I thought you were quoting Gordon Johnson for a second..GJ tesla. Stable solid quarter. We are almost through. Maybe 2 qtrs. Hang in there.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

larmor

Active Member

And that is why an auto oem is in talks to license FSD, buying low, prior to completion of the algorithm.In the conference call Elon reminded everyone to buy low and sell high. It would appear that while FSD has no to little value at this point, that would indicate a buying opportunity.

Knightshade

Well-Known Member

The software should have a net value of close to zero.

I mean, Elon said otherwise. Multiple times. Including saying it should have value on trade ins.

Granted he never actually got Tesla to DO that, but he said he would.

Here he is telling Pierre Ferrgau he's going to fix it (as he told a couple of people over the years- but never did)

People are confused when the hardware is free and a payment for the software is used to unlock the hardware.

I don't think they are.

I think they are confused when they pay $15,000 for an option on their vehicle (that someone who buys it without that option, used, would ALSO have to pay $15,000 for- and thus to a buyer of a used Tesla who wants FSD clearly has literal and significant value) and then Tesla tells them it's worth $0 on a trade in. Again- Elon agreed....multiple times... that it should have significant value despite Tesla never actually doing that.

Now- the trade in deal is likely a different story since the traded in car won't HAVE FSD (it's moving to another car, thus leaving the old one)--- but the person to whom I was replying was specifically talking about FSD being valuable when traded in still attached to the car.

Last edited:

PC__LoadLetter

Member

While I'm certain you're right about the future being storage, the future of the solar roof will be more about partnering with housing estate construction companies. It's easy & profitable to coordinate a neighborhood of 200-500 homes with the same basic roof. Eventually everyone will figure out that retrofitting one roof at a time isn't worth the pain.No Solar Roof on the house I am building either. Tesla told me to get stuffed after two years when we finally got to the point in construction where we were ready for the roof, with multiple forms signed and final applications filed with utility and township. We need a roof immediately and I am clueless.

First world problems.

I get the feeling that the Tesla Solar Roof is pretty much DOA as a mass market commodity.

Think Tesla energy is all about storage going forward, not generation.

Thekiwi

Active Member

So how did this work out?

Q1 ASP: $47.207

Q2 ASP: $45,625

So yeah, I'd say an average discount of ~$1,500 is "fairly minimal."

excluding credits:

Q2 2023:

Avg Sale Price: $45,021 (vs $45,976 in Q1, & $55,981 in Q2 2022)

Avg COGS: $36,854 (vs $37,256 in Q1, & $41,308 in Q2 2022)

Avg Gross Profit: $8,167 (vs $8,720 in Q1, & $14,673 in Q2 2022)

Thekiwi

Active Member

Drew just tweeted a photo of the gigaTexas megapack installation nearing completion.

I’m curious as to where Tesla is going to take its in house megapack installation in Texas.

It is starting out at 68 megapacks. At what point does it switch from becoming a security of supply/cost efficient energy source for the factory itself, to also becoming a significantly sized peaker power plant for Austin? (And a decent source of some services revenue?)

Anyone have the numbers handy on how much power the factory is likely to consume on an hourly basis?

We all know the economics of the Megapacks stack up for utilities - so the question becomes why doesn’t tesla also become a giant utility itself? It would sacrifice upfront revenue of the sale, but gain the presumably higher margin long term peaker plant profits. I know they are already doing this with the virtual power plant programs (using powerwall customers assets), but how about doing more of these giant megapack installations in house.

(although at a certain point I suppose the increase in mega pack installations slowly decreases the profitability of battery peaker plants perhaps, but that seems a while away)

I’m curious as to where Tesla is going to take its in house megapack installation in Texas.

It is starting out at 68 megapacks. At what point does it switch from becoming a security of supply/cost efficient energy source for the factory itself, to also becoming a significantly sized peaker power plant for Austin? (And a decent source of some services revenue?)

Anyone have the numbers handy on how much power the factory is likely to consume on an hourly basis?

We all know the economics of the Megapacks stack up for utilities - so the question becomes why doesn’t tesla also become a giant utility itself? It would sacrifice upfront revenue of the sale, but gain the presumably higher margin long term peaker plant profits. I know they are already doing this with the virtual power plant programs (using powerwall customers assets), but how about doing more of these giant megapack installations in house.

(although at a certain point I suppose the increase in mega pack installations slowly decreases the profitability of battery peaker plants perhaps, but that seems a while away)

Last edited:

I hate to say this... but that is likely as it should be. The product just isn't good enough to justify the business. I personally think it needs to work in more situations (lower pitched roofs for starters).I get the feeling that the Tesla Solar Roof is pretty much DOA as a mass market commodity.

I do think Tesla should stay in the solar installation business though, along with doing a major upgrade of the Powerwall line. There is a lot of room for improvements to the industry.

