And how are they reading right now?It’s really just a technical overboughtedness scale.. what I like to follow is the extreme FOMO, and MOMO ETF, and the build in retail investor money flows.. that’s when you know the rug is going to be pulled out, or the music stops, or there’s a missing chair, etc.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

tivoboy

Active Member

Sell calls.. ;-)And how are they reading right now?

thenewguy1979

"The" Dog

Expecting a Macro ATH pullback soon are we? CPI next week....Sell calls.. ;-)

tivoboy

Active Member

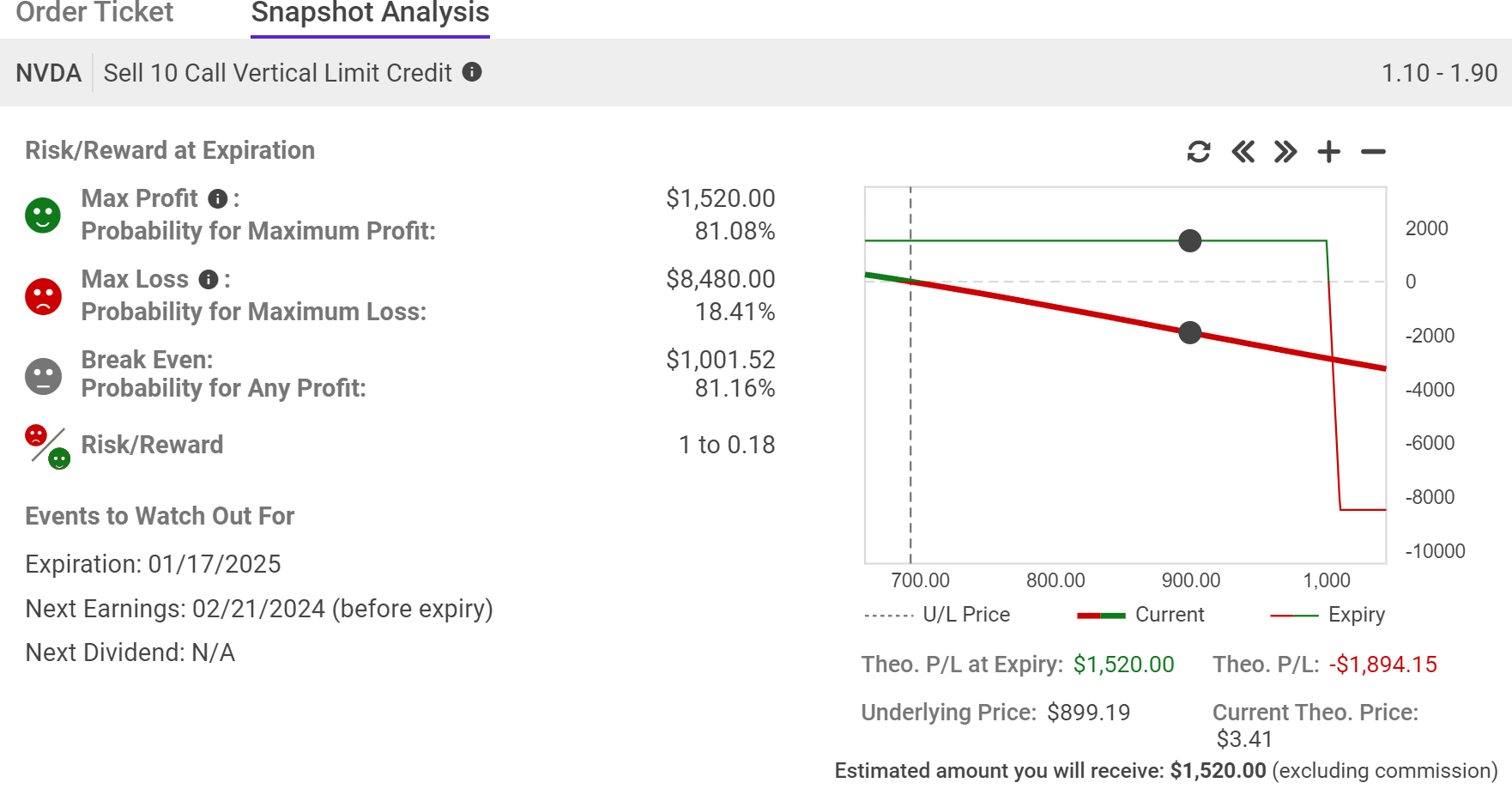

I’m selling calls in Mar/Apr at this point… against the other 97.5% of my ports. AMD, MSFT, NVDA, CRM, LLY, MSFT, AAPL, BKNG, MAR, PCAR, GE, META, AMZN, AVGO, AMGN, ADBE, IYH, MU and some others.. its been a daily exercise. LOTS of premium, which is good but some rolling has been required.Expecting a Macro ATH pullback soon are we? CPI next week....

