Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Remus

Active Member

Doesn't hold any water.Hmm, not true at all. Many MANY traders want to ride the wave till ER and then sell on news.

It doesn't explain all the buying power, especially after 250

Price of model 3 hiked $1k, I checked local inventory on Telsa, 0 cars in SA, Austin, Houston, Dallas. Ev-cpo shows 44 total new model 3 in US. We have a supply problem.

StealthP3D

Well-Known Member

if by some weird glitch in the matrix whatever numbers Tesla releases are miraculously perceived as a "beat" by the media, I think we really could be looking at a severe short squeeze situation. We're already way up from where a bunch of these $TSLAQ geniuses staked out positions, and cracks in their resolve are already beginning to show. One more big push could send them off the ledge. *fingers crossed*

I don't know why this *wouldn't* happen given the huge percentage of shares sold short. I suppose one reason it might NOT happen is if most of those short positions are held by oil/gas interests with billions of dollars to throw at the Tesla "problem".

StealthP3D

Well-Known Member

Valuation? Have you looked at Aurora Cannibis Inc? (TSE:ACB) $5.0B market cap on $55M in revenues. That's about 90x revenues.Can u say 'value'? NOT.

TSLA is a STEAL at these price (2x revenues) and is about to go on a very long and profitable run. I'm thinking that's who's the buyers (plus smarter shortzes r covering)

Cheers!

What do the shareholders of these two very different companies have in common?

The more you use their respective products, the more you think their stock is undervalued!

humbaba

sleeping until $7000

Yes, Tesla can no longer afford to make cars -- hence the supply problem. So they desperately raised the price to lower demand. But this will cost them more revenue and accelerate the plunge into bankruptcy.Price of model 3 hiked $1k, I checked local inventory on Telsa, 0 cars in SA, Austin, Houston, Dallas. Ev-cpo shows 44 total new model 3 in US. We have a supply problem.

Writing that introduced enough cognitive dissonance that I have a hard time believing smeagol doesn't get it. What are the odds that he's covered (or in the process of trying to cover) his position and is desperately trying to convince others to short as the result of some psychological disorder.

As an aside, I think the "Tesla is a Ponzi scheme" rests on the following:

In a Ponzi scheme the founder does make money via the payments flowing up. Of course, since all money is generated internally there is insufficient supply to pay out to those lower down and the scheme collapses.

In a Tesla "ponzi" scheme the parts to make a car are purchased on credit, an order with $2500 holding fee is taken, the car is manufactured, then sold. In principal this would allow repayment of the parts, but the problem is that Tesla sells all of its cars at a loss. But because some were sold the network effect allows more orders which creates an influx in funds of $2500 per order, which -- because there are more orders than cars already made -- allows paying off the suppliers and ordering more parts. Naturally, this scheme will come crashing down as soon as there are insufficient new orders to cover the losses of manufacturing the last batch of cars.

Of course that scenario relies on a couple of falsehoods. First, that Tesla cars are sold at a loss. This is "proven" by the fact that Tesla as a whole loses money while ignoring that this is due to investing in expansion. The SG&A is a popular "proof" here. Second, that $2.5k reservations represent meaningful revenue. This started with the initial 500k reservations which netted Tesla $1.25b and on its face proves that Tesla is lying about its manufacturing numbers and has huge losses because they have not been able to clear that backlog of reservations. Clearly there is only one answer here: Tesla cannot actually make cars for reservation holders so their claims of selling 90k per quarter is pure fabrication.

One person I know holds that position and refused to accept that I was able to buy a car last year without ever first having reservation. Since they have seen my car and haven't explained their thinking on this I'm not sure about the rationalization. Maybe they think I secretly held a reservation, or that I took over someone else's?

My point is that there is some structural similarity to a ponzi scheme if you can convince yourself that Tesla production numbers and margins are a lie.

Fact Checking

Well-Known Member

I cannot emphasis enough, the market, as a whole, is pretty slow and pretty stupid. It has a ton of "momentum" because it is mostly based on people's emotions, gut reactions, and ignorance and misunderstanding plays into this in a big way. Don't make the mistake of thinking the market price of a company is all that important - it is simply what it is, nothing more.

Also, beyond the emotional factor, there's also the two most expensive mistakes investors make: "herd mentality" and "common wisdom". CNBC and TSLAQ are driving a truck through those concepts to harm TSLA sentiment.

