RobDickinson

Active Member

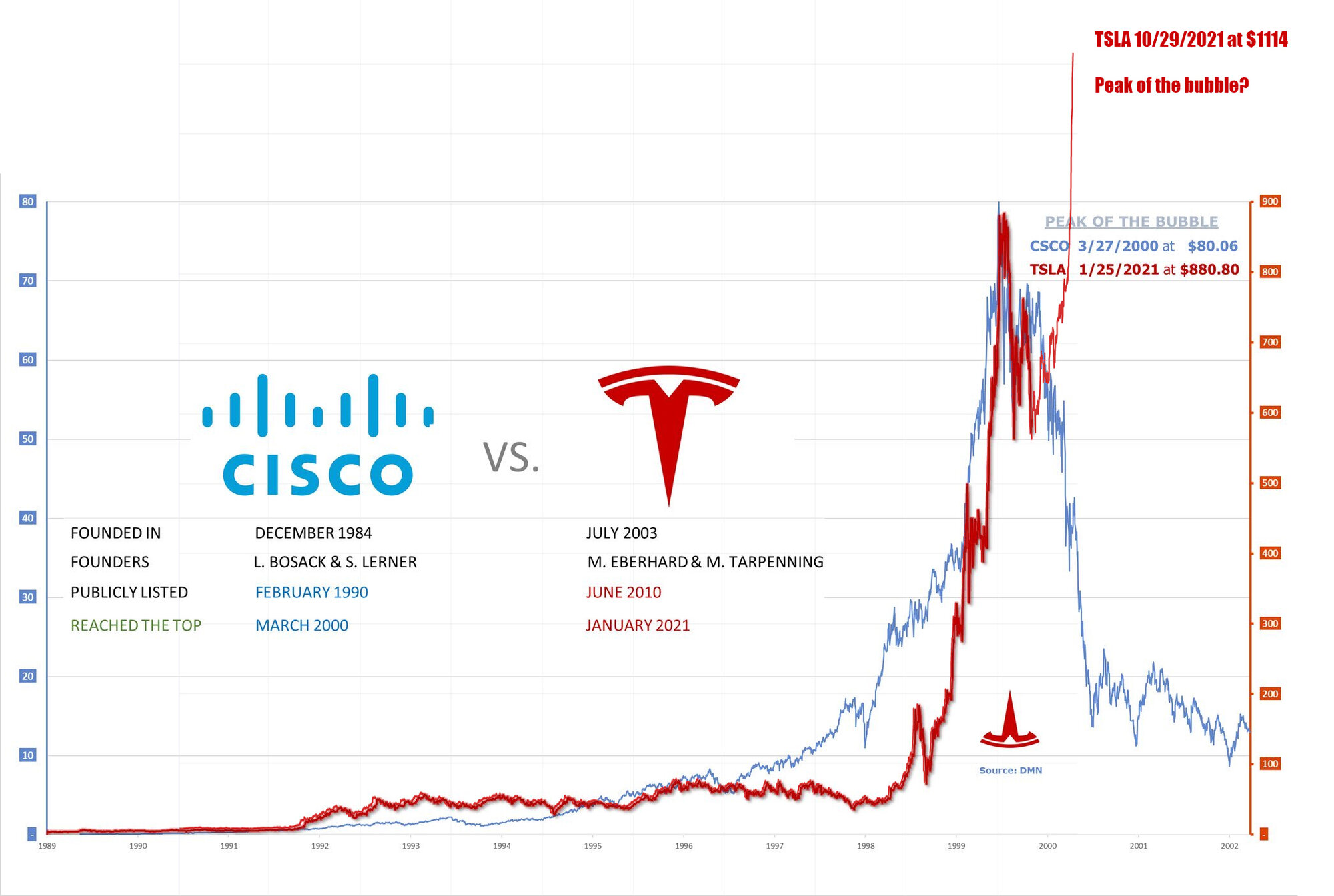

I call this one 'The peak?' A collab between tslaq and me

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

I deleted my post because I didn’t explain my situation well. Then I decided it wasn’t appropriate to ask for financial advice. But thanks for responding.@Prunesquallor wrote:

"The big fluctuations don’t make this easy."