It is actually not directly tied into the City of Austin power grid; it is on the Lower Colorado River Authority transmission grid. Its function is primarily grid service, although it does have a backup power role for the factory. Legalities of how power is used and metered means that there is likely not much power regulation of the factory by the battery.It is starting out at 68 megapacks. At what point does it switch from becoming a security of supply/cost efficient energy source for the factory itself, to also becoming a significantly sized peaker power plant for Austin? (And a decent source of some services revenue?)

It is far better to add batteries in more locations than have a few mega-sites.

Likely something in the 50-70MW range with the main factory building. Largely depends if they move more gas-fired processes to electric.Anyone have the numbers handy on how much power the factory is likely to consume on an hourly basis?

Dikkie Dik

If gets hard, use hammer

Excellent summary by Rob Maurer

www.youtube.com

www.youtube.com

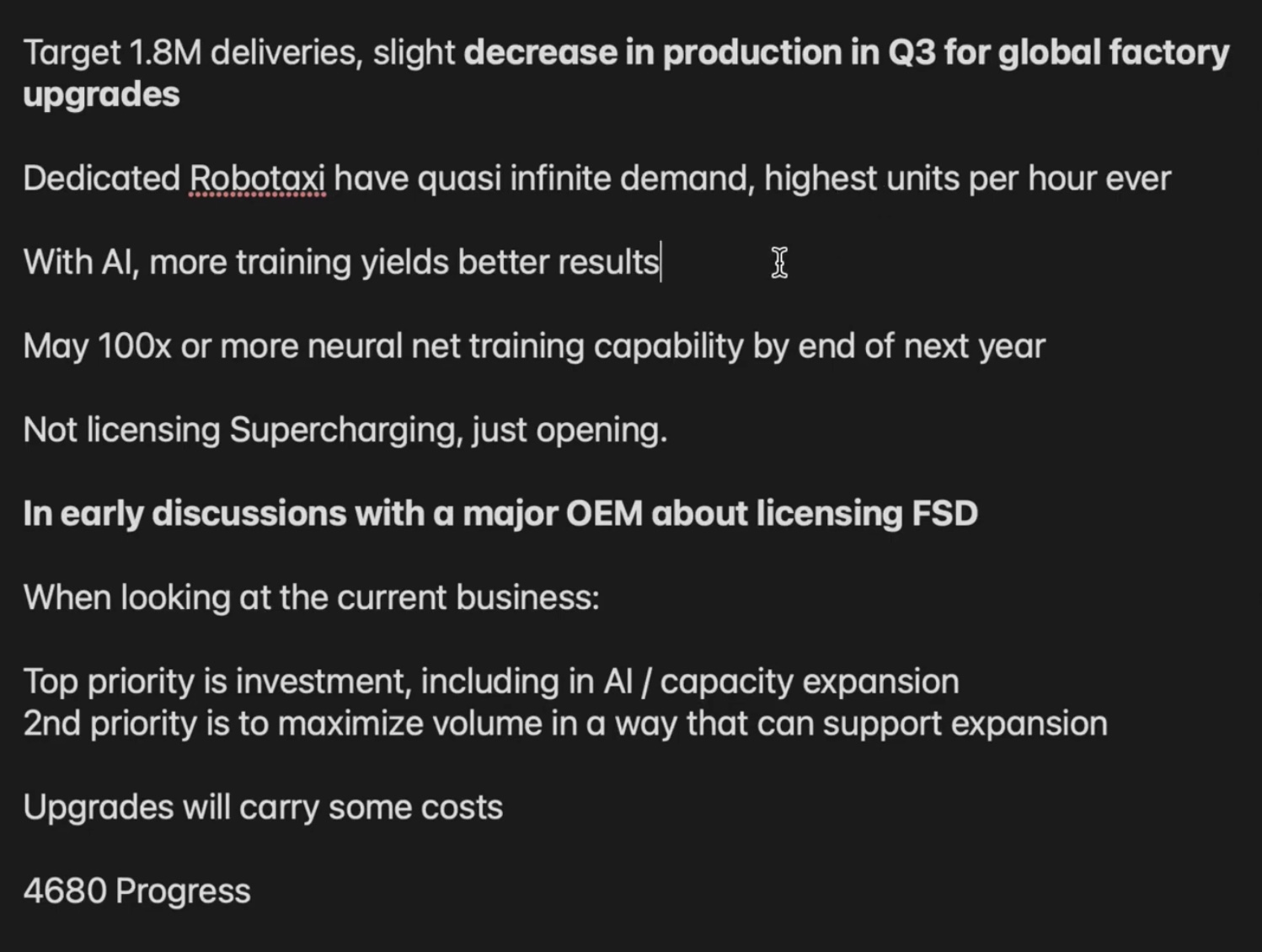

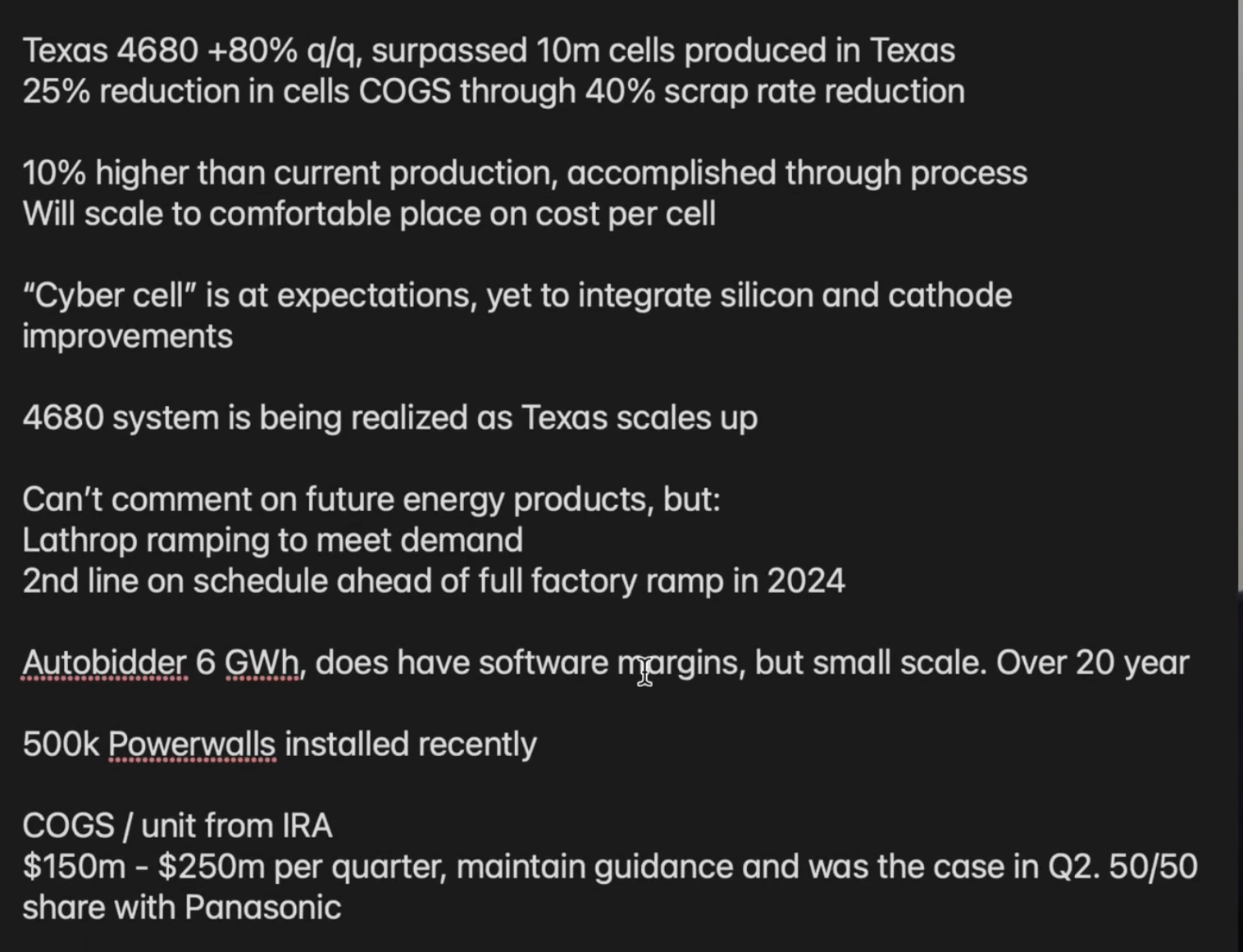

