That is different that before the Model 3 reveal. So they have already dropped the price $7,500. They know they can't compete.Bolt's MSRP (before tax incentives) is $37,500 according to their website (very bottom of 2017 Bolt EV: All-Electric Vehicle | Chevrolet).

Correction: news release by GM (Bolt EV Offers 238 Miles of Range) says MSRP will be below $37,500 (before tax incentives).

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

rallykeeper

Member

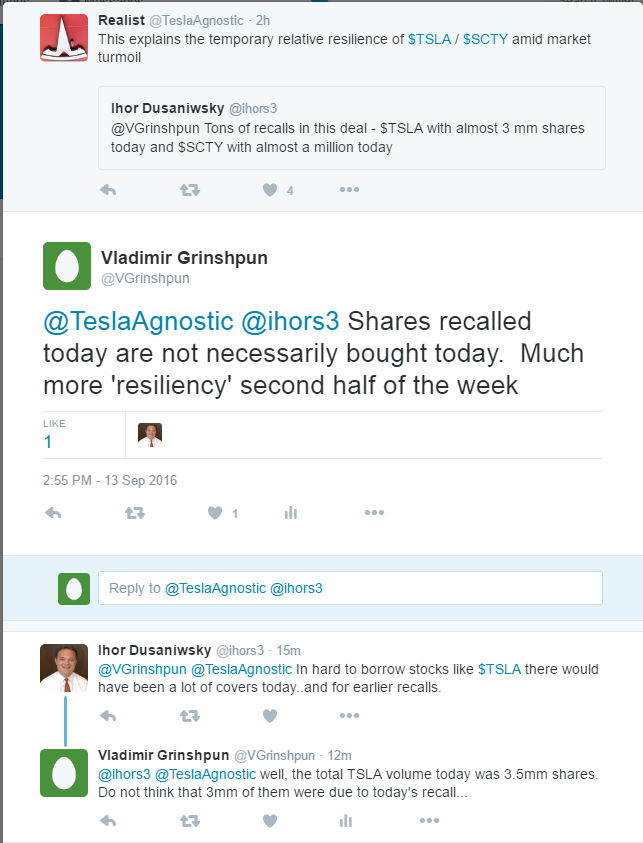

This is pretty useful info. Most importantly, shorts likely didn't cover!

I don't think volume was nearly high enough to include that many recalled shares.

Edit: I was posting at the same time as vgrinshpun while digging into volume data a bit. Missed the subsequent post making the same point as my initial post.

I'd be interested in some more nitty-gritty info too. However, I had always thought (on a somewhat informed basis from looking at securities lending agreements) that shorts really have to purchase on the day they are recalled, unless they can figure out how to source shares on short settlement (e.g., T+2 or T+1).

The reason you wouldn't see a squeeze quite yet is that they are still hoping to do that. If more shares are recalled tomorrow, the pressure will build.

If the shorts are unable to locate shares at a price they are willing to pay, they will fail to deliver shares on Recall+3 (for today's recall, this coming Friday). That will be a default and the agent can buy-in, take the collateral and seek compensation for the difference. The agent would be buying shares on Monday (I think).

Last edited:

Moving the focus out a bit from Bolt vs. Model III, this is an excellent analysis of Samsung/GM pouch battery tech vs. Panasonic/Tesla cell tech....Sam Korus from ARK Invest has some thoughtful Tesla pieces dating back a few years, including a projection of 1.0 million Tesla's sold in 2020 before Elon moved up the goal of 500k to 2018. He may have been the impetus for Bloomberg New Energy to work on the 2022/2023 peak oil piece.

Battery System Showdown: Is Tesla about to be overpowered?

Battery System Showdown: Is Tesla about to be overpowered?

That is different that before the Model 3 reveal. So they have already dropped the price $7,500. They know they can't compete.

For the past 2 years, GM has said the Bolt will cost about $30k after tax incentives.

Chevy Bolt EV Price | Chevrolet Bolt Forum

davecolene0606

Member

May I ask, why all the hubbub over the Bolt? Does anyone really think it's going to affect demand for any Tesla product?

Yup, it's gonna increase it

This is pretty useful info. Most importantly, shorts likely didn't cover!

I don't think volume was nearly high enough to include that many recalled shares.

Edit: I was posting at the same time as vgrinshpun while digging into volume data a bit. Missed the subsequent post making the same point as my initial post.

