When it’s clear your model is wrong, but you keep using it because “hey, it’s MY model".

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Very good analysis, but I think the approach of comparing Tesla sales as a %age of the "EV market" gives a false picture, should be measured against the whole marketThe best predictor of future performance is past performance.

Enough 2022 data has become available to do some meaningful crunching. I've not completely finished that yet, and there are some minor inconsistencies that I either haven't scrubbed out or don't yet have good data to scrub out. (So please don't fuss about any minor data inconsistencies). The data sources are the same public domain ones as I have used in the past, for previous annual summaries that I have put out at this point in the year. Already there is some interesting stuff emerging.

Crucially this raises two interesting questions on the cell supply front, which I would appreciate the views of those who have dug further into that:

- Q1. Can the cell suppliers (and their mineral suppliers) continue to meet the total annual increases that the historical evidence suggests will continue to be met ?

- Q2. Can Tesla continue to capture at least a 20% market share of that cell supply for vehicle use ?

Let us be clear, Tesla is doing very well in growing the business. But also, and we must recognise this, so too are the aggregate of all the other auto makers and their corresponding supply chain partners.

In my analysis I only classify 'pluggable' electric vehicles as EVs, i.e. EV = BEV + PHEV. The fuel cell vehicles (FCEV) and the non-pluggable hybrids I just lump in with internal combustion (ICE) as they are rounding errors. First of all we can see that the overall vehicle market has substantially stabilised but not necessarily recovered. Dino-juice (ICE) vehicle production is now falling and there is a growing wedge of EV production making up the market. The pluggable hybrid segment (PHEV) is still growing but its growth is definitely decellerating and it is clearly going to be a dead-end for the mass-market PHEV fairly soon.

View attachment 908943

Looking more closely at the EV market here is the overall market situation at the end of 2022 with the corresponding market shares in tabular form. It is important both to understand the vehicle shares, and the cell supply shares. You can see in the battery/vehicle that all vehicles are trending towards a greater cell capacity, no surprise there. At this rate of cell/vehicle growth in another three years non-Tesla BEV will be at 60kWh vehicle pack sizes:

View attachment 908924

Or if you prefer graphical form this is the market share situation :

View attachment 908926

Tesla's share of the EV market peaked in 2019 at 17% by vehicle volume, and also in 2019 Tesla's share of EV battery supply peaked at approx 35-32%, and on both metrics Tesla's share has been sliding since, now (2022) being at 12% and 22% respectively. So one needs to recognise that Tesla has done an outstanding job of growing profitably, but also to recognise that in aggregate the other auto makers (and their supply chain partners) have grown their EV offerings even faster than Tesla since then, albeit the likelihood is that they have struggled do do so profitably in EVs.

This is relevant because the long-run dataset is now providing a good match for S-curve adoption models in a way that there was not sufficient data to meaningfully predict before. And the result is dramatic, with it being game-over by 2030 if the current adoption trajectory is sustained.

View attachment 908942

This S-curve (grey) is a three parameter logistics curve that has been history-matched against actual data (green) from 2010-2022 using a computerised 'solver' to get the least-error fit.

Previously it did not seem to me that there was sufficient data to get a reliable result, plus there was the added confusion of the Covid pandemic. But now that there is stabilisation observable - and significantly - the Covid pandemic has not been too disruptive for EV growth, then a sufficient match seems to be emerging. And it is going faster than was expected as the incumbent ICE manufacturers are trying; and as the new-entrant ICE and EV players are very competitively forcing the transition (the switch of BYD to a full-EV manufacturer is very important). Plus of course Tesla.

As a generalisation such a growth model is a good prediction tool provided that a new constraint does not impose itself on the scene, and the constraint that I think we need to be aware of is in relation to cell supply growth, and everything necessary to achieve that in terms of raw materials etc. So let us look more closely at that. I've circled two cells in red for 2024, but first observe that the overall growth rate is tending to trend down. The 345 GWh vehicular ccell capacity production adds for 2023 appear realistic given the achieved 208GWh production add for 2022, and note that there must be excess production add available - we know this because the stationary storage market is also growing.