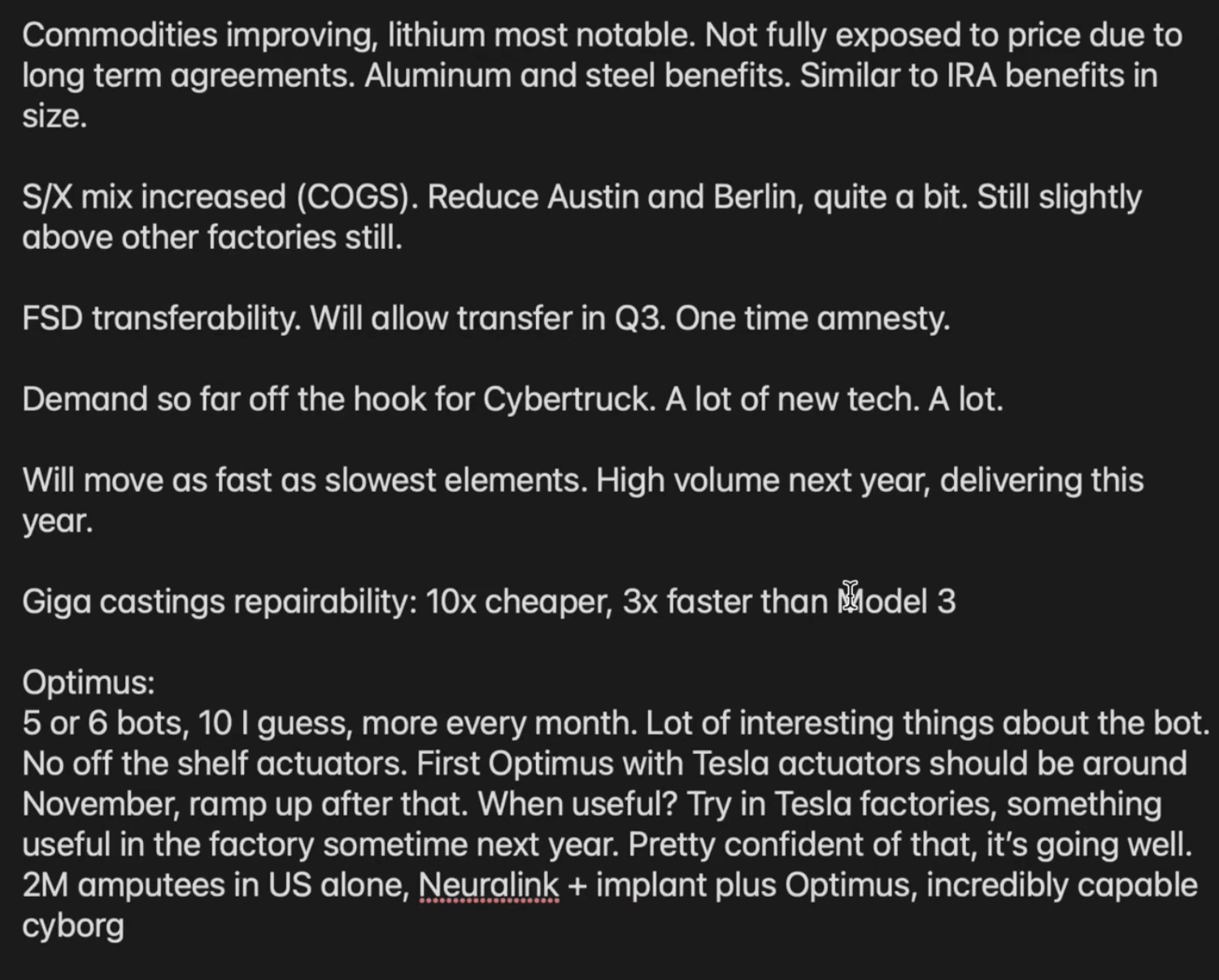

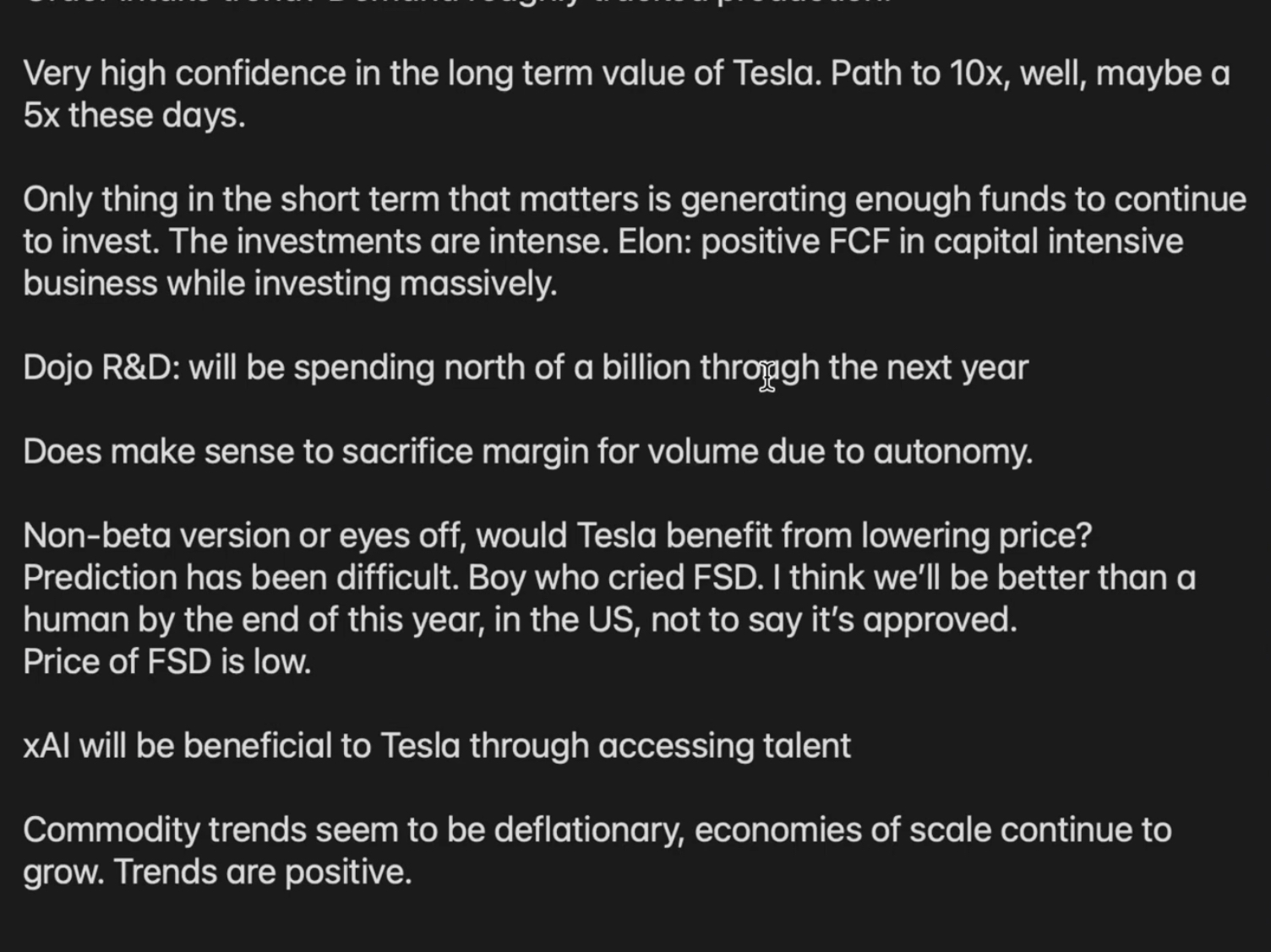

Screenshots of his bullet points

Big outtake for me is 4680 progress, everything is depending on a successful ramp of those.

Biggest News From Tesla's Q2 Earnings Call

⤠Join Rob Maurer for live reaction to Tesla's Q2 2023 earnings call⤠Reaction to shareholder letter: https://youtube.com/live/XoZNcLijT1gShareloft: https://...

Screenshots of his bullet points

Big outtake for me is 4680 progress, everything is depending on a successful ramp of those.

Remember that we are, wrt the stock price, in the “nothing to see here" phase of the earnings report drama  . Give it a week or three to see what the (semi-)real response is.

. Give it a week or three to see what the (semi-)real response is.

Awesome story I did not know: there is a group of elite engineers called The 25 guns.

The 25 Guns are rumored to be an elite group of @Tesla engineers that report directly to @elonmusk. They are brought in to solve the most challenging problems, especially when time is of utmost importance. Basically, they are the Delta Force of engineers. I would love to hear more about what they do.

