Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

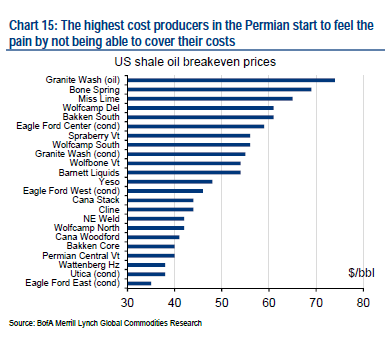

For those worried about Oil prices. The producers aren't going to bankrupt themselves. It doesn't change the fact we only have one planet. These are all facts and are truth. That and, in this price range for Model S... these people aren't worried about pump gas prices. The big implication is on things like freight and production of products.

You need to do some math to understand the scope of what you are saying. Saudi Aramco / Saudi Arabia has SO MUCH MONEY in reserve (over $30 *trillion* in 2012) that it can literally sustain market-breaking prices almost indefinitely for purposes of investment. They do not have to break even to survive.

On the flipside, all the heavily leveraged US producers very much DO need oil above breakeven to survive. Many of them won't. That is the plan. And if they default, the banks that backed them potentially get hammered too. And jobs are lost, and chaos ensues, etc.

We also have central banks all over the world scrambling to increase QE, while our own Fed is getting ready to raise rates.

This is spooky stuff. It's either the buying opportunity of the year, or a disturbing preview of further carnage.

Bank of America sees $50 oil as Opec dies - Telegraph

I couldn't stand it anymore and had to regress the weekly change in TSLA price on the change USO (oil future ETN that tracks the price of oil). Result is an R-squared stat of 1.6% on most recent 100 weeks. The slight correlation is easily due to general.market conditions. There is no statistical support for the belief that price of oil drives Tesla stock performance.

Further, jhm you do a great job with statistics, but you used flawed variables to analyze market movements. You cannot use historical correlation to oil prices to judge the current and future correlation. The market has decided this recently, so it does not "Show up" in any regression. The market prices equities on expectation of FUTURE profits, not past.

Finally -- let me be clear, I DO NOT THINK THIS CORRELATION IS JUSTIFIED. Demand for Tesla products WILL NOT BE AFFECTED MATERIALLY BY THE PRICE OF OIL. But THE MARKET thinks it will at present. And in the absence of communication to the contrary from Tesla PR or any other source, I expect this price action will continue as long as oil keeps falling.

Last edited:

drinkerofkoolaid

Active Member

Falling Oil Prices An Opportunity to Reform Fuel Subsidies | The Prince Arthur Herald

"The recent decline in oil prices, combined with other economic conditions, makes this an ideal time to enact reform. Inflation is well under 3%, nothing short of a record low. Lending rates, still bolstered by America’s quantitative easing policy, are equally generous and would act as a stimulus in converting those subsidy funds into infrastructure and other capital investments. But these conditions won’t last forever. Indonesia’s new president has spearheaded the effort, which he made a part of his campaign platform. India too has achieved some cuts, citing the opportunity of falling gas prices. The international community can encourage this behavior by including it in the United Nation’s Climate Change talks, namely the much hyped 2015 conference to be held in Paris. Given that IEA’s estimates that phasing out fossil fuel subsidies would avoid 2.6 gigatonnes of CO2 by 2035, half the emissions reductions advocated by the Intergovernmental Panel on Climate Change, this issue must at least be part of the negotiations.

In the same spirit as the much lauded Green Climate Fund, developing nations could be enticed to scraping fuel subsidies by rewarding them with low* interest loans tied to infrastructure investments or direct cash transfers. Likewise, policy assistance would be offered to implement reforms gradually and transparently to keep the masses informed of the greater benefits they’ll be receiving in exchange for losing their cheap gasoline"

Oil prices have plummeted in recent months, from US$115 a barrel in June to less than US$70.

That dramatic shift could increase greenhouse gas emissions in the short term, as consumers take advantage of cheap fuel.

It also gives policymakers a “golden opportunity” to scrap fossil fuel subsidies and bring in carbon pricing, a leading energy expert argued on Tuesday.

Oil price slump a "golden opportunity" to price carbon - IEA

"The recent decline in oil prices, combined with other economic conditions, makes this an ideal time to enact reform. Inflation is well under 3%, nothing short of a record low. Lending rates, still bolstered by America’s quantitative easing policy, are equally generous and would act as a stimulus in converting those subsidy funds into infrastructure and other capital investments. But these conditions won’t last forever. Indonesia’s new president has spearheaded the effort, which he made a part of his campaign platform. India too has achieved some cuts, citing the opportunity of falling gas prices. The international community can encourage this behavior by including it in the United Nation’s Climate Change talks, namely the much hyped 2015 conference to be held in Paris. Given that IEA’s estimates that phasing out fossil fuel subsidies would avoid 2.6 gigatonnes of CO2 by 2035, half the emissions reductions advocated by the Intergovernmental Panel on Climate Change, this issue must at least be part of the negotiations.

