ItsNotAboutTheMoney

Well-Known Member

83,996lbs?! That's now going to need overlimit permits to move it.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

83,996lbs?! That's now going to need overlimit permits to move it.

It has been confirmed to be a single Megapack that had an event.Hwy 1 is closed at Moss Landing due to a fire at the PG&E substation and battery project. It's hard to know exactly what is going on but I found this article that claims it is a Tesla Megapack. Hopefully we will learn more as this develops.

Highway 1 reopens after Tesla Megapack fire in Moss Landing

MOSS LANDING, Calif. (KRON) – A hazardous materials incident prompted a shelter-in-place advisory for parts of Moss Landing and caused traffic to gridlock along Highway 1 for several hours on…www.google.com

Quick math:

365*24*60/68*1900000=14685882352 = $14.6B worth of megapacks. 50% margins = $7.3B profit

68 minutes per unit all year is 7.7k, but they call out 10k/ yr (53 minutes) so maybe total includes GF1?

However, that volume increase is offset by pricing base MP:

10k units per year * $1.8M (average of 2 and 4 hour units without installation at 100 qty) = $18B

From there, add on installation at a different margin.

Before they pulled the public estimator:

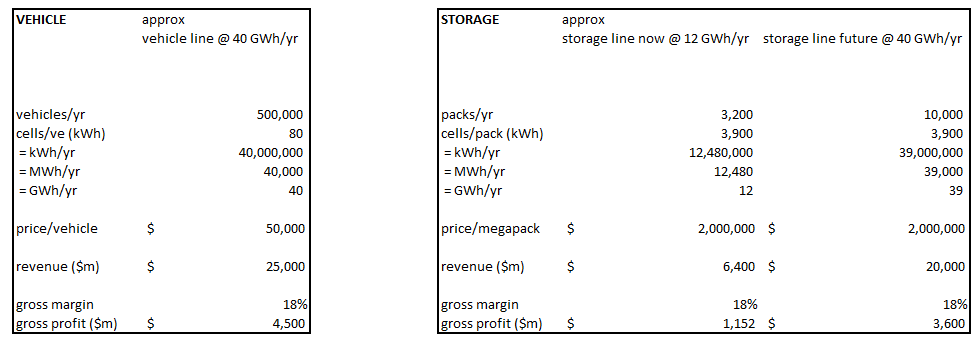

2. GM% on energy is now broadly equal to GM% on automotive, i.e. 18% or so in round numbers for illustrative purposes. A 500k/yr vehicle line consumes about 40 GWh/yr of cells. The Lathrop megapack storage line is currently consuming approximately 12 GWh/yr of cells (after allowing for some cells to go into Powerpacks, Powerwalls). This means that the Lathrop line is now the equivalent of about 150,000 vehicles/yr in both revenue and profit terms. You can see that Lathrop now is almost contributing as much revenue and profit as Berlin is now, as Berlin is at about 200k/yr now. When Lathrop reaches 40 GWh/yr it will be equal to about 500k/yr vehicles, i.e. that is the same as the fully built and fully ramped phase 1 of Berlin. It is not obvious whether Berlin phase 1 will get fully ramped to 500k/yr=40GWh/yr before Lathrop reaches the equivalent fully ramped situation. This means that there no longer needs to be any hesitation in selling/ramping/etc storage vs vehicles and that makes overall business strategy decisions so much easier. Well done Lathrop. That makes LFP cell capacity allocation and negotiations so much easier. Plus of course there is the long tail of service/etc income from storage.

This table sets out the approximate situation and the broad equivalency between a 40GWh vehicle line and a 40GWh stationary storage line.

3. This means that decisions on Megapack factories are as important for recipent nations as automotive factories, but that they involve less technology exposure than automotive. That is good as they don't need as much labour/etc as an auto factory. This has huge implications for ability to scale overall business in a way that manages sovereign / political / strategic risk.

I want to follow up on this because a lot of people still don’t really believe it but haven’t done the math.

Megapack margin at 50% sounds crazy until you look at the enormous subsidies the US federal government is handing out with the IRA:

So, for example, if the customer places an order priced at $360/kWh list price, the customer effectively pays only $252/kWh. Meanwhile, Tesla actually accrues $405/kWh (and even more than that if they get any 10% material credits). This is a $153/kWh difference! With Lathrop and Austin lines ramped up in a couple years, Tesla Energy will be the dominant grid-scale battery provider in the US, meaning they will have broad discretion to dictate the market price. No one else even has plans to approach the scale of production volume Tesla will be at. Basic microeconomic theory predicts that in a market owned by a monopoly, subsidies will mostly accrue to the monopolist firm. So even if Megapack were only a breakeven product when unsubsidized, with the $153/kWh subsidy it gets 38% gross margin.

- 30% discount on the purchase price to the customers

- $45/kWh production credit to Tesla (~13% of current selling prices)

- 10% credit to Tesla for critical minerals sourced domestically

Of course, Megapack probably isn’t a breakeven product. It was, roughly speaking, in the years of pilot production and R&D, but now we’re transitioning to the mass production phase which will dramatically reduce cost. Indeed, the recent quarters of Tesla Energy financials suggest this is already occurring. Tesla’s market-leading scale and technology should give them the lowest cost of anyone. And again, the price is so high that there is plenty of room for margin.

Let’s benchmark to an M3 long range. Tesla will sell a replacement pack for approximately $13k, or ~ $170/kWh. This can serve as a conservative high-end estimate for Tesla’s battery cost, because:

Last I remember hearing, Tesla’s actual pack-level cost was close to $100/kWh, which maybe is now like $130/kWh after inflation adjustment.

- it might include a markup

- it’s the price for a single pack in a service center (no economies of scale)

- it’s an NCA chemistry, not LFP

- car batteries have more stringent requirements for stuff like vibration, crash safety, etc. compared to a big box that just sits there and doesn’t have people riding on top of it at 80 mph

- it has 25x smaller capacity than a Megapack (1.9 MWh) which probably means Megapack will benefit from economies of scale relative to car pack

The question is how much everything else costs, such as the power electronics, battery management system, racks, outer shell, concrete foundation, etc. I think the actual cells are probably the majority of the cost, which is why ~$200/kWh is probably close.

This is why 50% gross margin on Megapack hardware produced and sold in the US could happen. It won’t be this way forever because the subsidies aren’t perpetual and because Tesla will bring down the price to go for sales of 1 TWh/year.

China has lots of excess battery capacity.