I'm thinking $50/kWh at the pack level by 2022. Full production target of TeraAustin. Happy to be wrong, but feel this is well within range given what we know after today's presentation

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Tesla just showed it’s roadmap to become the largest company in the world, by a wide margin. There will be enough people that see it this way too keep the stock price relatively high.TSLA is priced for perfection. Battery Day didn't deliver on million mile or dry plating. The share price will rightly get hammered.

Rohan

Member

Oh go on then you've talked me into it, replacement S it is in November!Probably a few folks no longer going to put off buying a S X 3 Y now as they don’t have to worry about an outdated battery in a couple weeks. Might help move a few inventory cars in the next few days.

Very cool briefing.

RobStark

Well-Known Member

Stop comparing it to auto companies. It's not valued like one because it does things that no other auto company in the world does. It's more of an engineering firm that happens to make cars.

RobStark

Well-Known Member

They don't have all of the improvements in place, yet. For instance, I have the impression that the maxwell dry process is not in place, yet.

I thought Elon said dry process machine is in its 4th iteration. It works but yields are low.

Runarbt

Active Member

Wow - what a day.. :-D Soo much information and ground breaking work.Notes from Battery day:

...

....- Tabless cell => improved charge rate vs. cell diameter curve

- 5x shorter electrical path.....

- 20% higher power density due to tabless

- 16% higher range from form factor alone

- 14% $/kWh reduction from form factor+tabless

If I were to pick one thing - the shorter electricial path on tabless has to be it.

This is the real bomb in my opinion. And should be way better than a 5x improvement.

A 2170 had a 1meter long anode/catode sandwich - making this tabless = 50cm travel turns into 7cm travel. = theoretical 7x improvement

The new 4680 battery - should have a 2meter (?) sandwich, tab in the middle = tab distance 100cm which turn into 8cm with tabless. = 12.5x improvement.

And the effect on heat management - Just WOW. = No more heat issues!

This was the part which I would have like to get more info on.

What effect does this have on longevity?

What effect does this have on SuperCharger rates?

What effect does this have on cooling needs? Less energy spent on heat management?

Can this be implemented on 2170 batteries from Panasonic at gigafactory?

All batteries used should be tabless asap. No need to stick with tabs.

Last edited:

insaneoctane

Well-Known Member

And well deserved. Drew was fantastic.His candor about where they are and the challenges to reaching their goals was indeed refreshing. It's as if he wanted to specifically avoid exaggeration.

A surprising thing to me was how comfortable Elon was deferring to Drew Baglino. It was good to see him trust someone else on stage like he used to with JB Straubel. Would be nice if this became a growing trend.

Artful Dodger

"Neko no me"

Yeah, not gonna happen this quarter. Tesla said late 2020 or Q1 2021 before LPF packs begin deliveries with the MiC Model 3 SR.The future as in this quarter? I called this one

Note that LFP is already below $100/kWh.

And that's gonna DOUBLE the bty supply that has been so slow to ramp from LG Chem. Sales will 6x once MiC Model Y comes online including the LFP SR version. So, 750K annual run rate by end of 2021?

Elon said 1M/yr eventually from Shanghai. Does that mean another Model 3 line, or something else? Not much room left for another product w/o more land purchases. But those watermelon farms look mighty tasty...

Cheers!

Last edited:

jkirkwood001

Active Member

"In 12 months we will produce roughly 5% of the worlds batteries and 20% of what we outsourced last year. By 2030 we will produce 10x what the entire world produced last year. Last year we made zero batteries. These will be less than half the cost of current batteries"

I don't know how that's not mind blowing.

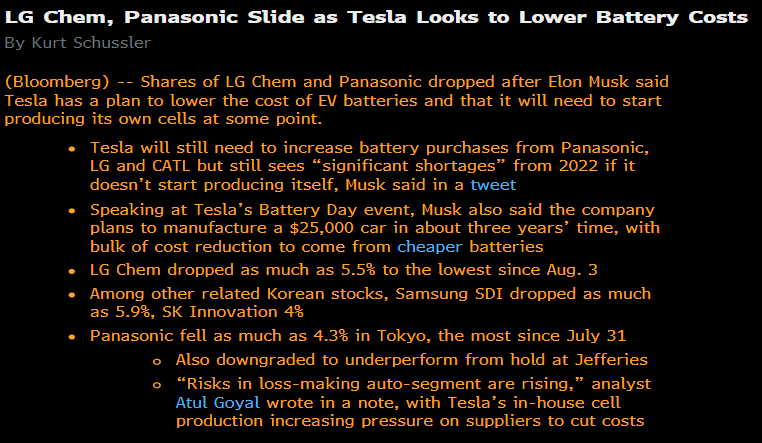

I'll be interested to know how Panasonic, LG and CATL react, both the engineering of the innovations (do they endorse as achievable?) and competitively ("we're with you, Tesla, on global market growth" vs. "screw you, we'll stop selling to you / block you in court / whatever").

