Looks like that was from last month...

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StealthP3D

Well-Known Member

I've never posted a YouTube link before, but just saw this commercial on the Michigan-Michigan State game. In case I screwed this up, it's for the GMC Sierra hands-free driving feature. Like, they literally have words on the screen saying "Hands Free". I mean, good for GMC, but...

I wonder what Voldemissy Cummings thinks about this?

Oh, what a relief. Now whenever a GMC pickup crashes it will make national news with something like "A GMC pickup crashed into a patrol car parked on the side of the highway last night. The driver was taken to the hospital with non-life-threatening injuries and the officer escaped injury. It was not immediately clear whether GMC's hands free driving feature was engaged at the time of the accident."

Errr... wait... OK, maybe I'm dreaming.

StealthP3D

Well-Known Member

My estimate of TSLA price remains as always. I have no specific idea what it will be at any given date. That is why my successful strategy was and is to HOLD. My firm conviction is that the direction will be up for several more years. I sleep well.

Oh, come on...Stop pulling our leg! Everyone knows making a lot of money is a lot harder than that! How gullible do you think we are?

There are price ratios, analyst's rankings, Bollinger Bands, cups and handles, vampire strangles, over-bought/over-sold metrics, etc. etc. etc. Don't you want to increase your returns beyond what a dead person would get?

/s

You expressed that well, thank you. My strategy is clear: TSLA for the win. But my tactics... ahhh. I'm trying to optimize in the face of tax consequences. Waiting to exercise options rather than taking the profit now, stuff like that.I like that a lot but it actually over-states the case in the opposite direction. The happy medium is to be aware of taxes enough for it to figure into your general strategy but not let it rule your investment choices.

I kinda like orthoslug instead of @OrthoSurg ,Well, my estimate seems to be the only one based on routine observation of key aspects affecting TSLA and the market, repeatedly, over time.

Because of the science behind it my target number should be memeorized for future reference.

@Unpilot is on the right track in the most recent response, though may be aiming a tad high.

@Oil4AsphaultOnly, @OrthoSurg and @insaneoctane deserve honorable mention.

..you know the best place to hide50 bucks from an orthopod , right?

StealthP3D

Well-Known Member

I was confused about that as well, but it is what my account is showing. I am assuming since each option has a different ticker the account is seeing them as different securities, or the wash has passed a certain date (Is it 3mo?). It will/would be a nightmare trying to figure out the wash rules on a few hundred option trades if the brokerage calcs are wrong. My strategy was to sell weekly calls against my longer term long calls to get the most premium. My long calls got so itm that their gains were basically the same as the stock so I split them to two calls at roughly twice the strike. That gave me a new long call to sell a short term call against. If the stock would slow down I could at least get some of the short term permium, but there has been zero pull back so the long calls are gaining unrealized gains while the short terms ones are piling up losses, reducing my realized gains.

I don't want to get into a tax discussion here but it's important to realize you shouldn't rely on your broker to interpret the tax liability of your trades and I've never heard of a broker that represents their tax determinations to be reliable for tax purposes. I have a tax accountant so I don't have to worry about it but don't think that it's some kind of protection to follow your broker's lead when it comes to tax treatment because the IRS doesn't care how the mistake originated - they assume all errors are honest mistakes anyway (without evidence to the contrary). So you will still be subject to the same penalties and audit requirements such a discovery may trigger. The fact that the error may have originated with your broker means nothing. I'm not trying to scare anyone, just saying it's worth it to investigate the tax treatment with a qualified professional if you think it may help avoid tax problems.

.

2daMoon

Mostly Harmless

Good eye!I kinda like orthoslug instead of @OrthoSurg ,

..you know the best place to hide50 bucks from an orthopod , right?

View attachment 727670

Slug gets the kudos, taking back the gold star for Surg.

MindOverMatcha

Member

I Love this!!(What follows is not financial advice, and all numbers are rounded and in nominal Oct 2021 $USD without regard to inflation.)

