What is factory hopping?Single data point but when I confirmed my modelX order I was told delivery late July but more likely August. My car has entered production early. Suspect factory hopping

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Chickenlittle

Banned

Moving along, being productive, churning the cars out quickly etc. not on track but ahead of scheduleWhat is factory hopping?

neroden

Model S Owner and Frustrated Tesla Fan

Great to hear, but does nothing for geographical distribution of service centers, which is the main thing I'm worried about. :-( In addition to the locations marked as "coming soon", Tesla needs 20 to 30 more for minimal geographic coverage in the US alone. Probably another dozen for Canada, and another dozen for Australia, at least . I think their geographic expansion to additional countries is unwise -- I can't imagine how many they'll need for India, probably 100. Dozens for Brazil.The service center in Bellevue is about to move to a new facility having a total square footage of between 4X and 5X the existing facility, based on my rough calculations. I walked around it yesterday. Even just considering the new service area alone, the new bays appear to have at least twice the area of the entire existing building. It would be interesting to know how many other facilities are getting upgrades, but this is definitely one of them.

Hey all, over the weekend I went through the Q2 Model X delivery threads and compiled a list of VINs, delivery dates and delivery estimates. It seemed like at most ~60% of the posters there use the ModelXTracker, so hopefully there are some new data points here. There are 268 entries, with 143 having taken delivery already in Q2.

Looking at VINs, deliveries covered mostly the 2000-6000 range up to today (June 19), with a few above the 6000s. Those who reported deliveries occurring from now until the end of the month had VINs filling out the 4000-7000 range, with some above that.

Given total X deliveries up to end of Q1 of about 2,650, including US Sigs and Founders (I understand that Sigs and Founders have a separate VIN sequence from Production vehicles, is this correct?), I'd guess that Tesla has already delivered at least 4,000 X's in Q2, and will likely deliver in the range of 5,000-6,000 for the quarter.

I also included a tab with notes and particular data points that may be of interest. Most important of these IMO are "one week ahead of schedule for production" (June 5), "2,000 car/week production" (June 12), "doing 50 factory deliveries/day, up to 160/day in coming week (June 17).

I'm expecting Model S to be somewhere around 12,000 again this Q, slightly lower than the 12,500 in Q1 due to transitioning to the refresh. Haven't looked into Model S deliveries much but seems to be moving along smoothly.

Overall, don't see an issue meeting the 17,000 guidance, but don't want to set my expectations too high for a large beat (>18,000).

Does anyone know how to upload Excel files here? It's not letting me so I am only able to post a pic of a graph I made from the data set right now.

Looking at VINs, deliveries covered mostly the 2000-6000 range up to today (June 19), with a few above the 6000s. Those who reported deliveries occurring from now until the end of the month had VINs filling out the 4000-7000 range, with some above that.

Given total X deliveries up to end of Q1 of about 2,650, including US Sigs and Founders (I understand that Sigs and Founders have a separate VIN sequence from Production vehicles, is this correct?), I'd guess that Tesla has already delivered at least 4,000 X's in Q2, and will likely deliver in the range of 5,000-6,000 for the quarter.

I also included a tab with notes and particular data points that may be of interest. Most important of these IMO are "one week ahead of schedule for production" (June 5), "2,000 car/week production" (June 12), "doing 50 factory deliveries/day, up to 160/day in coming week (June 17).

I'm expecting Model S to be somewhere around 12,000 again this Q, slightly lower than the 12,500 in Q1 due to transitioning to the refresh. Haven't looked into Model S deliveries much but seems to be moving along smoothly.

Overall, don't see an issue meeting the 17,000 guidance, but don't want to set my expectations too high for a large beat (>18,000).

Does anyone know how to upload Excel files here? It's not letting me so I am only able to post a pic of a graph I made from the data set right now.

Attachments

I hope your put (I'm long) goes green big time in the next few days, and you sell, followed by a meteoric rise when the rest of us can do well.

