A short rant to say that Tesla Solar in Az is not ready for any volume ramps based on my experience a few times now. 2-3 day turn around on eMails, and the App just says "We will contact you shortly" since 2 weeks ago, so that channel isn't established yet. No need to drag on with details. IDK, maybe there's no need to ramp support - sad thought coming from Arizona. Just seems like 2 separate companies today. Hopefully in transition soon.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Might help Powerwall and Megapack demand and raise prices. I know, production constrained, not demand... but still...I'd disagree.... War in Europe is likely to bring a strong recession to the area and rationing of energy. Which directly impacts people's ability to purchase Teslas and if rationing gets extreme enough, it could hurt Berlin production over the winter. Overall economic issues can hurt people's ability to afford cars too... now I'd say Tesla is likely the single best positioned automaker to demand issues, but if an 08 event hit (I don't think it will), we could see some issues even with Tesla.

Also, under an earnings compression event... earnings can grow and share prices can still plummet. If 50x is the new 100x (and we've seen those events happen in the past), then you have to double earnings to maintain the share price. The overall wider market tends to control that.

I should be clear that I'm not worried about Tesla's performance at all. I don't see signs things are lacking on their performance.

TheTalkingMule

Distributed Energy Enthusiast

There's a lot going on in the background, especially in markets like AZ that still have a lot of utility sabotage built into their ecosystem.A short rant to say that Tesla Solar in Az is not ready for any volume ramps based on my experience a few times now. 2-3 day turn around on eMails, and the App just says "We will contact you shortly" since 2 weeks ago, so that channel isn't established yet. No need to drag on with details. IDK, maybe there's no need to ramp support - sad thought coming from Arizona. Just seems like 2 separate companies today. Hopefully in transition soon.

Elon says it's a priority tho and I believe him. Solar installations are a mind blowingly simple operation at their base, it's all the ancillary crap that trips up the process.

Give Elon til the spring and it'll be sorted I'd imagine.

henchman24

Active Member

Here's the second test of support of the day... really need a stronger rejection this time around.

Phew I'm glad someone finally chimed in with an optimistic take on the situation, that is sorely lacking in this threadMaybe other companies need that to be cost competitive, but we're not invested in those companies are we?

Maybe you missed it, but Tesla has been planning to massively expand domestic battery production for years. Every decision Tesla makes is oriented toward accelerating the transition to sustainable energy, which includes the subgoal of minimizing cost to earn more money for expansion and to ensure that the long-term affordability goals can be met. So this must mean Tesla believed domestic battery production in the USA and N America was going to be the minimum-cost solution before the 2020 elections that enabled this shift in American tax policy to be implemented.

Oh...would you look at that...Tesla explicitly said domestic battery production would be cheaper two years ago on Battery Day:

View attachment 855668

View attachment 855670

View attachment 855673

I looked this up and saw that Tesla has been issuing such bonds since 2018. Therefore, if anything, canceling the bond sale in March indicates a reduction in Tesla's appetite for debt relative to earlier years. Per the Bloomberg report (source), "Tesla started its ABS program in early 2018 and has issued seven transactions."

Debt has been declining for a while now. Note that the non-recourse debt for vehicle and energy product financing has been shrinking even as the fleet of vehicles and energy products has been growing explosively, so when viewed as a fraction of the whole the debt has really been falling fast.

View attachment 855681

Furthermore, why has Tesla been able to pay down all this debt so quickly? Hmmm...oh I remember, it's because of the firehose of free cash flow that has been growing and will continue to do so, making debt even more unnecessary in the future.

View attachment 855692

A business with such high capital requirements??????????? Are you looking at the same financial statements as the rest of us?

Tesla has only spent $12.7B in CapEx in total in the last 9 reported quarters, while building Berlin and Austin from the ground up in that time period and doing everything else. Tesla factories are cheap. Tesla R&D is cheap. Pretty much all Tesla capital investments are cheap these days. This must be true unless that $12.7B number is fraudulent.

As you astutely pointed out a few months ago, we are boning our customers hard with high vehicle prices and these morons keep falling for it and buying anyway. As such, the factories pay for themselves so quickly that interest rates are literally a rounding error in the economics. I posted about this just yesterday:

2daMoon

Mostly Harmless

Glad to see a bevy of HODLers responding appropriately to this horrendous dive in the SP.