I'd be interested in some more nitty-gritty info too. However, I had always thought (on a somewhat informed basis from looking at securities lending agreements) that shorts really have to purchase on the day they are recalled, unless they can figure out how to source shares on short settlement (e.g., T+2 or T+1).

The reason you wouldn't see a squeeze quite yet is that they are still hoping to do that. If more shares are recalled tomorrow, the pressure will build.

If the shorts are unable to locate shares at a price they are willing to pay, they will fail to deliver shares on Recall+3 (for today's recall, this coming Friday). That will be a default and the agent can buy-in, take the collateral and seek compensation for the difference. The agent would be buying shares on Monday (I think).

Well we just know that there were 3mm shares recalled today. It is very likely that there were also sizable chunks of shares recalled last Friday and yesterday, so pressure got to be pretty high already. Volume since last Wednesday was pretty stable at about 3.5mm shares per day. If I would be asked to guess, majority of recalled shorts did not cover yet. If this is true, we should see significant SP move in the second half of the week. Do not forget that 100.5mm shares are held by Institutions, 31mm - by Elon. This pretty much eliminates about 132mm shares form the pool of shares available for covering the recalled short positions. I am not an expert, but this set up into the second half of the week looks pretty ominous.

You know there are a lot of long time, highly intelligent posters here who for some reason seem to fall for/jump on the "the Bolt shows major automakers are finally getting it" train.

That is a wonderful, but very flawed sentiment. BMW scrambling and rewriting their plans does qualify, maybe even VW - kicking and screaming - being dragged into the change because of diesel gate may show that too (somewhat), but the Bolt?!

By all reasonable calculations on these pages, people have deducted that the Bolt will be sold at 5-7.5k of a loss of manufacturing cost. (Note the difference between that and Tesla's loss over the cost of building up the global company while being very profitable on manufacturing the product).

Now why would a company sell a product at such a loss? I can think of a couple of reasons, but the most likely has been discussed here already. They did the math on how much ZEV credits would cost them and figured, as long as it's not worse than that and has the added benefit of helping the brand image, showing how green and progressive they are, why not? This would also stop the bleeding of some more green minded customers and giving money to the competition via ZEV.

I know this is over simplified, but you get the point. You can praise GM for seeing the light once they aim to make an EV at a profit and with the intent of replacing one of their major product lines/brands with it.

That is a wonderful, but very flawed sentiment. BMW scrambling and rewriting their plans does qualify, maybe even VW - kicking and screaming - being dragged into the change because of diesel gate may show that too (somewhat), but the Bolt?!

By all reasonable calculations on these pages, people have deducted that the Bolt will be sold at 5-7.5k of a loss of manufacturing cost. (Note the difference between that and Tesla's loss over the cost of building up the global company while being very profitable on manufacturing the product).

Now why would a company sell a product at such a loss? I can think of a couple of reasons, but the most likely has been discussed here already. They did the math on how much ZEV credits would cost them and figured, as long as it's not worse than that and has the added benefit of helping the brand image, showing how green and progressive they are, why not? This would also stop the bleeding of some more green minded customers and giving money to the competition via ZEV.

I know this is over simplified, but you get the point. You can praise GM for seeing the light once they aim to make an EV at a profit and with the intent of replacing one of their major product lines/brands with it.

In the real world, 0-60 is all that really matters. Anything else gets you a ticket. I don't get all these comments about lap times. Maybe 0.1% of people making these remarks have ever even driven a car on a track anyway, so who gives a *sugar*?

I was responding to a message that said in all areas. I for one care and some people who are willing to risk it on some mountain road will too. Going for a "spirited ride" up some beautiful twisties in the mountains and then having max power cut substantially half way into it gotta be unpleasant.

Quesder

Member

no, it is not. $37500 is before the credit.The price of the Bolt (around $37k), is AFTER the federal tax credit (unless they have already started discounting the car). Also GM has been going through its allotment of the tax credit with cars like the Volt.

Moving the focus out a bit from Bolt vs. Model III, this is an excellent analysis of Samsung/GM pouch battery tech vs. Panasonic/Tesla cell tech....Sam Korus from ARK Invest has some thoughtful Tesla pieces dating back a few years, including a projection of 1.0 million Tesla's sold in 2020 before Elon moved up the goal of 500k to 2018. He may have been the impetus for Bloomberg New Energy to work on the 2022/2023 peak oil piece.