In the same spirit as the much lauded Green Climate Fund, developing nations could be enticed to scraping fuel subsidies by rewarding them with low* interest loans tied to infrastructure investments or direct cash transfers. Likewise, policy assistance would be offered to implement reforms gradually and transparently to keep the masses informed of the greater benefits they’ll be receiving in exchange for losing their cheap gasoline"

Oil prices have plummeted in recent months, from US$115 a barrel in June to less than US$70.

That dramatic shift could increase greenhouse gas emissions in the short term, as consumers take advantage of cheap fuel.

It also gives policymakers a “golden opportunity” to scrap fossil fuel subsidies and bring in carbon pricing, a leading energy expert argued on Tuesday.

Oil price slump a "golden opportunity" to price carbon - IEA

Somehow, I doubt Elon cares about the 200 DMA."Tesla needs to deliver on its promises as soon as possible in order to regain the 200 DMA and the technical features of the stock."

In fact, barring a need to raise capital again, Tesla has little reason to care how the stock price fluctuates. They said as much in their Q3 ER.

aznt1217

Active Member

You need to do some math to understand the scope of what you are saying. Saudi Aramco / Saudi Arabia has SO MUCH MONEY in reserve (over $30 *trillion* in 2012) that it can literally sustain market-breaking prices almost indefinitely for purposes of investment. They do not have to break even to survive.

On the flipside, all the heavily leveraged US producers very much DO need oil above breakeven to survive. Many of them won't. That is the plan. And if they default, the banks that backed them potentially get hammered too. And jobs are lost, and chaos ensues, etc.

We also have central banks all over the world scrambling to increase QE, while our own Fed is getting ready to raise rates.

This is spooky stuff. It's either the buying opportunity of the year, or a disturbing preview of further carnage.

Bank of America sees $50 oil as Opec dies - Telegraph

Further, jhm you do a great job with statistics, but you used flawed variables to analyze market movements. You cannot use historical correlation to oil prices to judge the current and future correlation. The market has decided this recently, so it does not "Show up" in any regression. The market prices equities on expectation of FUTURE profits, not past.

Finally -- let me be clear, I DO NOT THINK THIS CORRELATION IS JUSTIFIED. Demand for Tesla products WILL NOT BE AFFECTED MATERIALLY BY THE PRICE OF OIL. But THE MARKET thinks it will at present. And in the absence of communication to the contrary from Tesla PR or any other source, I expect this price action will continue as long as oil keeps falling.

Fair point about the Saudi's. No disputing that arab money. But I'm pretty sure the federal government wouldn't let this occur to the point where it bankrupts domestic businesses. If anything, this move exemplifies the importance of solarcity and tesla and we should get energy independence sooner. Even if it was the case where crude dropped a ton and hypothetically... products would get cheaper and profits would be higher because things such as freight cost less assuming all is equal... it balances it?

Raffy.Roma

Rome (Italy)

Somehow, I doubt Elon cares about the 200 DMA.

In fact, barring a need to raise capital again, Tesla has little reason to care how the stock price fluctuates. They said as much in their Q3 ER.

But investors do care about the 200 DMA. The risk of not respecting the 200 DMA is that of losing investors.

Tesla cares about short term investors because....?But investors do care about the 200 DMA. The risk of not respecting the 200 DMA is that of losing investors.

It's fine for us to debate technicals and movements and what might move the stock, but it's a mistake to issue a call for action along the lines of "Tesla needs to" (your words) do X, Y and Z for short term stock movements.

Unless you were just talking hypothetically rather than indicating Tesla needed to address short term movements.

jhm

Well-Known Member

FluxCap, you are not contradicting my point. The correlation does in fact exist currently in the imagination of the market. In the future the correlation could just as easily be positive or negative. It all depends on the imagination of the market at that time. What looking at the past tells us is that there is no reliable relationship whereby Tesla must trade in correlation with oil. It all depends simply on the whim of the collective imagination of the market. Declining oil prices is just the dominant economic story right now. When this news slips back into the background, nobody will care if Tesla and oil are correlated.

I just saw your final paragraph. I think we're on the same page.

I just saw your final paragraph. I think we're on the same page.

But investors do care about the 200 DMA. The risk of not respecting the 200 DMA is that of losing investors.

TSLA is down thanks to oil. It will get back over the 200 DMA once oil stabilizes.

Raffy.Roma

Rome (Italy)

Tesla cares about short term investors because....?

It's fine for us to debate technicals and movements and what might move the stock, but it's a mistake to issue a call for action along the lines of "Tesla needs to" (your words) do X, Y and Z for short term stock movements.

Unless you were just talking hypothetically rather than indicating Tesla needed to address short term movements.

I meant investors in general. So also long term investors.

IMO the respect of the 200 DMA over the time is a sign of the reliability of the Company.

It all depends simply on the whim of the collective imagination of the market.

