1/26 100c and 150c mostly but might move onto 6/26 now. I keep them ITM now so they hold their value better and I can still sell CCs against them.What LEAPs have you been purchasing?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Don’t hate the question, if it’s true Elon has grown distracted and has new interests elsewhere (good ones but not Tesla), can this be an opportunity for him to make a lateral shift to his role at Tesla to one that’s not so tied to his behavior outside of it, where his every move affects the company often negatively, and gives him the space he seems to need and want, or is it impossible to separate Elon and Tesla without crashing the stock?

Would it be a good thing to eliminate the drama that so many have grown tired of and let Tesla mature on its own merits without him?

Would it be a good thing to eliminate the drama that so many have grown tired of and let Tesla mature on its own merits without him?

Well do you believe there is a material amount of share holders that only own TSLA because of Musk? Now do you think there are also a material amount of share holders with paper hands that will also sell out because the shorts will pile in and scare them? That's where your crash will come from.Don’t hate the question, if it’s true Elon has grown distracted and has new interests elsewhere (good ones but not Tesla), can this be an opportunity for him to make a lateral shift to his role at Tesla to one that’s not so tied to his behavior outside of it, where his every move affects the company often negatively, and gives him the space he seems to need and want, or is it impossible to separate Elon and Tesla without crashing the stock?

Would it be a good thing to eliminate the drama that so many have grown tired of and let Tesla mature on its own merits without him?

thenewguy1979

"The" Dog

That a great question Jim. A philosophical one indeed (putting on my smart dog's hat speaking in Gandalf accent).Don’t hate the question, if it’s true Elon has grown distracted and has new interests elsewhere (good ones but not Tesla), can this be an opportunity for him to make a lateral shift to his role at Tesla to one that’s not so tied to his behavior outside of it and gives him the space he seems to need and want, or is it impossible to separate Elon and Tesla without crashing the stock?

Would it be a good thing to eliminate the drama that so many have grown tired of and let Tesla mature on its own merits without him?

Hi name is so ingrain with Tesla that people see Elon as Tesla and Tesla as Elon. Can Tesla grow and succeed without Elon at the helm? Definitely my Jimmy.

But that will take times to prove and people minds to adjust the separation of the two.

In the immediate sense we would see a big dump due to "uncertainty".

Market don't like "uncertainty".

I don’t know. Many loud voices of complainers, not sure how deep and wide it goes.Well do you believe there is a material amount of share holders that only own TSLA because of Musk? Now do you think there are also a material amount of share holders with paper hands that will also sell out because the shorts will pile in and scare them? That's where your crash will come from.

thanks, i signed up for trialThe clouds have parted and we have a bright, shining opportunity before us. Will this key low at $180 hold? Does (TSLA) pull a 180 degree about face from this level? We’re going to get into a bit more of the theory behind our methodology. Also, we’ll talk about how we specifically zeroed in on the $180 level in the days before the last earnings report. Plus, more importantly, what is the forward-looking scenario? Where will it be further confirmed? Where is it wrong? Buckle up, because here we go (article in link):

https://www.elliottwavetrader.net/p/analysis/Tesla-Looking-For-A-180-From-180-202401308883242.html

Well, this weeks trading could not have gone any worse. Last week, before ER I bought a -180/+185 Put spread in case the SP went down. Last Friday it was worth about $30k profit. I closed it for only about $3k profit earlier today at 195 because it was looking to expire worthless. Now it may end up having been worth $50k if I had held.

I also rolled up and out 192.5CC for Friday when they went ITM to next week 205 for a small debit. So I gave up my CC earnings for the week. I tried to get new earnings today by selling 210CC for 0.51 and missed it by one penny. They would have been worth about $8k in profit.

What a cluster of a week.

At least I still have +180P for next Friday.

I also rolled up and out 192.5CC for Friday when they went ITM to next week 205 for a small debit. So I gave up my CC earnings for the week. I tried to get new earnings today by selling 210CC for 0.51 and missed it by one penny. They would have been worth about $8k in profit.

What a cluster of a week.

At least I still have +180P for next Friday.