Battery System Showdown: Is Tesla about to be overpowered?

I think that article is mostly crap. I am a bit too distracted and lazy right now to go through it point by point. Maybe later.

Interesting that Model S maintains value so well. Hopefully the same for X and Ξ.

Tesla Model S retains its value better than gas-powered cars in its segment, losing only 28% after 50k miles

Tesla Model S retains its value better than gas-powered cars in its segment, losing only 28% after 50k miles

Couldn't agree more. Here's the list of essentials to tell you whether the company is taking EVs seriously yet:You know there are a lot of long time, highly intelligent posters here who for some reason seem to fall for/jump on the "the Bolt shows major automakers are finally getting it" train.

That is a wonderful, but very flawed sentiment. BMW scrambling and rewriting their plans does qualify, maybe even VW - kicking and screaming - being dragged into the change because of diesel gate may show that too (somewhat), but the Bolt?!

By all reasonable calculations on these pages, people have deducted that the Bolt will be sold at 5-7.5k of a loss of manufacturing cost. (Note the difference between that and Tesla's loss over the cost of building up the global company while being very profitable on manufacturing the product).

Now why would a company sell a product at such a loss? I can think of a couple of reasons, but the most likely has been discussed here already. They did the math on how much ZEV credits would cost them and figured, as long as it's not worse than that and has the added benefit of helping the brand image, showing how green and progressive they are, why not? This would also stop the bleeding of some more green minded customers and giving money to the competition via ZEV.

I know this is over simplified, but you get the point. You can praise GM for seeing the light once they aim to make an EV at a profit and with the intent of replacing one of their major product lines/brands with it.

1. Does the car look like an ICE and is not trying to be different? Weirdmobiles are compliance cars, period.

2. Has the car been redesigned to be electric or have they just stuffed an electric powertrain where the engine once was?

3. Does the press release speak to battery sourcing issues? I don't care if it's done in-house or through a third party, but if the company isn't talking about ramping battery production then they will be severely production constrained no matter how compelling it is.

4. Does the company speak to fast-charging network solutions?

If the answer to any of these 4 is no, I assume they aren't serious. It could be a decent first step, but they aren't taking on Tesla.

You know there are a lot of long time, highly intelligent posters here who for some reason seem to fall for/jump on the "the Bolt shows major automakers are finally getting it" train.

That is a wonderful, but very flawed sentiment. BMW scrambling and rewriting their plans does qualify, maybe even VW - kicking and screaming - being dragged into the change because of diesel gate may show that too (somewhat), but the Bolt?!

By all reasonable calculations on these pages, people have deducted that the Bolt will be sold at 5-7.5k of a loss of manufacturing cost. (Note the difference between that and Tesla's loss over the cost of building up the global company while being very profitable on manufacturing the product).

Now why would a company sell a product at such a loss? I can think of a couple of reasons, but the most likely has been discussed here already. They did the math on how much ZEV credits would cost them and figured, as long as it's not worse than that and has the added benefit of helping the brand image, showing how green and progressive they are, why not? This would also stop the bleeding of some more green minded customers and giving money to the competition via ZEV.

I know this is over simplified, but you get the point. You can praise GM for seeing the light once they aim to make an EV at a profit and with the intent of replacing one of their major product lines/brands with it.

I agree with this.

To me the Bolt shows almost exactly the same thing about GM's commitment to EVs as the i3 showed about BMW's commitment to EVs: that it is weak at best.

I am glad GM is introducing a 200+ mile EV, but the lack of a competitive offering to comparably priced ICE vehicles, lack of significant projected sales volume and absence of any apparent plan to ramp that volume all suggest GM is not yet serious about EVs.

That could eventually change, but there is no evidence it has yet IMO.

Last edited:

By all reasonable calculations on these pages, people have deducted that the Bolt will be sold at 5-7.5k of a loss of manufacturing cost.

What reasonable calculation shows GM will manufacture at a loss???

They've got $8700 in cell costs. Even if pack, motor, inverter, powertrain costs add $10k more, they still have roughly $18-19k left to make and sell the car. It won't take take that much since it's a small car. They could probably finish the car off with just $8-10k on costs. GM will make a healthy margin on these cars at $37.5k. If price is lower than margin will be lower. But at any decent volume (i.e., 50k cars/years), they'll be making money. I don't see any credible calculations of them losing money on decent volume.

