Bullish when  David Trainer comes out of the woodworks, since when was he one of the 'leading' analysts ever???

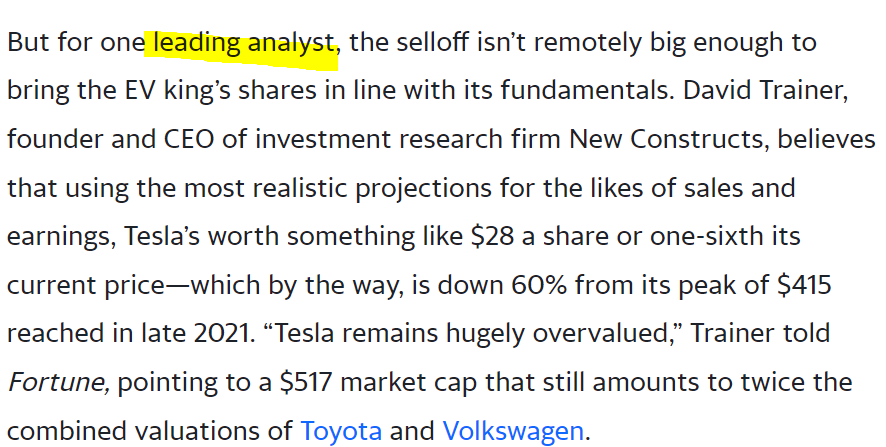

David Trainer comes out of the woodworks, since when was he one of the 'leading' analysts ever???

finance.yahoo.com

finance.yahoo.com

Tesla’s coming crash: As 7 analysts lower their price targets, one predicts the stock is heading to $28

David Trainer of New Constructs believes the selloff in Tesla shares isn’t remotely big enough to bring the EV king’s stock in line with its fundamentals.