EVNow

Well-Known Member

I thought the SP will likely go down and didn't sell any puts on Friday/yesterday. Today my call sale was missed by 1 cents ! So, this week I may just sit out ...Well, this weeks trading could not have gone any worse. Last week, before ER I bought a -180/+185 Put spread in case the SP went down. Last Friday it was worth about $30k profit. I closed it for only about $3k profit earlier today at 195 because it was looking to expire worthless. Now it may end up having been worth $50k if I had held.

I also rolled up and out 192.5CC for Friday when they went ITM to next week 205 for a small debit. So I gave up my CC earnings for the week. I tried to get new earnings today by selling 210CC for 0.51 and missed it by one penny. They would have been worth about $8k in profit.

What a cluster of a week.

At least I still have +180P for next Friday.

OptionsGrinder

Member

I have been an EWT subscriber for many years. Zac Mannes is outstanding at outlining targets based on fibonacci and Elliott wave theory, but requires a separate sub within the site to follow TSLA. Carolyn Boroden has her own paid sub-service which is good too.. Avi Gilburt is the master and generally only tracks the indexes but he has been posting occasionally on TSLA lately. Both Zac and Avi looking for big upside after current correction completes, and that correction could yet take another few monthsthanks, i signed up for trial

wait, i hv to pay separately to get all TSLA analysis?I have been an EWT subscriber for many years. Zac Mannes is outstanding at outlining targets based on fibonacci and Elliott wave theory, but requires a separate sub within the site to follow TSLA. Carolyn Boroden has her own paid sub-service which is good too.. Avi Gilburt is the master and generally only tracks the indexes but he has been posting occasionally on TSLA lately. Both Zac and Avi looking for big upside after current correction completes, and that correction could yet take another few months

Thank you for sharing this. I wasn’t sure where to begin with any of their services. Do you find the paid service useful for day-to-day TSLA trading like we do here, if yes which one(s)?I have been an EWT subscriber for many years. Zac Mannes is outstanding at outlining targets based on fibonacci and Elliott wave theory, but requires a separate sub within the site to follow TSLA. Carolyn Boroden has her own paid sub-service which is good too.. Avi Gilburt is the master and generally only tracks the indexes but he has been posting occasionally on TSLA lately. Both Zac and Avi looking for big upside after current correction completes, and that correction could yet take another few months

OptionsGrinder

Member

Yes. You get stock futures/SPX with the base subscription. Zac's TSLA charts (along with a couple other analysts) are under the StockWaves sub service. They update TSLA every day. Carolyn then has her own service that also covers TSLA every day, using an entirely different methodology (not Elliot Wave). Her analysis also picks up Fibonacci based timing which I have found to be uncanny. For example, identifying Monday as a temp low. At a minimum, you would want the StockWaves sub in addition to the base sub, if you found it worthwhile. You may or may not... however, as an example, yesterday afternoon Zac was showing a minor wave top with the rejection of the 196 area, targeting mid to low 180's, which we have hit. That was before the news came out last night.. So the value of EWT is I have often found that it can keep you grounded as to the possibilities and avoid FOMO. But regardless, you should be able to get a free trial of the StockWaves service for a couple of weeks, if you want to try it. Just to add... there is a way to filter the feed to just show what the site analysts are saying, and eliminate the noise of all of the random subscribers. I recommend that approach.. The analysts are very professional. Hope that helps!wait, i hv to pay separately to get all TSLA analysis?

Don’t hate the question, if it’s true Elon has grown distracted and has new interests elsewhere (good ones but not Tesla), can this be an opportunity for him to make a lateral shift to his role at Tesla to one that’s not so tied to his behavior outside of it, where his every move affects the company often negatively, and gives him the space he seems to need and want, or is it impossible to separate Elon and Tesla without crashing the stock?

Would it be a good thing to eliminate the drama that so many have grown tired of and let Tesla mature on its own merits without him?

I think this goes one of two ways. Either this lights a fire under him again to prove himself at Tesla, or it gives him the excuse to walk and do the AI work under his own private companies as he has threatened.