(This tends to suggest that whilst Covid has had a discerbable effect of EV adoption, it has not been the cause of a 'catch-up' of excess capacity in 2022. My suspicion is that all manufacturers prioritised keeping EV lines going during Covid, and preferentially idled ICE lines whenever supply chain disruptions became unamanageable. That there was some impact from Covid is also discernable when one looks at the actual vs history match error term, but it is surprising how small it is. Overall I don't think the history match is being fooled by Covid artefacts.)

But the crunch year overall is 2024 where 756GWh of additional vehicle cell capacity is needed. If the 2024 growth rate of 92% can be managed then everything after that is easy. And the reason why it is so large is that this forecast now assumes a strong return to the previous size of vehicle market that had been over 90-million per year, specifically to 92m/yr in 2024, and so this flows down to the cell demand. And because in the past the cell manufacturers did meet the demand, then the question becomes will they do so again ? Especially noting that excess cell capacity, primarily LFP, is flowing into the stationary market. After all the best predictor of future performance is past performance.

View attachment 908944

The alternatives are:

- vehicle buyers will switch from BEV to ICE at the margin, and the 92m demand will persist but be met by dino-juice; or

- vehicle buyers wil postpone vehicle purchases until BEVs become available, and the market will become capped at approx 80m/yr for several years; or

- the average cell/vehicle trend will flatten through the supply crunch, with a mixture of small-pack BEV and small-pack PHEV competing against big-pack Teslas so keeping the >90m/yr vehicle count but failing on the cell-supply (bad news for wannabe US-pick-up-truck drivers migrating from ICE to BEV); or

- cell suppliers (and their mineral supply chains) will meet the challenge.

For the time being I tend to discard the option that vehicle productivity/utilisation metrics will increase, i.e. I am being pessimistic regarding the likelihood that autonomous vehicle technology will be significant in this time period. Opinions may differ on this.

Hence my posing the first question :

- Q1. Can the cell suppliers (and their mineral suppliers) continue to meet the total annual increases that the historical evidence suggests will continue to be met ?

Turning to the effect for Tesla the quick take is that if this S-curve does play out, then the maximum (best) outcome for Tesla is to achieve its own stated target of 20 million vehicles per year by 2030. There is unlikely to be significant market growth of EVs after 2030, perhaps even decrease if autonomous driving eventuates. So for Tesla to grow after 2030 would require Tesla to gain market share from other EV manufacturers at that point, which is a zero-sum game. However we then need to return to this table and note that on EV vehicles Tesla is down to 12% market share, therefore Tesla will have to recapture EV market share in order to obtain a approx 19-20% market share by 2030 that is implicit in the stated target of 20m/yr. To pre-emptively counter the valid response that the BEV market share is what matters, one really needs to look at the core underlying constraint which is the cell supply. Here the Tesla cell position is 22% at end of 2022, so still on track.

View attachment 908924

But equally one can see that the Tesla cell position has been declining from its peak, and has been declining at a rate of 2-4% per year. This is because the other manufacturers have been outperforming Tesla in sourcing cells (even if they have made some bad decisions, such as going for pouch). Nevertheless as a minimum Tesla will need to arrest that decline in the cell supply fraction and hold it above 20% for a decade if it is to achieve its 20m vehicles/year target. The reason why Tesla has to capture a >20% cell supply fraction in order to meet its vehicle ramp targets is because Tesla puts larger packs in its vehicles, so Tesla has to try harder.

At the level of a Tesla shareholder this does tend to focus the share price analysis down to 'only' the 2030 time horizon. And if one is as cautious as I am regarding the financial performance of the Tesla energy side of the business (and I'm no bear)*, then the vehicle side's performance over the next 7-years is critical. If the decay in Tesla's relative position continues then if the vehicle parameter stabilises at 12% of EV, then the Tesla vehicle quantity will be 'only' 10.5 million/yr in 2030, and even this would represent a turnaround in the rate and direction of the ongoing decline in the cell % share. Staying above a 20% cell fraction is crucial for Tesla shareholders !

Hence my posing the second question :

- Q2. Can Tesla continue to capture at least a 20% market share of that cell supply for vehicle use ?

