Activists actually had an economic impact? Who knew? Nice for them to notice.For your entertainment, here's a "study" from the notorious Chamber of Commerce that blames those pesky environmentalists for $91 Billion in economic damage.

Chamber blames anti-fossil fuel activists for over $91 billion in economic losses

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

neroden

Model S Owner and Frustrated Tesla Fan

That organization is so anti-business.For your entertainment, here's a "study" from the notorious Chamber of Commerce that blames those pesky environmentalists for $91 Billion in economic damage.

Chamber blames anti-fossil fuel activists for over $91 billion in economic losses

Wiley E Oily paused in mid-air then realized he was still falling.

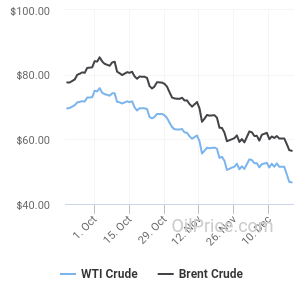

I think a real problem for oil is that the price is so driven by investor expectation. If investors believe the price is going to $100, then it keeps driving production up and past the point that demand slows down. Then it has a Wiley E Coyote moment and starts to fall. Then it thinks there is some floor say at Brent $60, but production can't dial back fast enough not does demand react fast enough. So then it keeps falling largely on investor sentiment. It will soon go into full crisis mode and try to bring down the whole global economy with its bearishness. But Wiley E Oily will be back to play the expectation game all over in a year or two.

I really think the only sane approach for oil producers is to hedge future production and let speculators take the fall for their hyped up expectations.

I think a real problem for oil is that the price is so driven by investor expectation. If investors believe the price is going to $100, then it keeps driving production up and past the point that demand slows down. Then it has a Wiley E Coyote moment and starts to fall. Then it thinks there is some floor say at Brent $60, but production can't dial back fast enough not does demand react fast enough. So then it keeps falling largely on investor sentiment. It will soon go into full crisis mode and try to bring down the whole global economy with its bearishness. But Wiley E Oily will be back to play the expectation game all over in a year or two.

I really think the only sane approach for oil producers is to hedge future production and let speculators take the fall for their hyped up expectations.

Did it reach $40 or do you expect it to?WTI below *$40*. Expectation is fracker bankruptcies.

mspohr

Well-Known Member

America's top oil-producing region has a new problem: $40 crudeDid it reach $40 or do you expect it to?

BloombergNEF on Twitter

This is encouraging. BNEF has updated their annual estimates of battery prices. The pack-level, volume-weighted, inflation-adjusted average price has fallen from $1160/kWh in 2010 to $176 in 2018. This 85% real decline in 8 years is an average 21%/yr decline. The annual decline in 2018 was 18% which is well in line with the average given volatility in decline rates. In other words, the decline appears to be continuing at 21%/yr.

At this rate, we see $110/kWh by 2020 and $87/ by 2021. This is right in line with what I was extrapolating last year and the year before that. In those years, BNEF was predicting the $100 would come in 2025. They were obviously anticipating that the decline rate would slow down, but it has not.

They have not yet published their forecast. I think to save face they need to pull it in to 2022-23. To be actuate, they need to go with 2020-21. We'll see what they do. 2025 is an embarrassment.

This is encouraging. BNEF has updated their annual estimates of battery prices. The pack-level, volume-weighted, inflation-adjusted average price has fallen from $1160/kWh in 2010 to $176 in 2018. This 85% real decline in 8 years is an average 21%/yr decline. The annual decline in 2018 was 18% which is well in line with the average given volatility in decline rates. In other words, the decline appears to be continuing at 21%/yr.

At this rate, we see $110/kWh by 2020 and $87/ by 2021. This is right in line with what I was extrapolating last year and the year before that. In those years, BNEF was predicting the $100 would come in 2025. They were obviously anticipating that the decline rate would slow down, but it has not.

They have not yet published their forecast. I think to save face they need to pull it in to 2022-23. To be actuate, they need to go with 2020-21. We'll see what they do. 2025 is an embarrassment.

"On Tuesday, Midland-based WTI was trading at about $7.25 to $7.60 below benchmark U.S. crude prices, according to OPIS. The lowest transaction confirmed by OPIS saw Midland crude sell for $40.10 per barrel."

So if a friend offers me a 100 mL sample of Midland crude for Christmas, will that set the WTI price at $0?

Naughtiness will get you a lump of coal. Not sure what you have to do to get a vial of Midland crude.So if a friend offers me a 100 mL sample of Midland crude for Christmas, will that set the WTI price at $0?

neroden

Model S Owner and Frustrated Tesla Fan

Aaaaah, that must have been what I saw. Price at the wellhead in the Permian.