Dawning Awareness of the Juggernaut

What we are witnessing now I believe is primarily the market waking up to basic facts that were obvious to anyone actually paying attention to the data:

1) Tesla is selling cars far below the market clearing price even though gross margin ex emissions credits is tickling 30% (backlogs of 9-12 months for almost all products they sell)

2) The competition is floundering

3) Tesla's earnings power is going to explode moving forward now that we've hit enough scale to pass the break-even point with fixed costs and as new manufacturing efficiencies come into play in Austin, Berlin and Shanghai

4) Tesla can construct factories faster and cheaper than anyone in the entire manufacturing sector of the world economy

GAAP Earnings per Share EXPLOSION

FY 2018 ($1.1)

FY 2019 ($1)

FY 2020 $0.7

Q3 '21 was $1.6 (that's right, 2.3x the EPS of all of 2020 in one quarter)

> At Friday's $1128 after-hours close, that's annualized P/E of 170

By Q1 '22 it will roughly double again to at least $3

> $1128/share --> annualized P/E of 90

Look forward to Q4 '22 and we've got like $5 EPS

> $1128/share -->annualized P/E 60

Then supply pressures hopefully have eased by 2023/2024ish and Austin and Berlin have ramped substantially. Sometime in 2023 or 2024 quarterly EPS will have doubled again to $10.

> $1128/share --> annualized P/E only 30!!! About equal to Apple's P/E.

And this is just looking at the vehicle business.

What's a Reasonable P/E?

Realistically, P/E is likely to stay well above 100 while earnings grow this quickly.

P/E DCF Derivation

If you have an asset producing an income stream that starts at $1 in Year 1

...that grows 50% annually for 10 years

...then stabilizes for 10 more years

...with an 8% discount rate

---> The net present value of that asset is a whopping $181.

Hmm...that's about the same as the current P/E of 170 that we hit on Friday! This is fundamentally why the P/E for Tesla's growth trajectory will probably be at least 150. The only good reason the P/E would fall is either material increases in interest rates (and thus the discount rate) or an expectation in any year that there isn't a clear path for sustained 50% earnings CAGR for a decade out from that point. Doing a more detailed discounted cash flow analysis for Tesla's earnings growth produces approximately this same result, so this is good enough for rough estimates.

Plus, I believe the potential of FSD and Energy will be increasingly adding to valuation in the coming years. If so, the 50% earnings CAGR projection could be egregiously too conservative.

If that 150 annualized P/E is applied to when quarterly EPS hits $10 in 2023/2024, then we're looking at a $6,000 share price.

Conclusion

I believe any drop in the share price from this level will be a buying opportunity that lasts 6 months at most.

Except for small amounts to fund quitting my job, I'm not f^$%ing selling.

On top of that, 50% is their safe estimate of CAGR. I think they did 70% + this year and are planning to do 70% a year for years to come.

Can't recall the exact video where Elon states this, but it may have been at the Giga Berlin festival or AI day.

Fact Checking on Tesla’s imminent cash flow explosion.

Although I would quibble with one of his points that fixed cost amortization improves with scale. For so long as Tesla grows at > 50%, they will always have lots of production lines ramping.

So fixed cost absorption can only be improved by growth slowing down, or production ramps being implemented more rapidly.

i.e. If production doubles every 20 months and it takes 10 months to fully ramp, then 33% of your lines will be in a ramping state, and fixed cost absorption will be suboptimal.

Although I would quibble with one of his points that fixed cost amortization improves with scale. For so long as Tesla grows at > 50%, they will always have lots of production lines ramping.

So fixed cost absorption can only be improved by growth slowing down, or production ramps being implemented more rapidly.

i.e. If production doubles every 20 months and it takes 10 months to fully ramp, then 33% of your lines will be in a ramping state, and fixed cost absorption will be suboptimal.

StealthP3D

Well-Known Member

So anyone thinking 2022 is going to be repeat of 2020 with those crazy 30-40% swings back n forth or 2021 where there's a huge blow off top and then long consolidation. I think you're going to be disappointed.

But I liked TSLA price action in 2020 (and the March COVID dip was the best!)! And 2021 is turning out pretty good too!

I don't think volatility is going to go away any time soon. It's the nature of any beast this disruptive.

Wicket

Member

Fact Checking on Tesla’s imminent cash flow explosion.

Although I would quibble with one of his points that fixed cost amortization improves with scale. For so long as Tesla grows at > 50%, they will always have lots of production lines ramping.

So fixed cost absorption can only be improved by growth slowing down, or production ramps being implemented more rapidly.

i.e. If production doubles every 20 months and it takes 10 months to fully ramp, then 33% of your lines will be in a ramping state, and fixed cost absorption will be suboptimal.

Are you considering that Tesla gave its projection for cap ex the next 2 years at I think 6-8b? It was basically 1b more than 2021.

I don't want to get into a tax discussion here but it's important to realize you shouldn't rely on your broker to interpret the tax liability of your trades and I've never heard of a broker that represents their tax determinations to be reliable for tax purposes. I have a tax accountant so I don't have to worry about it but don't think that it's some kind of protection to follow your broker's lead when it comes to tax treatment because the IRS doesn't care how the mistake originated - they assume all errors are honest mistakes anyway (without evidence to the contrary). So you will still be subject to the same penalties and audit requirements such a discovery may trigger. The fact that the error may have originated with your broker means nothing. I'm not trying to scare anyone, just saying it's worth it to investigate the tax treatment with a qualified professional if you think it may help avoid tax problems.

