BTW., while I agree with most of your post, I don't think that's true:

- Tesla has at least one GWh scale storage contract.

- Adding battery storage that has 10+ years of expected life time is a no-brainer upgrade and investment for wind farms: wind peaks in the night when power use is the lowest, so a lot of that power can only be sold at very low prices. With battery storage that peak nightly energy can be transformed into a peaker plant in essence, selling the energy for 10-20 times as much money ... Also there will be a gold rush effect: the first ones to do this will earn a lot from this.

- If only there was a company selling GWhs worth of battery capacity at reasonable prices.

- Note that Big Oil will have limited ability to run interference: power companies are strategic long term allies of Tesla, not of the Big Oil/Coal price cartel. Tesla will free power companies from Big Oil and give them energy independence and self-determination. That's a well established, several trillion dollars worth industry to transform, right there, available to the first mover.

The Australian battery project created quite a stir in the power industry. I agree with @KarenRei that Tesla Energy is one of this year's dark horses. (The other one is FSD.)

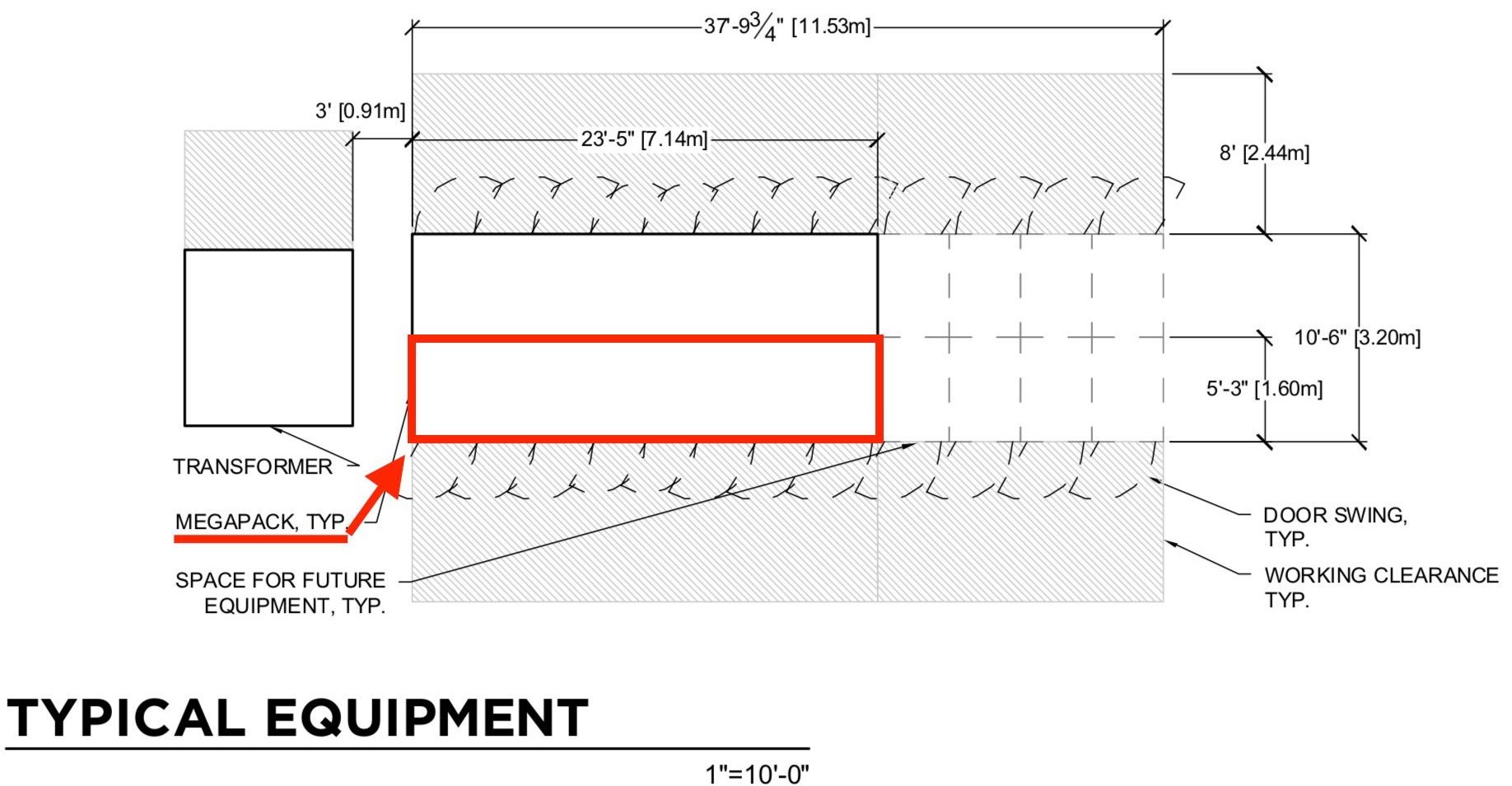

With the containerized "Megapack" Tesla is well positioned to push out as many of them as there's excess cell capacity at the Gigafactory:

But yeah, no way to model this, yet, but I agree with Elon and JB that Tesla Energy is going to outgrow the Tesla automotive side within a couple of years.