Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Featsbeyond50

Active Member

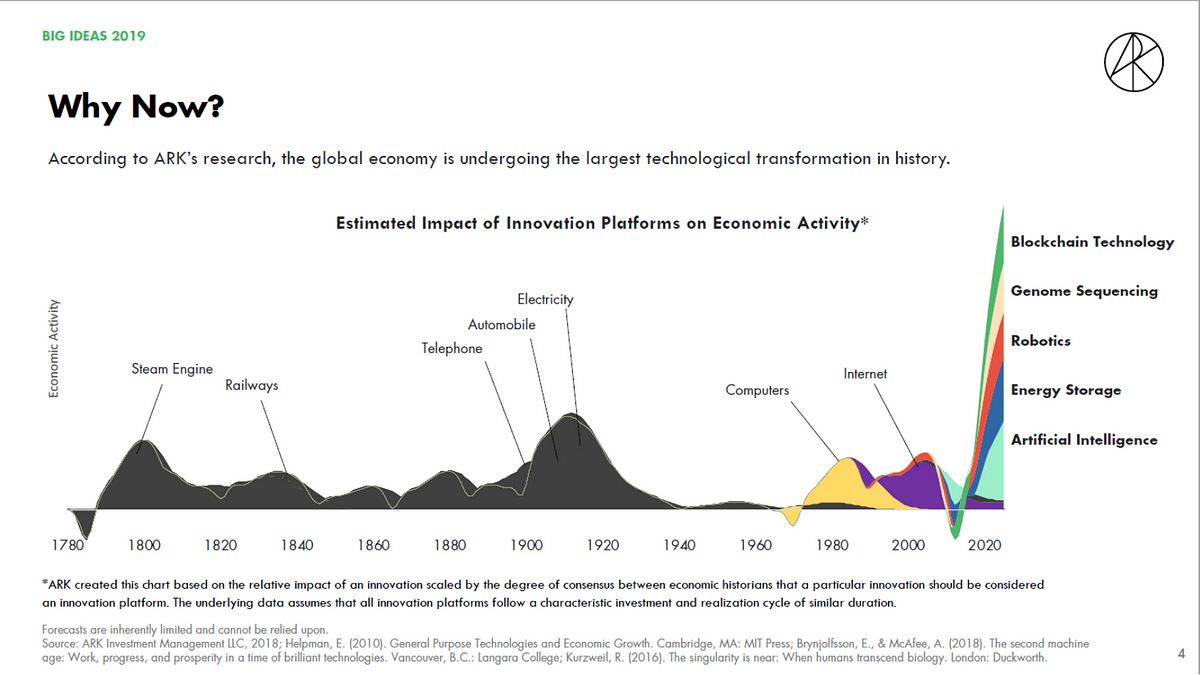

I agree completely with this. When I look at the holdings of the S&P 500 I see automotive and oil & gas companies that will be screaming for mercy over the next decade but I don't see them taking up a critical percentage that will lead to catastrophe. The S&P won't rotate them out as fast as they should but they will rotate them fast enough for mediocracy. I don't see the S&P being as vulnerable to fintech and biotech and ARK thinks.S&P has demonstrated just how slow it is to transition to the disruptive companies when they hemmed and hawed on TSLA even after they met all their criteria. I think in turbulent times like this the S&P will underperform as there are some real losers in there. Money is still doing a slow rotation out of the impacted industries and into the future. Investors putting their money into well run companies that will benefit from the transition into the technological age should outperform the S&P by a handy margin. Some of these industries benefitting will be traditional companies who are able to leverage technology to be leaner and more profitable. I do think the S&P will continue to have mostly positive years but, unless they suddenly become enlightened, returns will be very mediocre relative to the winners of the new economy. And that's going to hurt their reputation because, historically, the S&P has been good at focusing on the companies performing well and in their element.

In short, I don't think the S&P 500 will accurately represent market returns as well as they have in the past because investors and funds that pick stock will be able to outperform them. That has not traditionally been the case.

I will also add, controversially (cue the dislikes), that ARK funds are more likely to crash than the S&P. Cathie and her team are very sharp but the task of running a fund in today's environment is just too hard when there are only a few quality companies. They can't have a fund with just ten stocks so they have to fill there funds up with a bunch of junk. That junk will bring and end to the ARK glory days.

I continue to be dismayed at how ARK is rotating away from the companies I see as being quality and into the ones I see as junk. If I'm being honest with myself, I know everyone at ARK is probably smarter than me, but the more I look at it, I have to conclude they are buying too much into there own macro thesis and ignoring the lack of revenue & earnings growth and high & rising debt of the individual companies. Many are worth less than they owe.

