Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

FANGO

Active Member

Seems the small spike in volume and ~1.5ish point drop about an hour ago coincided nicely with Tesla getting SEC approval to buy SCTY. I really cannot see how that would drop the share price, like, were there people only holding onto stock because they thought the SEC were going to stop this deal from happening? Or are these robots just waiting for an "investigation" or some sort, and just saw the words SEC and Tesla in the same place?

I mean, I get that some people oppose this merger, but waiting until the SEC says Tesla can do it seems a very odd time to sell. I mean, at least this stock is a lesson to everyone who follows it that markets aren't efficient or rational...

I mean, I get that some people oppose this merger, but waiting until the SEC says Tesla can do it seems a very odd time to sell. I mean, at least this stock is a lesson to everyone who follows it that markets aren't efficient or rational...

I think you mean FTC.Seems the small spike in volume and ~1.5ish point drop about an hour ago coincided nicely with Tesla getting SEC approval to buy SCTY. I really cannot see how that would drop the share price, like, were there people only holding onto stock because they thought the SEC were going to stop this deal from happening? Or are these robots just waiting for an "investigation" or some sort, and just saw the words SEC and Tesla in the same place?

I mean, I get that some people oppose this merger, but waiting until the SEC says Tesla can do it seems a very odd time to sell. I mean, at least this stock is a lesson to everyone who follows it that markets aren't efficient or rational...

brian45011

Active Member

Seems the small spike in volume and ~1.5ish point drop about an hour ago coincided nicely with Tesla getting SEC approval to buy SCTY. I really cannot see how that would drop the share price, like, were there people only holding onto stock because they thought the SEC were going to stop this deal from happening? Or are these robots just waiting for an "investigation" or some sort, and just saw the words SEC and Tesla in the same place?

.

There was no approval, let alone any action by the SEC. The waiting period under Hart Scott Rodino lapsed and the FTC saw no reason to request additional information regarding anti-competitive issues.

RobStark

Well-Known Member

Elder,

Remember, there is $200,000,000 of VW settlement money going to be spent in California alone in the next 30 months for EV infrastructure. That amount of money could theoretically build a Supercharger like DCFC equivalent here if that's what they chose to do. We will see later this year what the proposed spending plan is. Then another 3 tranches at $200 million each every 30 months.

RT

You know very well a portion of that money will go to H2 Fuel Cell infrastructure not just EV charging or battery electric vehicle charging.

At the national level CNG,Propane, Bio-Diesel, Ethanol may also get a slice of that pie.

No, the FTC announcement was earlier than that, and seemed to boost TSLA. Dow and NASDAQ dropped at the same time as TSLA, so I think it was something Yellen said.Seems the small spike in volume and ~1.5ish point drop about an hour ago coincided nicely with Tesla getting SEC approval to buy SCTY. I really cannot see how that would drop the share price, like, were there people only holding onto stock because they thought the SEC were going to stop this deal from happening? Or are these robots just waiting for an "investigation" or some sort, and just saw the words SEC and Tesla in the same place?

I mean, I get that some people oppose this merger, but waiting until the SEC says Tesla can do it seems a very odd time to sell. I mean, at least this stock is a lesson to everyone who follows it that markets aren't efficient or rational...

You really believe that they have any doubt at all about the fact that the new packs are roadworthy?!QUOTE]

You are missing the point. Of course they will do a bunch of tests in M3 mules and in the lab too to make sure the packs are roadworthy. What I have been trying to say in the past 2 posts that you disagree with, is that if this new pack architecture is close to what the M3 will have, installing it in thousands of S and X and collecting a year of data during millions of miles driven in all weather and traffic conditions across the globe is surely a good set of data for Tesla to validate the M3 pack design.

But don't take my word for it, this new post on Electrek pretty much confirms what I have been trying to say. (Not that I am so smart, it's just logical)

FANGO

Active Member

No, the FTC announcement was earlier than that, and seemed to boost TSLA. Dow and NASDAQ dropped at the same time as TSLA, so I think it was something Yellen said.

Huh, well, there's a spike in volume and a drop at the same moment a headline about it was posted to Google Finance anyway.

You know very well a portion of that money will go to H2 Fuel Cell infrastructure not just EV charging or battery electric vehicle charging...

I don't "know" that, and neither do you, unless you happen to work for VW and are preparing the infrastructure project list.

At the national level CNG,Propane, Bio-Diesel, Ethanol may also get a slice of that pie.