These are absolutely dramatic rates of change we are witnessing, utterly transformative in a global sense for all humanity. At this point of course minor changes in trends might *sugar* things by a few years, or by a few tens of millions, but nonetheless the sheer scale and speed of what is going on is amazing. I've been working towards this for 30-years of my professional career in the wider energy sector, so it is very gratifying to see it coming to fruition. I am also a Tesla shareholder.

It is in that context that I pose the two questions I do.

* As an aside, by looking at the vehicle cell production add, one can see that global stationary storage uptake will really accelerate after 2025/2026. Until then the vehicle market will be the dominant cell growth driver.

petit_bateau

Active Member

Thanks.Very good analysis, but I think the approach of comparing Tesla sales as a %age of the "EV market" gives a false picture, should be measured against the whole market

I give the whole mkt numbers as well in the spreadsheets I have shown.

It gets to the same place as by 2030 there is only one market. And in the meantime the constraint is cell supply, hence the need to focus on the EV%. The question is how much market share does each company reach 2030 with as that is the period (the next 7-years) where one does the landgrab. After that gaining market share will likely be a zero sum game with difficult marginal profitability. If Tesla can capture 20% market share during the ongoing landgrab then it will have scale and position to sustain an Apple-style profitability for a considerable duration thereafter in the auto space alone (i.e. irrespective of what happens in energy and wider autonomy & whatever other stuff/services) which could conceivably be a stable outcome that last several decades.

I was wondering if anyone else has noted this pattern. It seems that when TSLA rises, SGML falls, and vice versa.

I saw an opportunity in that, particularly in the IRA account where there are no tax consequences.

I painfully liquidated my lifelong investment in TSLA (at $230) avoiding that not-so-sweet slide to the bottom and loaded up on SGML, which was climbing.

As SGML stalled, I moved into cash and in January re-entered TSLA at $123. The moral of the story is: Never get so emotionally attached to a stock that you cannot let it go when the charts and numbers scream to do so. There is no need to ride it to the bloody bottom.

~GETTING TOO EMOTIONALLY ATTACHED TO ANY STOCK CAN BE HAZARDOUS TO YOUR WEALTH~

I suspect our magic inverse relationship between TSLA and SGML might not be around too much longer with TESLAs potential takeover bid for SGML

seekingalpha.com

seekingalpha.com

May they both prosper!

I saw an opportunity in that, particularly in the IRA account where there are no tax consequences.

I painfully liquidated my lifelong investment in TSLA (at $230) avoiding that not-so-sweet slide to the bottom and loaded up on SGML, which was climbing.

As SGML stalled, I moved into cash and in January re-entered TSLA at $123. The moral of the story is: Never get so emotionally attached to a stock that you cannot let it go when the charts and numbers scream to do so. There is no need to ride it to the bloody bottom.

~GETTING TOO EMOTIONALLY ATTACHED TO ANY STOCK CAN BE HAZARDOUS TO YOUR WEALTH~

I suspect our magic inverse relationship between TSLA and SGML might not be around too much longer with TESLAs potential takeover bid for SGML

Tesla weighing takeover bid for Sigma Lithium - Bloomberg (NASDAQ:SGML)

Sigma Lithium (SGML) +26.4% post-market after Bloomberg reported Tesla (TSLA) has been considering a takeover of the company

May they both prosper!

Attachments

Last edited:

I was wondering if anyone else has noted this pattern. It seems that when TSLA rises, SGML falls, and vice versa.

I saw an opportunity in that, particularly in the IRA account where there are no consequences.

I painfully liquidated my lifelong investment in TSLA (at $230) avoiding that not-so-sweet slide to the bottom and loaded up on SGML which was climbing.

As SGML stalled, I moved into cash and in January re-entered TSLA at $123. The moral of the story is: Never get so emotionally attached to a stock that you cannot let it go, when the charts and numbers scream to do so. There is no need to ride it to the bloody bottom. ~GETTING TOO EMOTIONALLY ATTACHED TO ANY STOCK CAN BE HAZARDOUS TO YOUR WEALTH~

I SUSPE

Enjoy your trading. Glad it worked out for you, but sometimes it doesn't. Trying to time the market and thinking you're smarter than the market can backfire spectacularly as well.

