Article (and linked previous ones) said development was delayed due to supplier issues which led to redesign based on what was available.This may have been the first possible testing with an integrated system.“the noisy power issue came up during the most recent tests but had not come up in earlier design reviews.”

Gawd, that’s why you test early and often. This should have been discovered way before this stage of the game. I mean the fix was a simple power supply noise ripple filter. They were relying on paper design reviews just until right before launch?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

I still think that this kind of testing was left way too late.Article (and linked previous ones) said development was delayed due to supplier issues which led to redesign based on what was available.This may have been the first possible testing with an integrated system.

“the noisy power issue came up during the most recent tests but had not come up in earlier design reviews.”

Gawd, that’s why you test early and often. This should have been discovered way before this stage of the game. I mean the fix was a simple power supply noise ripple filter. They were relying on paper design reviews just until right before launch?

I think you misunderstand the way the legacy flow works vs the way the newspace/spacex flow works. In the legacy approach, there is indeed a LOT of early testing, and there's progressively more hardware inclusive testing, culminating in system level integrated testing--which necessarily is at the end of the ground campaign, just before shipping to launch. In the new space approach the goal is to get testing something as quickly as possible. That's a great way to reduce risks, but ultimately a full system level integrated test still can't be performed until all the bits and pieces are there which, again, is necessarily at the end of the ground campaign, just before launch.

The differentiator is that the legacy approach spends much more time/effort on design and analysis whereas the newspace approach prioritizes build-and-test-what-you-have and then leans on engineer-by-similaritry as revisions come through. There's plenty of upside and evidence of success for the newspace approach (it's basically an Agile vs Waterfall thing), but this example is not one of them. You really can't test the nuances of multi-subsystem interactions until all the subsystems are in their final configurations.

Ironically in all this, York is very much a newspace company that does things much more the way SX does, and that fast-and-loose was likely a major cause of this being a problem in the first place. An old space company follows the traditional V where something like power conditioning would properly flow down before the design even starts let alone parts get procured. And then--as is the case here--when a supplier needed to be changed a full analysis would be done to ensure FFF before green-lighting. A newspace company dives right in at the bottom of the V and starts buying parts, assuming they're going to be able to figure out how to make them all work in the end. And then--as is the case here--when a part gets changed they just assume it's going to work out too.

