Agreed and I think filling a complaint could be a good use of time: Broadcasting False InformationIt's one thing to get the Bitcoin/Free Cash Flow comment wrong . . . .I will give Andrew Sorkin (a communications major) the benefit of a doubt that he innocently does not understand the cash flow statement . . .BUT to call TSLA bulls sheeple is unforgiveable in my book. That was unnecessary. Does not sit well with me. If I am channel surfing and see Andrew on the screen, I will move on quickly to the next channel. Don't care for anything he has to say at this point.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

OMG, Q3 is going to be lit (not advice) and wow, if Q4 is $8.50 I'm honestly going to think about throwing a party at my house (that might be the negroni talking...)420k vehicles * ($18k current gross profit per car + $4k increase) - $1.7B OpEx

=

$7.54B net income before tax

$7.54B * (100% - 10% tax) / 1.15B shares outstanding fully diluted

=

About $6/share for auto

Energy finally showed positive 11.5% gross margin in Q2 with $100M income off $866M revenue. Megapack deployments projected by Tesla leadership to go up like 2-4x this year with Lathrop cranking up output. This should improve margins further with economies of scale and Wright’s Law for the manufacturing learning curve kicking in hard. Energy probably does $250M income by Q4 and $50M for services & other like in Q2.

Add that to math above and EPS goes to $6.13/share estimated, which is $24.52 annualized. If forward P/E is only 50 then TSLA is back at all-time high in the $1200s.

420k cars produced is conservative in my opinion.

If it’s actually more like this then we reach the $8/share high-end estimate @Discoducky shared. I also think if this happened then TSLA would trade at a higher forward P/E ratio because of the higher growth rate.

- Fremont should be at least at 140k

- Barely more than Q1 & Q2

- Shanghai at least 250k

- 71k rate in June * 3 —> 213k quarterly so this would be only a 17% increase

- This would leave a difference of 30k for Aus & Ber combined

- This is a rate they’re already approximately doing right now

- Guidance just given was for 5k per week each or 130k combined rate by end of year

- “I'm confident we'll get to 5,000 cars a week at -- in Austin and Berlin by the end of this year or early next year” - Tesla Technoking

- Accounting for growth from start to end of Q4, this corresponds to maybe 110k for Q4

Q4 2022 Estimates 300k Shanghai 150k Fremont 55k Berlin 55k Austin 560k Total Volume $63k ASP + Avg credit/car $150B Rev ($41k) Avg CoGS per car 35% Gross Margin $12.3B Auto Gross Profit $0.3B Energy + Services Profit ($1.7B) OpEx $8.50 Net earnings per share 80 P/E for Q4 $2,700 Stock Price

Not advice

I think this is why Elon says Tesla is "nothing" without FSD. While clearly Tesla is not "nothing", they will slowly just become a "car company" over time. (Let's ignore Solar/Energy for the moment). Of course they are a very well run car company and their profits and zero debt are very desirable.

The crazy P/E ratios of the past were because people were banking on the profits that we're now starting to see. Now that we're seeing the profits the P/E is adjusting to the new reality.

FSD, robotaxi and Bot are what will propel them into the stratosphere P/E wise. Personally I'm waiting for AI day 2 - Elon said on the earnings call that its going to be big.

To be extra clear, Elon did not exactly say Tesla is "nothing" without FSD. If I recall correctly, he said Tesla will be nothing in the future if it doesn't solve FSD while other companies do. This is pretty obvious, since cars/trucks with level 4 or 5 autonomy will obsolete nearly all those without it.

"Elon said Tesla is nothing" is a misinterpretation spread by FUDsters like CNBC (not you).

Indeed. Having a standing 'buy-back' policy would enable Tesla to take advantage of those frequent artificial/contrived dips in the SP (a few times per year). Thus, Tesla puts a floor on the SP, and may 'discourage' further monkey business going forward.

However, a continuous high SP works against some of Tesla's internal provisions for stock-based compensation (SBC), where employess are allowed to buy a certain amount of TSLA shares at a reduced price vs. the Market, but based on the lowest Market SP reached during the previous incentive period (2x per year, IIRC).

I think these two mechanisms can be made to work together. However, it does require that Shortzes continue to massively undervalue Tesla as a company (looking at egregious pink-buoy Craig Irwin/Roth Capital Partners). One of these parties will foot the bill, and that right shortly.

I like it. Make it so.

Cheers!

Here is the relevant excerpt from Teslas employee stock purchase program:

The employee stock purchase program is divided into six month time periods with two purchase dates: Feb 26th and Aug 31st.

First period is Sept 1 - Feb 26th

Second period is March 1st - Aug 31st

What is interesting is how Tesla determines the price for the shares.