Cool. Was just going to post the same. In the twitter comments, someone says Magnis has "the greenest graphite; pioneers of chemical free purification" for whaterver its worth..

A bit off topic - does anyone have an opinion if this could still be traded? There is a trading halt till tomorrow or announcement (whichever comes first). If I place an order now, would you expect the stock goes up for a couple of days or longer so it is tradable or would I likely pay peak price and not much of an appreciation afterwards?

I was wondering if anyone else has noted this pattern. It seems that when TSLA rises, SGML falls, and vice versa.

I saw an opportunity in that, particularly in the IRA account where there are no tax consequences.

I painfully liquidated my lifelong investment in TSLA (at $230) avoiding that not-so-sweet slide to the bottom and loaded up on SGML, which was climbing.

As SGML stalled, I moved into cash and in January re-entered TSLA at $123. The moral of the story is: Never get so emotionally attached to a stock that you cannot let it go when the charts and numbers scream to do so. There is no need to ride it to the bloody bottom.

~GETTING TOO EMOTIONALLY ATTACHED TO ANY STOCK CAN BE HAZARDOUS TO YOUR WEALTH~

I suspect our magic inverse relationship between TSLA and SGML might not be around too much longer with TESLAs potential takeover bid for SGML

Tesla weighing takeover bid for Sigma Lithium - Bloomberg (NASDAQ:SGML)

Sigma Lithium (SGML) +26.4% post-market after Bloomberg reported Tesla (TSLA) has been considering a takeover of the companyseekingalpha.com

May they both prosper!

But...you simply got lucky?

You had no idea that it would work out like it did for you at the time you sold all of your TSLA and moved it all into SGML. What if it had gone the other way? Which it very well could have of course, $230 could very easily have been the TSLA bottom. Luck played a huge factor in your profits here.

Timing the market can be profitable, but it's never a guaranteed thing and it's very easy to lose out when trying to time it like this. Most of us don't HOLD due to emotional attachments, we HOLD because it simply works long term.

The old adage holds very true: "Time in the market beats timing the market."

Agree. But ever since I dumped my broker, years ago, who had that same attitude, I have, with a little effort, been spectacularly blessed or spectacularly lucky.Enjoy your trading. Glad it worked out for you, but sometimes it doesn't. Trying to time the market and thinking you're smarter than the market can backfire spectacularly as well.

Take for example, last week. It doesn't take a lot of brainpower to realize that TSLA stock is going to take a hit with the announcement of a "recall". albeit invalid (Only 16% of Tesla's have FSD, it can be changed with a quick software update, and the public doesn't know that the female fighter pilot in charge of the NHSTSA has a case of the ass for Elon). I was fortunate to be in front of the computer when it came across my newsfeed. It had not yet hit the Stock feed, so I immediately sold IRA TSLA at $215. I bought the same number of shares back Friday morning for $202. It's not rocket science. It just takes a little interest and common sense and unfortunately, I currently don't have the time to study the market all day either, but trading on breaks while doing some meaningful volunteer work.

Do I take a risk? Of course, we all do. You don't think it made me anxious last week, when Musk announced he was worn out and overwhelmed by working day and night, seven days a week at Twitter and he couldn't handle it anymore. Did you ever imagine what the immediate effect to TSLA sfock would be if Elon wasn't around? Of course, it would bounce back, because it is essentially running on it's own now, but it's all about the media spin and the public perception (TESLA without Musk is a day without sunshine) and remember Tesla doesn't have a PR department to right the ship. It's a good argument for diversity, but. then again, I'm a risk taker and 73% in TSLA at present. And long-term holders are too. They risk missing out on taking advantage of the ups and downs.

With the market fall last week, a close investor friend told me he was feeling too heavy into TSLA and was going to pull out 30% to invest elsewhere. I challenged him to tell me one other stock that will rebound as fast as TSLA. He was silent.