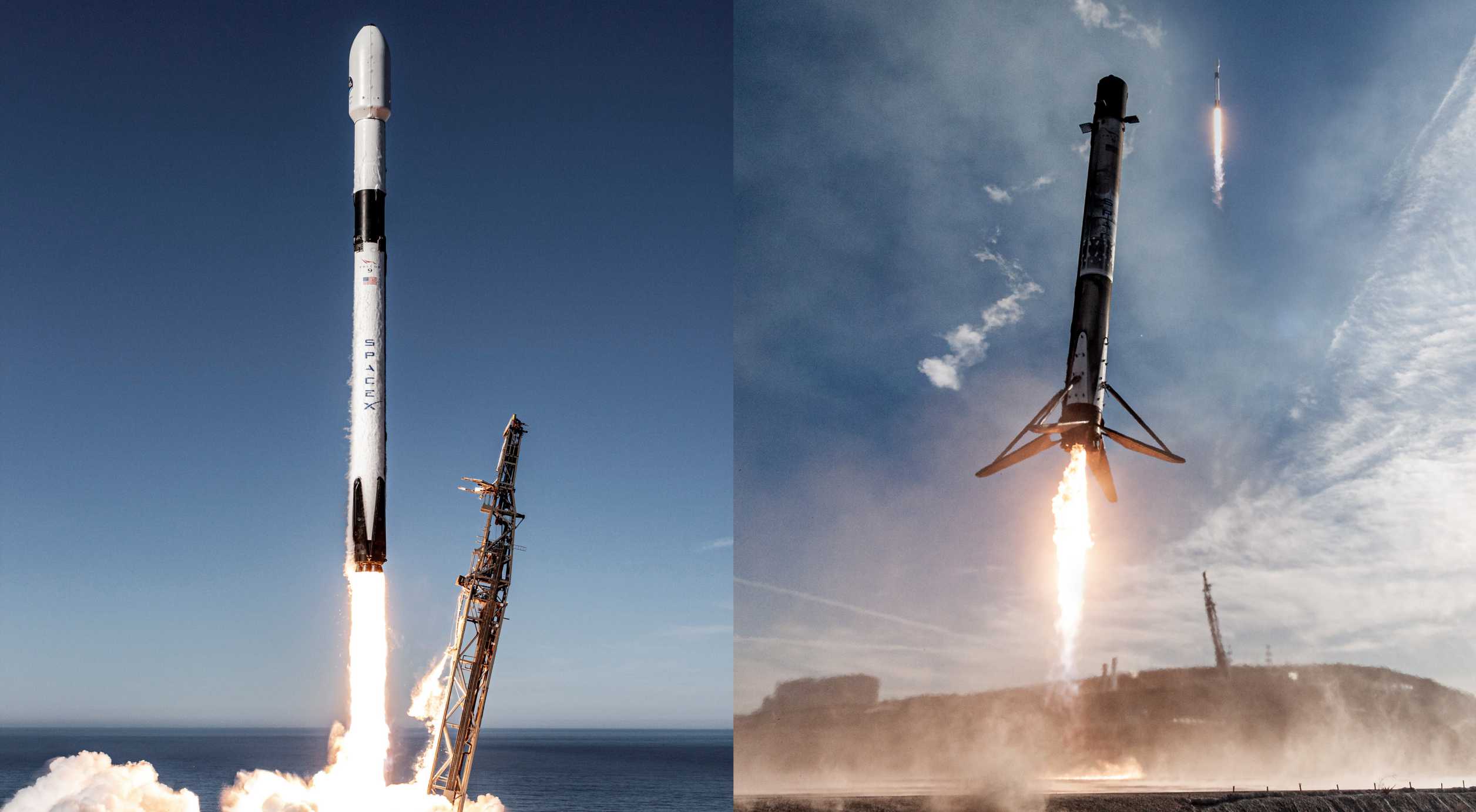

SpaceX wins Sentinel 6B radar satellite launch contract

SpaceX has won a contract to launch the joint US-European Sentinel 6B radar satellite as early as November 2025. Five years ago, NASA also chose SpaceX to launch Sentinel 6A, the first of two identical satellites designed to use radar altimeters to determine global sea levels more accurately...

Impulse Space announces first orbital transfer vehicle mission - SpaceNews

Impulse Space announced Jan. 4 it will launch its first orbital transfer vehicle late this year on a SpaceX rideshare mission.

From Eric Berger’s weekly Rocket Report newsletter, as part of a discussion of how many small launch startups will likely go bust soon:

SpaceX currently charges $275,000 to launch a 50-kilogram smallsat to Sun-synchronous orbit on its "Transporter" rideshare missions, which take place three or four times a year. This is far less than list prices for many dedicated smallsat launch vehicles. Adam Spice, chief financial officer of Rocket Lab, said: "I think the fact is they’ve suppressed prices in the market. I think the fact is they’ve taken a lot of volume off of the market," he said of Transporter missions. "That’s a reset that really wasn’t there in the model even only a few years ago."

Note: Pet the website, SSO are around 4 times a year. LEO is more often.From Eric Berger’s weekly Rocket Report newsletter, as part of a discussion of how many small launch startups will likely go bust soon:

SpaceX

Not a contract yet, but could lead to some contracts:

Not a contract yet, but could lead to some contracts:

FWIW, unlikely this ever represents a full launch, so unlikely more than a small drop in the revenue bucket.