For TSLA, there isn’t enough -CC premium really to warrant my effort. I’m watching +p and some -p positions for MAR for more premiums and entry.

thenewguy1979

"The" Dog

Curious what Call are you selling against NVDA. That one seem to be the "crazy" one now.... crazy dog me was planning to sell ATM Puts for NVDA and close them out before earning to ride the pump wagon.I’m selling calls in Mar/Apr at this point… against the other 97.5% of my ports. AMD, MSFT, NVDA, CRM, LLY, MSFT, AAPL, BKNG, MAR, PCAR, GE, META, AMZN, AVGO, AMGN, ADBE, IYH, MU and some others.. its been a daily exercise. LOTS of premium, which is good but some rolling has been required.

For TSLA, there isn’t enough -CC premium really to warrant my effort. I’m watching +p and some -p positions for MAR for more premiums and entry.

Is there a % from the SP that the Call are sold - 15% OTM? Naked Call or Long Leg bounded 30 width etc..?

Was waiting for the world domination plan which you were working on

tivoboy

Active Member

Unfortunately, my world domination plan was 97.5% NOT TSLA, so it’s discussion was not relevant to this thread/forum.Was waiting for the world domination plan which you were working on

thenewguy1979

"The" Dog

Holy

NVDA IC for next Friday +570/-600 -800/+830 pays 0.53

What?!?

juanmedina

Active Member

Holy

NVDA IC for next Friday +570/-600 -800/+830 pays 0.6ish

What?!?

IV is insane right now. Earning is on the 21st I wonder if it will sell off.

@Yoona we have Mike's thread just for you. Please post NVDIA data there:

Selling Other Stocks Options - Be the House

This is a thread for Tesla investors who may want to diversify their options trades beyond TSLA from time to time, as opportunities present themselves. Sometimes there are amazing set-ups like when VFS was over $80. And maybe it’s not always a good idea to be 100% reliant on TSLA for action...

Last edited:

⚡️ELECTROMAN⚡️

Village Idiot

Looks like someone bending over waiting to get ****ed. That can't be good.

@Max Plaid what's your method for estimating extrinsic value on an option at x price. For example, I have 15x -P280 1/2025 that shows $3.46 extrinsic @ SP $187.50. I'm looking to learn how to model what the extrinsic will be at slices below, say $270, $260, $250, etc. to estimate when extrinsic falls to $0.00 and danger of early assignment looms.

TIA

TIA

@Max Plaid what's your method for estimating extrinsic value on an option at x price. For example, I have 15x -P280 1/2025 that shows $3.46 extrinsic @ SP $187.50. I'm looking to learn how to model what the extrinsic will be at slices below, say $270, $260, $250, etc. to estimate when extrinsic falls to $0.00 and danger of early assignment looms.

TIA

Isn't it just a function of what the bid price is? If people are willing to pay more than the intrinsic value of the option, then it still has extrinsic value. I've never seen it as anything that can be estimated, because there were times when a higher strike put (short-hand for "strike price of put option") actually had MORE extrinsic value (because the lower strike put was thinly traded) and same with calls (but in opposite direction).

True! But @Max Plaid has a way to ballpark it which I’m trying to learn how he does it.Isn't it just a function of what the bid price is? If people are willing to pay more than the intrinsic value of the option, then it still has extrinsic value. I've never seen it as anything that can be estimated, because there were times when a higher strike put (short-hand for "strike price of put option") actually had MORE extrinsic value (because the lower strike put was thinly traded) and same with calls (but in opposite direction).

you know, i eat corrections for breakfastWell the way NVDA has been going, I wouldn't be that confident writing a -c730 for tomorrow!

