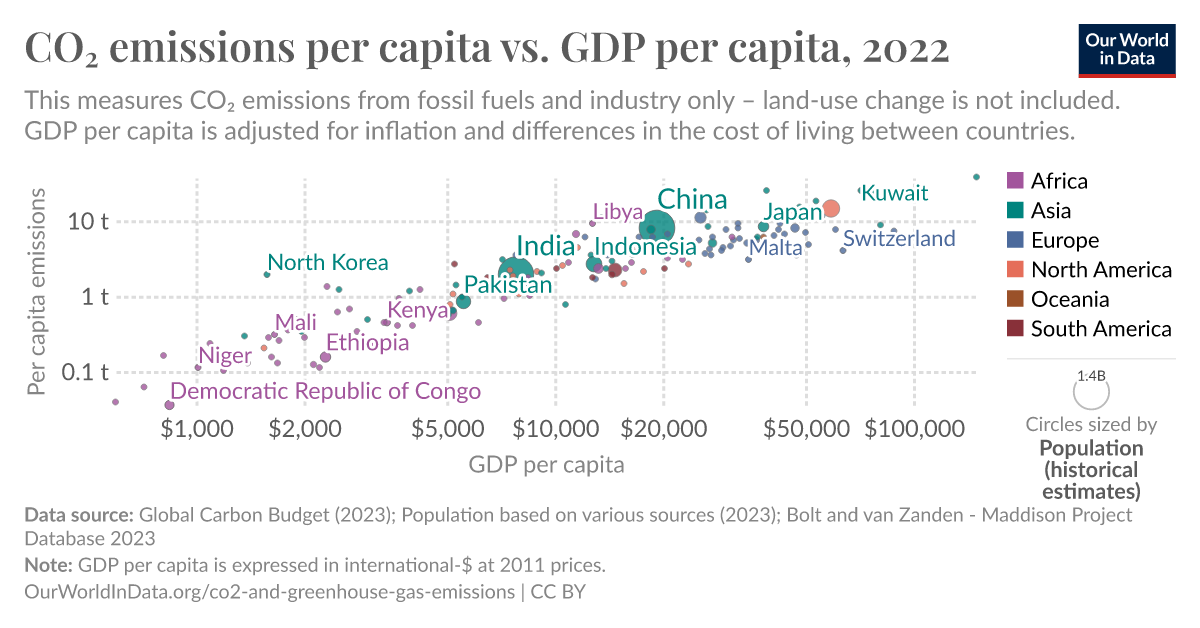

The most convenient dataset to examine for an answer to this is the CO₂ emissions per capita vs GDP per capita, which produces a nice graphic. This demonstrates that even other industrialised advanced economy countries comparable to the USA in GDP/capita terms (such as UK, Japan, South Korea, Germany) and with fairly similar economy mixes to the USA, manage to create their wealth in a far more energy-efficient manner than the USA, or Australia or Canada.

On the graph if you hover your mouse over the Oceania part of the key it will show you where NZ and Australia are, otherwise it is difficult to find Australia. This helpfully shows how much more energy-efficent NZ is in emissions terms.

My personal opinion, which a lot of data tends to support, is that the development of USA (etc) over the last few centuries to become what we see today is to a very great extent entirely because of cheap access to energy, plus a sufficiency of people/land/water. If the cheap energy had been absent then the economic (and other) development of these countries would have been very different, and the flyover belts would be even more sparsely occupied than they are. So it is a somewhat circular debate.

One can pick holes in such an opinion, but that tends to be a very marginal holepicking in my experience. However it is irrefutable that these particular countries are profligate consumers of energy and the resultant emissions. Wasteful is a word that some people get emotional about.

The trick is to get all countries (and all people) onto a different trajectory whilst there is still time to avoid the worst consequences of our (and my) historical actions.

This measures COâ emissions from fossil fuels and industry only â land-use change is not included. GDP per capita is adjusted for inflation and differences in the cost of living between countries.

ourworldindata.org