Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla stock - how low will it go?

- Thread starter spon88

- Start date

- Status

- Not open for further replies.

MadScientist

Member

Hang on, I’ll just get my crystal ball….  . As a positive, Elon has said he’s not going to sell any more stock. (But can you rely on that?). On the down side, EVs have become less popular in the energy crisis so prices may fall in the short term.

. As a positive, Elon has said he’s not going to sell any more stock. (But can you rely on that?). On the down side, EVs have become less popular in the energy crisis so prices may fall in the short term.

I think you should look at it as a longer term investment not without some risk.

I think you should look at it as a longer term investment not without some risk.

SR-Plus

Member

I reckon it will fall further….. it was always over valued and it’s still higher than pre covid levels (after taking into consideration the stock split)

SpanishJ0n

Member

Don't try and time the market, you will lose. A lot has happened since 2020, the fundamentals of Tesla are still fsntastic, CT coming out nect year, new M3, Tesla semi etc. The current stock price is a once in a lifetime bargain. Im buying with every spare penny...

Ricecooker

Member

Nobody can time the exact bottom but if you believe in Tesla just dollar cost average, split your investment pot and buy at increments, buy some when it drops, buy some more if it drops more.

The pipeline does seem positive. This quarter's figures will also be interesting - but likely worth a calculated punt now/soon.Don't try and time the market, you will lose. A lot has happened since 2020, the fundamentals of Tesla are still fsntastic, CT coming out nect year, new M3, Tesla semi etc. The current stock price is a once in a lifetime bargain. Im buying with every spare penny...

Cardo

Active Member

Stay away!The only thing guaranteed to make a stock drop further is me investing.

I’ve just put in an order for a handful more shares. It’s always a gamble, but they look like a bargain, at the moment.

I personally feel like they’ve got a decent amount left to go.

If you’re holding for several years then is probably not a bad time, but the days of endlessly rising stocks are over. 2023 is going to be very difficult cost of living wise, interest rates are only going to be going one way.

I don’t trust that Elon won’t sell more stock if he’s left in a position where he needs to, and he’ll just make up some excuse about why he had to do it. He said no further stock sales planned earlier in the year, after all.

On the flip side - people seem to have very short memories. If you invested 3 years ago you’d still be up ~500%. I don’t have any TSLA shares but I’m keeping an eye on the price.

If you’re holding for several years then is probably not a bad time, but the days of endlessly rising stocks are over. 2023 is going to be very difficult cost of living wise, interest rates are only going to be going one way.

I don’t trust that Elon won’t sell more stock if he’s left in a position where he needs to, and he’ll just make up some excuse about why he had to do it. He said no further stock sales planned earlier in the year, after all.

On the flip side - people seem to have very short memories. If you invested 3 years ago you’d still be up ~500%. I don’t have any TSLA shares but I’m keeping an eye on the price.

Buzzliteyear

Member

Watts_Up

Well-Known Member

I would recommend looking at this following TMC thread:

teslamotorsclub.com

teslamotorsclub.com

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

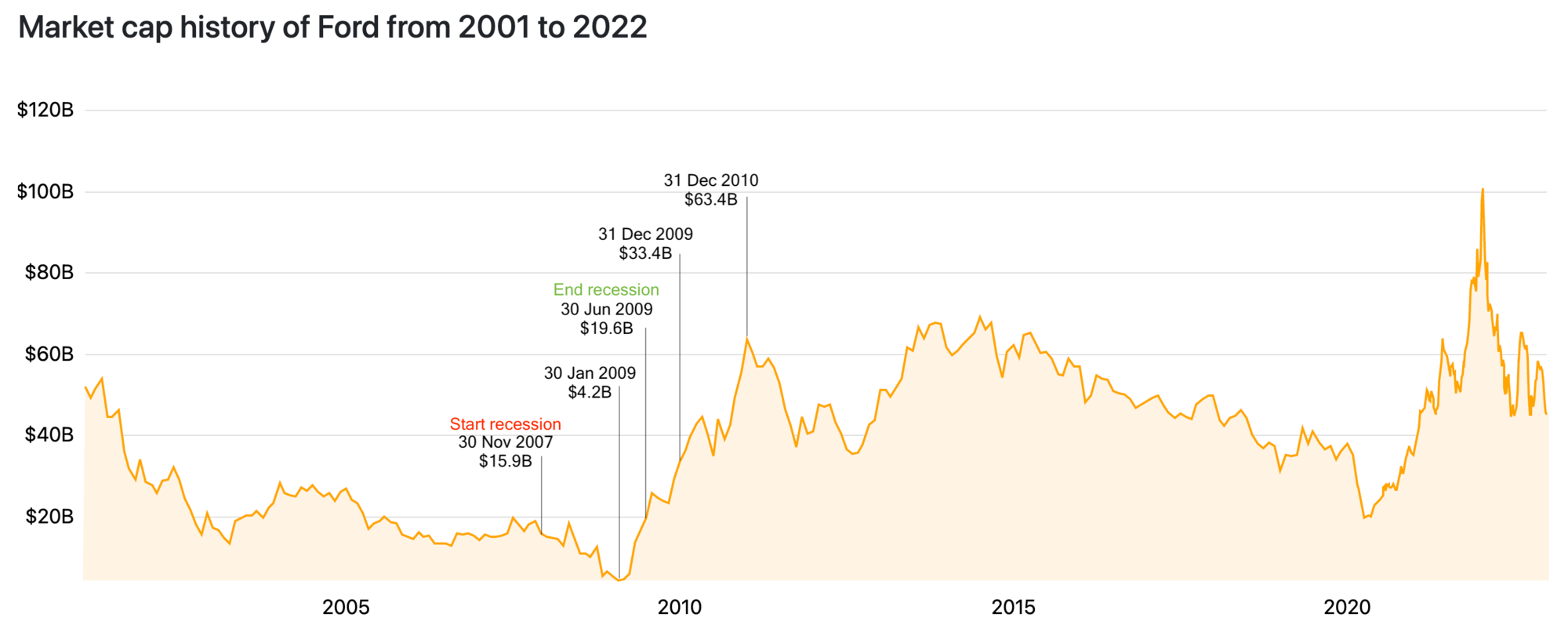

A lot of people here are very concerned about their investment. Although that's quite understandable, let me try to put the current situation a bit in perspective. I constructed a picture of what happened with the stock price (market cap) of Ford during the last recession. As pointed out in...