Elon confirmed it.

They were instrumental to the success of Giga Berlin

There is even a job listing on the website:

www.tesla.com

www.tesla.com

The 25 Guns are rumored to be an elite group of @Tesla engineers that report directly to @elonmusk. They are brought in to solve the most challenging problems, especially when time is of utmost importance. Basically, they are the Delta Force of engineers. I would love to hear more about what they do.

Elon confirmed it.

They were instrumental to the success of Giga Berlin

There is even a job listing on the website:

“25 Guns” Taskforce Engineer (m/f/d) – Gigafactory Berlin-Brandenburg | Tesla Careers

Apply for the “25 Guns” Taskforce Engineer (m/f/d) – Gigafactory Berlin-Brandenburg position in Grünheide (Mark), Brandenburg.

Robertj

Member

The software should have a net value of close to zero. You are technically paying to buy a key to activate the entire function of the hardware put into your car. Much like a key to an actual house, there should just be a one key to one house. Now Elon is granting people a replacement key for a new house.

How much is the metal key worth vs the cost of the house?

I understand when people say "hey that software should be transferrable"...uh but the hardware isn't. Tesla is not in the business of giving you a master key so you can live in whatever house you want.

People are confused when the hardware is free and a payment for the software is used to unlock the hardware. Like if the software is included but it cost 15k to buy the hardware, not one person would cry about it not being transferrable even though it's the same thing.

Having paid $15k USD for FSD which hasn’t been delivered , which I can’t use in its current form . I then have the possibility to transfer it in a one off purchase in the next two months .

However , RHD Model S isn’t being sold ? I will just keep my shares and not update my car

Xepa777

Member

Same here. Case of excited shareholder. Very disappointed customer. I will keep my lovely 2017 model s till it drops but assume this is end of the line in the uk market at least.Having paid $15k USD for FSD which hasn’t been delivered , which I can’t use in its current form . I then have the possibility to transfer it in a one off purchase in the next two months .