Agree. But ever since I dumped my broker, years ago, who had that same attitude, I have, with a little effort, been spectacularly blessed or spectacularly lucky.

Take for example, last week. It doesn't take a lot of brainpower to realize that TSLA stock is going to take a hit with the announcement of a "recall". albeit invalid (Only 16% of Tesla's have FSD, it can be changed with a quick software update, and the public doesn't know that the female fighter pilot in charge of the NHSTSA has a case of the ass for Elon). I was fortunate to be in front of the computer when it came across my newsfeed. It had not yet hit the Stock feed, so I immediately sold IRA TSLA at $215. I bought the same number of shares back Friday morning for $202. It's not rocket science. It just takes a little interest and common sense and unfortunately, I currently don't have the time to study the market all day either, but trading on breaks while doing some meaningful volunteer work.

Do I take a risk? Of course, we all do. You don't think it made me anxious last week, when Musk announced he was worn out and overwhelmed by working day and night, seven days a week at Twitter and he couldn't handle it anymore. Did you ever imagine what the immediate effect to TSLA sfock would be if Elon wasn't around? Of course, it would bounce back, because it is essentially running on it's own now, but it's all about the media spin and the public perception (TESLA without Musk is a day without sunshine) and remember Tesla doesn't have a PR department to right the ship. It's a good argument for diversity, but. then again, I'm a risk taker and 73% in TSLA at present. And long-term holders are too. They risk missing out on taking advantage of the ups and downs.

With the market fall last week, a close investor friend told me he was feeling too heavy into TSLA and was going to pull out 30% to invest elsewhere. I challenged him to tell me one other stock that will rebound as fast as TSLA. He was silent.

Making trades with a small portion of your position is one thing and I agree there are times when the stock seems to behave predictably in the short term. I do this myself from time to time. But in your first post you said you "liquidated my lifelong investment in TSLA (at $230)" and re-entered at a lower point. That strikes me as very risky indeed, because you may miss your re-entry point or the stock may have other ideas and start suddenly rising unexpectedly instead of falling. If it's a small portion of your holding then "oh well", otherwise there's the possibility of not ever being able to buy back in without taking a large loss.

Last edited:

Creekstalker

Member

Think he'd be telling us this story had it gone sideways? Or shared his winning plays on the front end instead of a week later?Making trades with a small portion of your position is one thing and I agree there are times when the stock seems to behave predictably in the short term. I do this myself from time to time. But in your first post you said you "liquidated my lifelong investment in TSLA (at $230)" and re-entered at a lower point. That strikes me as very risky indeed, because you may miss your re-entry point or the stock may have other ideas and start suddenly rising unexpectedly instead of falling. If it's a small portion of your holding then "oh well", otherwise there's the possibility of not ever being able to buy back in without taking a large loss.

FastEddieB

Member

Or a vast underwater plain topped by the Britton Seamount.

Thanks! Even as Florida escapee, I had to look that up. I was under the impression Mt. Dora was the highest point in Florida and I just learned into not even in the top 10! Live and learn…

I agree with you on that point and it's largely circumstantial. I am not trying to be arrogant, but my stocks are not my sole means of support, so I can assume a lot more risk. I have retirements that provide me more support than I need, so I do tend to be considerably more of a risk taker than the average investor.Making trades with a small portion of your position is one thing and I agree there are times when the stock seems to behave predictably in the short term. I do this myself from time to time. But in your first post you said you "liquidated my lifelong investment in TSLA (at $230)" and re-entered at a lower point. That strikes me as very risky indeed, because you may miss your re-entry point or the stock may have other ideas and start suddenly rising unexpectedly instead of falling. If it's a small portion of your holding then "oh well", otherwise there's the possibility of not ever being able to buy back in without taking a large loss.

I love one of my investor friend's attitudes, "I want to amass as much money in my life as I can, and die penniless." He gives so much to so many.

Investing in the market is really sanctioned gambling. And, as you know, risk-taking can be addictive and self-reinforcing and one has to respect its power. One should never gamble more than one can afford. I personally have no interest in margins, bitcoins, or any of the like. I also believe in having less than 10 stocks. I can't devote the time necessary to adequately manage anymore.