OptionsGrinder

Member

I do find it useful, just replied to Yoona with an example. To expand on that a little, they are now showing potential waves that range from 200-210 (as a temp high), down to 160ish for a more major low. And the road to 200ish has an alternative path that could take us into the mid-170's first. Eventually targeting a bigger 3rd wave up (following by a 4th down and a final 5th up) that would exceed ATH's ultimately targeting 1200-1500s. As we know, no single service is going to be always right, or be the only approach. It is very useful to me to use in conjunction with other analysis, including that of Yoona and the team here. So if I am in a situation where I played my CC's too close, and shares get called away, I may be able to see from EWT that they are anticipating likelihood of a corrective phase that would allow me to get my shares back cheaper, and not chase by prematurely buying back in.Thank you for sharing this. I wasn’t sure where to begin with any of their services. Do you find the paid service useful for day-to-day TSLA trading like we do here, if yes which one(s)?

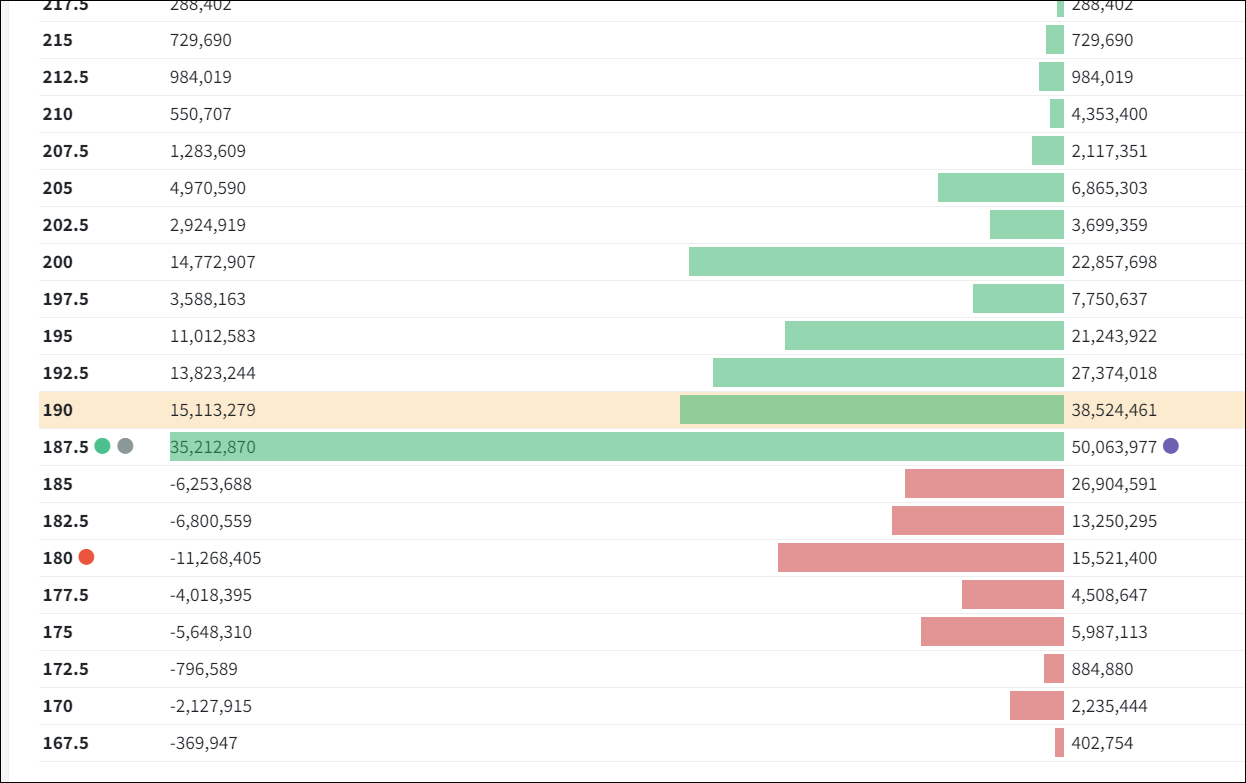

We are trading over Gamma flip zone ($187.50), hopefully it gives some support and lift to next green bars.

