A collection of tips from @dl003's old posts:

During winter what matter most is keeping yourself and loved ones safe and sound: Cash reserve, low margin usage, low expenses etc. Whatever mistakes we made during the good times, now is not the time to ponder the wouldas and couldas. Now is not the time to “make it back.” Bear market doesnt just go straight down. Bears can lose just as much money as bulls during a bear market. I know because I see it every day. Once we have ensure our survival through this dark time, we have to accept what we have right now is all we have to work with. It keeps us from taking unneccesary riss. Then, we need to find systems and methods that we have successes with.

• Start small and slow.

• Fail small and often.

• Make those small losses back before betting larger.

Personally every day I try to answer these questions:

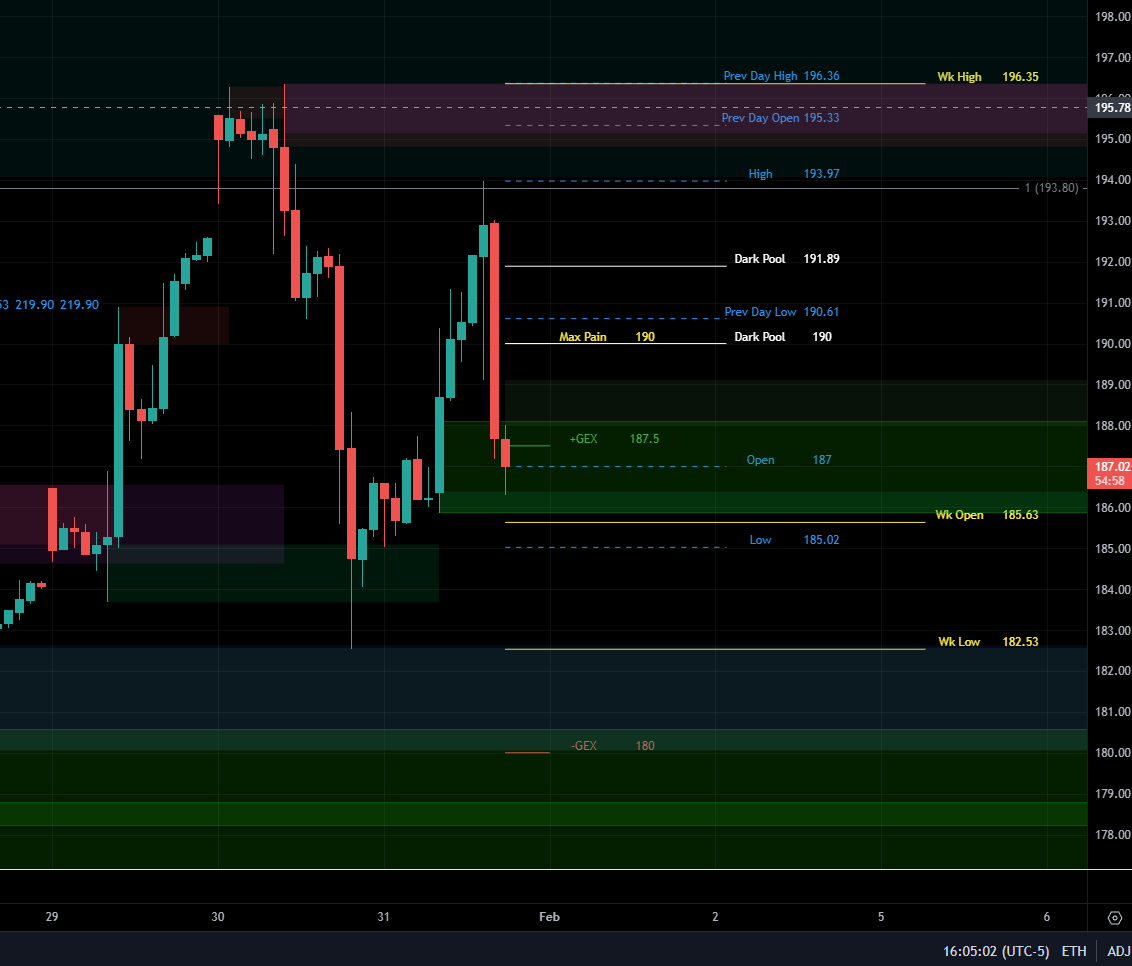

1) What are the important supports/resistance levels?

2) What is the large/medium/small degree wave count? Are we more likely to go up/down/sideway this day/week/month?

3) Is there a bullish/bearish divergence signal on the appropriate timeframe? If we drop 10% from high I’m not going to look at anything lower than 1H for signs of reversal.

4) How is the market going to try and trap me today?

If the trend is up LT and MT I'm going to sell ATM puts aggressively.

If it is up LT but down MT, I'm going to try to find a ST bottom to sell OTM puts.

If it is down LT I will not sell any puts.

Bottoms can be called based on S/R, wave count and divergences.

Macro event timing is also a powerful tool. I don't know how CPI and FOMC is going to go but I know the week before will be a "reversal to the mean" week. People will settle big bets before the week is over which means there's a limit to how low/high the SP can go.

---

The formula to find a new strike price is: new theoretical top x 0.618 - 87 =x

If you wonder whether your roll is a good/safe roll, do this quick calculation: strike price / 0.618 - 141. The result will be the highest TSLA can go before correcting for your roll to be considered "safe." I know I've been harping on about the 50% retracement. However, to be "safe", give yourself only 38.1%. If the stock tops out at 287, it will pullback to 265 minimum.

To choose a low, the retracement/consolidation that precedes it has to be a major one.

