Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Dave's Q3 profit estimate. $400-450 million.

I know this will sound flippant, but if/when Tesla gets to that point we will all be so wealthy we won't care. I think Tesla will need to be careful when using market power in their side businesses like insurance. For example, if they truly become the dominant auto seller they may need to provide quotes from other auto insurance companies during the sales process. That's similar to the compromise that Microsoft was given with internet browsers.I don't foresee this as a current threat to TSLA, but given how vertically integrated the company is becoming, and how dominant it is in the EV space, do people believe this could become a problem in say 10 years?

Democrat-led House panel to seek breakup of big tech, GOP lawmaker says

House Panel to Seek Breakup of Tech Giants, GOP Member Says

CyberDutchie

Active Member

Not one of oldest members here but still got in pretty early. Still haven’t sold a single share. No options, no leverage (unless you count taking out a loan for my P85+ instead of paying cash so I could invest more in TSLA). Used to joke I wasn’t selling until $4K (pre-split). Now I’m not planning to sell until $4K period. Buy and hold really works.

View attachment 595855

Unrealized gains... meaning you could still lose it all

I'm pretty certain that DEMs will be controlling all levels of government, so shouldn't be a problem.

Not to get political, but it's looking like a landslide victory right now, I'm not sure there's ever been such a wide lead going into the election: President—Forecasting the US 2020 elections

Remember Hilary was a dead-cert to win with, what a 3-point lead.

Again, not to talk politics here, just to foresee what's coming and how me may need to react to it.

Whatever you do, do not use unintelligent journalists with a terrible track record of predicting outcomes for predictions about outcomes. Just go straight to the experts, the betting market.

Current odds with $260k+ on the line is 41%:

Augur Prediction Market Data & Statistics | Predictions.Global

If you disagree with these odds, go ahead and collect your free expected value. If the journalist actually believes what he is writing in intelligent he has a chance to double his money for 10% risk of losing. So either he hates money or he doesn’t understand basic math...

lafrisbee

Active Member

and only vaguely TSLA related...

Anyone else get a little jolly when Elon referred to the Epoxy-rigid Battery aspect making a current tesla even more rigid than it is now, even if it were a convertible? Just a regular old Model 3 or Y convertible-esque vehicle? Cybertrck?

Anyone else get a little jolly when Elon referred to the Epoxy-rigid Battery aspect making a current tesla even more rigid than it is now, even if it were a convertible? Just a regular old Model 3 or Y convertible-esque vehicle? Cybertrck?

Dan Detweiler

Active Member

Thought I would drop this here as it may have impact on the short term stock price if it is representative of where Tesla is on solar roof and panels. Just got a private message from a guy in Georgia that says his company is currently in the training process for installing both Tesla solar panels AND the Solar Roof. This is huge news for us down here since Tesla Energy products have been unavailable to this point. He said they are not allowed to market the fact yet as they are still in the training process, but said he would have someone in sales reach out and give me a quote anyway.

If Tesla is indeed expanding their energy products then it could be a huge upside to TSLA very soon.

Dan

If Tesla is indeed expanding their energy products then it could be a huge upside to TSLA very soon.

Dan

I don't foresee this as a current threat to TSLA, but given how vertically integrated the company is becoming, and how dominant it is in the EV space, do people believe this could become a problem in say 10 years?

Democrat-led House panel to seek breakup of big tech, GOP lawmaker says

House Panel to Seek Breakup of Tech Giants, GOP Member Says

Is anyone talking about breaking up Apple? How did Steve Jobs skate past getting hit with a criminal indictment when he was actually caught repricing stock options, even though other CEOs got sent to jail for the same crime?

The answer is that the company and the person are/were too politically popular for the feds to tackle. As long as people love Teslas, I don't think Tesla has anything to worry about. In ten years, they'll have the best cars in most vehicle segments. Musk will be hailed as a national treasure for SpaceX. His military contracts will ensure the spooks will want to protect him, etc. I really don't see this as a problem. Of course, ten years is a long time for any crystal ball.

RobStark

Well-Known Member

Giga India is looking more like a real possibility, which I find a bit surprising. I know there was some Tesla Tuk Tuk discussion earlier, but what do we see as the real opportunity here? No doubt more APAC factories will be needed, but India wouldn’t have topped my list, maybe because I’m not coming at it from first principles, but from my ingrained stereotypes - Bangalore is for offshoring IT, not manufacturing; ASP would need to be too low, etc.

I’m sure someone here is knowledgeable about the Indian vehicle market and has a better idea why they should be the next factory (apart from, you know, all the people that live there). I know that to sell there you need to manufacture there, so is the reason just that simple? Or is there something else about the market or their manufacturing capabilities that would move them to the top of the list?

Maybe it is just as simple as India has 1.4B people and if you want to decarbonize the global economy you have to be in India.