ALdawg

Member

I am not an expert but it seems that the wait time for a car can be modeled using Queueing Theory. In my workplace we model the wait time for an expensive medical procedure using this methodology. When a resource (the factory or the medical equipment) is fully or nearly fully utilized, small changes in new demand (new patients or car orders) will dramatically increase wait times. There is a distribution of the rate of new arrivals (patient demand or new car orders). This distribution of demand will not allow you to utilize 100% of your capacity at all times without significant increase in wait times. Tesla of course could just make extra cars for export but a hospital cannot always find new patients during times that demand is slightly less than maximum. An increase in capacity to make cars will have an exponential impact on reducing wait times with constant demand. Bottom line is that Tesla’s significantly increased capacity should have non-linear impact on wait times with a constant demand distribution.

TheTalkingMule

Distributed Energy Enthusiast

Meh. I think this is perfectly natural tree shaking that inevitably turns to big volume buying. Hope it happens here too!Here's the second test of support of the day... really need a stronger rejection this time around.

Clearly the market bears narrative of the world ending because dad yelled at us again is not taking hold. Let the rally begin!

henchman24

Active Member

We will see... normally the more support is tested and the weaker the rejections... the more likely it is to break. This is a weaker rejection than the one we saw earlier today. Traditionally, not a great sign.Meh. I think this is perfectly natural tree shaking that inevitably turns to big volume buying. Hope it happens here too!

Clearly the market bears narrative of the world ending because dad yelled at us again is not taking hold. Let the rally begin!

Site capability request sent via Contact Use. Suggest others do likewise.NB I used to pay to be on this site. I stopped because I have to view replies to people I've put on ignore, making ignore a useless option because nobody here will leave the trolls alone. If the OWNERS of this site will fix it so I don't have to see replies to ignored members'posts I'll start paying again.

Won't Teslabot be the biggest inflation saver one day by lowering labor costs?How are the currency moves impacting your model on this quarter's financials, if at all?

Deflation is not an issue. If you want to see the FED really go hog wild, start giving negative prints on the inflation numbers, and they will dispatch a flock of helicopters to shower money.

Despite what the FED said yesterday, so much of that is punching market in the face for messing with what they are trying to do. If the CPI prints start coming in weak and economic indicators are plunging they will pivot on a dime.

...also if we'd come to our senses and vet wannabe immigrants, which would also grow the economy.

My mom lets me run her investing portfolio, so if she's giving you investing advice I suggest you ignore it.View attachment 855729

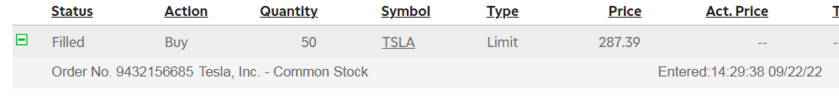

Bought more @$288...i am NOT going to let someone with a username of "YOUR MOM" influence me that Demand is falling off a cliff!!!!!!

Last edited:

henchman24

Active Member

Now that is better! At least getting a close above 11,100 would be good. Breaking the 11,140 range would setup tomorrow decently well.

StarFoxisDown!

Well-Known Member

This is a downright ugly trading day for TSLA and keeps getting more ugly as the day has progressed. Down 10X the S&P now. The “tree shaking” for TSLA will probably last until Thursday of next week………..funMeh. I think this is perfectly natural tree shaking that inevitably turns to big volume buying. Hope it happens here too!

Clearly the market bears narrative of the world ending because dad yelled at us again is not taking hold. Let the rally begin!

henchman24

Active Member

Tesla is down ~4% and SP500 is down ~1%... where are you getting 10x?This is a downright ugly trading day for TSLA and keeps getting more ugly as the day has progressed. Down 10X the S&P now. The “tree shaking” for TSLA will probably last until Thursday of next week………..fun

StarFoxisDown!

Well-Known Member

S&P is down .36%Tesla is down ~4% and SP500 is down ~1%... where are you getting 10x?

The Nasdaq is down 1%

TSLA down 4%

How did I miss the Forbes articles about Apple recalling every single phone they ever sold each and every day ?Holy Moses, Forbes with some delicious FUD!

I'll tell you what.....we've seen the FuD and TMC care bear trolls ramp up at various points in the past. All these are megabullish!

Hold onto your hat!

View attachment 855700

-- since there is always some apps that get an OTA update each day...

Last edited:

henchman24

Active Member

Was a bug on my ticker and was stuck at .96%, my bad!S&P is down .36%

The Nasdaq is down 1%

TSLA down 4%

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K