Plus is has gone up so far for so long now, it's surely due a correction at some point...?

nvda is starting to lose momentum; IV is a bit dropping and call volume fell over 4 days, hinting tiredness to the upside

SPY daily/weekly are overdue for pullbacks; only 256 stocks are up and the rest are red for the year (tsla is #1 loser)

of the green 256, 40% of gains are from only 4 stocks and the other 252 stocks are not participating as much so beneath the surface, the stock market is not as strong as it seems

NASDAQ 60 min/daily are also overdue for pullbacks

TYVM but i am still not convinced ppl want to go back-and-forth 2 options threads@Yoona we have Mike's thread just for you. Please post NVDIA data there:

besides, what is there to talk about TSLA only? it's up, now it's down, oh it's up again, never mind down again, here's a line to look at, there's another line, wait an hour for the next post, here's my trade, oh look EM tweeted something, etc

there is nothing new to learn about options if we're talking about the same thing day in and day out

if i posted my dramatic nvda 1dte vs tsla 7dte trade on the other thread, hooray all of 3 ppl would see it

how does that benefit the tsla community if they didn't know they could park their capital somewhere else while waiting for tsla to come back?

the irony is, most of those who want to keep this thread "tsla only pls" hardly even post anything, if at all

all take on the give-and-take

sorry, mods

Last edited:

I definitely will NOT do a NVDA IC earnings week. I could definitely see a 25% swing. But I think I will play next week....IV is insane right now. Earning is on the 21st I wonder if it will sell off.

View attachment 1016682

@Yoona we have Mike's thread just for you. Please post NVDIA data there:

Selling Other Stocks Options - Be the House

This is a thread for Tesla investors who may want to diversify their options trades beyond TSLA from time to time, as opportunities present themselves. Sometimes there are amazing set-ups like when VFS was over $80. And maybe it’s not always a good idea to be 100% reliant on TSLA for action...teslamotorsclub.com

Would also love to know of other stocks that have nice premiums on a $30 wide spread, and have good volume....

Arul

Member

She has a point this thread can handle two stocks easily. Her contribution will bene fit everyone.TYVM but i am still not convinced ppl want to go back-and-forth 2 options threads

besides, what is there to talk about TSLA only? it's up, now it's down, oh it's up again, never mind down again, here's a line to look at, there's another line, wait an hour for the next post, here's my trade, oh look EM tweeted something, etc

there is nothing new to learn about options if we're talking about the same thing day in and day out

if i posted my dramatic nvda 1dte vs tsla 7dte trade on the other thread, hooray all of 3 ppl would see it

how does that benefit the tsla community if they didn't know they could park their capital somewhere else while waiting for tsla to come back?

the irony is, most of those who want to keep this thread "tsla only pls" hardly even post anything, if at all

all take on the give-and-take

sorry, mods

You mean 170/160/150? As you move down on strikes, extrinsic increases so thats not a problem. the problem is when the stock drops, extrinsic drops so I wonder why you say 270/260/250.@Max Plaid what's your method for estimating extrinsic value on an option at x price. For example, I have 15x -P280 1/2025 that shows $3.46 extrinsic @ SP $187.50. I'm looking to learn how to model what the extrinsic will be at slices below, say $270, $260, $250, etc. to estimate when extrinsic falls to $0.00 and danger of early assignment looms.

TIA

1. When you short DITM puts, make sure it has a lot of open interests to decrease the odd of getting assigned early.

2. What is the risk of getting early assignment? Nothing major. There is a slight inconvenience from your cash disappearing and you stop earning interest on them or start paying interest if margin was used. There is no extra margin pressure or tax concern.

3. Add up the current stock price and the put premium. Subtract the strike price from that sum. The result will be the extrinsic.

4. If you wonder what the extrinsic will look like if the stock drops $20, look at a strike $20 higher and calculate its extrinsic. If you wonder what a 280p will look like if the stock drops from 190 to 170, look at a 300P.

Last edited:

It has nice premium because the risk associated warrants it. If you dont see the risk, you're just not looking hard enough.I definitely will NOT do a NVDA IC earnings week. I could definitely see a 25% swing. But I think I will play next week....

Would also love to know of other stocks that have nice premiums on a $30 wide spread, and have good volume....

thenewguy1979

"The" Dog

Same NVDA play like last time? Butterfly on Call side and Calender Spread on Puts Side?It has nice premium because the risk associated warrants it. If you dont see the risk, you're just not looking hard enough.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 11K

- Replies

- 5

- Views

- 6K