Tesla can start manufacturing Battery Energy Storage/Solar in India then move to vehicle manufacturing later.

India has high tariffs against Chinese Imports and may be going higher resulting from the military friction at the border. Manufacturing BES/Solar may be very profitable in India.

and only vaguely TSLA related...

Anyone else get a little jolly when Elon referred to the Epoxy-rigid Battery aspect making a current tesla even more rigid than it is now, even if it were a convertible? Just a regular old Model 3 or Y convertible-esque vehicle? Cybertrck?

Yes indeed. IMHO that's a knock against current Tesla vehicles, body roll. I personally can't wait for a stiffer chassis!

The extended, ‘tho Chinese, version is Oolong.Chai

Driver Dave

Member

Buy and hold really works.

There definitely is some good humor in:

One guy working every day, following the news, buying the dips, selling the peaks, doing the calls and puts and what have you, and running back to examine where things lie on the bollinger band and where is max pain today?!?!? ... every day, day after day...

And the other guy who buys TSLA, watches TV for 10 years, and then sells at 10x.

One of them is, verily, Max Painful.

~~~AND...by the way...this thread has become polluted with a lot of that lazy wording that is impermissible. You are more than welcome to talk that way to your grandmother, to your spouse, to your three-year old - but STOP trashing this thread with your trash talk. Responses to this message are not welcome.~~~

~~~AND...by the way...this thread has become polluted with a lot of that lazy wording that is impermissible. You are more than welcome to talk that way to your grandmother, to your spouse, to your three-year old - but STOP trashing this thread with your trash talk. Responses to this message are not welcome.~~~

10x? That's it in 10 years?There definitely is some good humor in:

One guy working every day, following the news, buying the dips, selling the peaks, doing the calls and puts and what have you, and running back to examine where things lie on the bollinger band and where is max pain today?!?!? ... every day, day after day...

And the other guy who buys TSLA, watches TV for 10 years, and then sells at 10x.

Wow. Tesla energy still has a ways to go with the solar roof. Basically, Tesla attempted to use a brand new underlayment that failed with a week of using it. Sounds pretty bad.

Tesla Solar Roof buyer left without roof and tarps over his house after 2-month-long nightmare - Electrek

Tesla Solar Roof buyer left without roof and tarps over his house after 2-month-long nightmare - Electrek

Causalien

Prime 8 ball Oracle

I don't foresee this as a current threat to TSLA, but given how vertically integrated the company is becoming, and how dominant it is in the EV space, do people believe this could become a problem in say 10 years?

Democrat-led House panel to seek breakup of big tech, GOP lawmaker says

House Panel to Seek Breakup of Tech Giants, GOP Member Says

Tesla can then argue it is just one of the many automakers. Like all the analysts have been valuing it with.

corduroy

Active Member

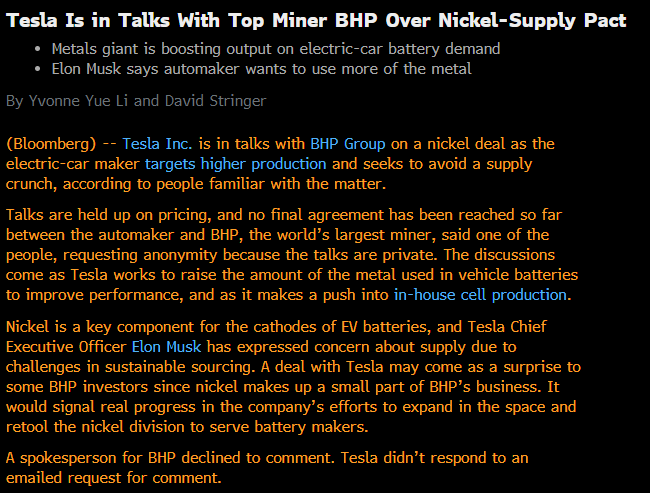

So it this our cue to go buy a bunch of BHP calls and hope for another Piedmont bump?

Tslynk67

Well-Known Member

Wow. Tesla energy still has a ways to go with the solar roof. Basically, Tesla attempted to use a brand new underlayment that failed with a week of using it. Sounds pretty bad.

Tesla Solar Roof buyer left without roof and tarps over his house after 2-month-long nightmare - Electrek

So one person has an issue with their roof install and it's considered news?

Favguy

Member

OK, MY Face should at least be nominated for Mount Teslamore. You guys talk about buying in at a certain PRICE and making big bucks... Well if you got a million dollars and you put $50k in TSLA you ain't risking your life.

Me? I am balls in. It should be about how much of Your Savings, not how much money. Used to be I couldn't buy a coke unless it was a special event. Now I've got four 2 liter bottles sitting on the floor, just sitting there. No one's Birthday is this week.