It does take some energy to make wise decisions about the market. I have an investment partner who is a chart hound and I tend to be a news hound, so we make a pretty good team, and we communicate often throughout the day. Over the past few years, we have quadrupled what we would have had with a standard broker mentality. Our combination works for us. For example, he may say, CARVANA looks great on the charts and I may respond with an article on their impending bankruptcy.

Several articles have been written about people who devote their lives to managing the market and the results are usually only 2-3% above those who let "time" do the work. We have done much better than that, of course,, largely attributable to TSLA.

We then share our information by getting young veterans to get their money out of low-interest-bearing accounts and into the market. We advise them with the information we have, and they all appear to be doing quite well. Many of them rode the TSLA-SGML interaction of which I spoke, with a huge smile. They knew the risk and they are happy with the result. Of course, we make miscalls. We have had numerous flubs along the way. Don't we all? Let's talk Lemonade, Roku, Carvana, and any of the crazy pharmaceuticals, which we have learned to avoid.

Thanks for the dialogue. It all makes us better at what we do!

FastEddieB

Member

Investing in the market is really sanctioned gambling. And, as you know, risk-taking can be addictive and self-reinforcing and one has to respect its power. One should never gamble more than one can afford. I personally have no interest in margins, bitcoins, or any of the like. I also believe in having less than 10 stocks. I can't devote the time necessary to adequately manage anymore.

I had a gambling problem in my family for many years and attended GamAnon meetings weekly*.

It was recommended that the gambler not “play” the stock market, for the reasons you suggest. Day trading is especially addictive.

But I’m not sure I agreed with the recommendation - buying a conservative stock or stocks or mutual funds and holding them while reinvesting dividends is such a wonderful way to amass wealth that it seems a poor choice to deny compulsive gamblers that opportunity. Investing is not inherently gambling, but it’s easy to see - right in this very thread - the psychological compunctions that lead to compulsive behavior Involving stocks and options.

*I’m not sure 12 step programs are the panacea that some hold them out to be. I was witness to so many failures in my time in the program that I have little faith in them, at least as regards compulsive gambling.

BTW, I shared ALL of this info on the SGML and TSLA connection on this forum, on multiple occasions, as it was taking place, and you guessed it. All I got was about 30+ THUMBS down. (Look it up) To each their own. Everyone here had the same opportunity to play, but there comes a point when you enact grandma's rule. "Never try and teach a pig to sing, it just frustrates you and irritates the pig." And BTW, I share the losses, as well as the wins. It only helps us to be better at what we do.Think he'd be telling us this story had it gone sideways? Or shared his winning plays on the front end instead of a week later?

Interesting that a number of these refer to dataset size/accuracy/labeling improvements. Moreso than I recall in previous release notes, based on my admittedly casual perusals.FSD Beta v11.3 Release Notes

- Enabled FSD Beta on highway. This unifies the vision and planning stack on and off-highway and replaces the legacy highway stack, which is over four years old. The legacy highway stack still relies on several single-camera and single-frame networks, and was setup to handle simple lane-specific maneuvers. FSD Beta’s multi-camera video networks and next-gen planner, that allows for more complex agent interactions with less reliance on lanes, make way for adding more intelligent behaviors, smoother control and better decision making.

- Added voice drive-notes. After an intervention, you can now send Tesla an anonymous voice message describing your experience to help improve Autopilot.

- Expanded Automatic Emergency Braking (AEB) to handle vehicles that cross ego’s path. This includes cases where other vehicles run their red light or turn across ego’s path, stealing the right-of-way.

- Replay of previous collisions of this type suggests that 49% of the events would be mitigated by the new behavior. This improvement is now active in both manual driving and autopilot operation.

- Improved autopilot reaction time to red light runners and stop sign runners by 500ms, by increased reliance on object’s instantaneous kinematics along with trajectory estimates.

- Added a long-range highway lanes network to enable earlier response to blocked lanes and high curvature.

- Reduced goal pose prediction error for candidate trajectory neural network by 40% and reduced runtime by 3X. This was achieved by improving the dataset using heavier and more robust offline optimization, increasing the size of this improved dataset by 4X, and implementing a better architecture and feature space.