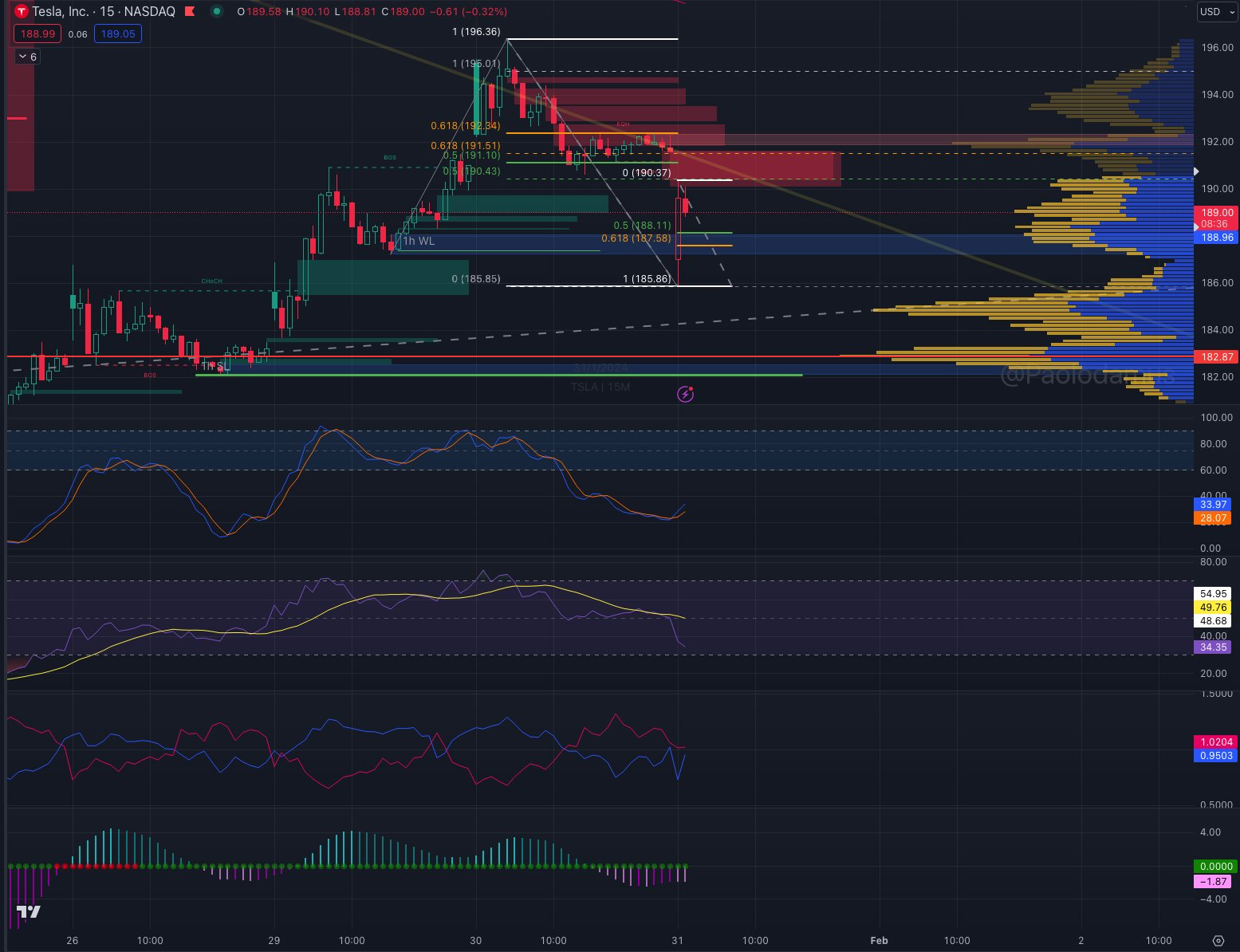

Paolo's update:

Credit: Paolodamus

- 15min - Opening bell PA is stuck in tug of war over the court verdict news.

- Intraday fib ext target back up to $195 yields 0.5 res $190.43, and 0.618 res $191.51.

- Opening stick already rejected once on the 0.5 fib, however Stochastic and VI+ are enthusiastic.

- If we fill the gap upwards expect res at $191.51 and then finally $192.34 (0.618) on the upwards retracement back up to $196/195 fib ext target.

- Note: Local support to the downside sits at an order block between $188.11 - $187. Below that there's low volume on the 15 min VP until ~$185.

- I closed out my covered calls earlier just in case. Looking to re-enter once we have a more clear direction.

Credit: Paolodamus

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K