hershey101

Active Member

Source? 9% is a lot!JB Straubel filed with the SEC, intent to sell about 9% of his shares. Not that it's real news, but that's never stopped the media. I could see a price drop for 5 or 10 minutes based on this. <shrug>

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Source? 9% is a lot!JB Straubel filed with the SEC, intent to sell about 9% of his shares. Not that it's real news, but that's never stopped the media. I could see a price drop for 5 or 10 minutes based on this. <shrug>

JB Straubel filed with the SEC, intent to sell about 9% of his shares. Not that it's real news, but that's never stopped the media. I could see a price drop for 5 or 10 minutes based on this. <shrug>

I know many on here think it is the case, but I don't think BABA is directly affecting the whole market or growth stocks to any degree that we would even notice. BABA is selling something like 30bn worth of stock to the open public today...the entire capitalization of the US stock market is in in the several trillions. My point is, that even if BABA didn't exist we would still be down almost exactly as much we are now (maybe a few pennies higher) from our highs.

Thanks for the heads up on the 6.0 blog by the way

Note that as of around 10am TSLA has been trading almost in perfect harmony with the Nasdaq. So I don't see us rising up out of this slump and will likely lock in at best 260 today.

one other comment, a friend asked me about adding shares yesterday. I told him, I don't know, but I'd estimate 50% chance we drop below $250, 30% chance we see $220s, 10% chance we see $180s, with none of that requiring anything effecting Tesla's fundamentals to occur (and my estimate that in 2020 the stock will be worth $550-$650). if model X not revealed until mid-Jan, I'd tweak those scenarios to 65%, 35%, 10%.

So you really thought that there is 90% chance that TSLA will go under $250?

BTW you tweaked numbers add to more than 100%

Vgrin, no, I do not think there's a 90% chance TSLA will go under $250, nor does my tweak add to over 100%. under $230 and under $190 are subsets of under $250, and under $190 is a subset of under $230.

Note that as of around 10am TSLA has been trading almost in perfect harmony with the Nasdaq. So I don't see us rising up out of this slump and will likely lock in at best 260 today.

one other comment, a friend asked me about adding shares yesterday. I told him, I don't know, but I'd estimate 50% chance we drop below $250, 30% chance we see $220s, 10% chance we see $180s, with none of that requiring anything effecting Tesla's fundamentals to occur (and my estimate that in 2020 the stock will be worth $550-$650). if model X not revealed until mid-Jan, I'd tweak those scenarios to 65%, 35%, 10%.

If you actually believe any of this, you should be knocking people over to get to a computer and buy some puts/sell calls. You are getting way better than 10:1 on your money to buy some 180 puts.

Given that Goldman's very low 2020 volume targets seem self-serving (IIRC, 75% likelihood Tesla is under 300K/year in 2020, despite company's 500K+ guidance), and $6B cap raise chatter seems like a twisting of Tesla's comments/fabrication, it may be that their comments about Model X reveal in January is more of the same.

I know DaveT has twice gotten word just this week from Tesla IR when analyst statements were not based on anything from the company... Dave, maybe you could get the word on this one too?

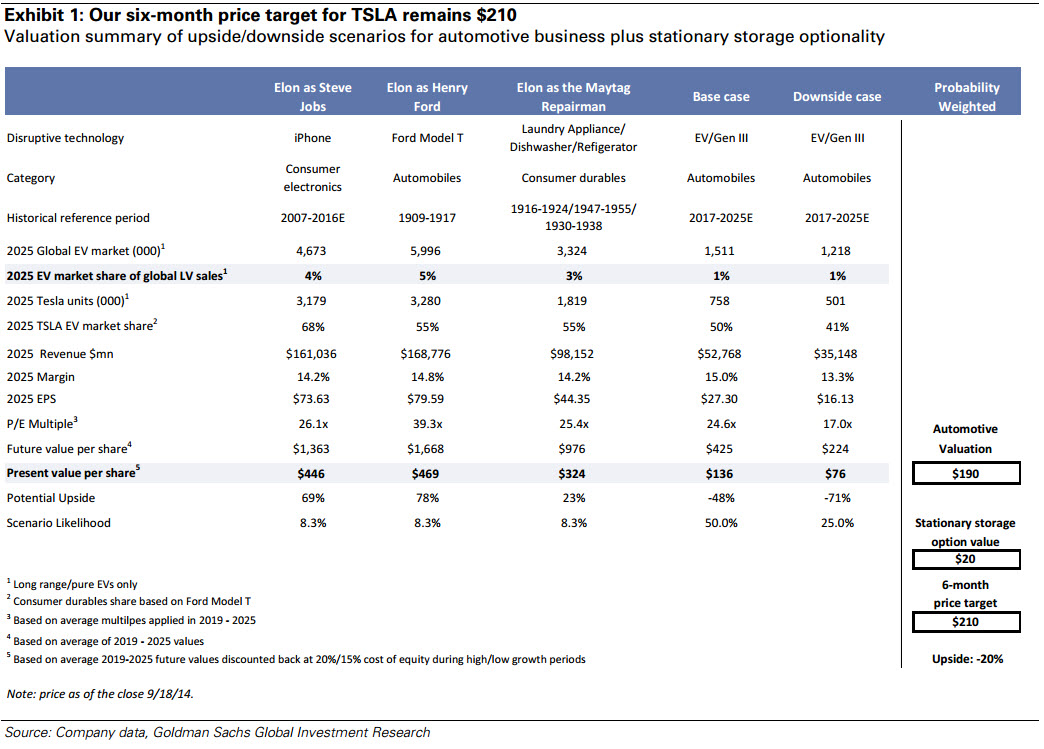

I'm sorry, but this is pretty weak. If you let me predict every stock in the market with $400 range I'd bet I'd get it right 99.9% of the time. Is this all it takes to earn a million dollar bonus at Goldman?A good explanation of their valuation they just updated, continues on their previous analogy of Elon vs Jobs/Ford/Maytag

http://www.zerohedge.com/sites/default/files/images/user3303/imageroot/2014/09/20140919_iTSLA.jpg

Can someone point out when was model S revealed before production start in June? Trying to compare events for Model x and timing.