- Improved occupancy network detections by oversampling on 180K challenging videos including rain reflections, road debris, and high curvature.

- Improved recall for close-by cut-in cases by 20% by adding 40k autolabeled fleet clips of this scenario to the dataset. Also improved handling of cut-in cases by improved modeling of their motion into ego’s lane, leveraging the same for smoother lateral and longitudinal control for cut-in objects.

- Added “lane guidance module and perceptual loss to the Road Edges and Lines network, improving the absolute recall of lines by 6% and the absolute recall of road edges by 7%.

- Improved overall geometry and stability of lane predictions by updating the “lane guidance” module representation with information relevant to predicting crossing and oncoming lanes.

- Improved handling through high speed and high curvature scenarios by offsetting towards inner lane lines.

- Improved lane changes, including: earlier detection and handling for simultaneous lane changes, better gap selection when approaching deadlines, better integration between speed-based and nav-based lane change decisions and more differentiation between the FSD driving profiles with respect to speed lane changes.

- Improved longitudinal control response smoothness when following lead vehicles by better modeling the possible effect of lead vehicles’ brake lights on their future speed profiles.

- Improved detection of rare objects by 18% and reduced the depth error to large trucks by 9%, primarily from migrating to more densely supervised autolabeled datasets.

- Improved semantic detections for school busses by 12% and vehicles transitioning from stationary-to-driving by 15%. This was achieved by improving dataset label accuracy and increasing dataset size by 5%.

- Improved decision making at crosswalks by leveraging neural network based ego trajectory estimation in place of approximated kinematic models.

- Improved reliability and smoothness of merge control, by deprecating legacy merge region tasks in favor of merge topologies derived from vector lanes.

- Unlocked longer fleet telemetry clips (by up to 26%) by balancing compressed IPC buffers and optimized write scheduling across twin SOCs.

Are we seeing the results of Dojo in action?

Dojo is an alternate hardware platform to Nvidia chips. Tesla can run the same training and autolabling software on either, just at different price/time/energy usages.Interesting that a number of these refer to dataset size/accuracy/labeling improvements. Moreso than I recall in previous release notes, based on my admittedly casual perusals.

Are we seeing the results of Dojo in action?

Dataset improvements are independent of platform; though faster compute leads to faster itteration and/or larger dataset support.

FastEddieB

Member

What one expert (ChatGPT) has to say on stock investing and gambling:

The answer to whether investing in the stock market is gambling depends on how one defines gambling.

Investing in the stock market involves buying ownership (in the form of shares) in companies with the expectation of receiving a return on that investment, typically in the form of capital appreciation (increase in stock price) and/or dividends (a share of the company's profits). This type of investment typically involves analyzing the financial health and future prospects of a company before deciding to buy its shares.

Gambling, on the other hand, typically involves risking money or something of value on an uncertain outcome, often in games of chance such as roulette or slot machines, or in activities such as sports betting.

While both investing and gambling involve some degree of risk, there are important differences. In investing, the outcome is typically influenced by the financial performance of the company, industry trends, and other economic factors that can be analyzed to some extent. In gambling, the outcome is typically determined by chance, and the odds are often stacked against the gambler.

Therefore, investing in the stock market is not considered gambling in the traditional sense. However, it is important to note that all investments carry some degree of risk, and it is possible to lose money in the stock market. Therefore, it is important to carefully analyze investments and diversify one's portfolio to minimize risks.

The answer to whether investing in the stock market is gambling depends on how one defines gambling.

Investing in the stock market involves buying ownership (in the form of shares) in companies with the expectation of receiving a return on that investment, typically in the form of capital appreciation (increase in stock price) and/or dividends (a share of the company's profits). This type of investment typically involves analyzing the financial health and future prospects of a company before deciding to buy its shares.

Gambling, on the other hand, typically involves risking money or something of value on an uncertain outcome, often in games of chance such as roulette or slot machines, or in activities such as sports betting.