Neoen says Tesla big battery to deliver more savings this summer

This is pretty cool. The Hornsdale Power Reserve will be used to extent the transmission interconnection capacity from 600MW to 650MW.

This is pretty cool. The Hornsdale Power Reserve will be used to extent the transmission interconnection capacity from 600MW to 650MW.

“At its core, the new interconnection limit will bolster competition within the South Australian electricity market by increasing interstate trade,” the Neoen statement says.

“This reduces wholesale power prices and subsequently creates a knock-on effect on end-user charges across the state.” Neoen puts the savings in “the millions of dollars per year.”

Franck Woitiez, the head of Neoen Australia, said in a statement it was “another prime example of how innovative, forward-looking and advanced renewable energy technology, when combined with storage, has the power to significantly drive down electricity prices for consumers across the country.

“These savings are just the beginning of what is to come with the planned new large interconnector between South Australia and New South Wales,.”

TheTalkingMule

Distributed Energy Enthusiast

We should have running regional "% of value" figures for battery storage. As in....what percent of revenue or value can be directly attributed to storage and storage only? It's probably far lower than anyone would imagine.

In the example above theres the benefit of becoming a transmission buffer. Same project has also shown it's far more valuable as a load balancer than simple storage facility.

In Germany all the wind is up north and they need to get that power south. What's the value of trickling that power south through batteries overnight every night? The cost avoidance of grid and transmission upgrades would be huge.

Nice to see real numbers being put to these activities I never even thought of prior to 2016. In certain regions, the first 10% of battery storage installed will have 5x the value of the last 10%. What a wonderful economic force to help speed adoption.

In the example above theres the benefit of becoming a transmission buffer. Same project has also shown it's far more valuable as a load balancer than simple storage facility.

In Germany all the wind is up north and they need to get that power south. What's the value of trickling that power south through batteries overnight every night? The cost avoidance of grid and transmission upgrades would be huge.

Nice to see real numbers being put to these activities I never even thought of prior to 2016. In certain regions, the first 10% of battery storage installed will have 5x the value of the last 10%. What a wonderful economic force to help speed adoption.

$50 Oil Won’t Kill U.S. Shale | OilPrice.com

US is still on track to increase crude production by 1.2 to 1.3 mb/d in 2019.

EV displacement in 2019 looks to be on scale of 0.2 mb/d. So between US shale and EV growth, supply meets or even exceeds demand growth. So basically unless US producers pull back on production, the oil market will likely not balance in 2019. Basically US shale is imposing on OPEC to cut as much as the US gains. We could be on the verge of a multi-year glut. With EVs growing fast and reaching scale, 2020 might not be any easier for the oil market to balance than 2019.

US is still on track to increase crude production by 1.2 to 1.3 mb/d in 2019.

EV displacement in 2019 looks to be on scale of 0.2 mb/d. So between US shale and EV growth, supply meets or even exceeds demand growth. So basically unless US producers pull back on production, the oil market will likely not balance in 2019. Basically US shale is imposing on OPEC to cut as much as the US gains. We could be on the verge of a multi-year glut. With EVs growing fast and reaching scale, 2020 might not be any easier for the oil market to balance than 2019.

neroden

Model S Owner and Frustrated Tesla Fan

I went to oilprice.com to check the various other prices at different locations.Geez Louise, Brent is dropping under $54.5.

Williston sweet crude (North Dakota) is at $21. Most of the other US blends are circling $40. Central Montana Crude is $6.54.

There's clearly some transportation issues going on. California grades are over $50.

RobStark

Well-Known Member

For your entertainment, here's a "study" from the notorious Chamber of Commerce that blames those pesky environmentalists for $91 Billion in economic damage.

Chamber blames anti-fossil fuel activists for over $91 billion in economic losses

"The report was issued by the Chamber’s Global Energy Institute and the Laborers’ International Union of North America."

mspohr

Well-Known Member

obviously they're worried about oil jobs (but don't see the non union solar and wind jobs)

"The report was issued by the Chamber’s Global Energy Institute and the Laborers’ International Union of North America."

View attachment 362737

$40 million profit in 1 year, just on FCAS, not including other things (Frequency Control Ancillary Services)Neoen says Tesla big battery to deliver more savings this summer

This is pretty cool. The Hornsdale Power Reserve will be used to extent the transmission interconnection capacity from 600MW to 650MW.

Similar threads

- Replies

- 1

- Views

- 475

- Replies

- 0

- Views

- 746

- Replies

- 19

- Views

- 4K

- Replies

- 3

- Views

- 475