Bit editorial here, but IMO the various "space tug" type companies out there are going to be fighting a shrinking market with as time moves on. With the progress being made on affordable electric propulsion--not to mention opening up electric propellants beyond the traditional and massively expensive Xe (a lot of the world's supply comes from the Ukraine....), its becoming far more practical and efficient to just have a full-up satellite rather than have a third party solution (and corollary interfaces) to do the lifting.

There's also regulations that are either in place or about to be put in place that require satellites bigger than a ~cubesat to have on board propulsion for COLA, and then there's also similar deorbit-to-reentry (rather than deorbit to graveyard) regulations--including a max timeline--that effectively require many satellites to carry quite a bit of propellant to deorbit to a tenable altitude. At that point it's not a massive <ahem> lift to also carry enough propellant for orbit raising as well.

IMO about the only space that could have some sustainable market is recovery--if there's a dead sat floating around everyone else would greatly prefer it be removed. The current problem we're seeing with that notion is: who is actually responsible. Sure, if it's a megaconstellation, it's probably in their best interest to get the dead satellite out of orbit for their own sake. But if its a smaller entity in much less statistical jeopardy from that dead sat than, say, the megaconstellations, that smaller company doesn't really have a lot of incentive to take action, especially when that action is fairly costly and 0% ROI.

There's also a technical element to recovery that's not a slam dunk. Yeah, if the dead sat is stable (no or very low spin rates) then its reasonable to capture...but once the rates start ramping up--and certainly if the rates are across multiple axes--it gets really REALLY had to capture.

Nevertheless, there's definitely conversations going on regarding this kind of scenario, and at some point we'll likely (hopefully?) see some level of regulation...though without full global compliance (looking at you, Jai-Nuh) its going to be an uphill battle.

Somewhat related, at the big smallest conference last week in Mountain View (as opposed to the big one in Logan that's always in August...) Dankberg actually called for proactive action to mitigate worst case scenarios. In a nutshell his proposal is to limit total mass and satellite area relative to an orbit, with a corollary to limit what would become an explosion in space real estate. Obviously the concept is a shot directly at Starlink (and Kuiper) so there's more than just a Good Samaritan agenda going on, but rising above that it does carry some pretty sound logic.