While both investing and gambling involve some degree of risk, there are important differences. In investing, the outcome is typically influenced by the financial performance of the company, industry trends, and other economic factors that can be analyzed to some extent. In gambling, the outcome is typically determined by chance, and the odds are often stacked against the gambler.

Therefore, investing in the stock market is not considered gambling in the traditional sense. However, it is important to note that all investments carry some degree of risk, and it is possible to lose money in the stock market. Therefore, it is important to carefully analyze investments and diversify one's portfolio to minimize risks.

UkNorthampton

TSLA - 12+ startups in 1

Hour long audio-only of interview of Tony Seba by Bobby Llewellyn. I haven't watched it yet, but seems to be largely about cost curves, electric vehicle adoption progress

willow_hiller

Well-Known Member

In investing, the outcome is typically influenced by the financial performance of the company

I see ChatGPT's training data is missing TSLA...

I put a disagree here, not because the Thwaites risk is not real, but because the risk is not imminent hence Curt's western Florida solar-powered project will probably long outlast his presently young life.So @Curt Renz , interesting info about people fighting solar panel projects, that really sucks. We have 3 projects in our local area and while I haven't read about interference yet, given the political landscape here I wouldn't put it past some people.

On another note, been reading a lot about the Thwaites Glacier in Antarctica, nicknamed the Doomsday Glacier because of what will almost inevitably happen when it breaks off in just a few years. That event is theorized to rise the global sea level by 2 ft. Would that affect your location in Florida and/or the ranchland utilized for solar panels?

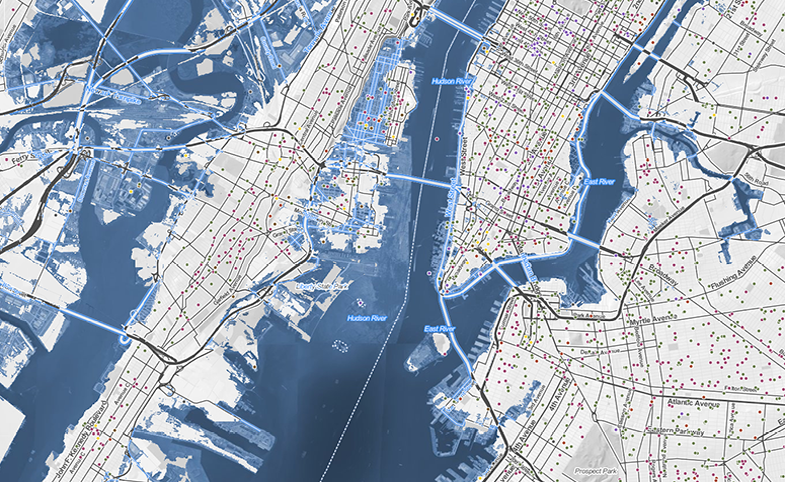

Once the Thwaites ice shelf collapses there still will not be catastrophic sea rise since the present melting is under the ice shelf. The catastrophe follows the shelf collapse over time as the land borne ice rapidly moves to the sea, so the dual effects of new fresh water in the Antarctic ocean and rise of ground level in Antartica do definitely produce catastrophe worldwide, with this handy mapping device showing the consequences:

It is worthwhile to note that the consequences of such and event would decimate most of the world's most consequential cities. from New York, Washington and Miami to Shanghai, London, the Netherlands, Bangladesh, Kolkata and so much more.

All the TSLA considerations disappear, as does the planet as humans have known it.

'Doomsday' is obviously not alliterative. The real questions are: one, is there anything that can be done to stop that; two, what about Greenland?; three, what about the arctic regions and permafrost melting?; four; how can mankind stop destruction and simultaneously resuscitate the health of our planet?

On a pessimistic day I am convinced Elon Musk may well be the only really influential person who understands we are destroying our planet. Thus on slight less pessimistic days I HODL TSLA and and some others. Surely those will endure well beyond my lifetime. I rather doubt my nephews and nieces will live so well, if they survive. My spouse and I are the only ones who live in edifices above that zone of rise, and our second home is well below the future water level.

Of course all this will not effect any material change in human behavior until the catastrophe strikes.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K