Quant Data@Yoona is the site where you get these from this one Quant Option Group - Realtime Option Flow & More or this one Quant Data (or another)?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

EVNow

Well-Known Member

Given the inflation but election year - I expect a rate cut closer to November.What if we get a surprise rate cut tomorrow? Wouldn't that be a white swan event for the SP to Moon?

thenewguy1979

"The" Dog

Closed out my NVDA -875P with some profit.

Take a little profit before uncle Powell start talking. The guy is the only person I know (beside Elon) that can tank the Market in minutes.

Not waiting to find out.

Only re-entering till FOMC is over. Rather be safe. Doing only 2-3DTE NVDA riding the AI wagon upward momentum.

Not touching TSLA till proven bull run or bull crap......

Take a little profit before uncle Powell start talking. The guy is the only person I know (beside Elon) that can tank the Market in minutes.

Not waiting to find out.

Only re-entering till FOMC is over. Rather be safe. Doing only 2-3DTE NVDA riding the AI wagon upward momentum.

Not touching TSLA till proven bull run or bull crap......

Nov will be too late ... So I think Jun/July ...Given the inflation but election year - I expect a rate cut closer to November.

So, I'd like NVDA to close out the week around $900, please, obviously because I have 5x -p900 in play, they're 50% down now, but IV always high on this stock in the final few days... plan after that is to shift to 10x $10 premiums, where-ever that may be, keeping 10x in my pocket available for rolling if needed

SMCI I sold 2x -p850 yesterday, tbh it can drop as much as it likes, with the +p800 I'm holding, would be nice to just milk -p800 with zero risk for the next 22 months

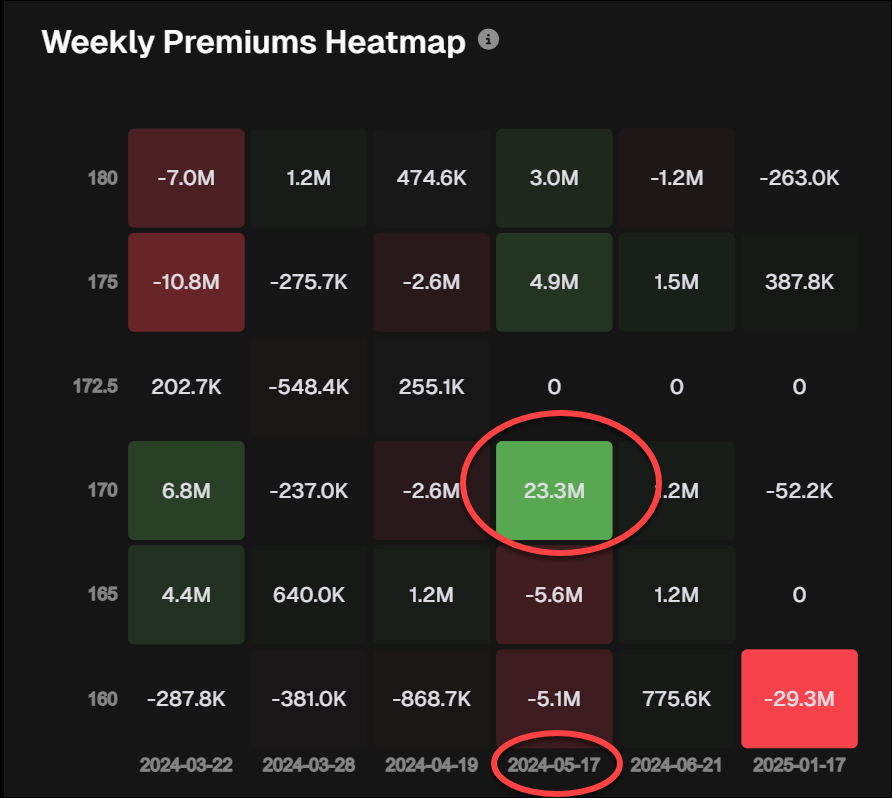

TSLA, 100X -c170's, if they expire then I'll look at -c175's for next week, if not, will probably just roll at 170