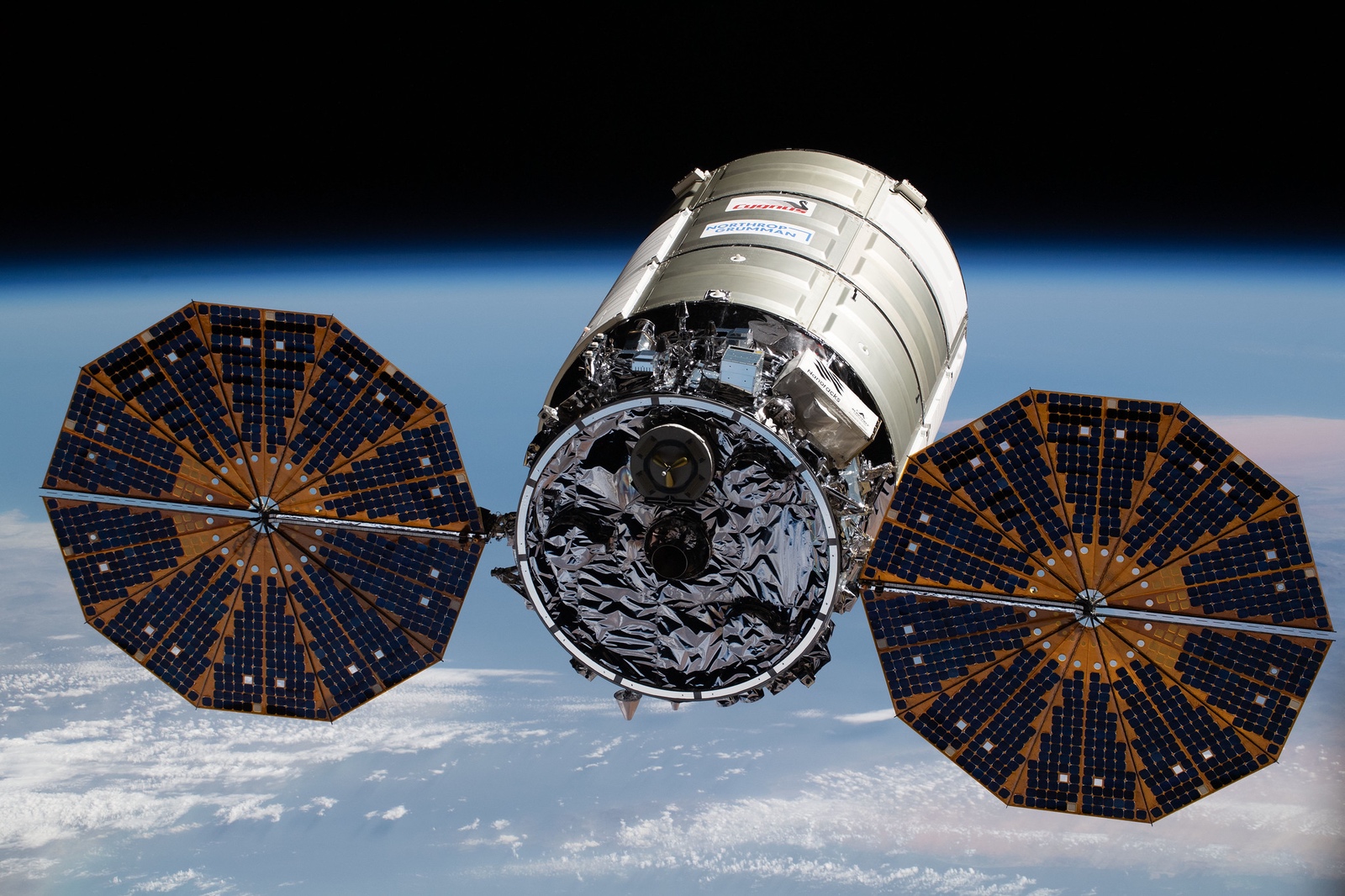

NASA proposes final extension of ISS cargo contracts

NASA is proposing extending three existing contracts to transport cargo to and from the International Space Station through its anticipated end in 2030.

Here's a big one: 12 launches!

www.tesmanian.com

www.tesmanian.com

Rivada Space Networks signs a contract with SpaceX to launch 300 satellites on twelve Falcon 9 missions

Rivada Space Networks is a company headquartered in Munich, Germany, that aims to build a business-to-business broadband satellite constellation. The company signed a contract with SpaceX to launch a total of 300 satellites on twelve Falcon 9 missions that are scheduled to liftoff between April...

Here's a big one: 12 launches!

Rivada Space Networks signs a contract with SpaceX to launch 300 satellites on twelve Falcon 9 missions

Rivada Space Networks is a company headquartered in Munich, Germany, that aims to build a business-to-business broadband satellite constellation. The company signed a contract with SpaceX to launch a total of 300 satellites on twelve Falcon 9 missions that are scheduled to liftoff between April...www.tesmanian.com

You know, all this reminds me of what Tesla has done with EVs. Before Tesla, there was zero investment money available for an EV startup. Now, almost anyone with a powerpoint can get funded for an EV startup (not quite, but you get my point).

Similarly with SpaceX, now creating a multi-hundred satellite constellation in LEO is no longer toxic (remember that the pioneers in the 1990s all went bankrupt).

Personally, I'll stick with investments in Tesla (and I wish SpaceX!).

Here's a big one: 12 launches!

Rivada Space Networks signs a contract with SpaceX to launch 300 satellites on twelve Falcon 9 missions

Rivada Space Networks is a company headquartered in Munich, Germany, that aims to build a business-to-business broadband satellite constellation. The company signed a contract with SpaceX to launch a total of 300 satellites on twelve Falcon 9 missions that are scheduled to liftoff between April...www.tesmanian.com

Missed responding to this one...