Consider pricing out the cost of purchasing long-dated Puts for that nn% of your holdings. For example, if you only want to borrow 10% against the value, you'd select Put contracts at a strike price somewhere around 10% of the current SP (very cheap indeed).

This locks in the share value for an HLOC-type asset-based loans while costing very little. Again, if you want to borrow 25%, you need to buy puts at a strike price around one-quarter of the current SP. Another bonus is this is cheaper when the SP is high, and can provide years of price protection. Does get more expensive as volutility goes up, however.

For example, I can lock-in sufficient value for a AWD 7-seater Model Y on 300 shares at around a 25% strike price for around $460/yr. It costs more if you plege fewer shares, less if you plege more.

The interest is on top of this of course, lenders like it and my offer a better rate. You are insulated from SP flucuations for a fixed period of time, which you can roll forward at your pleasure. Then you have the luxury of buying cheap when the SP is high, while riding out the lows with a big SEG.

Cheers!

BE CAREFUL! Schwab told me they only match up exact options on their "disallowed loss" display, but that is not what the tax law says, as far as I know.I was confused about that as well, but it is what my account is showing. I am assuming since each option has a different ticker the account is seeing them as different securities, or the wash has passed a certain date (Is it 3mo?). It will/would be a nightmare trying to figure out the wash rules on a few hundred option trades if the brokerage calcs are wrong. My strategy was to sell weekly calls against my longer term long calls to get the most premium. My long calls got so itm that their gains were basically the same as the stock so I split them to two calls at roughly twice the strike. That gave me a new long call to sell a short term call against. If the stock would slow down I could at least get some of the short term permium, but there has been zero pull back so the long calls are gaining unrealized gains while the short terms ones are piling up losses, reducing my realized gains.

Well, my estimate seems to be the only one based on routine observation of key aspects affecting TSLA and the market, repeatedly, over time.

1332?

what did i win?

I think your very scientific projection is a tad high also. My mathematical analysis came up with $1420.42 at years end.Well, my estimate seems to be the only one based on routine observation of key aspects affecting TSLA and the market, repeatedly, over time.

Because of the science behind it my target number should be memeorized for future reference.

@Unpilot is on the right track in the recent response, though may be aiming a tad high.

@Oil4AsphaultOnly, @OrthoSurg and @insaneoctane deserve honorable mention.

So you HAVE been cooperating. That’s our lad.After working with several police agencies for about a year, I can kinda understand why …

Hmm, I’ve been planning on cleaning out my mess of prices and dates to Jan 23 leaps. Looks like I’ve got some homework before December.BE CAREFUL! Schwab told me they only match up exact options on their "disallowed loss" display, but that is not what the tax law says, as far as I know.

To be compliant, 30 days either side of the loss sale you can't have bought the security or its options. This is what I am using to control. I had been expecting to have to sell Jan '22 1000 and Mar '22 1100 calls for about $400K loss, and was preparing to embargo my buys, but we know how that is looking after this week.

I remember buying a bunch of CSCO at just under $80. It was one of my less brilliant trades.

I hate to settle for less, but, ultimately, it is hard to question numbers like that.I think your very scientific projection is a tad high also. My mathematical analysis came up with $1420.42 at years end.

Yeah, you need to go back and read what I wrote. I am pretty sure I was writing from the viewpoint of a non-tesla, climate change doesn't matter stance that the majority of the people believe today. I wasn't discussing facts. I was writing of perceptions and how people aren't going to buy cars to save the world. they are going to buy damn good cars. And That is the truth.Pooh poohing the acid rain problem to support your view is like Pooh poohing Covid. Thanks to a major effort many lives have been saved (with the ones saved often not knowing that they would otherwise have perished). similarly, acid rain was addressed successfully in an international effort. Check out the first link to see two US maps with the pH levels (Remember, a pH difference of 1 means 10 times the concentration in H3O+) with a time difference of 14 years.

