Several years back,

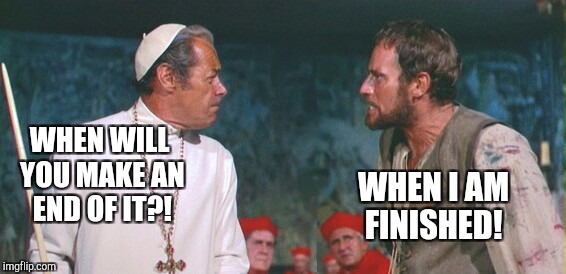

@TrendTrader007 used to post here regularly. Typically would be a message like "Based on the chart, $TSLA poised for huge break out to $XXX" - this is OK, but he'd post these every other week, of course it never happened and he ended up getting laughed at so much that he left, returned, left, returned, then finally left, until he returns again...

He couldn't handle people criticising his perpetual

proclamations and started to be abusive, with stuff like "screw you amateurs, I've more money than all of you combined, go f yourselves", or words to that effect

We never knew how much $TSLA he had, but he implied it was >100k shares pre-split. He was forever flipping in and out of stock and calls. In theory he should be a billionaire by now, who knows...

I follow him on Twitter, he's somewhat schizophrenic, one day he's loading on $TSLA, the next he claims the apocalypse is coming and he has sold everything and moved into cash