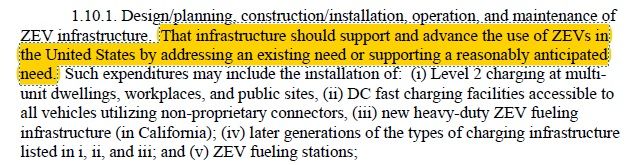

Maybe this flys somewhere else, not in California. Note the definition for Zero Emission Vehicle investments here:

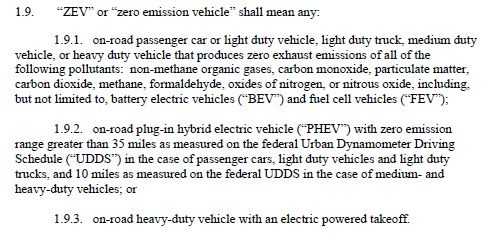

Oops, check that, the National ZEV plan also stipulates ZEV investment only. Here is the definition of ZEV:

[URL=http://s882.photobucket.com/user/RubberToe420/media/zevdef_zpsaqxoc5zn.jpg.html]

[/URL]

[/URL]RT

Yellen’s speaks at 10 a.m. ET Friday 8-26-2016 in Jackson Hole, WyoNo, the FTC announcement was earlier than that, and seemed to boost TSLA. Dow and NASDAQ dropped at the same time as TSLA, so I think it was something Yellen said.

CALGARYARSENAL

Member

anticitizen13.7

Not posting at TMC after 9/17/2018

FredTMC

Model S VIN #4925

Anyone have any insight around whether the new "2 year lease" is popular with customers?

I've seen some good interest on some threads. Especially around demo/inventory cars.

Wonder if this new lease will spike orders through rest of the year.

Tesla has a big challenge to produce and deliver ~50k cars during 2nd half of 2016...

I've seen some good interest on some threads. Especially around demo/inventory cars.

Wonder if this new lease will spike orders through rest of the year.

Tesla has a big challenge to produce and deliver ~50k cars during 2nd half of 2016...

RobStark

Well-Known Member

I don't "know" that, and neither do you, unless you happen to work for VW and are preparing the infrastructure project list.

I do know that because ZEV is not BEV. And FCEV is explicitly in the documents you have quoted in multiple places on TMC.

Alternative fuels, partial zero emission vehicles, and plug-in hybrids get partial zero emission credits all over the US. Explicitly in the documents you quoted. Zero emission for 10 miles for heavy duty or 35 for light duty.

It is naivete and/or willful ignorance to suggest all $2B will go towards batter electric vehicle charging.

Anyone have any insight around whether the new "2 year lease" is popular with customers?

I've seen some good interest on some threads. Especially around demo/inventory cars.

Wonder if this new lease will spike orders through rest of the year.

Tesla has a big challenge to produce and deliver ~50k cars during 2nd half of 2016...

Fred, my guess is that since the 2 year lease offer is only good through September 15, it will spur quite a few orders by individuals who don't want to miss the offer. Also, the short time-span of the offer may primarily be aimed at "Sale, today only!" mentality, or it might just be used as a way of bridging demand until AP 2.0 is released (Hoping the end date of the 2 yr lease program is a hint at when Autopilot 2.0 hardware is coming).

Tam

Well-Known Member

Tesla wins U.S. antitrust approval to buy SolarCity

"Tesla Motors Inc (TSLA.O) has won U.S. antitrust approval to buy solar panel installer SolarCity Corp (SCTY.O), moving closer to its goal of creating a carbon-free energy and transportation company.

The Federal Trade Commission said on Thursday that the deal was approved. It was on a list of proposed transactions that were granted quickly because the merging partners have few or no overlaps."

"Tesla Motors Inc (TSLA.O) has won U.S. antitrust approval to buy solar panel installer SolarCity Corp (SCTY.O), moving closer to its goal of creating a carbon-free energy and transportation company.

The Federal Trade Commission said on Thursday that the deal was approved. It was on a list of proposed transactions that were granted quickly because the merging partners have few or no overlaps."

What does it mean?

It is tea leaves reading.

What does it mean?

Supposed to be a bullish pattern implying imminent break-out:

Principles of Technical Analysis: The Cup-and-Handle Pattern

Beyond that I know nothing on how to trade it, but I can google things quite well!

andrerodpt

Member

Oh. My. God.

Get ready to say goodbye to a lot of electric cars

Queue the "The end is near for the EV" billboard.

Get ready to say goodbye to a lot of electric cars

Queue the "The end is near for the EV" billboard.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 2

- Views

- 938

- Replies

- 19

- Views

- 1K

- Replies

- 20

- Views

- 3K