Mitch....That would be great....but as we all know....TSLA moves in mysterious ways

geneclean55

Active Member

Hey all, over the weekend I went through the Q2 Model X delivery threads and compiled a list of VINs, delivery dates and delivery estimates. It seemed like at most ~60% of the posters there use the ModelXTracker, so hopefully there are some new data points here. There are 268 entries, with 143 having taken delivery already in Q2.

Looking at VINs, deliveries covered mostly the 2000-6000 range up to today (June 19), with a few above the 6000s. Those who reported deliveries occurring from now until the end of the month had VINs filling out the 4000-7000 range, with some above that.

Given total X deliveries up to end of Q1 of about 2,650, including US Sigs and Founders (I understand that Sigs and Founders have a separate VIN sequence from Production vehicles, is this correct?), I'd guess that Tesla has already delivered at least 4,000 X's in Q2, and will likely deliver in the range of 5,000-6,000 for the quarter.

I also included a tab with notes and particular data points that may be of interest. Most important of these IMO are "one week ahead of schedule for production" (June 5), "2,000 car/week production" (June 12), "doing 50 factory deliveries/day, up to 160/day in coming week (June 17).

I'm expecting Model S to be somewhere around 12,000 again this Q, slightly lower than the 12,500 in Q1 due to transitioning to the refresh. Haven't looked into Model S deliveries much but seems to be moving along smoothly.

Overall, don't see an issue meeting the 17,000 guidance, but don't want to set my expectations too high for a large beat (>18,000).

Does anyone know how to upload Excel files here? It's not letting me so I am only able to post a pic of a graph I made from the data set right now.

Nice work!

I am expecting Tesla to try hard to at least match q1 delivery numbers for the MS, so as to counter any FUD along the lines of falling demand.

CALGARYARSENAL

Member

Futures are screaming to the upside. I love the smell of nervous nellies getting smacked like a red headed step-child.

Nicely done and I agree - I think we see a beat in Q2.Hey all, over the weekend I went through the Q2 Model X delivery threads and compiled a list of VINs, delivery dates and delivery estimates. It seemed like at most ~60% of the posters there use the ModelXTracker, so hopefully there are some new data points here. There are 268 entries, with 143 having taken delivery already in Q2.

Looking at VINs, deliveries covered mostly the 2000-6000 range up to today (June 19), with a few above the 6000s. Those who reported deliveries occurring from now until the end of the month had VINs filling out the 4000-7000 range, with some above that.

Given total X deliveries up to end of Q1 of about 2,650, including US Sigs and Founders (I understand that Sigs and Founders have a separate VIN sequence from Production vehicles, is this correct?), I'd guess that Tesla has already delivered at least 4,000 X's in Q2, and will likely deliver in the range of 5,000-6,000 for the quarter.

I also included a tab with notes and particular data points that may be of interest. Most important of these IMO are "one week ahead of schedule for production" (June 5), "2,000 car/week production" (June 12), "doing 50 factory deliveries/day, up to 160/day in coming week (June 17).

I'm expecting Model S to be somewhere around 12,000 again this Q, slightly lower than the 12,500 in Q1 due to transitioning to the refresh. Haven't looked into Model S deliveries much but seems to be moving along smoothly.

Overall, don't see an issue meeting the 17,000 guidance, but don't want to set my expectations too high for a large beat (>18,000).

Does anyone know how to upload Excel files here? It's not letting me so I am only able to post a pic of a graph I made from the data set right now.

FredTMC

Model S VIN #4925

Nicely done and I agree - I think we see a beat in Q2.

Don't forgot that Tesla had over 1000 MXs built but undelivered in Q1. These got delivered in Q2.

Yes, tesla will beat guidance of 17k cars in Q1.

I concur. 17k deliveries is the floor. 18k to 18.5k is likely. Shorts will run naked to the hills if there over 19k deliveries and 2016 delivery guidance is revised upwards to 90k-100k.Nice work!

I am expecting Tesla to try hard to at least match q1 delivery numbers for the MS, so as to counter any FUD along the lines of falling demand.

MartinAustin

Active Member

Surprised no-one mentioned the Tesla coverage in the "refreshed" U.K. Top Gear TV show. They completely skipped over the Model S and went to the Model X.

