Now that charging equipment sales are becoming large, questions are:

1. what are probable margins for sale of adapters through OEM?

2. For non-OEM sales of adapters what are probable margins?

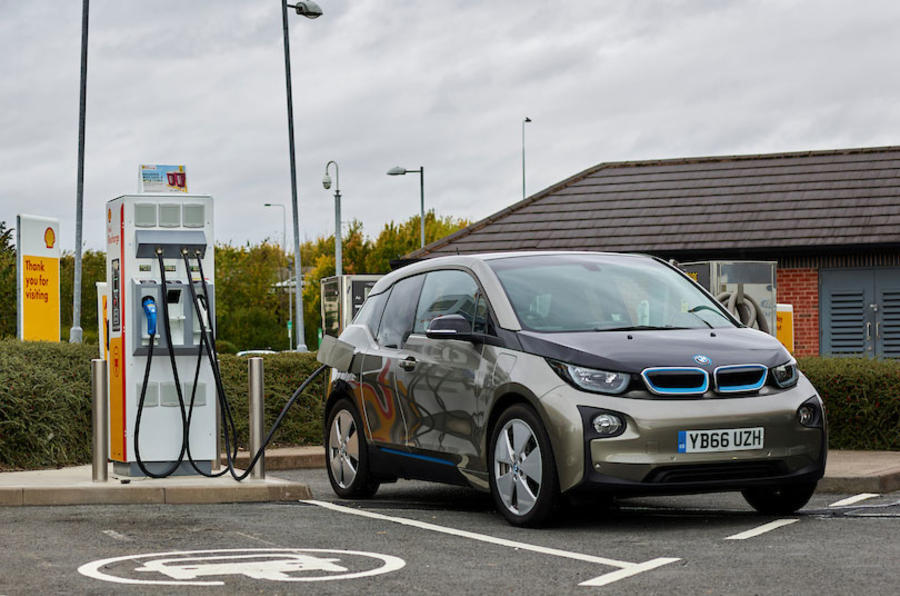

3. Supercharger sales are now growing too; in the announcements for BP and this one there is not much detail about what is to be provided. Is it turnkey installation? Is some kind of processing included? on what basis is the electricity sourced. If in UK/EU Tesla could be the actual provider. Is it to be?

The range of similar questions for OEM NACS is even broader. There AFAIK is no detail provided on any deals thus far.

We have had some speculations here. We need solid evidence on these and other questions, precisely because all this activity probably will be material in 2024, and in some respects may already be material.

A closely related group of questions exists for subscriptions, Supercharger revenue and the Megapack servicing revenue. We cannot forget FSD, Premium Connectivity and the likely evolution of games and entertainment.

Since we already know that Tesla Energy revenues last quarter finally achieved critical mass all these others seem ready to do so in early 2024, accelerating rapidly thereafter.

The problem is quantifying all that. Do any of us know how to approach that series of questions?

For context, as a long-time AAPL shareholder I was amazed to watch the ancillary revenues and margins rise rapidly and keep rising with steady margins. Those have been dubbed the 'ecosystem'. TSLA most definitely is not AAPL, but... NACS and Superchargers clearly are the core competency that nobody else has, lest we forget, NACS happened because Tesla built a standard when there was none and CCS2 has such critical flaws that connector failures alone make both level 3and level 2 unreliable, if for no other reason that the infernal clip failures. Thus TSLA has become the NA standard setter.

We all know the foregoing. We all know the potential. However, no analyst mentions this (at least none of whom I am aware) and no OEM mentions this, while Tesla certainly is disinclined to clarify the questions.

All these are the huge looming developments on 2024/2025 that are completely 'under the radar' now.

We know how to quantify both the automotive and Core Tesla Energy opportunities and expectations, as well as the major unknowns for each.

We do not for Services. With AAPL people ignored that category while it was growing 'like topsy'. Even now analysts often say iPhone is THE product, despite Services being the glue that promotes cross sales and direct margins. Let us try to avoid that error with TSLA.

Much of the opinion and information on these questions needs a dedicated thread, or more than one. Of course we already have threads on several subsets. Should there be a direct thread for financial quantification of these questions?

While I am very interested in the questions I am acutely aware of my limitations in quantifying these issues.

As such I hope some of us are better equipped to help minimize the unknowns.