Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

strago13

Member

StarFoxisDown!

Well-Known Member

Volume picked up

Just looking at the volume, sure looks like someone taking a new position or adding to there. Volume is coming in bunch of big orders that are spaced out in groups.

Annnnnnd....it's followed immediately by MM's flooding sell orders to block any further increase. What a surprise

Last edited:

Tesla is advertising Tesla electricity in Bavaria.

My excitement was curbed when the link sent me to octopus energy. I am not sure, what association they have with Tesla.

View attachment 691946

Powerwall users only.

Octopus Energy is great. I waited for them to be available in Germany.

Why? They are based in UK & are registered as normal energy provider. They had "experiments" like "We pay you for using energy this weekend between xx and yy" when the sun was shining & winds were strong & the european net had a surplus of renewables.

I think they are just a means to get Teslas autobidder deployed in the european energy market.

Also they want to offer dynamic pricing (like charging your powerwall when rates are cheap/free) and other benefits.

Plus they are "just digital" and have no big overhead of people to pay - so they should be cheaper than alternatives.

I really want to try them out - my current contract is still running a bit

StarFoxisDown!

Well-Known Member

Stock goes up on strong volume......stock gets dropped on a bunch of tiny sell orders......Sure that makes sense.

StealthP3D

Well-Known Member

I plan to test drive a bunch of new EV models to determine who might have a chance to be top 3 or top 5 in 2030 and 2035 based upon how far behind their tech is today from Tesla.

Investing is a non-intuitive endeavor for most people. People have a tendency to do what worked last time because they think they are "learning". I would suggest to avoid this trap. You were an early investor in Tesla, perhaps because the cars were amazing to drive. That's good. The way the Model 3 drove was a major factor in my confidence in Tesla during the dark days of late 2018 through the first half of 2019.

But I would suggest that using the same process to try to determine the winners looking forward 5 or 10 years will not be as successful. It will not be revealed by which car is the most amazing to drive (they will likely all drive well and have different strong points and so personal preference and value offered will rule the day). Elon has made it abundantly clear the manufacture is the difficult part, that anyone can make a good car, the difficulty is in mass producing them at a favorable cost in high volume.

As an investor you are concerned with much more than how the cars drive, they will all likely be very similar in ways that matter to most buyers. Driving the cars will not tell you which one will last the longest, have the lowest warranty expense or cost the least to make. Some makers will be forced to price their cars below cost just to be able to sell enough to be viable. If they are priced too high, they sell even fewer and the cost to make each car rises as well. In any case, waiting for the cars to actually be produced will probably be later than ideal for investment purposes.

My point here is don't necessarily keep doing what worked last time, because you don't know why it worked. As investors we don't live long enough to learn long-term investing from experience. You can improve slowly over time by using past investment experience as a guide but you won't become an expert this way until long after you are dead. You can learn to day-trade from experience because it's possible to trade every day or multiple times/day to build enough personal experience to become an expert at it. But you cannot learn long-term investing through the same process. It's not going to happen on any meaningful scale. You need to parse different information to become a good long-term investor and study past examples and even have a good grasp of how the world works outside of investing. Apply first principles thinking to investing. Know that most of what you think is wrong. Ignore 90% of the stuff out there that most people think is important investment info and focus on the bigger picture, longer trends, and less specific info. Sometimes detailed data can help you see the bigger picture but it should only be used to generally inform, not to base investment thesis on. There is no certainty in investing, you have to use your knowledge of how the world works to see into the future and use an early and accurate understanding of how the broader trends unfold with time. And it comes down in the end to risk/reward ratio. You need to win bigger and win more than you lose.

Most data on this shows most people would be better off throwing darts at a stock board or simply buying S&P Index funds. I think most people are capable of doing much better than the statistics show because the statistics include people making a lot of stupid decisions, people who are not focused on what matters in the longer term. These are people who base their investment decisions on things they think are important. Price ratios, earnings, etc. Sure, at some point those things need to fall in line for your investment thesis to be proven correct but those are not metrics the most profitable investors use to form their early discovery of value in the market or their early discovery of problems with a previously successful company.

I will suggest the next Tesla is likely Tesla. If my thesis changes it won't be because I saw it in the sales data, it will be because I saw the company change in ways I don't like. Maybe a change in management that I don't think will be as effective, maybe a shift in the way the public is starting to view the company or a shift in transportation itself. Likewise, it probably won't be because I drove the latest model Tesla and didn't like the way it drove compared to the competition. I suppose that is possible, but very unlikely.

Tesla's big advantage is battery supply and manufacturing/corporate efficiency, things that competitors cannot quickly copy. That's why TSLA is a screaming buy for the long-term. Their manufacturing efficiency is on display on multiple fronts including their technological lead in EV drivetrains which allows them to build the same car with fewer batteries. That makes the car lighter and cheaper. Also, the manufacture itself is more efficient due to relentless application of first principles thinking, removing unnecessary steps wherever possible and making other steps more efficient. This is one area that traditional manufacturers are quite good at - the only problem is the manufacture of EV's is much different from the manufacture of ICE and thus has different optimizations. Because traditional OEM's are not nimble, it takes them forever to apply the necessary optimizations to all the new processes. That's why we can openly discuss it without worry!

On the other front, Tesla's corporate efficiency benefits from the same first-principles thinking as that used in their manufacturing, as well as lack of historical corporate baggage.