Artful Dodger

"Neko no me"

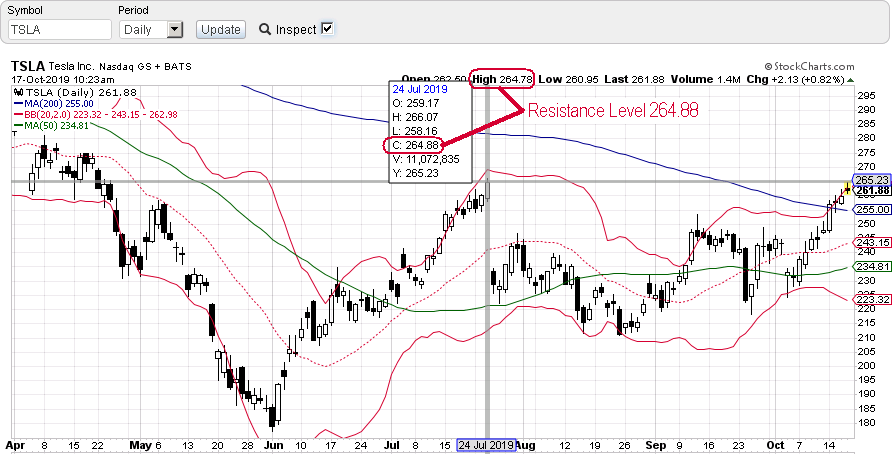

Case anyone's wondering how simple minded technical traders are, here's the 200d chart:

Can you spot the resistance level? We got to within 10 cents of the Closing SP from Jul 24 (just before the Q2 Earnings Call). Today, shortzes say 'this far and no further'.

Tough slog into Earnings then? Or will some be bold enough to push the SP higher?

Cheers!

Can you spot the resistance level? We got to within 10 cents of the Closing SP from Jul 24 (just before the Q2 Earnings Call). Today, shortzes say 'this far and no further'.

Tough slog into Earnings then? Or will some be bold enough to push the SP higher?

Cheers!

StealthP3D

Well-Known Member

Price of model 3 hiked $1k, I checked local inventory on Telsa, 0 cars in SA, Austin, Houston, Dallas. Ev-cpo shows 44 total new model 3 in US. We have a supply problem.

What? Tesla raised the price of the Model 3? Dang, now do all the recent buyers have to send another $1000 to Tesla? I mean, they were really upset when the price was dropped - they thought they should get a refund.

I guess people LIKE one-way streets - as long as the street is going the direction they want to travel...

jeewee3000

Active Member

Doesn't hold any water.

It doesn't explain all the buying power, especially after 250

The buying power can be explained by technicals. (Many on TMC call Technical Analysis as stupid as reading tea leaves, but the fact that many technical traders trade based on charts makes it a self-fulfilling prophecy which should not be ignored in the short term.)

I'll refer to my post 8 days ago (the stock price was between $240 and $247):

Tesla, TSLA & the Investment World: the 2019 Investors' Roundtable

Once we broke +$250, the chart looked good until at least $260. Now we see more caution in the low $260's (today's high $264,78) since we are exactly where we were before Q2 ER (close of $264,88).

I expect the stock to remain here until ER or show some consolidation.

All bets are off if the macro's push us up or down (Brexit, trade deal, Syria, etc) but that's always the case with TA.

TLDR: the buying power is perfectly explained by TA.

EDIT: @Artful Dodger noticed the same technicals as I was writing this post, which adds to my point: do NOT disregard TA.

Wow.

I don't think this kind of organic expansion of U.S. Tesla demand ever happened before on such a scale, so early in a quarter (we are 2.5 weeks into Q4).

Previously we had big increases in orders when production volumes were still low and new Model 3 variants were released (Q2-Q4 2018), but that was primarily pent-up demand. None of that happened in this quarter and production has expanded further, which makes it even more impressive IMHO.

While Tesla did indicate an uptick in the order book in the Q3 delivery report, based on production levels I guessed it to be max of 1-3 weeks worth of demand - not 4-10 weeks (!).

I'm really curious what caused this:

Or something else?

- Is this the Nürburgring effect? Did Tesla finally crack one of the secrets to Porsche's stable sales and sky high margins?

- Is this the Taycan effect? Did a good chunk of the 30,000 Taycan reservations flock to the Model S and M3P in disappointment at Porsche's mediocre performance where the only thing 'ludicrous' is the price?

- Is this the trade war effect? Does the

unconditional capitulation of Trumptremendous win of Trump in the trade war against China and the resulting cease-fire ease consumer worries about short-term U.S. recession and job loss risks?- Is this the portfolio effect? Does a +40% rise in TSLA and other high-tech stocks improve U.S. balance sheets enable some profit taking or deleveraging to allow another Tesla for the family, or two?