Few more tweets on the subject of recalls. It seems that recalls ARE happening since Friday. If that is the case, just by looking at steady volume since last Wednesday (and actually higher in the beginning of last week) it seems that buying these recalled shares will be heavily back loaded to the second half of the week.

Couldn't agree more. Here's the list of essentials to tell you whether the company is taking EVs seriously yet:

1. Does the car look like an ICE and is not trying to be different? Weirdmobiles are compliance cars, period.

2. Has the car been redesigned to be electric or have they just stuffed an electric powertrain where the engine once was?

3. Does the press release speak to battery sourcing issues? I don't care if it's done in-house or through a third party, but if the company isn't talking about ramping battery production then they will be severely production constrained no matter how compelling it is.

4. Does the company speak to fast-charging network solutions?

If the answer to any of these 4 is no, I assume they aren't serious. It could be a decent first step, but they aren't taking on Tesla.

1. Bolt looks like a small hatchback. Looks normal to me.

2. Bolt is a ground-up new design for GM. It's not a modified ICE. 2017 Chevrolet Bolt EV Sets Benchmark for EV Design

3. GM's battery sourcing has no problems currently, nor in the foreseeable future. Many companies are ramping production to provide low-cost cells (inc. LG Chem, Samsung SDI, BYD).

4. You'll hear more from GM and others about DC fast-charging in the coming year or two. But this is definitely one of the big achilles heels for the Bolt, until DC fast chargers are more prevalent.

IMO:

I hated how the LEAF drove... I didn't take it seriously and still don't.

I was impressed at how the Volt drove, and I think it was a noble attempt at a plug-in hybrid.

The Bolt... I'm going to wait until test driving it to make a conclusion. But it's definitely in a different (smaller, less performance) class than the Model 3... and ultimately the price will need to reflect that.

1. Bolt looks like a small hatchback. Looks normal to me.

2. Bolt is a ground-up new design for GM. It's not a modified ICE. 2017 Chevrolet Bolt EV Sets Benchmark for EV Design

3. GM's battery sourcing has no problems currently, nor in the foreseeable future. Many companies are ramping production to provide low-cost cells (inc. LG Chem, Samsung SDI, BYD).

4. You'll hear more from GM and others about DC fast-charging in the coming year or two. But this is definitely one of the big achilles heels for the Bolt, until DC fast chargers are more prevalent.

IMO:

I hated how the LEAF drove... I didn't take it seriously and still don't.

I was impressed at how the Volt drove, and I think it was a noble attempt at a plug-in hybrid.

The Bolt... I'm going to wait until test driving it to make a conclusion. But it's definitely in a different (smaller, less performance) class than the Model 3... and ultimately the price will need to reflect that.

Bolt is a heavily modified Gamma 2 platform vehicle, of which many dimensions shared with the Buick Encore. Certainly not from scratch.

GM is using up LG's underutilized capacity in their Ochang, SK factory. After that, they will need to build much more than they have announced thus far. LG's total capacity by end of year next year is likely around 7 GWh. Similarly, Samsung and SKI are growing, but coming from a small capacity. Tesla is looking to ship that much this year, before the Gigafactory is online.

Ex-Chevy chief engineer of the Volt estimated the pack pricing of the Bolt to be $210/kWh based on the announced cell pricing. Note that GM's expectation is that the cell pricing stays at $145/kWh through 2019.

Bolt is a front wheel drive vehicle... reviewers have been charitable thus far, and the primary target market of Leaf and Prius owners are used to such crap that the Bolt is likely a step up. We would likely be disappointed if the Model 3's driving experience cannot be compared to German sports sedans.

I think they will sell all they can make.

I do think they are losing money on it. The Encore starts at $24k, doing some subtraction, make some additions, $12k for the battery pack, and likely there is zero or slightly negative gross margin. But factor in the ZEV credits they don't have to buy, and it's a win.

1. Bolt looks like a small hatchback. Looks normal to me.

2. Bolt is a ground-up new design for GM. It's not a modified ICE. 2017 Chevrolet Bolt EV Sets Benchmark for EV Design

3. GM's battery sourcing has no problems currently, nor in the foreseeable future. Many companies are ramping production to provide low-cost cells (inc. LG Chem, Samsung SDI, BYD).

4. You'll hear more from GM and others about DC fast-charging in the coming year or two. But this is definitely one of the big achilles heels for the Bolt, until DC fast chargers are more prevalent.