So when it comes to Bull... here is my nut sack. This is all my life's savings. And it ain't like I didn't save. If I was all in on TSLA and only had 3 shares then I'd not have the "life-changing" aspect this does. A quarter-of-a-million-Dollars is a huge amount when the four 2 liter bottles of coke you have on the floor are Generic coke because you can't see wasting the money to get real coke. Now I do almost own my home, and my truck is paid for but it is 12 yrs old... this is what a tesla stock market account looks like (Thankfully it is all in a ROTH).

Symbol Last Price $ Change $ Change % Days Gain $ Total Gain $ Volume Value $ Price Paid $ Qty Total Cost

ALLM 0.107 -0.0028 -2.55% -352.23 -13,366.28 25575 13,460.17 0.21191 125,796 26,826.46

NVNXF 0.885 0.1162 15.11% 87.15 19.30 521321 663.75 0.85 750 644.45

TSLA 417.2209 -8.46 -1.99% -5,126.21 -25,468.44 27712858 252,835.87 459.2480 606 278,304.31

THAT is roughly 91% TSLA of my $278K ROTH. (And I don't have any other Stock or investments. And I am 64 yrs old). So if we are talking about Bulls' nutsacks let make it real... it ain't if you have a big nutsack, it is the percentage of the nutsack you are willing to risk. Sure I'd like to have a bazillion dollars in TSLA, but I ain't got a BAZILLION DOLLAHS. However 9/10ths of my sack is on the butcher's block.

Am I crazy? Am I reckless? When does a Bull go from being "bullish" to reckless?

Lol!! Let me tell you about balls of steel... 100% of my life savings have been in TSLA since early 2012. In February this year, I borrowed an additional £40k and added 100% of it to my holding. It's now at a point where on particularly volatile days the value of my holding fluctuates by more than your entire ROTH!

And I'm as tranquil as the Money Calm Bull... (Google it, it's a British thing)

I think the reason I'm so calm is I treat my ownership of TSLA as if it was my own growing business. I feel I'm a part owner of one of the most transformative companies in the world today, with enormous potential. It's not just a shareholding to me.

Or maybe I'm just too stupid to realise how precarious my financial situation is by doing what I've done!

StarFoxisDown!

Well-Known Member

Wow. Tesla energy still has a ways to go with the solar roof. Basically, Tesla attempted to use a brand new underlayment that failed with a week of using it. Sounds pretty bad.

Tesla Solar Roof buyer left without roof and tarps over his house after 2-month-long nightmare - Electrek

Eh

Fred always emphasizes every Tesla misstep or issue. I swear he scans non-stop for anyone having a bad Tesla experience. Just like you sometimes get a lemon with a car or a improperly installed regular roof from a contractor, there will be instances of bad experiences.

Mo City

Active Member

Tenderfoot, don't even talk to me until you are over 97%.OK, MY Face should at least be nominated for Mount Teslamore. You guys talk about buying in at a certain PRICE and making big bucks... Well if you got a million dollars and you put $50k in TSLA you ain't risking your life.

Me? I am balls in. It should be about how much of Your Savings, not how much money. Used to be I couldn't buy a coke unless it was a special event. Now I've got four 2 liter bottles sitting on the floor, just sitting there. No one's Birthday is this week.

So when it comes to Bull... here is my nut sack. This is all my life's savings. And it ain't like I didn't save. If I was all in on TSLA and only had 3 shares then I'd not have the "life-changing" aspect this does. A quarter-of-a-million-Dollars is a huge amount when the four 2 liter bottles of coke you have on the floor are Generic coke because you can't see wasting the money to get real coke. Now I do almost own my home, and my truck is paid for but it is 12 yrs old... this is what a tesla stock market account looks like (Thankfully it is all in a ROTH).

Symbol Last Price $ Change $ Change % Days Gain $ Total Gain $ Volume Value $ Price Paid $ Qty Total Cost

ALLM 0.107 -0.0028 -2.55% -352.23 -13,366.28 25575 13,460.17 0.21191 125,796 26,826.46

NVNXF 0.885 0.1162 15.11% 87.15 19.30 521321 663.75 0.85 750 644.45

TSLA 417.2209 -8.46 -1.99% -5,126.21 -25,468.44 27712858 252,835.87 459.2480 606 278,304.31

THAT is roughly 91% TSLA of my $278K ROTH. (And I don't have any other Stock or investments. And I am 64 yrs old). So if we are talking about Bulls' nutsacks let make it real... it ain't if you have a big nutsack, it is the percentage of the nutsack you are willing to risk. Sure I'd like to have a bazillion dollars in TSLA, but I ain't got a BAZILLION DOLLAHS. However 9/10ths of my sack is on the butcher's block.

Am I crazy? Am I reckless? When does a Bull go from being "bullish" to reckless?

Not only that, I've got your dollar amount beat multiple times. You have less now than I did before going "all-in" on March 19th at $373 ($74.60). Go ahead, do the math.

You still want me to get out the tape measure?

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K