- Is this the final $1,750 federal tax credit effect? Use it or lose it - but only ~1.5% of a Model S/X ASP, and only ~3% of a Model 3 ASP, so according to @neroden's tax credit model it's worth about 1-2 weeks of pull-forward demand.

- Is this the Smart Summon effect? Over half a million Smart Summon demonstrations all across the U.S. over a single weekend sure caught attention. If yes then the Halloween pranks with Smart Summon will add another week or demand or so to the backlog ...

- Is this the V10 release effect? Sentry mode finally usable, Caraoke, Netflix, Spotify, computer games - what more to ask for?

Very curious development, and while Q3 earnings could be really bad ("Tesla missing Wall Street expectations" in all categories), this is bullish AF in the long run. I'm particularly happy about Model S/X order queue of 4-10 weeks - this is a big potential GAAP profit factor.

This IMO also explains the Model Y leaks and the Pickup Truck unveil: Tesla is now focused on developing Q1 demand. Would not be surprised if the Pickup Truck unveil was in late November, to guarantee that any media attention and influx of orders would help the January/February numbers.

The more tenacious long term shortz will also have to start seriously considering the prospect of Tesla being added to the S&P 500 in May-June or August-September next year: if Q4 is profitable and Q1 or Q2 is borderline profitable with a bit of FCA credits and deferred revenue help, then S&P 500 addition looks probable, given that the bad Q1'2019 (and Q2'2019) losses will have rolled out of the 4-quarter window of the S&P 500 profitability equation:

I.e. if Q3 isn't "too bad" - say -$200m loss, then Q4 earnings of $410m or better, and a profit of $200m in Q1'2020 would trigger S&P 500 inclusion of TSLA. Or if not then, then in Q2, with August-September addition to the S&P 500, because the -$408m loss of Q2 will have rolled off then.

- Q2'2019: -$408m

- Q3'2019: -$200m?

- Q4'2019: +$410m?

- Q1'2019: +$200m?

- Q2'2019: +$300m?

Still way too early to call though and not advice - I have a particularly bad track record with GAAP profitability and S&P 500 inclusion speculation ...

It’s encouraging that the wait times for US have increased, but, we do not know how much of this has to do with logistics of rotating production to cars intended for international markets (which continue to expand. one example, Japan ramping up from initial very limited Q3 deliveries. even with as poorly as most imported vehicles do in Japan, I wouldn’t be surprised at all if there were 20k pent up Model 3 orders from years of waiting. possibly more. I think the Model 3 could sell 60k/year in Japan... Elon/Tesla/Silicon Valley tech may have an appeal in this market that Detroit, or even Germany do not have).

I wouldn’t be surprised if the logistics of rotating to international deliveries is the lion share of the change in wait time. Remember, in the last week of September Elon’s email said total net orders were something like 110k for the quarter. 6 extra weeks of Model 3 production would be about 40k orders... have we seen anything in the past 2-3 weeks (since that update) suggestive of a massive spike in US orders?

Last edited:

Autotrader (also appeared today in MarketWatch):

Autotrader - page unavailable

The top 3 are all Teslas. However the comment about a $7500 tax credit is no longer fully true for Tesla and GM EVs. Also, unless the policy has changed, Tesla does not label cars with a year other than the production date.

Autotrader - page unavailable

The top 3 are all Teslas. However the comment about a $7500 tax credit is no longer fully true for Tesla and GM EVs. Also, unless the policy has changed, Tesla does not label cars with a year other than the production date.

Last edited:

StealthP3D

Well-Known Member

WooHoo! Somebody got 4K+ discounted shares at the start of retail pre-market trading right at 08:00 ET. And those shortzes shortly lost their shortz, now up to $262.25 and stablized... there's a quick way to lose $3.25/share

What the shortz lack in brains they make up for in resilience. Reminds me of this guy:

Dan Detweiler

Active Member

Remus

Active Member

Even believers admit TA doesn't work over fundamental event such as earnings.The buying power can be explained by technicals. (Many on TMC call Technical Analysis as stupid as reading tea leaves, but the fact that many technical traders trade based on charts makes it a self-fulfilling prophecy which should not be ignored in the short term.)