Expert reactions (scientific community too) will be be interesting, although doubting Tesla / Elon has been proven wrong time and time again.

Panasonic weighs options over Tesla new battery production

TOKYO (Reuters) - Panasonic Corp 6752.T is studying options for new electric car battery production with partner Tesla TSLA.O after the U.S. carmaker unveiled a plan to expand output and halve the price of the key auto component, the Japanese firm said on Wednesday.

“We are considering a variety of options, but nothing has been determined at this time,” a Panasonic spokeswoman said after Tesla Chief Executive Elon Musk outlined his plans in the closely watched “Battery Day” presentation.

“We value our relationship with Tesla and look forward to enhancing our partnership.”

TOKYO (Reuters) - Panasonic Corp 6752.T is studying options for new electric car battery production with partner Tesla TSLA.O after the U.S. carmaker unveiled a plan to expand output and halve the price of the key auto component, the Japanese firm said on Wednesday.

“We are considering a variety of options, but nothing has been determined at this time,” a Panasonic spokeswoman said after Tesla Chief Executive Elon Musk outlined his plans in the closely watched “Battery Day” presentation.

“We value our relationship with Tesla and look forward to enhancing our partnership.”

Green Pete

Active Member

I'll be interested to know how Panasonic, LG and CATL react, both the engineering of the innovations (do they endorse as achievable?) and competitively ("we're with you, Tesla, on global market growth" vs. "screw you, we'll stop selling to you / block you in court / whatever").

Expert reactions well be get interesting, although doubting Tesla / Elon has been proven wrong time and time again.

It's possible, but I have a hard time thinking the suppliers were more in the dark than the public. A lot of the guesses here were right. Sure suppliers have known and been communicated too that it's a long term plan to grow massive enough to stop climate disaster. We need you no matter what.

In Frankfurt Tesla is trading at around $396 (€339.65).

Tslynk67

Well-Known Member

Wait, it is??! That’s huge though and negates comments by Musk that it’s not “final”. Is he really looking after Osborne effect here or am I not reconciling something correctly?

Elon said that the "yield was low", which implies to me that they're making cells, just not so many.

I would guess they'd save them up and produce a new semi each time there's enough, start getting them out there to clients.

UkNorthampton

TSLA - 12+ startups in 1

Yeah, that next call to Panny is going to awkward AF.

I don't think so. I think

1) We'll take all your cells.

2) We have more demand than we can satisfy - want to use some of our tech?

3) The world has more demand than supply and we're in a race as a species to stop the fossil fuel experiment before it's too late. Want to use our tech to make cells for others?

Others - er where are our cells?

Suppliers - shipped to Tesla but we're increasing supply thanks to Tesla and we'll have some spare in a few years. How's the ICE business? Oh and because your liabilities are so huge we'll have to ask for payment up front.

marvinat0rz

Member

RobStark

Well-Known Member

I don't think so. I think

1) We'll take all your cells.

At cost plus 1%.

Panasonic CEO "We should get into the Supermarket business, at least they have good margins."

insaneoctane

Well-Known Member

Other than option traders with short-term time horizons, I would be surprised for Wall Street to miss BDs message. Educated institutional investors CONSTANTLY try to get Tesla to share $/kWh. Tesla has been pretty guarded with this lately. BD literally made a step change to the cost of batteries (in the near future) while the industry continued contently trying to eek an extra percentage each year. These announcements are stunning and game changing. It's the perfect evidence that Tesla is playing AI directed 4D Chess while the others play eat the crayons. Even though BD had tons of details and engineering candy, competent investors have to see the game, set, match with battery costs shown today? Interestingly, one of the many reasons I've felt my investment in Tesla was smart was the existence of the Gigafactory. This demonstrates Tesla "gets it", is control of their own destiny, and others didn't. Now apply Terafactories making these new innovative cells while everyone else seems to still be flat-footed and, well, it's time to buy some more TSLA

cricketman

Member

Battery day was awesome!

They explained brilliantly why Lithium is the way forward and how it will completely transition the world to sustainable energy, and why Tesla may have to do it all themselves. It couldnt have been more bullish. We are talking about Tesla becoming the largest company the world has ever seen since the East India Tea Company.

Yes there was a slight disappointment that they didnt have the batteries already in the cars, or a refreshed S/X, but really we all got a bit carried away. Tesla is ace but it isnt magic!

They explained brilliantly why Lithium is the way forward and how it will completely transition the world to sustainable energy, and why Tesla may have to do it all themselves. It couldnt have been more bullish. We are talking about Tesla becoming the largest company the world has ever seen since the East India Tea Company.

Yes there was a slight disappointment that they didnt have the batteries already in the cars, or a refreshed S/X, but really we all got a bit carried away. Tesla is ace but it isnt magic!

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K