They drove it around Manhattan and some rural parts of the northeastern USA. Drag raced it against the 707hp Dodge Challenger, which was trounced by the Tesla

There were a few mistakes not worthy of mentioning, but overall they gave the Model X a great review, saying "it's the future" etc. a lot.

Exact opposite of what happened to the Roadster in 2008.

They drove it around Manhattan and some rural parts of the northeastern USA. Drag raced it against the 707hp Dodge Challenger, which was trounced by the Tesla

There were a few mistakes not worthy of mentioning, but overall they gave the Model X a great review, saying "it's the future" etc. a lot.

Exact opposite of what happened to the Roadster in 2008.

I very much hope they WON'T raise 2016 guidance.I concur. 17k deliveries is the floor. 18k to 18.5k is likely. Shorts will run naked to the hills if there over 19k deliveries and 2016 delivery guidance is revised upwards to 90k-100k.

1, Tesla doesn't need it. They already raised the money they need - for this year anyway.

2, The Tesla team/workers already have more than enough pressure on them.

3, I'd rather they stay at 80-90k and beat with 92k, than raise the bar to 95k and miss with 92k.

dennis

Model S Plaid

I'd rather they stay at 80-90k and beat with 92k, than raise the bar to 95k and miss with 92k.

Hear, hear! A great strategy (but somewhat out of character).

RobStark

Well-Known Member

Great to hear, but does nothing for geographical distribution of service centers, which is the main thing I'm worried about. :-( In addition to the locations marked as "coming soon", Tesla needs 20 to 30 more for minimal geographic coverage in the US alone. Probably another dozen for Canada, and another dozen for Australia, at least . I think their geographic expansion to additional countries is unwise -- I can't imagine how many they'll need for India, probably 100. Dozens for Brazil.

Tesla does not need nor should prioritize 100% geographic coverage.

Take the low hanging fruit first.

Cover 95% of projected customers not geography.

Tesla can get BFE 2-5 years from now.

Indeed, "choose your battles wisely".Tesla does not need nor should prioritize 100% geographic coverage.

Exactly why is it necessary for Tesla to cover India? Immediately or soon? Just because the country is on the globe?

Taking a too big bite too soon is a recipe for chapter 11.

erha

Member

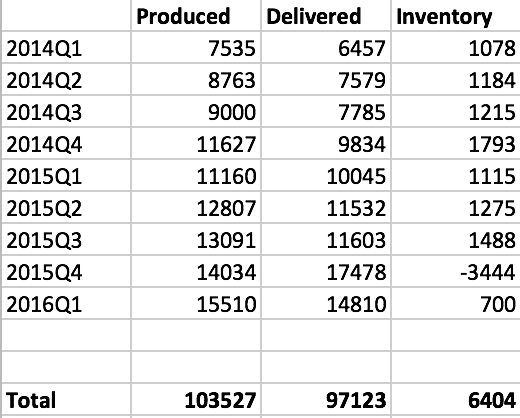

I looked at the difference between produced and delivered cars all the way back to Q1 2014, and there seems to be an inventory of about 6500 cars. Is this reasonable if we add together all the loaners, gallery cars and transit cars? There might be some cars that just had to be demolished as well because of production quality...