IMO:

I hated how the LEAF drove... I didn't take it seriously and still don't.

I was impressed at how the Volt drove, and I think it was a noble attempt at a plug-in hybrid.

The Bolt... I'm going to wait until test driving it to make a conclusion. But it's definitely in a different (smaller, less performance) class than the Model 3... and ultimately the price will need to reflect that.

Good points. What really sets Tesla apart, miles ahead, from the rest is the software in it. Having well designed fully electric car is one thing, but providing great software enabled utility, like autopilot, is an order of magnitude more important. Tesla is widening this gap everyday and there is no stopping it.

You know there are a lot of long time, highly intelligent posters here who for some reason seem to fall for/jump on the "the Bolt shows major automakers are finally getting it" train.

That is a wonderful, but very flawed sentiment. BMW scrambling and rewriting their plans does qualify, maybe even VW - kicking and screaming - being dragged into the change because of diesel gate may show that too (somewhat), but the Bolt?!

By all reasonable calculations on these pages, people have deducted that the Bolt will be sold at 5-7.5k of a loss of manufacturing cost. (Note the difference between that and Tesla's loss over the cost of building up the global company while being very profitable on manufacturing the product).

Now why would a company sell a product at such a loss? I can think of a couple of reasons, but the most likely has been discussed here already. They did the math on how much ZEV credits would cost them and figured, as long as it's not worse than that and has the added benefit of helping the brand image, showing how green and progressive they are, why not? This would also stop the bleeding of some more green minded customers and giving money to the competition via ZEV.

I know this is over simplified, but you get the point. You can praise GM for seeing the light once they aim to make an EV at a profit and with the intent of replacing one of their major product lines/brands with it.

My Theory is that the Bolt is a test of demand. The Volt, even accounting for the problems of support and marketing, didn't meet its demand goals so GM is throwing out a canary.

GM has five times the revenue of McDonald's; When it moves, companies take notice. If the Bolt is supply constrained in two years, there will be multiple huge companies fighting to Supply GM and the other automakers with batteries and parts. The plans are already in place and this will be the proof to pull the trigger. This is also a good reason GM outsources much of the Bolt, to show they are looking to share.

Tesla success has moved the market, but it is still unclear how much of demand is purely for electric vehicles and how much is due to wanting to be a part of a underdog silicon valley start -up lead by someone like Elon.

The Bolt is a traditional looking and driving car in a rising segment that is priced at a 20-30% premium to gas counterparts. If there are over 50,000 people a year who want to buy this product that GM will look at more mainstream electric production. A process that might involve hundreds of billions of dollars over the next decade.

Really? you guys with the "squeeze" focus of investing.

"Well there you have your squeeze. Almost a two dollar increase in the last 45 minutes."

Since end of July shares held short is basically unchanged through 8/31,(most current data) shares are hard to borrow and yet the SP is down 16%. So who has been doing all the selling?

I am looking at the possibility of a recall from a spectator's standpoint, trying to understand the flow of shares. Who has been selling? Once TSLA begins one of its downward journeys, all sorts of longs including institutional investors have a reason to reduce their holdings until they see evidence that the slide has bottomed out. This is why I've been hoping to see at least 2 positive days of TSLA trading in a row, to change the momentum and put bulls back in the driver's seat. The tough call is naming the bottom, of course, and for this reason many TSLA longs such as myself ride out the downward run because we strongly suspect the turn up is not far away. The outlook for 3Q delivery numbers in early October gives a reason for bulls to increase their TSLA holdings prior to that date.

:You can look at today's loss as coming from a cup of macro pressure, a half cup on downward slide momentum, a quarter cup of Bolt range seasonings, and three heaping tablespoons of FUD from various quarters. From this ingredient's list, you could assume that the drop today would have been greater than it was without some short shares being recalled, and if we see some additional recall pressure plus good macros soon, we will see green again (remember what that looked like?). In particular, I think an unexpected rise in TSLA SP an hour before closing is a good sign that some shorts are covering, because it's not a particularly attractive time for longs to jump in and suddenly start buying without some news to support that move.

On a day with 3.6M shares of TSLA trading hands, I find the estimate of 3M of those shares being bought to close short positions as being unrealistic. Let's see if vgrinshpun gets his answer from Ihor Dusaniwsky. TSLA held up better than the Dow today, even with the ingredients in today's recipe.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 2

- Views

- 921

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K