Acid rain - Pollution, Effects, Solutions

Acid rain - Pollution, Effects, Solutions: Modern anthropogenic acid deposition began in Europe and eastern North America after World War II, as countries in those areas greatly increased their consumption of fossil fuels. International cooperation to address air pollution and acid deposition...www.britannica.com

The second link gives an overview of what has been done to achieve success

Lots of art of cathedrals and works of art have suffered from acid rain. Now I’m an agnostic atheist who thinks religion is not a good thing because it discourages people from scrutinizing their opinions instead of being open to being wrong and aligning one’s opinions with the one reality for all of us. I’m also a nerd and I don’t care about art at all. Yet both personal views are not a reason to cheer on acid rain.

I do acknowledge that different people value different things, and I don’t mind people going for an EV for the acceleration more than for its environmental benefits, but willful ignorance doesn’t go well with me. There is only one reality, and I hope that on this forum (and outside that) that reality is used as the benchmark. It is of essence for our TSLA investments and for our planet.

Here's the thing. And this applies in general to the Tax Credit for EV's. And I am not looking for a reply like, "Well they should have forced whoever to pay them a living wage.."I am third generation union — it is indeed part of my DNA. I believe in the fundamental tenets of unionism; good living wages and benefits.

More important than all of this is resolving climate change. Elon Musk and Tesla have led the charge, they have accomplished far more than any government in the world. President Biden should be seeking Elon’s advice and counsel, instead of placing obstacles in his way.

(What follows is not financial advice, and all numbers are rounded and in nominal Oct 2021 $USD without regard to inflation.)I took a peek in that thread and while there will always be potential for small pullbacks, I strong believe we're not seeing another repeat of 2021 for many years. The "P/E" contraction that was always going to happen at some point has happened, from 1,200 to 250(right after Q3 earnigns). Now because of Tesla's earnings scale and continued rapid earnings growth, even with the share price gaining 20-25%% every quarter, the P/E will continually drop. Maybe you get dips of 5-10% every now and then, but those hoping for 20-30% drops after rallies from here on out are probably in for a rude awakening.

There was a lot of room/buffer for the stock to move to the downside when it's P/E was 1,200, even 600. But now it's much tighter and that has big implications for how the stock will trade going forward.

I think @The Accountant $12 GAAP EPS for 2022 is baseline.

If Jame's estimates end up being closer to reality, then you're looking at $15+ GAAP EPS for 2022. Stock isn't pulling back in any significant way even at much higher share prices if that comes to fruition

I very much do think that Wall St will keep Tesla's forward P/E around range 150-200 for as long as Tesla keeps executing at 50%+ growth.(What follows is not financial advice, and all numbers are rounded and in nominal Oct 2021 $USD without regard to inflation.)

Dawning Awareness of the Juggernaut

What we are witnessing now I believe is primarily the market waking up to basic facts that were obvious to anyone actually paying attention to the data:

1) Tesla is selling cars far below the market clearing price even though gross margin ex emissions credits is tickling 30% (backlogs of 9-12 months for almost all products they sell)

2) The competition is floundering

3) Tesla's earnings power is going to explode moving forward now that we've hit enough scale to pass the break-even point with fixed costs and as new manufacturing efficiencies come into play in Austin, Berlin and Shanghai

4) Tesla can construct factories faster and cheaper than anyone in the entire manufacturing sector of the world economy

GAAP Earnings per Share EXPLOSION

FY 2018 ($1.1)

FY 2019 ($1)

FY 2020 $0.7

Q3 '21 was $1.6 (that's right, 2.3x the EPS of all of 2020 in one quarter)

> At Friday's $1128 after-hours close, that's annualized P/E of 170

By Q1 '22 it will roughly double again to at least $3

> $1128/share --> annualized P/E of 90

Look forward to Q4 '22 and we've got like $5 EPS

> $1128/share -->annualized P/E 60

Then supply pressures hopefully have eased by 2023/2024ish and Austin and Berlin have ramped substantially. Sometime in 2023 or 2024 quarterly EPS will have doubled again to $10.