However , RHD Model S isn’t being sold ? I will just keep my shares and not update my car

When Tesla first announced the 1.8 Million vehicles target for 2023 (and Elon upped to maybe 2M), I thought they likely had some production upgrade downtime built in (highland/HW4 etc). At the time the totalled production run and ramp rates of factories seemed to indicate that a much higher number could be possible for 2023. So I wasn't surprised when they announced on todays call the Q3 production numbers would be impacted by some down time for production upgrades.

I was watching the stock price pretty closely through the earnings call and noted that a major downturn in stock price occured just after Elon mentioned the production impacts. With the quality of the results I was expecting something else in the call would reverse it higher but nothing else stuck. It didn't help that Elon used up so much of the call time giving investment advice and repeating things from other calls.

However I expect the major Wall St players got the dip they wanted anyway and from that point on it has all just proceeded to plan. The question now will be how long before the stock price can reverse its initial post-earnings downturn and get back on the upwards trajectory these earnings deserve?

I was watching the stock price pretty closely through the earnings call and noted that a major downturn in stock price occured just after Elon mentioned the production impacts. With the quality of the results I was expecting something else in the call would reverse it higher but nothing else stuck. It didn't help that Elon used up so much of the call time giving investment advice and repeating things from other calls.

However I expect the major Wall St players got the dip they wanted anyway and from that point on it has all just proceeded to plan. The question now will be how long before the stock price can reverse its initial post-earnings downturn and get back on the upwards trajectory these earnings deserve?

Last edited:

I hope its BYD. The legacy automakers aren't producing enough EVs to make it a big deal and ICE have too high operating costs to be competitive with EVs.

Buckminster

Well-Known Member

8 mins in:

DEDICATED robotaxi products- ie. no steering wheel gen 3. I have speculated previously that gen 3 may not come with steering wheel from the beginning.

Tesla Robotaxi (Gen 3)

Tesla Robotaxi (Gen 3)

ls7corvete

Member

Help me out; I thought that the re-tooling and resulting production impacts were announced several quarters ago? Did I make this up; or am I just confusing TMC rumors with official reports.I was watching the stock price pretty closely through the earnings call and noted that a major downturn in stock price occured just after Elon mentioned the production impacts. With the quality of the results I was expecting something else in the call would reverse it higher but nothing else stuck. It didn't help that Elon used up so much of the call time giving investment advice and repeating things from other calls.

I would have thought all of this was priced in already. Never mind the fact that model refresh will likely improve revenue and margins.

petit_bateau

Active Member

My early thoughts:

1. Lucky accident that in my forecast I got the GAAP EPS correct at $0.78, mainly because of the bump of $328m in the other income line, as auto GM% was below my forecast. But a win is a win, nailed it.

(see the Quarterly Projections thread if you want to stay abreast of that stuff Near-future quarterly financial projections )

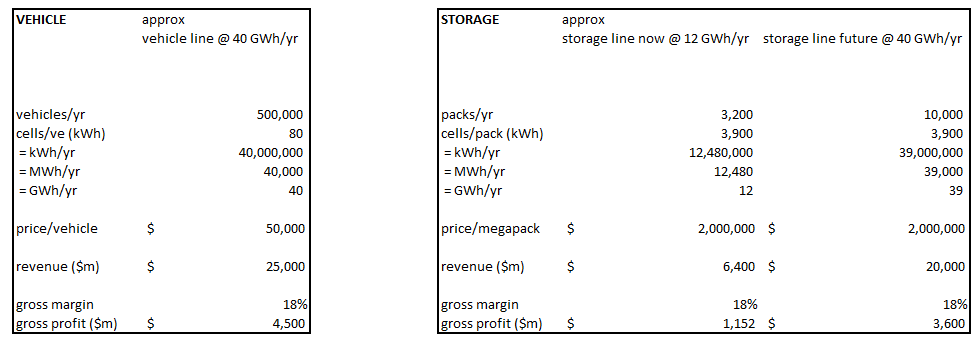

2. GM% on energy is now broadly equal to GM% on automotive, i.e. 18% or so in round numbers for illustrative purposes. A 500k/yr vehicle line consumes about 40 GWh/yr of cells. The Lathrop megapack storage line is currently consuming approximately 12 GWh/yr of cells (after allowing for some cells to go into Powerpacks, Powerwalls). This means that the Lathrop line is now the equivalent of about 150,000 vehicles/yr in both revenue and profit terms. You can see that Lathrop now is almost contributing as much revenue and profit as Berlin is now, as Berlin is at about 200k/yr now. When Lathrop reaches 40 GWh/yr it will be equal to about 500k/yr vehicles, i.e. that is the same as the fully built and fully ramped phase 1 of Berlin. It is not obvious whether Berlin phase 1 will get fully ramped to 500k/yr=40GWh/yr before Lathrop reaches the equivalent fully ramped situation. This means that there no longer needs to be any hesitation in selling/ramping/etc storage vs vehicles and that makes overall business strategy decisions so much easier. Well done Lathrop. That makes LFP cell capacity allocation and negotiations so much easier. Plus of course there is the long tail of service/etc income from storage.