.

One really can't rely on ones tax accountant either, they can easily get stuff wrong. Mine has given us horrible advice. I would kind of prefer to have a financial advisor/CPA all rolled together at this point.

Your actual prediction was as follows. You didn't state the split amount, so it was ambiguous. So you got the ???Clearly there is an error in recording my prediction.....hence the ???

I am SURE I put in 2420.69

Thanks.

In that case we talking pre split price...cause I think we will get a split this year.

And when we do I am going for a 1069 price post split.

It looks like what is happening in my account even though it is not my intended purpose is accomplishing exactly what the wash sale rule was written to prevent. I think if I sell my gains that go with the losses that will eliminate that effect and I can use the brokers numbers since the adjusted basis for the options that are gaining should be the same as the wash sale that is not being accounted (I’ll show a net large realized gain instead of a small or negative one). It’s going to show eventually anyway because all my current option are less than 12mo expirery. Anyone have a favorite tax software they use? I’ve never generated this many trades in my life.I don't want to get into a tax discussion here but it's important to realize you shouldn't rely on your broker to interpret the tax liability of your trades and I've never heard of a broker that represents their tax determinations to be reliable for tax purposes. I have a tax accountant so I don't have to worry about it but don't think that it's some kind of protection to follow your broker's lead when it comes to tax treatment because the IRS doesn't care how the mistake originated - they assume all errors are honest mistakes anyway (without evidence to the contrary). So you will still be subject to the same penalties and audit requirements such a discovery may trigger. The fact that the error may have originated with your broker means nothing. I'm not trying to scare anyone, just saying it's worth it to investigate the tax treatment with a qualified professional if you think it may help avoid tax problems.

.

mars_or_bust

Member

Can donating towards a new university be considered a tax writeoff?

If so, this TITS initiative might become very real, with Elon providing billions very soon towards it, in the process paying much less upcoming taxes.

If so, this TITS initiative might become very real, with Elon providing billions very soon towards it, in the process paying much less upcoming taxes.

2

22522

Guest

Still trying to make sense of the world with respect to TSLA. In math this is something like a cross product. Every entity and experience is evaluated to see if some insight into TSLA can be gained. Here is an article from Inside EVs. I would put a link here, but a bunch virus scan windows popped up, so here is the important part of the text:

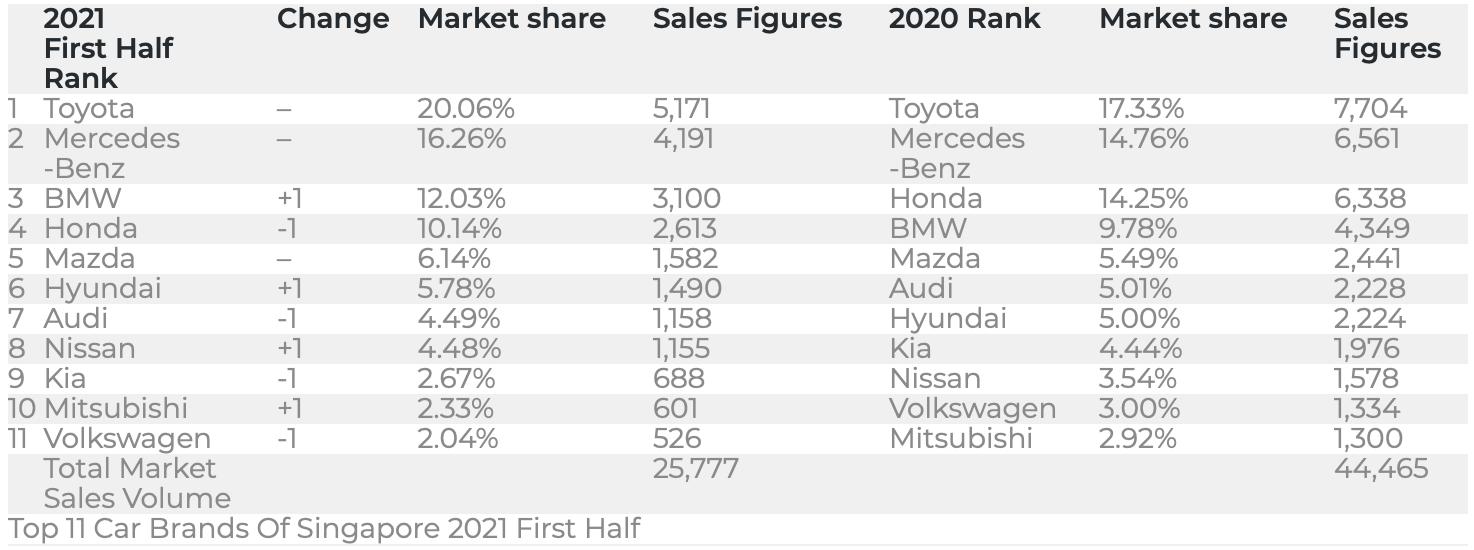

Besides the fact that the article is about Tesla, it is also about Singapore, where they are seeing remarkable success. Here is a list of what sells in Singapore.

So, obvious to anyone with the experiences I have had, crossing everything I encountered with TSLA over the last few Halloween days:

Toyota/Lexus is the ICE that may be hurt first. Besides all the obvious reasons outlined in the previous 12 O'Clock High post where I looked up and for some reason the sun got in my eyes. And for some unexplained reason my neck hurt at the end of the day...

A Lexus used to be the best car according to consumer reports. The gap in scoring when the LS400/450 was introduced was like the gap when they tested the Tesla Model S. There is a new king of that court.

The people who buy Lexi care about safety, reliability and power. Tesla has these.

If you consider the tactile experiences of steering a BMW E90 or earlier, or even the "as if on rails" experience with a Mercedes, those brands make memories - even "walked into the room" status memories. Lexus is just a good car that is nice in a powerful way. I don't think it makes memories as the others do.

So the Halloween imagery is that employees and distribution channels for Toyota will suffer first as a consequence of poor management decisions made by the people who are driving Lexus.

It all adds up. Once you see it, you can't unsee it.

The island city-state of Singapore, located in Southeast Asia, is widely regarded as the most expensive place in the world to buy a new car. Taxes and import costs (as well as emissions charges for non-EVs) result in cars typically costing around three to four times as much in Singapore as they would in the US. An entry-level Honda Civic for example retails at the equivalent of $83,000 there.

So, when Tesla entered the Singaporean market earlier this year locals weren’t expecting their cars to be cheap – even if their EV status meant they could dodge all the emissions charges. And they weren’t wrong, with a base Model 3 SR+ costing the equivalent of around $125k after all incentives have been applied and registration fees paid. Fancy a Model 3 Performance, perhaps with a few options? Prepare to fork out over $160,000 after you’ve paid your mandatory Certificate of Entitlement required for all new vehicles in Singapore.

Besides the fact that the article is about Tesla, it is also about Singapore, where they are seeing remarkable success. Here is a list of what sells in Singapore.

So, obvious to anyone with the experiences I have had, crossing everything I encountered with TSLA over the last few Halloween days:

Toyota/Lexus is the ICE that may be hurt first. Besides all the obvious reasons outlined in the previous 12 O'Clock High post where I looked up and for some reason the sun got in my eyes. And for some unexplained reason my neck hurt at the end of the day...

A Lexus used to be the best car according to consumer reports. The gap in scoring when the LS400/450 was introduced was like the gap when they tested the Tesla Model S. There is a new king of that court.

The people who buy Lexi care about safety, reliability and power. Tesla has these.

If you consider the tactile experiences of steering a BMW E90 or earlier, or even the "as if on rails" experience with a Mercedes, those brands make memories - even "walked into the room" status memories. Lexus is just a good car that is nice in a powerful way. I don't think it makes memories as the others do.

So the Halloween imagery is that employees and distribution channels for Toyota will suffer first as a consequence of poor management decisions made by the people who are driving Lexus.

It all adds up. Once you see it, you can't unsee it.

Last edited by a moderator:

The last time I opened a patient’s file was 3 weeks ago, that’s probably where your $50 and it will never be foundI kinda like orthoslug instead of @OrthoSurg ,

..you know the best place to hide50 bucks from an orthopod , right?

View attachment 727670

If I remember correctly internal med will never find a $100 if hidden in the wound dressing of their patient and the neurosurgeon will never find it if hidden on the face of their kids!

Now it’s time to get people estimates for stock price at the end of year 2022, let’s see where that slug can get you. Probably 2420,69

Last edited:

RobStark

Well-Known Member

Fact Checking addressed that in his tweets. I agree wholeheartedly with everything he said overall. Just with one minor quibble over one minor point.Are you considering that Tesla gave its projection for cap ex the next 2 years at I think 6-8b? It was basically 1b more than 2021.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M