You have just described every single stock price in the market. Trading stocks is predicting future whims of future investors from a time horizon of a few nanoseconds from now to a few years, and betting you know more than someone else. That's all it is, and all it ever will be.

NigelM

Recovering Member

Tesla cares about short term investors because....?

It's fine for us to debate technicals and movements and what might move the stock, but it's a mistake to issue a call for action along the lines of "Tesla needs to" (your words) do X, Y and Z for short term stock movements.

Unless you were just talking hypothetically rather than indicating Tesla needed to address short term movements.

Agreed. It would actually be a bad strategy for Tesla to start addressing short term movements; it's distracting, once they start there's no end in sight, and the net result would be even greater volatility and unpredictability.

- - - Updated - - -

You have just described every single stock price in the market. Trading stocks is predicting future whims of future investors from a time horizon of a few nanoseconds from now to a few years, and betting you know more than someone else. That's all it is, and all it ever will be.

You caused me to remember this amusing tweet from a couple months back:

Agreed. It would actually be a bad strategy for Tesla to start addressing short term movements; it's distracting, once they start there's no end in sight, and the net result would be even greater volatility and unpredictability.

- - - Updated - - -

You caused me to remember this amusing tweet from a couple months back:

View attachment 65649

Agreed, Nigel!

Still, investor relations does have a fiduciary duty to respond to misleading or false information such as the Ward's auto made-up sales figure debacle ,which they handled very well (partially at TMC forum member/investor's own urging). I'm not saying this latest falsehood that "cheap oil drives down demand for Tesla products" falls into that category, but I certainly wish there were louder voices making that clear in the media (social or MSM). Even a circuitous blog post or article that demonstrates something like "Tesla buyers overwhelmingly agree that there is no price of oil that would make them want to buy a combustion car ever again" sure would be nice, wouldn't it?

There are more ways to disseminate positive information that build a marketing "moat" around perceptions of the company too...but those take resources (dollars and time and personnel) that we don't have at present.

Last edited:

chickensevil

Active Member

1) D: There's a lot of excitement about D, and there will be lots of demand, but Tesla needs to get production of the Ds going (a) to get the money (b) to build confidence that they aren't going to have major difficulties delivering every major new change.

I still don't get this. They said December, with no "official" deadline specified. All customers got was the "estimated" delivery date... which has always been exactly that... an estimate. They blow past those estimates all the time... just as the bump people up in the chain all the time. Dinging Tesla on missing an estimate because it happens to be the first customer (that we know of) anticipated to take delivery of a new variation of a current product doesn't really make any sense and is totally irrational. At that, the delay amounted to around a week or so, which is also well within the "oops" factor that again, happens all the time.

So either A: investors should be much more upset about them ALWAYS blowing past their estimates or B: Stop screaming bloody murder on this non-issue in the grand scheme of things.

I could totally understand getting upset if things got pushed back a month or more... but come on! If the stock moved negatively based on this, then people selling are just not aware of how Tesla has been doing business since the very beginning of the company.

To be clear, I am not suggesting that the stock wasn't affected by this, simply that the people who sold off *because* of this factor makes no sense to me.

NigelM

Recovering Member

Still, investor relations does have a fiduciary duty to respond to misleading or false information such as the Ward's auto made-up sales figure debacle ,which they handled very well (partially at TMC forum member/investor's own urging). I'm not saying this latest falsehood that "cheap oil drives down demand for Tesla products" falls into that category, but I certainly wish there were louder voices making that clear in the media (social or MSM). Even a circuitous blog post or article that demonstrates something like "Tesla buyers overwhelmingly agree that there is no price of oil that would make them want to buy a combustion car ever again" sure would be nice, wouldn't it?

There are more ways to disseminate positive information that build a marketing "moat" around perceptions of the company too...but those take resources (dollars and time and personnel) that we don't have at present.

Nothing to disagree with there.

All the stuff about oil prices etc only shows the level of short-term thinking - it's almost mind boggling that anyone should think a temporary drop in oil prices is going to have significant impact on EV adoption. I don't recall whether this chart has been posted but:

Source: www.macrotrends.net

jhm

Well-Known Member

InTheShadows

Active Member

At what price of oil would you buy a gasoline generator just to recharge your Model S?

I wouldn't do it if the oil was free. Now a solar array to recharge it is a different story.

Total Nasdaq and Dow carnage continues. Tough to see how this reverses tomorrow unless OPEC signals a floor for oil and/or heartening currency news comes out of Eurozone / Asia.

Legendary Oil Trader Says $50 Oil is Next and the Saudis are Letting it Happen | Tumblr Blog - Yahoo Finance

Legendary Oil Trader Says $50 Oil is Next and the Saudis are Letting it Happen | Tumblr Blog - Yahoo Finance

Last edited:

- Status

- Not open for further replies.

Similar threads

- Replies

- 23

- Views

- 814

- Replies

- 21

- Views

- 6K

- Replies

- 0

- Views

- 223

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 6

- Views

- 620