Lately I've been doing some thinking on the linkage between carbon emissions and GDP growth. So playing around with world real GDP from World Bank and data from the BP statistical review, I came up with this humdinger.

So let that sink in. The trend here suggests that the more quickly we ramp up carbon emissions, the faster the global economy grows. I suspect many climate deniers have this in their mental map of how the world works. Their fear is that if we slow emissions growth, then the whole economy will slow down too. Economy vs the Climate. But that of course would be a causal reading of this chart, and most of us know to say that correlation does not imply causation. That's true, but how do we deconstruct this chart to better understand the plausible causality behind obvious correlation in this chart.

Don't despair. Carbon emissions really should not have much of impact on the economy, at least not in the short run. In the chart above we are looking at year over year growth. The real damaging impacts of emissions a cumulative, longer-run effect. Besides that sort of impact would have a negative correlation. What actually drives the economy is the value that energy use provides. Emissions are mostly a nasty by-product of otherwise value creating energy use.

So let's break this down. Perhaps growth in oil production, or coal or natural gas production, would be closer to where the value is created. Moreover, the carbon emissions estimates here are just a calculation done by BP based on some assumptions about average emissions rates by type of fuel. So here's the chart for oil.

Ah, this makes more sense. Pump more oil, and the economy grows. But notice the R-squared here. For emissions it was 54.5%, but for oil it is only 27.5%. Natural gas and coal have even lower correlations with real GDP growth. So how could emissions have a stronger correlation with the economy than oil, gas or coal separately? Well the combined effect can be stronger than individual contributions. Specifically consider how coal and gas compete with each other in the electricity generation market. So maybe that combined competition for market share is more strongly correlated with economic growth.

So let's test this out. Let's look at the relationship between electricity and GDP growth.

Ok, look that that. R-squared is 70%. This is a very strong relationship with the economy. Power generation alone explains 70% of the variation in GDP growth. So how essential are all those emission? If the economy uses more renewable energy, it can avoid emissions but still have the electricity needed to run the global economy.

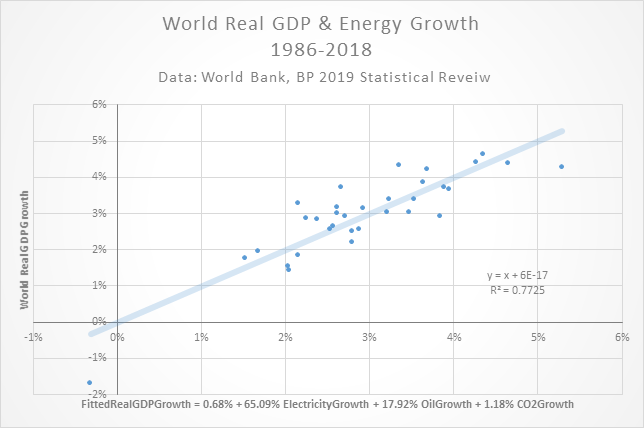

This raise the question, if we can condition on electricity growth, does oil growth or emissions growth still matter for explaining economic growth? One basic tool for answering this sort of question is regression analysis. It turn out that adding oil growth to electricity growth in a regression model boosts R-squared from 70% to 78%. Oil is important and statistically significant, but not nearly as important as electricity.

Furthermore, adding emissions growth to this model is trivial and not statistically significant. That is, electricity and oil growth explain so much of the variance in GDP growth, that we can't tell if remaining effect of emissions growth is positive or negative. This answer our earlier question. The apparent correlation GDP and emissions growth is explainable in terms of electricity and oil growth. So we can reject the idea emissions growth is essential to GDP growth. It's not causal.

The next chart shows the relationship between GDP growth and the predictive values of the model containing our three regressors. Yes, I do include emissions effect, though it is not statistically significant. But it is good to see just how small this effect is, as estimated. We'll see in some calculations below that including this variable avoids potential bias and makes certain calculations more conservative.

The coefficients are worth interpreting. Average GDP growth is 3.0%. The average growth in electricity generation is 3.1% and with a coefficient of 65.09%, electricity contribute about 2.0% points to GDP in an average year. This is really a huge effect. By comparison, average oil production growth is 1.5%, which on a coefficient of 17.92, this contributes less than 0.28% to growth. This is important, but not huge. And finally average emissions growth is 1.8%, and on coefficient of 1.18% coefficient contributes a mere 0.02% to GDP growth. So the emissions effect is very low practical significance in additions to not being statistically significant.

The big question is whether 3.0% GDP growth can be sustained even while cutting oil, say -5% per year and emissions -7% per year (to be consistent with a 1.5C scenario, cutting emissions in half by 2030). The good news is that this model implies growing electricity 5.1%, up 2% from historic 3.1% average is sufficient. The extra growth of electricity, of course, is needed to cut oil consumption and other carbon emissions. So while this is not a causal model, it does suggest that such a change in growth trajectories conserving economic growth is not inconsistent with this descriptive model. I’d be much more worried if this were not the case.

What makes this work is that the model is picking up on a key tradeoff. In terms of economic impact a 1% lift in electricity growth is as good as a 3.6% lift in oil growth. So electricity seems to be a much more potent driver of economic growth.

One objection here may be to note that a scenario where electricity is up 5% while oil is down 5% is a bit of an extrapolation for this model. We simply have not seen historical observations within a neighborhood of this. However, consideration of the sort of economic scenario where this happens suggest that it happens in either an extreme post oil demand peak or post oil supply peak scenario. The better way to think about that this is directional. We need to move toward electricity up 5.1, while oil and emissions are down substantially. That is the only way to approach arresting climate change while holding steady economic growth.

The narrative of economy versus climate is fundamentally wrong. Not that we should lack the moral will to sacrifice some economic growth to right the ship in the near-term, but that a world that is rapidly decarbonizing can enjoy sustainable long-term growth. Indeed, the right sort of economic growth can power through the transformation that we need to make. For eample, suppose instead of growing power at 5% we boost that to 6% so that we can load up on renewables even faster. This could be consistent with adding an extra 0.65% points to real GDP growth. Given that the triad of wind, solar and battery storage is getting cheaper each year, we could get to a place where it is economical to acelerate the retirement coal plants, gas plants and ICE vehicles. This could stimulate the economy, cutting energy costs and boosting productivity. I would also suggest that EV adoption is critical for boosting the growth of electricity generaton. Over the next 20 years, EVs boost power growth by 2% to 3.6% over the 3.1% average growth rate. That power boost to the global economy can easily offset the declines in oil and other fossil emissions.

It's time to power up the economy and give the boot to fossil emissions.