This table sets out the approximate situation and the broad equivalency between a 40GWh vehicle line and a 40GWh stationary storage line.

3. This means that decisions on Megapack factories are as important for recipent nations as automotive factories, but that they involve less technology exposure than automotive. That is good as they don't need as much labour/etc as an auto factory. This has huge implications for ability to scale overall business in a way that manages sovereign / political / strategic risk.

4. Berlin capacity is now significantly ahead of Austin capacity. The cell supply situation out of China has perked up now that Shanghai has gone fully LFP, clearing the way for the LG 2170 stream to go to Berlin. As yet the 4680 ramp in Austin has not caught up with the Chinese stream into Berlin (and into Lathrop). Well done to the Chinese LFP suppliers. It is still all about the cells.

5. The improved 4680 for CT sounds to me like same external 4680 can, maybe with decreased wall thickness and perhaps (?) tweaked chemistry. The 4680 ramp is likely the pacing factor for CT launch, and since there is still plenty to do on vehicle shakedown and cell side they don't seem in any hurry. Pencil in Q4 deliveries in low volumes.

6. Volume expansion and operating at full capacity is still the overriding target. Forget all about the waffle in the Q1 call about targetting operating margin. Or in previous calls about any other margin. Or about maintaining positive cash flow. though happily things are - and will continue to be - cash generative and so fully internally funded. Or share price stability. Or anything, except ramping as fast as possible and keeping the lines full. It is quite clear from the actual observable facts, that Tesla will reduce prices and throw in whatever promotional stuff it takes to keep the lines full.

7. This means that the real determinant of Tesla price is - wierdly - the extent to which there are competitive BEVs available from other automakers. The market will obviously take as many credible BEVs as the industry can produce, provided they aren't outrageously priced. So if Tesla has limited competition then Tesla can pretty much hold its own price up to a reasonable extent, with the result that Tesla obtains a (now) 18% or so GM%. And since (at the moment) the competitor BEVs are not as compelling a customer proposition (and their CoGS are higher) then the competitor OEMs are forced into low or negative GM%. It is really difficult to get those numbers, but let's just posit they range from +5% GM to -5% GM with an average BEV competitor of 0% GM. This is why demand for BEVs is collapsing at VAG etc, and they are in a cash crisis. The implication is that Tesla is probably near the bottom on pricing for the time being. Only if the competitors start bringing better products to market in a manner that is financially sustainable for them, will Tesla need to reduce prices. Of course that will happen, and so there may be further Tesla price reductions. But hopefully by then Tesla may have been able to make further CoGS reductions, and obtained further scale benefits, and so stay ahead of the game. But note - in an odd way - given that Tesla prizes capacity expansion above all else, then it is competitor products that now determine Tesla GM% and that is a new realisation for me.

8. Actuators are the pacing constraint on Optimus. Software is constrained by hardware. The hardware cycle is many months, that is the pacing constraint at this stage.

9. FSD will go to market in USA first. One day. Maybe.

10. Yeah, Q3 won't be a lot of growth. We are pretty sure the 3 lines (Shanghai, Fremont) will get a full rebuild and a next-gen 3 product. We don't know how fast they will ramp coming out of that. We don't know what will be done to the Y lines to keep them in lockstep (Berlin, Austin, Fremont, Shanghai). It seems to me that there is no reason for cell production to slow during Q3 (except of course for cell factories to do their hols and line maintenance & updates) and so they can build cells to stock, then that gives excess cells to mop up in Q4. Since vehicle line capacities seem to me to exceed cell line capacities that means that Q4 should be good. FSD-switch promotion to keep deliveries up during Q3 and avoid Osborning. I'm sure they will find enough promotions t keep it going - Herz etc.

11. So 1.8m for the year plus storage.

12. Very steady growth in S&S, nice.

1. Lucky accident that in my forecast I got the GAAP EPS correct at $0.78, mainly because of the bump of $328m in the other income line, as auto GM% was below my forecast. But a win is a win, nailed it.

(see the Quarterly Projections thread if you want to stay abreast of that stuff Near-future quarterly financial projections )

2. GM% on energy is now broadly equal to GM% on automotive, i.e. 18% or so in round numbers for illustrative purposes. A 500k/yr vehicle line consumes about 40 GWh/yr of cells. The Lathrop megapack storage line is currently consuming approximately 12 GWh/yr of cells (after allowing for some cells to go into Powerpacks, Powerwalls). This means that the Lathrop line is now the equivalent of about 150,000 vehicles/yr in both revenue and profit terms. You can see that Lathrop now is almost contributing as much revenue and profit as Berlin is now, as Berlin is at about 200k/yr now. When Lathrop reaches 40 GWh/yr it will be equal to about 500k/yr vehicles, i.e. that is the same as the fully built and fully ramped phase 1 of Berlin. It is not obvious whether Berlin phase 1 will get fully ramped to 500k/yr=40GWh/yr before Lathrop reaches the equivalent fully ramped situation. This means that there no longer needs to be any hesitation in selling/ramping/etc storage vs vehicles and that makes overall business strategy decisions so much easier. Well done Lathrop. That makes LFP cell capacity allocation and negotiations so much easier. Plus of course there is the long tail of service/etc income from storage.