100x TSLA +p150's I'm not touching at this moment, neither selling or selling against, they're there to catch the post-P&D crash, if it comes

Planning to be out of short TSLA weeklies for the P&D, got burned too many times on that

SMCI I sold 2x -p850 yesterday, tbh it can drop as much as it likes, with the +p800 I'm holding, would be nice to just milk -p800 with zero risk for the next 22 months

TSLA, 100X -c170's, if they expire then I'll look at -c175's for next week, if not, will probably just roll at 170

100x TSLA +p150's I'm not touching at this moment, neither selling or selling against, they're there to catch the post-P&D crash, if it comes

Planning to be out of short TSLA weeklies for the P&D, got burned too many times on that

Interesting, while many are building a 5/17 +P170 position this shows up:

@dl003 TSLA hanging around your $171 line in the sand, seems it finally got the message

Let's see if it can survive >$170 into Friday close

Let's see if it can survive >$170 into Friday close

tivoboy

Active Member

June, Sept, Dec (maybe)Given the inflation but election year - I expect a rate cut closer to November.

thenewguy1979

"The" Dog

For the last 10 weeks NVDA has been making higher high every week regardless of the intraweek dump.So, I'd like NVDA to close out the week around $900, please, obviously because I have 5x -p900 in play, they're 50% down now, but IV always high on this stock in the final few days... plan after that is to shift to 10x $10 premiums, where-ever that may be, keeping 10x in my pocket available for rolling if needed

SMCI I sold 2x -p850 yesterday, tbh it can drop as much as it likes, with the +p800 I'm holding, would be nice to just milk -p800 with zero risk for the next 22 months

TSLA, 100X -c170's, if they expire then I'll look at -c175's for next week, if not, will probably just roll at 170

100x TSLA +p150's I'm not touching at this moment, neither selling or selling against, they're there to catch the post-P&D crash, if it comes

Planning to be out of short TSLA weeklies for the P&D, got burned too many times on that

Last week closed was 878. If the momentum continue (see to be so far) we should see it closed above 878.

We at 890 AH.

900 looks kind of toppy to me. Volume is high but SP has been flat after an insane run - makes me think profit takers are being replaced by new money.For the last 10 weeks NVDA has been making higher high every week regardless of the intraweek dump.

Last week closed was 878. If the momentum continue (see to be so far) we should see it closed above 878.

We at 890 AH.

View attachment 1029746

I bought and sold a 860p today. Thinking about buying put spreads or selling ITM call spreads.

On TSLA, volume was really low today and I still don’t see us going much higher short term with the low delivery numbers expected. Added +p170 and some -c172.50 for Friday.

CapitulationIt's so funny to me. Everyone and their mother goes short or closes their long position last week. If it seems too good to be true it usually is. Now a lot of these shorts are going to get shaken out and some old bulls will buy back. But absolutely nothing has changed. If you traded through Nov-Dec 2022 you know all too well that what we are witnessing the past few days is totally normal and means nothing. It's too easy for SP to fall immediately after everyone seems to have turned bearish. We'll first build back up before a push lower, just like SP did Feb 5th - Mar 1st, 2024.

Reversal

Momentum

FOMO

Rince and repeat

EVNow

Well-Known Member

Yes, when I say closer - I mean in fed POV. So, unlikely March, likely July/Aug.Nov will be too late ... So I think Jun/July ...

No new posts since Yesterday at 6:37 PM???

Spooky...

---

Spooky mod: several FSD posts got axed. That discussion belongs in the main thread or the dedicated FSD threads, not the options thread.

Spooky...

---

Spooky mod: several FSD posts got axed. That discussion belongs in the main thread or the dedicated FSD threads, not the options thread.

Last edited by a moderator:

No new posts since Yesterday at 6:37 PM???

Spooky...

People must be scared to make predictions today for fear of being JPOWed.

ProfessorZoom

Member

Here is what will happen during jpow in regard to price action: the chart will go to the right

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K