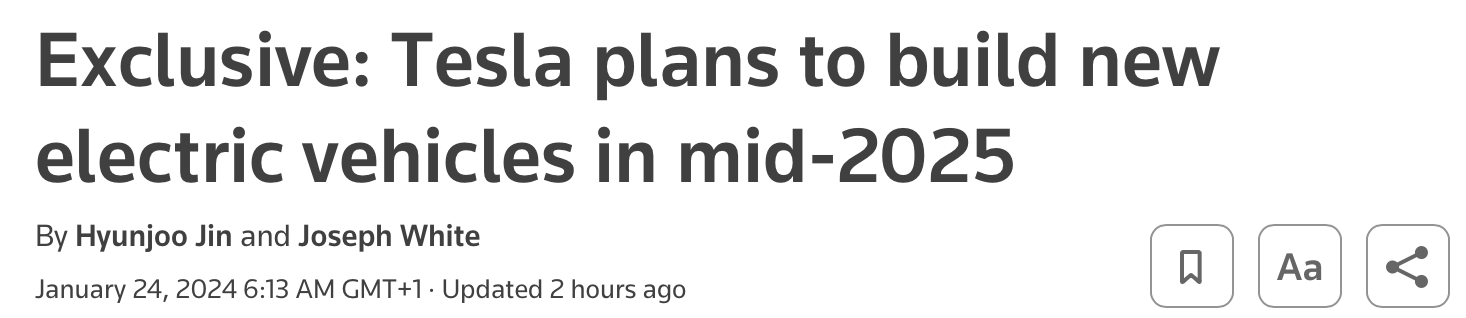

Reuters, so to be taken with some scepticism, but they're not in the habit of reporting false positives:

Now if this was actually actually announced by Tesla then we might get some upside

Now if this was actually actually announced by Tesla then we might get some upside

But don’t we already know this? Tesla has a Mexico site that will start construction soon, and supposedly, a pilot plant within Giga Texas that is supposed to start this next gen car late this year or early next year. Isn’t this just confirmation?Reuters, so to be taken with some scepticism, but they're not in the habit of reporting false positives:

Now if this was actually actually announced by Tesla then we might get some upside

View attachment 1011723

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K