If you roll your CC to 197.5, the highest TSLA can go before correcting will be 260 before pulling back to 197.5. That's safe. As your CCs go ITM, don't just look at how far the stock can run, but also whether your CC will survive all the way to the bottom of the pullback. That's what matters. It keeps you from cutting losses prematurely. That's also the reason why, when I have ITM CCs, I'd spend about 0.5 - 1 to roll them out every week, improving the strike $2.5 - 5 further than I would have without spending that $0.5 - 1. Since the pullback will be at least 38.1% of the runup, every $2.5 - 5 strike improvement you give yourself can work itself out to $5 - 10 added to the top.

----

Monitoring IV and rising call prices as one metric.

Divergences and volume are very helpful.

Fib level where divergence develops tells a bigger story about whats coming next. From a potential bottom, if momentum stalls just above the 23.6 level, the bounce has no legs because it has to get above 38.2 for a bottom to be in. Stalling just above 23.6 is no good. This is just one of many things to look for.

----

Hidden bullish divergence:

lower rsi on higher SP at the TOP is bearish divergence, leading to reversal.

lower rsi on higher SP at the bottom is hidden bullish, leading to continuation.

-----

Here is a easy way to figure out % ITM risk profile that it is not for the actual strike but strike+ (calls ) or strike- (puts). If you add up all the strike deltas it is way more than 1!

----

As an option seller, there are 3 kinds of probability I want to know before opening a position:

a. What's the probability of the current price being close to a local top / bottom?

b. If, in the off chance, the stock goes beyond my expectation, what's the probability of it re-visiting the current price during the next consolidation phase?

c. If I don't know the first 2, what's the probability of the stock never exceeding my strike before consolidating?

At 206 last week it was so close to my bottoming zone that I decided to wait on selling CTM calls until I get more information from the next leg up. Once the next leg up got rejected hard at 217, it helped me draw the levels: 227, 236, 248, and 260. As it got close to 248, I sold 250C expiring 11/24. There were still a risk of the stock going past 250, but the probability of the next consolidation dropping the stock below 250 was very high. I do these calculations whenever I'm mulling over what position to open/close.

Right now I don't expect the stock to drop hard which is why I'll be looking to sell puts once the next leg down has concluded within my bottoming zone. However, there is still a risk of a straight up crash from here. The only thing that swings me over to the "healthy pullback" camp right now is the fresh overbought reading on the 4H RSI but that, too, is not 100% guaranteed.

On the upside, it is favorable to sell calls right now until 226 has been violated. However, the closer it gets to 242, the safer it is to sell calls as the distance between your entry and the stop loss point gets smaller and smaller. It may not get to 242 at all so if you wait, your return may diminish. If it trades over 242, the bottom may have been made at 226 but that's not what I'm getting from the chart.

Many of your questions are outside of what's going on in my head. Questions such as what the closing price will be or how strong the move will be I can't answer. However, what I do say out loud like "I wouldn't be surprised to see 230 next week" are not said willy nilly. Even if you don't agree with it, it's better you understand why I say it.

-------

On selling puts after shares assign on a CC:

Not much of an expert when it comes to selling puts as I've always been almost 100% all in and only sell naked puts for extra income. But if your goal is to get back in, treat a short put as a BW. When you think it's bottomed out, try to guess how far it's gonna run up and how far the pullback is going to be, before going up again. You have 2 choices: either get in at the bottom and ride it back up or sell some puts. If you sell puts at the bottom you won't be able to get back in at the bottom because that how bottoms work. Once it touches it, it's gonna rocket back up. If you sell puts at the bottom, you've determined to get back in at the pullback. Say it touches 235 and you think that's the bottom. Then you think it's gonna go up to 260 for the 2nd peak of the triple top pattern, before pulling back to maybe 240. At 235, you sell a 240P 1 week out. Fun fact: a 240P sold at 235 gives you the same amount of time value as a 230P. As the stock touches 260, you close this 240P and then use the profit to get back in when it pulls back to 240. If it sounds complicated, that's because it is. Nothing beats a good old fashion share grab at the bottom.

On Rolling:

There's no use talking about strikes without looking at the chart. Generally speaking, I look at option premium as primarily made up of 2 components: theta and delta. If you think the stock is going to make big moves in 1 direction, triggered by some sort of signal, then better to exchange delta for theta, and don't half ass it. If you think the stock is going to reverse, do the opposite. This is not about how long you're gonna be tied up. It's about whether you have the information and conviction to do this dance. Done right, you can get a ton of room for the stock to run when it's about to run and then roll it back just in time before it reverses. Thinking "how long am I gonna be tied up?" is already accepting defeat. Stocks don't run up forever, when you only think about rolling it out, you're only dealing with one half of the journey without giving any thought to the second part. So if it breaks 258.08, roll it out to December 2025 at even credit. Then when you think it's topped out, roll it back in to 7 DTE for even credit, or better yet, close the calls and sell the shares. Now, my chart read can be wrong and it has been wrong enough times to make other strategies just as relevant if done right. This is just how I'd do it.

----

Higher IV means the market is pricing in larger moves in either direction (options are more expensive). Lower IV means the market is pricing in smaller moves in either direction.

-----

On cycling contracts:

It depends on the wave. For example: if you sell calls at top of wave 1, it's prudent to close them at the bottom. If you sell OTM calls at top of wave 3 and it's a major one, you probably can hold those calls all the way to top of wave 5. ATM calls you should always close at nice profits. Macroeconomic timing and opex also play a big role. If the stock reverses to the downside on Wednesday morning then might as well hold those calls all the way to EOD Friday. Reversal happening on Monday leaves more room for bottoming and subsequent upside reversal.

----

If you find yourself too desperate for the stock to go up or down, leverage up or down the other way accordingly.