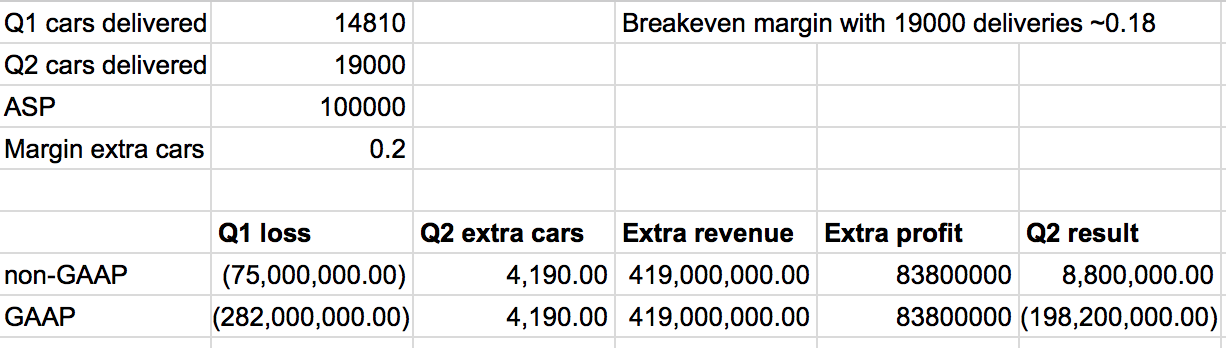

I also did a back of the napkin calculation for Q2. I know this is really sloppy, but it might give us some idea about profitability. Assuming that everything is like it was in Q1, and then adding the profit from extra cars delivered we need about 19000 deliveries and a 0.18 margin on the extra cars delivered to be non-GAAP profitable.

Expenses are probably a little bit higher than Q1, but the margin on all cars should be higher. Not only the additional cars delivered in Q2 over Q1. Tesla Energy might also add some profit.

I also did a back of the napkin calculation for Q2. I know this is really sloppy, but it might give us some idea about profitability. Assuming that everything is like it was in Q1, and then adding the profit from extra cars delivered we need about 19000 deliveries and a 0.18 margin on the extra cars delivered to be non-GAAP profitable.

Expenses are probably a little bit higher than Q1, but the margin on all cars should be higher. Not only the additional cars delivered in Q2 over Q1. Tesla Energy might also add some profit.

erha

Member

I've added J17 and J18 leaps with strike prices ranging from 260 to 310. I think Q2 will turn out to be a great quarter regardless of profitability and cash flow. The financial world will realize that Tesla is producing tons of cars, have sorted out the Model X problems and that future quarters will be even better than Q2.

If we get a profitable Q2 (non-GAAP as GAAP is out of the question) I think we will see a rapid appreciation of the stock price to and beyond all time high.

If we get a profitable Q2 (non-GAAP as GAAP is out of the question) I think we will see a rapid appreciation of the stock price to and beyond all time high.

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

I've added J17 and J18 leaps with strike prices ranging from 260 to 310. I think Q2 will turn out to be a great quarter regardless of profitability and cash flow. The financial world will realize that Tesla is producing tons of cars, have sorted out the Model X problems and that future quarters will be even better than Q2.

If we get a profitable Q2 (non-GAAP as GAAP is out of the question) I think we will see a rapid appreciation of the stock price to and beyond all time high.

Love your enthusiasm and share much of it. Just remeber that there have been new SEC regulations with regard to non-GAAP reporting, so it may be that Tesla's freedom to use non-GAAP numbers and the "free cash flow from operations" metric has become limited. Regardless, the numbers will speak for themselves and they will be allowed to talk about the actual numbers during the conference call, it just may be that they are a bit more limited in what they can put in their shareholder letter and SEC filings.

SW2Fiddler

We Are Cognitive Dissidents

Love your enthusiasm and share much of it. Just remeber that there have been new SEC regulations with regard to non-GAAP reporting, so it may be that Tesla's freedom to use non-GAAP numbers and the "free cash flow from operations" metric has become limited.

Since we're "quoting" them, might as well be accurate here...

..."positive cash flow from our core operations"- from the letter

I'm not an accountant, so IDK if there's a distinction in this free/positive difference. Carry on!

/nit: picked

FredTMC

Model S VIN #4925

Love your enthusiasm and share much of it. Just remeber that there have been new SEC regulations with regard to non-GAAP reporting, so it may be that Tesla's freedom to use non-GAAP numbers and the "free cash flow from operations" metric has become limited. Regardless, the numbers will speak for themselves and they will be allowed to talk about the actual numbers during the conference call, it just may be that they are a bit more limited in what they can put in their shareholder letter and SEC filings.

I don't think tesla does anything in reporting that the SEC is taking exception to. SEC is concerned with companies not including everything in operating expenses when arriving at "operating" related numbers.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 2

- Views

- 913

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K