Tesla looks at the closing price on the first and last trading days of the period. For the Feb purchase this could be Sept 1 and Feb 26th assuming both days are trading days.

Tesla then takes the lower of the two closing prices, applies a 15% discount on the lower price, and applies this share price as the purchase price for employees.

So the important dates are Sept 1st and Feb 26th, and also March 1st and Aug 31st. Since the dates are adjoining at the beginning and end of each period we can just focus on the purchase dates: Feb 26th and Aug 31st.

Here is how a beneficial stock buyback program could work:

For the time period Sept 1st to Feb 26th. Take the closing price on Sept 1st and apply the 15% discount that employees will receive. This will be the share floor that activates the buyback program. Between Sept 1st and Feb 26th anytime the closing share price breaks below this number Tesla may buyback shares.

This can be applied to the March 1st to aug 31st time period as well. The amount of the buyback would be up to Tesla to decide.

This works under the theory that, in the long run, Tesla will continue to grow and increase profitability so any drops in share price are temporary and likely exacerbated by Fud and shorting.

Here is the relevant excerpt from Teslas employee stock purchase program:

View attachment 832084

The employee stock purchase program is divided into six month time periods with two purchase dates: Feb 26th and Aug 31st.

First period is Sept 1 - Feb 26th

Second period is March 1st - Aug 31st

What is interesting is how Tesla determines the price for the shares.

Tesla looks at the closing price on the first and last trading days of the period. For the Feb purchase this could be Sept 1 and Feb 26th assuming both days are trading days.

Tesla then takes the lower of the two closing prices, applies a 15% discount on the lower price, and applies this share price as the purchase price for employees.

So the important dates are Sept 1st and Feb 26th, and also March 1st and Aug 31st. Since the dates are adjoining at the beginning and end of each period we can just focus on the purchase dates: Feb 26th and Aug 31st.

Here is how a beneficial stock buyback program could work:

For the time period Sept 1st to Feb 26th. Take the closing price on Sept 1st and apply the 15% discount that employees will receive. This will be the share floor that activates the buyback program. Between Sept 1st and Feb 26th anytime the closing share price breaks below this number Tesla may buyback shares.

This can be applied to the March 1st to aug 31st time period as well. The amount of the buyback would be up to Tesla to decide.

This works under the theory that, in the long run, Tesla will continue to grow and increase profitability so any drops in share price are temporary and likely exacerbated by Fud and shorting.

ESPPs are cool, but note this isn't unique to Tesla. I've worked at two different companies that had a similar ESPP. Only difference was the dates.

Last edited:

Didn't think it was especially different from any other ESPP. Was commenting more that a buyback program could coincide with the ESPP in the example I providedESPPs are cool, but note this isn't unique to Tesla. I've worked at two different companies that had a similar ESPP. Only difference was the dates.

Hock1

Member

Please. Enough with your hunches and gut feelings! Most of the veterans, and some who have learned quickly, know that hunches and gut feelings are rarely correct assessments of what the market is likely to do. And, do you honestly think that anyone reading this board is going to make an investment decision based on your (an unknown internet stock jockey's) gut feelings? And as long as I'm ranting, please everyone, give up the constant P/E analysis. P/E is a meaningless metric for a company growing at more that 50% CAGR. As I have said before, anyone who knows basic math can calculate a P/E and then obsess about it (a useless metric). Give it up, please.Ideally, yes, if the market allows it. My hunch is the MM's will do everything they can to hold the share price down from here on out, no matter how awesome Tesla becomes. And manipulating the PE is their best tool to do so by utilizing naked shorts and other stock manipulation tools they have.

It's just what I'm expecting to see play out over the next few years. We all have seen how much effort the MM's put into holding TSLA down, my gut feeling is that's not going to stop anytime soon...

TheTalkingMule

Distributed Energy Enthusiast

You want me to stop considering the ratio of share price to earnings? What should I base my investments on.....logos?Please. Enough with your hunches and gut feelings! Most of the veterans, and some who have learned quickly, know that hunches and gut feelings are rarely correct assessments of what the market is likely to do. And, do you honestly think that anyone reading this board is going to make an investment decision based on your (an unknown internet stock jockey's) gut feelings? And as long as I'm ranting, please everyone, give up the constant P/E analysis. P/E is a meaningless metric for a company growing at more that 50% CAGR. As I have said before, anyone who knows basic math can calculate a P/E and then obsess about it (a useless metric). Give it up, please.

Looking at PE relative to revenue and earnings growth should be the foundation of any discussion around share price. Just because the entire world is thinking about it irrationally doesn't mean I need to shift to some other metrics that are equally irrational.

