Listening some of the forecasting discussions here—Tesla has this valuation by then; does not!; does so!; nuh uh!; uh huh!—reminds me of a trick I developed back when I was hearing a variety of such back and forth discussions.

I like to mentally insert an "I can’t imagine how" when I was hearing someone say this thing couldn‘t happen or that thing would happen no earlier than such and so date.

It is a reminder to myself to see them for their background and to ask myself what they might be missing.

So as not to take a position on valuation, let me use the example of the Teslabot.

Let‘s say an engineer tells me that the bot cannot happen till at earliest a decade hence (yep, as I’ve said "decades" are a red flag).

What is it they cannot imagine happening? Let’s say they’re thinking about precise movements and maintaining that precision in the face of wear. They can’t imagine the materials being sufficiently good for sufficiently long perhaps.

Now they may even know about neural networks. Ones that might even be good enough to drive a car. Ones that are frozen after training, i.e. supervised.

But do they know how primates, say, deal with the fact that they have compliant effectors in bodies that are perpetually changing? Do they know what the cerebellum is and what it does (it’s hard for me to imagine that the bot will be able to function without the on-going tuning that it provides)? Do they know that there are models of it dating back more than four decades (CMAC, J. Albus, 1975)?

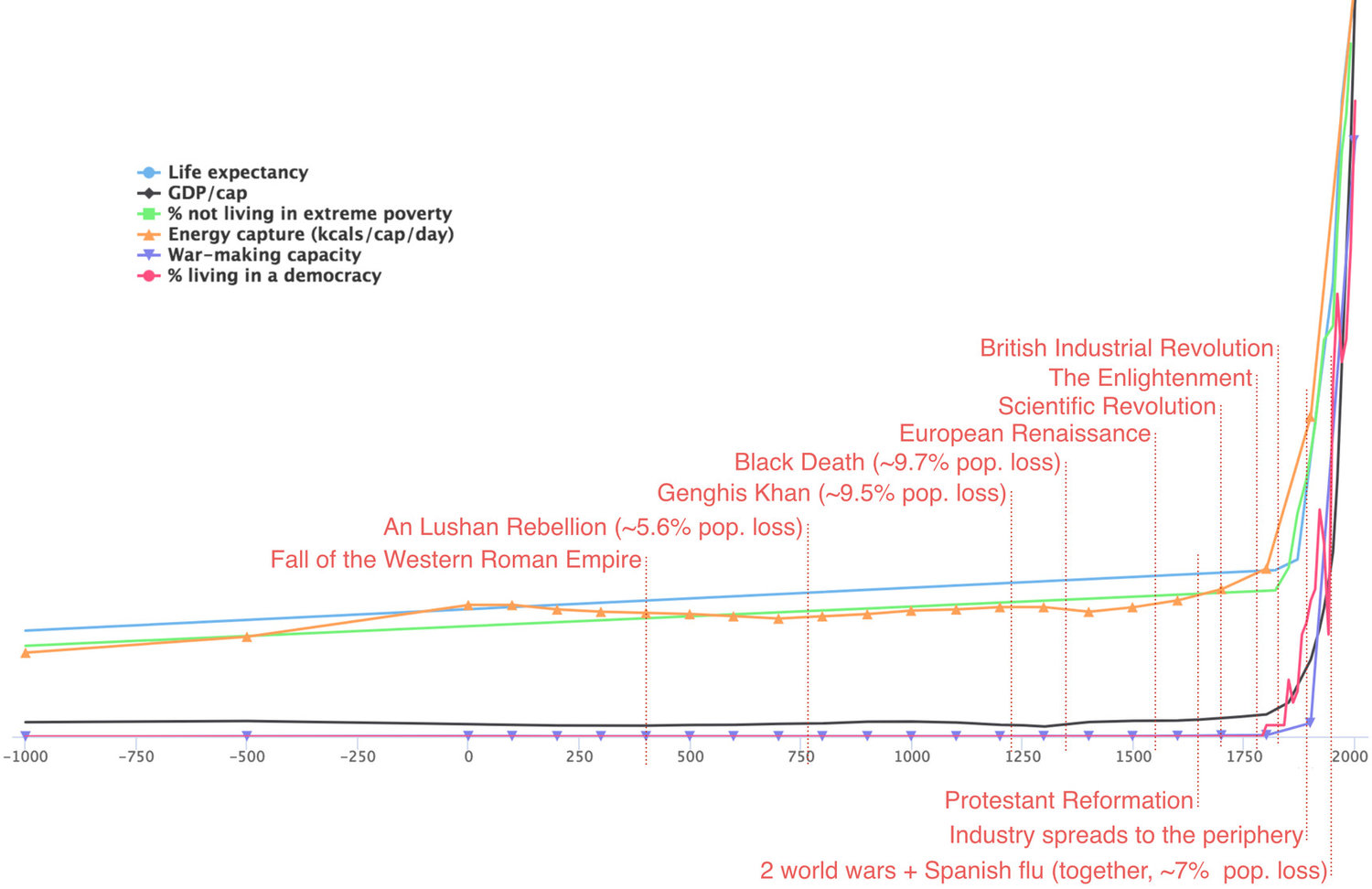

As for valuation, a year or two here or there matters less and less unless you are arguing we’re going to asymptote:

View attachment 715669

From the ever-lucid Vox, a straightforward but startling article that shows just how dramatic a turn recent human history has taken. An extract below: Luke Muehlhauser is a researcher who studies risks to human civilization. Last year, he embarked on an amateur macrohistory project:

www.thealternative.org.uk