Might start a bit of a firestorm here, but it's worth reiterating that this is a contract with SpaceX to lift ~150T to orbit in 2025-2026…on Falcon 9’s. While there could very well be some Starship option/clause in the contract, it should speak volumes that the hard ink is for Falcons.

...with SpaceX, now creating a multi-hundred satellite constellation in LEO is no longer toxic...

Sort of. Save for Starlink this is literally the first constellation of any merit since Iridium Next. It's not like investors are raining $B's for satellite constellations; its not like the good old days of The Year Of The SPAC (which, it should be noted, did not actually result in funding any constellations).

It's also worth reiterating that SX isn't really a massive cost differentiator here. For the Rivada satellite constellation, using the F9 rack rate of $67M (0th order we can say volume discount washes with escalation), that's $804M to launch the constellation. Using Ariane 64's $115€ rack rate and capacity (22T to LEO...call it 8 launches for Rivada's 150T) its ~$971M to launch the constellation, or a stupid tax of ~$167M.

$167M saved is nothing to sneeze at for sure, but it only represents a ~20% increase in launch cost or a ~5% space segment premium to build and launch the constellation on a non-SX rocket (~$3.2B vs ~$3.4B). Bump up to the program level and factor in things like the ground network and ops (which will cost hundreds of millions at a minimum) and that 5% gets even smaller.

Less than 5% price difference is not a make or break for any credible business. It does not impact toxic vs attainable. It's a nice upside and that's about it.

The main differentiator for Rivada and anyone else that wants to put up a big constellation right now is Falcon's availability, and that's really only because Kuiper nuked non SX [existing] capacity.

Ovzon gets deadline extension for debut satellite

Mobile satcom services provider Ovzon said March 28 it has secured a deadline extension enabling it to keep priority spectrum rights for its first broadband satellite, as long as it launches early enough in a July-September window SpaceX has set for the mission.

Astrobotic purchases Falcon Heavy for third lunar lander mission

Lunar lander developer Astrobotic announced April 25 it will launch a third mission to the moon in 2026 on a SpaceX Falcon Heavy.

Not quite a contract yet but, with todays success, there's little doubt it will be coming.

Vast is launching a space station on Dragon that they will later dock to with a crew Dragon.

VAST Announces the Haven-1 and VAST-1 Missions. — VAST

VAST Announces the Haven-1 and VAST-1 Missions. — VAST

Not officially on a F9 yet, but... And maybe SpaceX will build the satellites as well...