Tesla is growing revenue and profits at an absurd rate, and are clearly going to continue doing so. Companies with these attributes in growth industries shouldn't have anywhere near an 80 PE. That's just simple "unassailable" logic. Any rational investor should simply stop there.

So I stop there. You do whatever you like.

Ok - My Price to P/E Graph earlier had mistakes :-(

I've fixed it up and I've extended it back as far to July 1 2020, so we have a full 3 years of data in it now:

It will be interesting to see how the P/E ratio moves over this Q.

View attachment 831948

Lets see how it compares with Amazon

From 6/30/2015->12/31/2018, PE went from infinite down to 72

Stock price went from 21-->75(split adjusted price)

The difference is vast. Tesla managed to compress PE down to under 100 with a P valuethat 20x while Amazon's P value from PE only 3x during that time. So the E part of the equation has Tesla beating out Amazon by a wide margin.

Bone head stock analysts have Tesla's earnings to be around 25 dollars by 2025. This is why they haven't open up the multiples further than they should. It's an absurd number considering annualized Q4 estimated EPS is already close to 20 dollars while Berlin/Texas continues to drag on margins.

I’ll bring Ring-Dings and PepsiOMG, Q3 is going to be lit (not advice) and wow, if Q4 is $8.50 I'm honestly going to think about throwing a party at my house (that might be the negroni talking...)

If this is not a falcing bullish sign, I don’t know what is.

Artful Dodger

"Neko no me"

The only roles I could see being acceptable to Deiss at Tesla would be as President (reporting to the CEO/Technoking) or as a Board Member. Also - Deiss may leave with a severance package that does not allow for him to work for a competitor for 1-2 years.

Why Did VW CEO Herbert Diess Get Fired? } Bloomberg.com (13 hrs ago)

VW's Billionaire Clan Plotted CEO Ouster While He Was on US Trip. Decision blindsided jet-lagged CEO under contract until 2025.

So, Deiss may be trying to escape...

Cheers to the Longs!

Last edited:

Imo value it on the net present value of the expected future earnings.You want me to stop considering the ratio of share price to earnings? What should I base my investments on.....logos?

Then we can debate about what discount rate to use and how much they will earn, but anything less than that is just being lazy.

Btw the net present value of the future earnings is highly dependent of the discount rate. That's why the present value shrinks fast with increasing interest rates.Imo value it on the net present value of the expected future earnings.

Then we can debate about what discount rate to use and how much they will earn, but anything less than that is just being lazy.

petit_bateau

Active Member

The problem with an NPV analysis and using discount rates is that anything more than a few years out gets factored away to near zero. Show me your shareprice and I'll tell you your discount rate.Imo value it on the net present value of the expected future earnings.

Then we can debate about what discount rate to use and how much they will earn, but anything less than that is just being lazy.

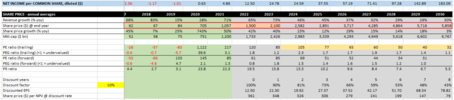

If one assumes that TSLA ceases growth in 2030 at a production rate of 20m vehicles/year and 1.5TWh/yr storage, and applies only a 10% discount rate to account for risk, then one gets this - look at the bottom half of the spreadsheet, the top half is more conventional PE/PR/PEG stuff:

Reduce that discount rate to say 6% and one gets this

And come down to 2% and one gets this

So ..... what discount rate do you fancy ?

I appreciate that hower one does a rational analysis there is an implicit discount rate in there, so one cannot evade the question entirely. I take the view that in the market there are a whole lot of different styles of fairly long term investors. Some only look at historical facts (i.e. trailing data), some look forwards. Some buy on PE metrics, some PR, some PEG. Because they all influence shareprice (even by their absence as buyers) I try to avoid a hypothetical future shareprice that creates too great a step function in any one metric. The result is the red outline bar in the above.

Looked at on a quarterly basis it is this:

Personally this all helps me as a buy signal, less so as a sell signal. At least right now, though that may of course change in the future.

Attachments

New article published yesterday with a click-bait “Warren Buffett”title. It does neatly summarize published comments made over the years by Musk and Buffett on each other, with no additional value for those who have been following their opinions on each other.

In summary, the article is saying they respect each other in what they are doing but have no financial Interest, which is what many investors already know.

Warren Buffett: Why I’d Bet Against Tesla (UNBELIEVABLE)

In summary, the article is saying they respect each other in what they are doing but have no financial Interest, which is what many investors already know.