Featsbeyond50

Active Member

I didn't know that. Dang!Now, you know the Brits have Skynet assigned to satellites already, right?

Maybe Skybet, in honor of the short term stock gamblers, or, the Hedgies and MMs who might get ... terminated?

I’m trying to reconcile how mainstream media is proclaiming EM man of the year after trashing him relentlessly throughout the year.

I think this reflects the fundamental problem of all news outlets. Bad news is instantaneous. Good news happens over long periods.

Want the big picture. Don’t look for it in the mainstream media. It’s not biased. It’s just short term thinking.

I think this reflects the fundamental problem of all news outlets. Bad news is instantaneous. Good news happens over long periods.

Want the big picture. Don’t look for it in the mainstream media. It’s not biased. It’s just short term thinking.

StealthP3D

Well-Known Member

Idle observation: almost 11 months go on Jan 25th TSLA traded intraday at $900.

Ah yes, those were incredible, heady days, eh? If only we could have that back! Er, wait, we do! I remember 11 long months ago the price climbed to an incredible $900 but, alas, it could only hold that for the briefest of moments.

Now that price is near the bottom of the channel, not the tippy-top! Funny how that works.

StealthP3D

Well-Known Member

I’m trying to reconcile how mainstream media is proclaiming EM man of the year after trashing him relentlessly throughout the year.

I think this reflects the fundamental problem of all news outlets. Bad news is instantaneous. Good news happens over long periods.

Want the big picture. Don’t look for it in the mainstream media. It’s not biased. It’s just short term thinking.

Mainstream media is not biased? Really?

This is the TMC forum, I think you might be lost.

Featsbeyond50

Active Member

Content doesn't matter. Clicks matter.I’m trying to reconcile how mainstream media is proclaiming EM man of the year after trashing him relentlessly throughout the year.

I think this reflects the fundamental problem of all news outlets. Bad news is instantaneous. Good news happens over long periods.

Want the big picture. Don’t look for it in the mainstream media. It’s not biased. It’s just short term thinking.

henchman24

Active Member

Interesting. What is the "big transition for Tech" that you think will be over in 3-4 years?

And what do you and others (@petit_bateau, @henchman24, @FrankSG) think of Cathie Wood's prediction that the S&P500 will crash because most of its companies will be disrupted by the five "platforms of innovation"? (I think that's what she said.)

I don't think the SP500 will crash, the gains are just going to be further and further consolidated into a select few companies and they are likely to underperform the greater market. As the outlook and dominant pieces of the market change, the SP500 will change... slowly.

StealthP3D

Well-Known Member

I will also add, controversially (cue the dislikes), that ARK funds are more likely to crash than the S&P. Cathie and her team are very sharp but the task of running a fund in today's environment is just too hard when there are only a few quality companies. They can't have a fund with just ten stocks so they have to fill there funds up with a bunch of junk. That junk will bring and end to the ARK glory days.

This ignores how the growth of the winners will be astonishing. This will more than make up for the laggards that go nowhere.

Funds that are a basket of stocks cannot have growth that astounds, that grow at many multiples of the overall market over long periods of time, but they still can still handily beat market returns. That is the point of ARK funds. If they could maintain 12-15% average annual growth over a long period, they will have done their job.

The long-term compound growth of 12-15% can be astonishing over longer time periods. Cash is a high-risk option (due to inflation), it does not grow over time, it shrinks.

this is somewhat related with big projects, Dr. Richard Perez of SUNY, Albany, NY, USA pointed out how the NE blackout and grid collapse of August 14-16, 2003This is actually a great post..........except instead of Steinbach, I would propose that Tesla already has the tools in their tool box to improve Arizona's water supply if we were to really approach this problem on a scale that the Infrastructure Bill/BBB originally deserved to face the Climate Crisis and our Grid concerns head-on. And they could do so by simply expanding on the concept of solar covered canals that have already been successfully deployed elsewhere, but do it on an 'Elon Scale' here. Solar covered canals coupled with Tesla battery storage solutions would improve the amount of water available to AZ residents, would increase the amount of renewable energy on the West Coast Grid, would reduce the amount of water needed from the Colorado River, and ultimately would provide a path to dramatically reduce the amount of CO2 emissions from the State of AZ. A couple years ago @jbcarioca and I had some fun conversations about this. It is late, the market has long been closed, and this is slightly on topic (thanks for the segue @SOULPEDL) so here we go:

About 35% of Arizona's water supply comes from a single source through the Central Arizona Project (CAP), which delivers the Colorado River water to Central and Southern Arizona. Its a 336-mile long diversion canal that runs through the desert to deliver approximately 500 billion gallons of water, lifting it up to 2,900 feet using 15 pumping stations that deploy a total of 115 giant pumps using 2.5 million MWh of electricity each year - the largest of these pumps can move 3,740 gallons per second. At the Mark Wilmer pumping plant alone there a six 66,000 horsepower pumps available for use as needed, each requiring 50 Megawatts of power, thus each pump requires more power than the entire city of Lake Havasu. This makes CAP the largest power user in Arizona. And from Wikipedia, "the canal loses approximately 16,000 acre-feet (5.2 billion gallons) of water each year to evaporation, a figure that will only increase as temperatures rise. It loses 9,000 acre-feet (2.9 billion gallons) annually from water seeping or leaking through the concrete."

View attachment 746557

I am simply going to assume that just about anyone reading this already has their hackles up regarding a few of the statistics above - most particularly that:

*the Central Arizona Project is THE LARGEST POWER USER in Arizona (read that again please just so it sinks in since it is rarely talked about)

*over 5 Billion gallons of precious Colorado River water simply evaporate along the route in the photo above, and this is happening while we are shown updates of water levels lowering at Hoover Dam almost weekly now. 5 Billion gallons is approximately enough water for 100,000 people annually.........and it just evaporates.

The combination of these two facts become really important when you consider that until just a few years ago almost all the power for the CAP project came from the Navajo Generating Station. This was a 2.25 Gigawatt coal plant located near Page, AZ that was operated until the end of 2019. The Navajo Generating Station received most of its coal from the Navajo Reservation about 100 miles away. From the information I could find, it looked like the majority of this system was in operation for roughly 30 years delivering coal-powered water from the Colorado River across the desert. And it takes a LOT of coal to get this water to the ends of the canal. If you assume that there is approximately 2,500 kWh per ton of coal, and the CAP used 2.5-million Megawatt hours per year............then the CAP project was literally using 1 Million tons of coal per year to move AZ's CAP water - roughly 8,600 rail cars worth of coal - which would have produced about 2.86 million tons of CO2 each year - not counting the CO2 from mining the coal and moving it 100 miles to the Navajo Generating Station. So while almost everyone is aware of the Arizona's water crisis, very few people stop to consider the Carbon Footprint and Global Impact of Arizona's water crisis..........which in my opinion far exceeds the water crisis itself. After the closure of the Navajo Generating Station in 2019, CAP power has been supplied by a mix of coal and natural gas power, and I have read that approximately 1% of the power supply also comes from solar...............? These last statistics I am having trouble nailing down and would gladly look to more knowledgeable folks on TMC for a sharper pencil here.

View attachment 746569

In a nutshell, a 336-mile long canal (approximately 80' wide at the surface, 30' wide at the bottom, and about 18' deep) following a route through high elevation desert where substantial amounts of electricity must be delivered to each pumping station along the route. Let's assume we cover the 80' wide canal with a 100' span of Tesla 420 panels. If we covered 100 miles of the CAP we would cover about 52,800,000 ft2 with 420's. If we throw 17 watts/ft2 at it, that 100 mile portion of the CAP could be generating up to 897.6 MW at peak solar production. Napkin math says the CAP is roughly using about 300 MW of power for the full system, so we are already able to put some surplus energy into storage during peak hours while taking Arizona's largest power user off the grid at that time (yes, lots of room for argument with these numbers - this is all 50,000' concept stuff on TMC - but please jump in and help me out where you can).

But lets say this happened on the Hornsdale Battery project-scale........that perhaps the 'Michael Cannon-Brookes of Arizona' tweeted Elon and asked him to cover 300 miles of the canal because he wanted to maximize solar production and energy storage capacity, and he wanted to minimize the amount of evaporation along the CAP by shading it with solar panels while using the water in the canal to help cool the underside of the panels to help raise their efficiency. That 300-mile stretch could create a 2.7 Gigawatt solar project that could take the CAP entirely off the grid with sufficient storage capacity.....and it could help supplement Arizona's increasing power demand..........and it could also significantly reduce the 5 Billion gallons per year that is currently evaporating from the CAP. (For reference the Phoenix area had a peak demand of about 7.6 GW during last summer's heat wave, which was about 2 GW higher than the peak of 2015).

All fun speculation, but all becoming well within 'the art of the possible' if moving the needle on reducing coal & natural gas CO2 emissions and saving water in the Colorado River while improving Arizona's water supply really do become important enough to tackle. All while not using any additional land to do so. Fingers crossed the 'Michael Cannon-Brookes of Arizona' tweets Elon about the potential for such a project soon.