There are a lot of ways this could go. Elon might have another wheeze to take his focus in a different direction or he could finally crack and go loopy. Tesla might hive off the charging system to a separate tesla subsidiary, and or do the same with their truck and semi lines. As to CT - well it will sell reasonably in the US but sales elsewhere harder to predict and with the delays a lot of truck-wanters that put down deposits might dump them. The semi is still an unknown quantity until its charging system is widespread when it will be taken up by a few companies wanting green credentials. In practical terms if Tesla were meaning to get into the commercial vehicle business then a Transit shaped EV and a something the size o a supermarket delivery van would fill the need for white van man and courier companies. With the competition gearing up on the EV market and many more folk losing faith in Tesla promises I doubt there's going to be any sort of meteoric rise in share price.. And then there is the big question - whether it suits China to throw a spanner into the works and have an outbreak of diplomatic disease in export chip factories and rare earth mining...

UrbanSplash

Active Member

Over supply. Lower demand potentially. High material costs etc.

Price cuts? Will kill second hand Tesla prices too.

The UK market for Tesla is in for an extremely difficult time in 2023.

Share prices could go anyway of course

Price cuts? Will kill second hand Tesla prices too.

The UK market for Tesla is in for an extremely difficult time in 2023.

Share prices could go anyway of course

Nick77

Deep Blue Model 3 LR (2021 MIC)

I bought some. Longer term its only going to go back up.

There are a lot of ways this could go. Elon might have another wheeze to take his focus in a different direction or he could finally crack and go loopy.

Seeing as he thinks being LGBT or science behind a global pandemic is a "mind virus" he's either already gone or he was hiding it while too busy.

Tesla is on basic autopilot on b-roads with no driver right now.

goRt

Active Member

It's always painful as a company moves from a growth stock to value, not long to go before Tesla joins the 90% club - Yahoo was a double holder!!!

Fursty Ferret

Member

I’m not sure it is. It could, as Tesla is a profitable company. However, they’re now under increasing pressure from competition and have little to answer them.Longer term its only going to go back up.

The Model 3 and Y are priced much higher than anticipated and not selling well any more; the Model S hasn’t changed shape since it launched in 2012, they have nothing to compete in the “Model 2” price bracket while others do, FSD has hit a brick wall in the last six months, Supercharger prices are 400% higher than 2021 despite wholesale energy prices falling, they have removed parking sensors from a £55,000 car, and the last photo I saw of a Tesla Semi showed it on fire.

So feel free to take a gamble but I think it’s unwise.

Last edited:

mjwojtukiewicz

Member

I think this is the most important part of this thread.FSD has hit a brick wall in the last six months

FSD - and wider autonomous tech like the Tesla Bot - was keeping the company's growth prospects in the stratosphere. Instead of normal measures of long term profitability, Tesla was judged by the measures of a late 90s tech start-up - it might go bust, but also it might make you 10 or even 100 times your investment. Now that FSD has reached its limits for the foreseeable future and with no prospect of FSD being widened to level 3 let along level 5 autonomy, the market has come to realise it is just another boring company that makes cars. And overpriced ones at that.

The semi is a niche product, likewise the Cybertruck, with limited growth potential. No sign of an affordable car to allow Tesla to be a volume manufacturer. And with Musk's unhinged right-wing drivel, his running into the ground a genuine tech company, and no real design or marketing flair, there doesn't seem to be strength in depth for the company to claw its way out of the hole. Unless of course Musk gets margin-called into so many share sales that he is replaced as CEO.

UkNorthampton

TSLA - 12+ startups in 1

Model y still tops or number 2 of sales charts of ANY kind of powerplant in many markets eg uk in November, Norway, Germany, France regularly.

At $14,000 gross margin per car compared to $0-3000 for others, no debt, big and growing cash pile, more efficiencies from already built or expanded factories reducing per vehicle apportioned costs, going from no USA subsidy in last few years to perhaps $7,500 plus direct battery subsidiaries from Inflation Reduction Act, Tesla can survive any downturn better than any other car maker I can think of.

Only BYD seem to make profit on EVs, very small profit. Maybe other Chinese companies, but no European, USA or Japanese companies. Perhaps Hyundai/Kis don't make profits on EVs, hard to know or keep track.

At $14,000 gross margin per car compared to $0-3000 for others, no debt, big and growing cash pile, more efficiencies from already built or expanded factories reducing per vehicle apportioned costs, going from no USA subsidy in last few years to perhaps $7,500 plus direct battery subsidiaries from Inflation Reduction Act, Tesla can survive any downturn better than any other car maker I can think of.

Only BYD seem to make profit on EVs, very small profit. Maybe other Chinese companies, but no European, USA or Japanese companies. Perhaps Hyundai/Kis don't make profits on EVs, hard to know or keep track.

- Status

- Not open for further replies.

Similar threads

- Replies

- 10

- Views

- 695

- Replies

- 268

- Views

- 55K

- Replies

- 0

- Views

- 112

- Replies

- 26

- Views

- 1K