Warren Buffett: Why I’d Bet Against Tesla (UNBELIEVABLE)

Last edited:

Gary Black has poor fundamental analysis compared to masters like Ron Barron and if he and his clients finds this little dip we've had the last several months troublesome, well, it's his own fault for taking on clients that don't understand reality and calling himself an investment advisor and/or fund manager. He's worse than a brokerage analyst and that's saying a lot.

Worse, he has fundamental misunderstandings about Tesla that run deep and wide. In short, he's an idiot. If you want proof, it's in the first Tweet above which makes absolutely no sense. Somehow, he thinks the F-150 Lightning launch is relevant to Tesla (and Twitter?). I get the feeling he thinks the fact that the Lightning launched before the Cybertruck is somehow a negative (as if they are each other's primary competition). I would argue the Lightning launch is completely irrelevant to Tesla's positioning in the market. How he thinks the Lightning matters to Tesla is beyond me.

I can't for the life of me figure out why any Tesla investors give two hoots about what he says.

Even if I agree with you, Gary Black is the closest thing we have to see inside Wallstreet analysts way of reasoning. We might not agree with the way Gary Black is expecting catalysts or negative factors but that’s probably how wallstreet sees events too.

Please. Enough with your hunches and gut feelings! Most of the veterans, and some who have learned quickly, know that hunches and gut feelings are rarely correct assessments of what the market is likely to do. And, do you honestly think that anyone reading this board is going to make an investment decision based on your (an unknown internet stock jockey's) gut feelings? And as long as I'm ranting, please everyone, give up the constant P/E analysis. P/E is a meaningless metric for a company growing at more that 50% CAGR. As I have said before, anyone who knows basic math can calculate a P/E and then obsess about it (a useless metric). Give it up, please.

Well that was a harsh post, surprised to see this sentiment here in this thread.

Analyzing PE ratios is an integral part of predicting future share prices. The trend over time is Tesla's PE has fallen gradually, and my "hunch" and "gut feelings" are a result of analyzing this declining trend and assuming the PE continues to fall on average (TTM) over time.

Predictions are impossible without making some assumptions, but in my opinion assumptions based on data and trends are always better than blind assumptions.

As to your question:

"Do you honestly think that anyone reading this board is going to make an investment decision based on your (an unknown internet stock jockey's) gut feelings?"

No, I don't, but the purpose of this very thread is to discuss TSLA investing and information, both statistical and predictive. Many investors here, most of who are "unknown internet stock jockey's", share their own models, assumptions, and beliefs on where the stock might go over time.

If you don't like that, might I suggest you stop reading this thread then?

Why would you accept as low as 10% discount rate, when stocks have returned an average of 6.5 percent to 7 percent per year after inflation over the last 200 years. 10% is barely that.The problem with an NPV analysis and using discount rates is that anything more than a few years out gets factored away to near zero. Show me your shareprice and I'll tell you your discount rate.

If one assumes that TSLA ceases growth in 2030 at a production rate of 20m vehicles/year and 1.5TWh/yr storage, and applies only a 10% discount rate to account for risk, then one gets this - look at the bottom half of the spreadsheet, the top half is more conventional PE/PR/PEG stuff:

View attachment 832178

The Accountant

Active Member

The problem with an NPV analysis and using discount rates is that anything more than a few years out gets factored away to near zero. Show me your shareprice and I'll tell you your discount rate.

If one assumes that TSLA ceases growth in 2030 at a production rate of 20m vehicles/year and 1.5TWh/yr storage, and applies only a 10% discount rate to account for risk, then one gets this - look at the bottom half of the spreadsheet, the top half is more conventional PE/PR/PEG stuff:

View attachment 832178

Reduce that discount rate to say 6% and one gets this

View attachment 832179

And come down to 2% and one gets this

View attachment 832180

So ..... what discount rate do you fancy ?

I appreciate that hower one does a rational analysis there is an implicit discount rate in there, so one cannot evade the question entirely. I take the view that in the market there are a whole lot of different styles of fairly long term investors. Some only look at historical facts (i.e. trailing data), some look forwards. Some buy on PE metrics, some PR, some PEG. Because they all influence shareprice (even by their absence as buyers) I try to avoid a hypothetical future shareprice that creates too great a step function in any one metric. The result is the red outline bar in the above.

Looked at on a quarterly basis it is this:

View attachment 832181

Personally this all helps me as a buy signal, less so as a sell signal. At least right now, though that may of course change in the future.

At an 11% discount rate, I get a share price of $1,865 at Dec 2022. This is the NPV of Cash Flow 2023 - 2042.

It's important to go out 20 years and then add a terminal value in year 21 ( I use 3 times year 20).

This is a lot of work and I short cut it a bit by doing a detailed 10 year forecast and then growing cash flow in years 11-20 by 10% tapering down to 5% as I get to year 20.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K