View attachment 746579

(projects in India above) The first 1 km development was expected to save 9,000 m3 of water per year while producing 1.6 GWh of electricity

It has been taking a long time for PV and renewables to ramp.

Many people have been doing a lot of work for a very long time.

it would be interesting to see ARK fund performance minus TSLA ... Cathy was an early Tesla supporter , but to think all these disruptions will play out like Tesla is just naive... she references the Telecom/Tech bubble/bust of 2000 and all the companies not ready for prime time .. many of ARK picks are in the same boat in my opinion ....I agree completely with this. When I look at the holdings of the S&P 500 I see automotive and oil & gas companies that will be screaming for mercy over the next decade but I don't see them taking up a critical percentage that will lead to catastrophe. The S&P won't rotate them out as fast as they should but they will rotate them fast enough for mediocracy. I don't see the S&P being as vulnerable to fintech and biotech and ARK thinks.

I will also add, controversially (cue the dislikes), that ARK funds are more likely to crash than the S&P. Cathie and her team are very sharp but the task of running a fund in today's environment is just too hard when there are only a few quality companies. They can't have a fund with just ten stocks so they have to fill there funds up with a bunch of junk. That junk will bring and end to the ARK glory days.

I continue to be dismayed at how ARK is rotating away from the companies I see as being quality and into the ones I see as junk. If I'm being honest with myself, I know everyone at ARK is probably smarter than me, but the more I look at it, I have to conclude they are buying too much into there own macro thesis and ignoring the lack of revenue & earnings growth and high & rising debt of the individual companies. Many are worth less than they owe.

I looked hard at ARKx funds last year thinking maybe diversify a bit ... conclusion .... more TSLA

Featsbeyond50

Active Member

They keep selling their winners.This ignores how the growth of the winners will be astonishing. This will more than make up for the laggards that go nowhere.

Funds that are a basket of stocks cannot have growth that astounds, that grow at many multiples of the overall market over long periods of time, but they still can still handily beat market returns. That is the point of ARK funds. If they could maintain 12-15% average annual growth over a long period, they will have done their job.

The long-term compound growth of 12-15% can be astonishing over longer time periods. Cash is a high-risk option (due to inflation), it does not grow over time, it shrinks.

Knightshade

Well-Known Member

I’m trying to reconcile how mainstream media is proclaiming EM man of the year after trashing him relentlessly throughout the year.

I think the question misunderstands what man of the year means as Time uses it.

It's an award related to the individuals impact on things for that year- not if they're a good or bad person.

The award has gone to folks all across the spectrum from Stalin and Hitler on one end to Gandhi and MLK on the other.

StarFoxisDown!

Well-Known Member

Take note how they were told the same information as Gary was told and yet they won't put hard numbers in there such as Tesla stating the guidance for 1.5 million P/D for 2022.

Why?

Because they know they'd have to update their PT in a big way. As always, even the Bull side analyst clearly play the Wall St game. Hands down they're talking individually to big clients of their's and telling them the more specific information.

MTL_HABS1909

Active Member

I think it’s pretty obvious that Elon is selling today.

JRP3

Hyperactive Member

Put in a GTC order for 893 yesterday that just triggered. Did not expect that after the open this morning.

As frustrating as this Elon sell has been; I think we will look back and see what a gift it was (unless you’re holding short dated options).I think it’s pretty obvious that Elon is selling today.

It’s now clear that fundamentally this is a company worth more than current market price. Wall Street has voted on this in November.

Earnings growth, new factories and forward PE will backstop this sell off soon.

zach_

Member

Volume has been noticeably higher so far this morning than it has been recently, which stands out given the overall market volume is somewhat light.I think it’s pretty obvious that Elon is selling today.

StarFoxisDown!

Well-Known Member

I wouldn't have said that in the first 30 mins but these past 30 mins make it look like it is. It could also just be hedge funds testing the 100 day average.I think it’s pretty obvious that Elon is selling today.

I haven't been thrilled about how Elon chose to do this whole thing up until now but it's beyond stupid to schedule sell days before a holiday break if this is in fact a scheduled Elon sell. I think we like to think there's some broader set up or plan here by Elon but odds are the most basic one is the real reason. Which is simply that Elon got fleeced here by his Wall St brokers

Maybe Elon was annoyed because doing it privately, Wall St was asking for too much of discount. But they clearly have gotten an even bigger discount in the way Elon chose to do this.

Though to be clear, this could easily be hedge funds just trying to break the 100 day on week where they know it's light trading, it's just as likely as Elon selling.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K