I'll refer to my post 8 days ago (the stock price was between $240 and $247):

Tesla, TSLA & the Investment World: the 2019 Investors' Roundtable

Once we broke +$250, the chart looked good until at least $260. Now we see more caution in the low $260's (today's high $264,78) since we are exactly where we were before Q2 ER (close of $264,88).

I expect the stock to remain here until ER or show some consolidation.

All bets are off if the macro's push us up or down (Brexit, trade deal, Syria, etc) but that's always the case with TA.

TLDR: the buying power is perfectly explained by TA.

EDIT: @Artful Dodger noticed the same technicals as I was writing this post, which adds to my point: do NOT disregard TA.

And everyone just agreed to dump after earning? God forbid someone decided to front run every one else by an hour? What if another group of people decided to front run them?

Then how do you explain that M3P delivery times for the U.S. didn't increase to 8-10 weeks, 2 weeks into Q2 or Q3?

If the M3P take rate is 10% then there's quarterly demand for about 4,000 non-US units - which can be made in the first 3-4 weeks of Q4 production, 3 of which are over already... (Final ~4 days of October production were for Q4 already.)

I.e. even taking production constraints into account, 8-10 weeks of waiting list suggests that there must be a big increase in M3P demand either in the U.S., or elsewhere, or both.

Or elsewhere makes more sense to me. See above re international

There’s also the fact that these estimate times are not super diligently updated another poster mentioned (an update might of been skipped in a prior quarter)

What’s more, recent US order increase? Yes, seems likely... but I think an increase strong enough to soak up inventory vehicles (ie a few thousand that can be moved around the US and delivered in ~two weeks) is far more likely than an increase of ~40k, or 6 weeks of production.

Krugerrand

Meow

Yes, Tesla can no longer afford to make cars -- hence the supply problem. So they desperately raised the price to lower demand. But this will cost them more revenue and accelerate the plunge into bankruptcy.

Writing that introduced enough cognitive dissonance that I have a hard time believing smeagol doesn't get it. What are the odds that he's covered (or in the process of trying to cover) his position and is desperately trying to convince others to short as the result of some psychological disorder.

As an aside, I think the "Tesla is a Ponzi scheme" rests on the following:

In a Ponzi scheme the founder does make money via the payments flowing up. Of course, since all money is generated internally there is insufficient supply to pay out to those lower down and the scheme collapses.

In a Tesla "ponzi" scheme the parts to make a car are purchased on credit, an order with $2500 holding fee is taken, the car is manufactured, then sold. In principal this would allow repayment of the parts, but the problem is that Tesla sells all of its cars at a loss. But because some were sold the network effect allows more orders which creates an influx in funds of $2500 per order, which -- because there are more orders than cars already made -- allows paying off the suppliers and ordering more parts. Naturally, this scheme will come crashing down as soon as there are insufficient new orders to cover the losses of manufacturing the last batch of cars.

Of course that scenario relies on a couple of falsehoods. First, that Tesla cars are sold at a loss. This is "proven" by the fact that Tesla as a whole loses money while ignoring that this is due to investing in expansion. The SG&A is a popular "proof" here. Second, that $2.5k reservations represent meaningful revenue. This started with the initial 500k reservations which netted Tesla $1.25b and on its face proves that Tesla is lying about its manufacturing numbers and has huge losses because they have not been able to clear that backlog of reservations. Clearly there is only one answer here: Tesla cannot actually make cars for reservation holders so their claims of selling 90k per quarter is pure fabrication.

One person I know holds that position and refused to accept that I was able to buy a car last year without ever first having reservation. Since they have seen my car and haven't explained their thinking on this I'm not sure about the rationalization. Maybe they think I secretly held a reservation, or that I took over someone else's?

My point is that there is some structural similarity to a ponzi scheme if you can convince yourself that Tesla production numbers and margins are a lie.

Best fiction I’ve read all week.

if by some weird glitch in the matrix whatever numbers Tesla releases are miraculously perceived as a "beat" by the media, I think we really could be looking at a severe short squeeze situation. We're already way up from where a bunch of these $TSLAQ geniuses staked out positions, and cracks in their resolve are already beginning to show. One more big push could send them off the ledge. *fingers crossed*

Some short covering may occur

Short squeeze? A very rare animal. Even the launch from $40s to $180 over 5 months in 2013 was not a short squeeze. Shares short went from high 20%s to a low of 17-18%. That low was still outlier HIGH shares short vs rest of the market, and this move was over 4-5 months, not a short squeeze of spiraling margin calls.

fwiw, this is all consistent with the “bigger game” theory of the many years long outlier short position discussed here on TMC for several years now.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K