This table sets out the approximate situation and the broad equivalency between a 40GWh vehicle line and a 40GWh stationary storage line.

3. This means that decisions on Megapack factories are as important for recipent nations as automotive factories, but that they involve less technology exposure than automotive. That is good as they don't need as much labour/etc as an auto factory. This has huge implications for ability to scale overall business in a way that manages sovereign / political / strategic risk.

4. Berlin capacity is now significantly ahead of Austin capacity. The cell supply situation out of China has perked up now that Shanghai has gone fully LFP, clearing the way for the LG 2170 stream to go to Berlin. As yet the 4680 ramp in Austin has not caught up with the Chinese stream into Berlin (and into Lathrop). Well done to the Chinese LFP suppliers. It is still all about the cells.

5. The improved 4680 for CT sounds to me like same external 4680 can, maybe with decreased wall thickness and perhaps (?) tweaked chemistry. The 4680 ramp is likely the pacing factor for CT launch, and since there is still plenty to do on vehicle shakedown and cell side they don't seem in any hurry. Pencil in Q4 deliveries in low volumes.

6. Volume expansion and operating at full capacity is still the overriding target. Forget all about the waffle in the Q1 call about targetting operating margin. Or in previous calls about any other margin. Or about maintaining positive cash flow. though happily things are - and will continue to be - cash generative and so fully internally funded. Or share price stability. Or anything, except ramping as fast as possible and keeping the lines full. It is quite clear from the actual observable facts, that Tesla will reduce prices and throw in whatever promotional stuff it takes to keep the lines full.

7. This means that the real determinant of Tesla price is - wierdly - the extent to which there are competitive BEVs available from other automakers. The market will obviously take as many credible BEVs as the industry can produce, provided they aren't outrageously priced. So if Tesla has limited competition then Tesla can pretty much hold its own price up to a reasonable extent, with the result that Tesla obtains a (now) 18% or so GM%. And since (at the moment) the competitor BEVs are not as compelling a customer proposition (and their CoGS are higher) then the competitor OEMs are forced into low or negative GM%. It is really difficult to get those numbers, but let's just posit they range from +5% GM to -5% GM with an average BEV competitor of 0% GM. This is why demand for BEVs is collapsing at VAG etc, and they are in a cash crisis. The implication is that Tesla is probably near the bottom on pricing for the time being. Only if the competitors start bringing better products to market in a manner that is financially sustainable for them, will Tesla need to reduce prices. Of course that will happen, and so there may be further Tesla price reductions. But hopefully by then Tesla may have been able to make further CoGS reductions, and obtained further scale benefits, and so stay ahead of the game. But note - in an odd way - given that Tesla prizes capacity expansion above all else, then it is competitor products that now determine Tesla GM% and that is a new realisation for me.

8. Actuators are the pacing constraint on Optimus. Software is constrained by hardware. The hardware cycle is many months, that is the pacing constraint at this stage.

9. FSD will go to market in USA first. One day. Maybe.

10. Yeah, Q3 won't be a lot of growth. We are pretty sure the 3 lines (Shanghai, Fremont) will get a full rebuild and a next-gen 3 product. We don't know how fast they will ramp coming out of that. We don't know what will be done to the Y lines to keep them in lockstep (Berlin, Austin, Fremont, Shanghai). It seems to me that there is no reason for cell production to slow during Q3 (except of course for cell factories to do their hols and line maintenance & updates) and so they can build cells to stock, then that gives excess cells to mop up in Q4. Since vehicle line capacities seem to me to exceed cell line capacities that means that Q4 should be good. FSD-switch promotion to keep deliveries up during Q3 and avoid Osborning. I'm sure they will find enough promotions t keep it going - Herz etc.

11. So 1.8m for the year plus storage.

12. Very steady growth in S&S, nice.

Stretch2727

Engineer and Car Nut

I don't think they formally announced anything.Help me out; I thought that the re-tooling and resulting production impacts were announced several quarters ago? Did I make this up; or am I just confusing TMC rumors with official reports.

I would have thought all of this was priced in already. Never mind the fact that model refresh will likely improve revenue and margins.

Tesla does not know exactly where they will be at the end of the year. They have given a range (1.8-2.0M) that is reasonable and accounts for both planned and unplanned events. The stock price is effected by people betting on probability of the outcomes. Announce shutdowns and a Q3 that is flat or down from Q2 and there is a higher probability they will be closer to 1.8M. It's that simple.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K