spacenews.com

spacenews.com

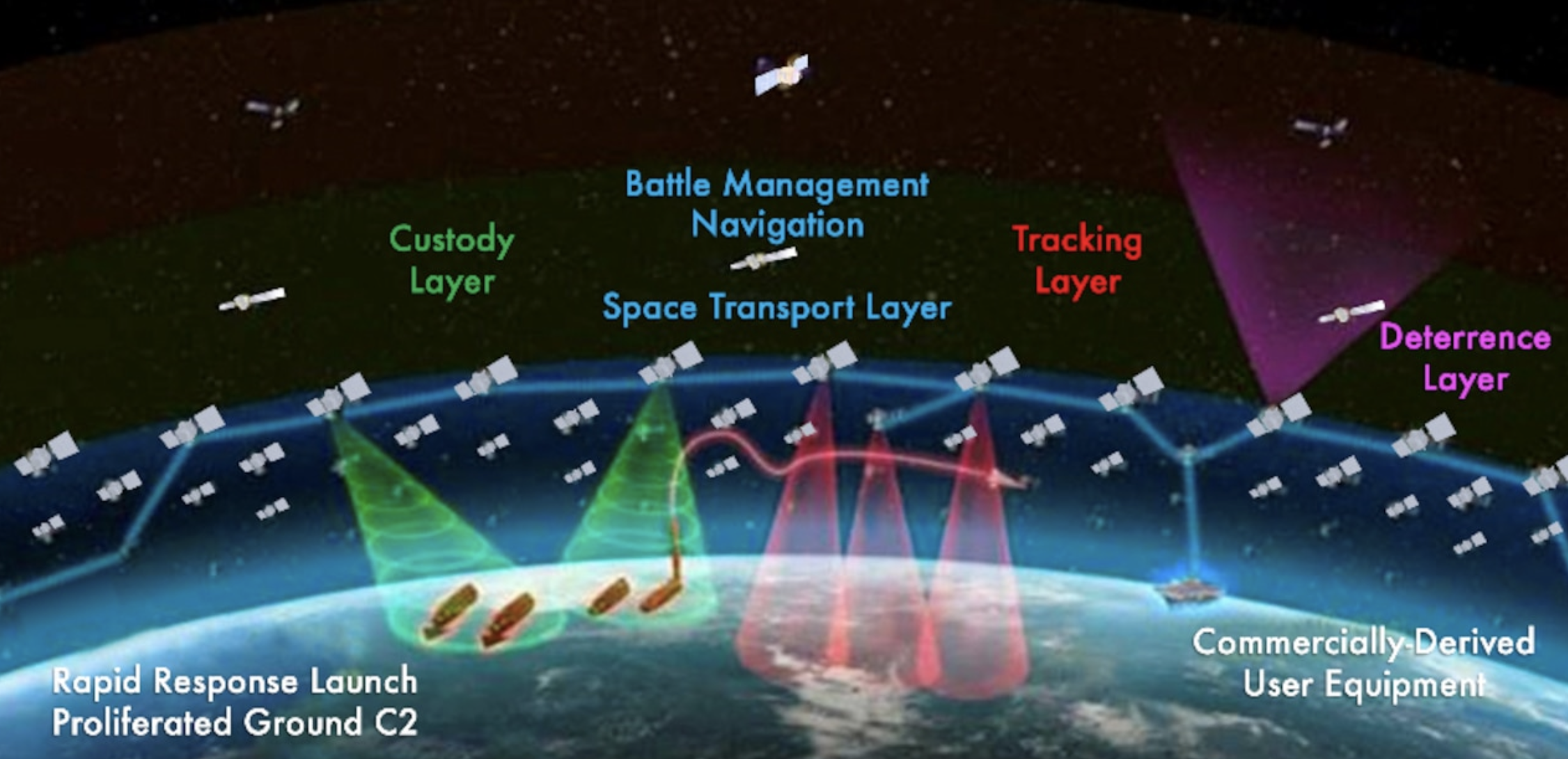

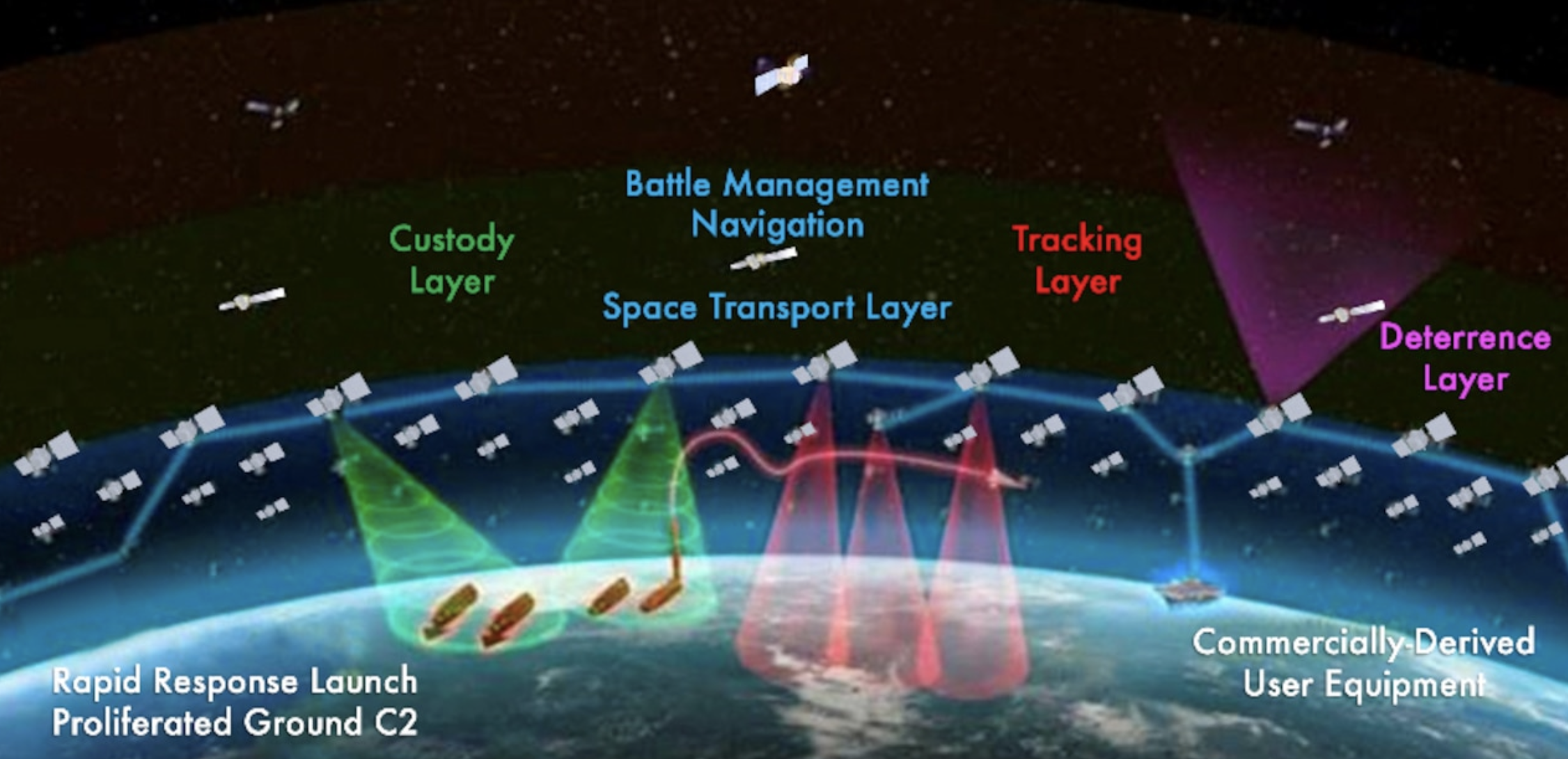

Space Development Agency issues new solicitation for 100 satellites

Space Development Agency issues new solicitation for 100 satellites

Besides Euclid, a lot of the payloads that were supposed to go on other European launchers are transferring over to SpaceX:

arstechnica.com

arstechnica.com

Europe’s Euclid telescope launched to study the dark Universe

SpaceX is filling in for ESA as European rockets face delays.

Delays in the Ariane 6 rocket has also prompted ESA to agree to launch the agency’s Hera asteroid probe on a Falcon 9 rocket from Cape Canaveral in 2024. Earlier this week, ESA’s director general said an Earth science satellite called EarthCARE will also have to launch on a SpaceX Falcon 9 rocket due to problems with its European Vega C rocket.

And ESA, along with the European Union, is considering launching up to four Galileo navigation satellites on two SpaceX Falcon 9 rockets because European launchers are not ready.

Lest any of my fellow Americans get cocky about this on our Independence Day, let's remember that we were relying on Soyuz launches for nearly a decade.Besides Euclid, a lot of the payloads that were supposed to go on other European launchers are transferring over to SpaceX:

Europe’s Euclid telescope launched to study the dark Universe

SpaceX is filling in for ESA as European rockets face delays.arstechnica.com

Similar threads

- Replies

- 1

- Views

- 482

- Replies

- 0

- Views

- 588

- Replies

- 6

- Views

- 934

- Replies

- 0

- Views

- 325

- Replies

- 697

- Views

- 44K