> $1128/share --> annualized P/E only 30!!! About equal to Apple's P/E.

And this is just looking at the vehicle business.

What's a Reasonable P/E?

Realistically, P/E is likely to stay well above 100 while earnings grow this quickly.

P/E DCF Derivation

If you have an asset producing an income stream that starts at $1 in Year 1

...that grows 50% annually for 10 years

...then stabilizes for 10 more years

...with an 8% discount rate

---> The net present value of that asset is a whopping $181.

Hmm...that's about the same as the current P/E of 170 that we hit on Friday! This is fundamentally why the P/E for Tesla's growth trajectory will probably be at least 150. The only good reason the P/E would fall is either material increases in interest rates (and thus the discount rate) or an expectation in any year that there isn't a clear path for sustained 50% earnings CAGR for a decade out from that point. Doing a more detailed discounted cash flow analysis for Tesla's earnings growth produces approximately this same result, so this is good enough for rough estimates.

Plus, I believe the potential of FSD and Energy will be increasingly adding to valuation in the coming years. If so, the 50% earnings CAGR projection could be egregiously too conservative.

If that 150 annualized P/E is applied to when quarterly EPS hits $10 in 2023/2024, then we're looking at a $6,000 share price.

Conclusion

I believe any drop in the share price from this level will be a buying opportunity that lasts 6 months at most.

Except for small amounts to fund quitting my job, I'm not f^$%ing selling.

| Fleet Size | Connectivity @ 75% | FSD Sub @ 10% | FSD Sub @ 15% | FSD Sub @ 20% |

| 5,000,000 | $37,500,000 | $99,500,000 | $149,250,000 | $199,000,000 |

| 10,000,000 | $75,000,000 | $199,000,000 | $298,500,000 | $398,000,000 |

| 15,000,000 | $112,500,000 | $298,500,000 | $447,750,000 | $597,000,000 |

| 20,000,000 | $150,000,000 | $398,000,000 | $597,000,000 | $796,000,000 |

| 30,000,000 | $225,000,000 | $597,000,000 | $895,500,000 | $1,194,000,000 |

I think you may have suffered a concussion during that fall.12 O'Clock High.

Did some math. A prevent defense results in a guaranteed loss. So that is not going to happen.

Been reflecting on recent TSLA stock advances, so on the way to mountain biking (femoral artery adaptation) I said, "Play They Can't Take that Away From Me by June Christy." Thoughts being I don't know the future, but so far so good.

They were having a WWII (and some WWI) aircraft show at Redbird Airport (across the street from trail). I crossed everything I saw with the TSLA business performance and here are my thoughts.

The sun was blinding, hard to see this B-24 Liberator, but you could definitely hear it! Getting this picture made me think that Tesla is coming out of the sun. People hear noises, but they have no idea what is coming.

View attachment 727655

This is a B-17 Flying Fortress in silver, reminded me of Starship. There was a green one flying as well. Starship went together in a hurry...

View attachment 727659

Here are a 3 fighters. They go faster. More like Tesla. The shutter speed on the iPhone sometimes lumped all the prop blades on one side.

View attachment 727660View attachment 727661View attachment 727662

After looking up and squinting, I look at the trail. This is the warm up part:

View attachment 727664

About 2 hours in, I mis-time the loading of the fork at the top of a hill defined by a root bed. Go over the handlebars - landing on my back on the smooth, flat, level part of the trail where bike and rider are supposed to end if executed properly. I look up at the sky. It is beautiful!

View attachment 727666

This might be where the story ends. The most expensive part of the day was the trip to Trader Joe's on the way back home.

Somehow this picture from the beginning of the day has meaning. I walked past this Lexus while cleaning up after painting the transom on a 50 year old Laser sailboat.

View attachment 727667

Just trying to make it all make sense. Somehow it is getting close. Nice day. Go TSLA!

I wasn't going to post this until I reached a certain round number (not far to go now). For those who aren't aware, horrible histories is a children's' educational program/ book series. This song is about "the world's richest geezer", which is how some of us are feeling this week