As an investor, if you want to take early action as competitors improve, you don't want to base your actions on the final product because it might be too late. You want to watch how the competition is changing, what processes they are employing, how they are progressing with reducing corporate overhead, how they are dealing with the baggage of their dealerships, how public perception is changing. I would suggest it might be a long time before Tesla has competitors than offer similar value.

The stronger volume days are coming.......2 weeks maybe.....Stock goes up on strong volume......stock gets dropped on a bunch of tiny sell orders......Sure that makes sense.

Artful Dodger

"Neko no me"

GM was already losing $10k on every Bolt sold, and now they just announced an $800M charge for the recall. Something tells me they're lying about wanting to go 'all in on EVs'. They'll just keep coming up with excuses to delay.

Market Summary > General Motors Company

53.10 USD −4.81 (8.31%) today

No no, way too many buttons.

Tesla will use cameras and AI to decide what needs to be done.

Woha, stop... no, this results in images that I do not want to think about.

34 more days like this and we hit $1k.

edit, ok more like 99 days.

edit, ok more like 99 days.

Last edited:

StealthP3D

Well-Known Member

Speculation is great when it stems from educated guesses based in fact. That kind of speculation allows investors to make rational decisions about future financials.

But I believe there are many people on social media who pretend to have inside information to gain followers, and may literally be creating rumors from whole cloth. There's a lot of baseless rumor flying around; and that hurts our ability to make rational decisions about the future.

Generally, I agree but it doesn't hurt our ability to make rational decisions about the future If we essentially ignore them. When I see social media rumors posted here my brain typically says, "Well, that's neither here nor there, I have no way to know, whatever" and move on.

StarFoxisDown!

Well-Known Member

You mean 34 more days of the stock being bought up only to be spoofed nonstop and walked back down to .2% gain for the day34 more days like this and we hit $1k.

The chart between now and the end of the year is going to be flat........with like a 2-3 day 25% rally at some point.....followed by flat so that MM's can start milking options again.......followed by another 25% rally....and repeat.

Last edited:

You are probably correct. I'll unload my October and November calls if it feels like we hit a solid rally. None are above $800 but still.You mean 34 more days of the stock being bought up only to be spoofed nonstop and walked back down to .2% gain for the day

The chart between now and the end of the year is going to be flat........with like a 2-3 day 25% rally at some point.....followed by flat so that MM's can start milking options again.......followed by another 25% rally....and repeat.

Todd Burch

14-Year Member

Perhaps once everyone gets back from the Hamptons...The stronger volume days are coming.......2 weeks maybe.....

So, the scumbags are at it again...

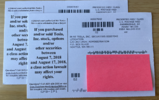

Got a couple of these in the mail regarding our purchase of a round number of TSLA shares on Aug 7th, 2018. The 420 day.

Those positions are showing 840% gain on their almost 3-year anniversary.

Normally, I would toss these things on arrival but for some odd reason I flipped it over and read it this time. Turns out, unless you contact them and explicitly opt out of this class action clownery, you are an active participant. This is how you get actual investors with 840% appreciation to complain about said appreciation. What a bunch of rats.

Just an FYI and feel free to distribute these online as needed.

Oh, and also ordered a Plaid X for our Montana property. With only 20k in premium over the LR car, it seems like a bargain. :-D

Got a couple of these in the mail regarding our purchase of a round number of TSLA shares on Aug 7th, 2018. The 420 day.

Those positions are showing 840% gain on their almost 3-year anniversary.

Normally, I would toss these things on arrival but for some odd reason I flipped it over and read it this time. Turns out, unless you contact them and explicitly opt out of this class action clownery, you are an active participant. This is how you get actual investors with 840% appreciation to complain about said appreciation. What a bunch of rats.

Just an FYI and feel free to distribute these online as needed.

Oh, and also ordered a Plaid X for our Montana property. With only 20k in premium over the LR car, it seems like a bargain. :-D

Attachments

Last edited:

StealthP3D

Well-Known Member

The chart between now and the end of the year is going to be flat........with like a 2-3 day 25% rally at some point.....followed by flat so that MM's can start milking options again.......followed by another 25% rally....and repeat.

You seem awfully sure about that but my observations of the market over the years tells me to expect the unexpected. Elon, Zach, etc. are probably in the best position to know what the share price might do and it's a big guess even for them!

That's why I'm simply remaining long. OK, I admit it, it's also my revulsion to performing boring tasks like trying to eek out an extra few thousand here, a few thousand there.

UkNorthampton

TSLA - 12+ startups in 1

Octopus & Tesla are linked ("Authorised retail partner"). target markets include Germany, UK and AustraliaTesla is advertising Tesla electricity in Bavaria.

My excitement was curbed when the link sent me to octopus energy. I am not sure, what association they have with Tesla.

View attachment 691946

Powerwall users only.

UK:

Octopus' Tesla tariff (rate) needs solar (by anyone) & Octopus will organise Powerwalls

Octopus do vehicle leases inc Tesla

Octopus do various EV-friendly tariffs

Octopus have Kraken, similar to Autobidder

As previously stated - no legacy - all virtual, not corporate, not even an HR department, everyone empowered to do what they think is best. Downsides include some complaints (but lots of good reviews) including slow to swap out meters to allow for EV tariffs

Tesla Model 3 | Octopus Electric Vehicles

Lease a Tesla Model 3 with Octopus Electric Vehicles.

Octopus Energy (picture below)

Wife just walked into the room and asked 'What's up with the Tesla's burning in the garage?' In my mind, im thinking 'This is exactly why I'm retiring from $TSLA and you're still gonna be working'

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K