Then wouldn't TSLA still be the best thing in those scenarios? It would be the one that still keeps selling despite bad times since its the best product. Even more so if it happens a few years in the future when their production costs are lower so they can afford to lower prices and keep volume up.Macro related due to inflationary or geopolitical concerns.

Call it a market “correction”.

Just feel that’s inevitable - as it always is.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

hacer

Active Member

Huh?The 2022 $100 calls are trading for $337.65 right now, when TSLA is $430.00 - i.e. the low strike price calls are trading at a $7.65 premium.

2022 $100 puts are going for $6.60 - so in fact it's $1 cheaper to buy the stock and $100 puts to insure against catastrophic loss.

In general there's no free lunch: stock and option prices are closely arbitrated.

If you buy the call, you will be out of pocket $337.65.

If you buy the stock AND the put, it will cost you $430 + $6.60 = $436.60.

If TSLA implodes such that the call is worthless you'd be out your purchase price $337.65 (x100).

With the second strategy, you'd exercise the put and get back $100, so your loss is $436.60 - $100 = $336.60 (x100)

So the second strategy did come out $1.05 ahead in the case of implosion. But it was in no way cheaper to acquire in the first place. In fact you tide up $98.95 (x100) more money to take on the stock+put posiiton. That's money which could very likely earn more than $1.05 in interest (0.53 % APR).

If instead TSLA rockets, you're still only $1.05 ahead for the stock + put at expiration. But if it rockets soon, then increased volatility might actually gain you more on the call if you exit early. Plus it did give you some small amount of leverage, possibly allowing you to take a position that you otherwise couldn't take.

The actual downside to the call is (1) limited time - the position ends in 2 years so if things go badly you can't just wait it out. This is a serious risk -for sure the most important risk of the call strategy (2) If successful and you sell the call before expiration it will be a short-term capital gain (in the US anyway) regardless of how long you held it. If instead you exercise it, then that starts the clock for the holding period so a year later you would have a long-term capital gain.

Just as a personal cautionary tale, I bought 6 July 2019 calls with a $250 strike a the end of Q3'18 when the stock was in the $360's. Those calls expired worthless and it was only yesterday that my portfolio position recovered to where I was when I bought those calls. If they'd been longer term I could have waited it out if I had nerves of steel. The time limit of options is their big deal.

Durring this bull run I have noticed that it typically gaps up at the opening of the pre market. afterhours aft mostly flat. As far as I remember this was different in the last two years.

Does this hint to an European oder Asian buyer?

Does this hint to an European oder Asian buyer?

Tesla set to begin deliveries of China-made Model 3s on Monday

BEIJING/SHANGHAI -- Tesla Inc. said it will begin delivering Model 3 vehicles built at its Shanghai factory on Monday.

Construction of its first plant outside the United States began in January and production started in October. It aims to produce 250,000 vehicles a year after production of the Model Y is added in the initial phase.

The first 15 customers to get the cars on Dec 30 are Tesla employees, the company told Reuters.

The delivery date of Dec. 30 means that the plant will start delivering cars to customers just 357 days after the factory's construction started, which will mark a new record for global automakers in China.

The China-made cars are priced at 355,800 yuan ($50,000) before subsidies and Tesla has said it wants to start deliveries before the Chinese new year beginning on Jan. 25.

BEIJING/SHANGHAI -- Tesla Inc. said it will begin delivering Model 3 vehicles built at its Shanghai factory on Monday.

Construction of its first plant outside the United States began in January and production started in October. It aims to produce 250,000 vehicles a year after production of the Model Y is added in the initial phase.

The first 15 customers to get the cars on Dec 30 are Tesla employees, the company told Reuters.

The delivery date of Dec. 30 means that the plant will start delivering cars to customers just 357 days after the factory's construction started, which will mark a new record for global automakers in China.

The China-made cars are priced at 355,800 yuan ($50,000) before subsidies and Tesla has said it wants to start deliveries before the Chinese new year beginning on Jan. 25.

The Accountant

Active Member

Tslynk67

Well-Known Member

Can all you big brains making vague predictions about an eventual correction just enjoy the run first?

Sheesh

Yeah, but when to offload those option, eh?

Tslynk67

Well-Known Member

Tesla at 37:45

Worth listening folks.

Tslynk67

Well-Known Member

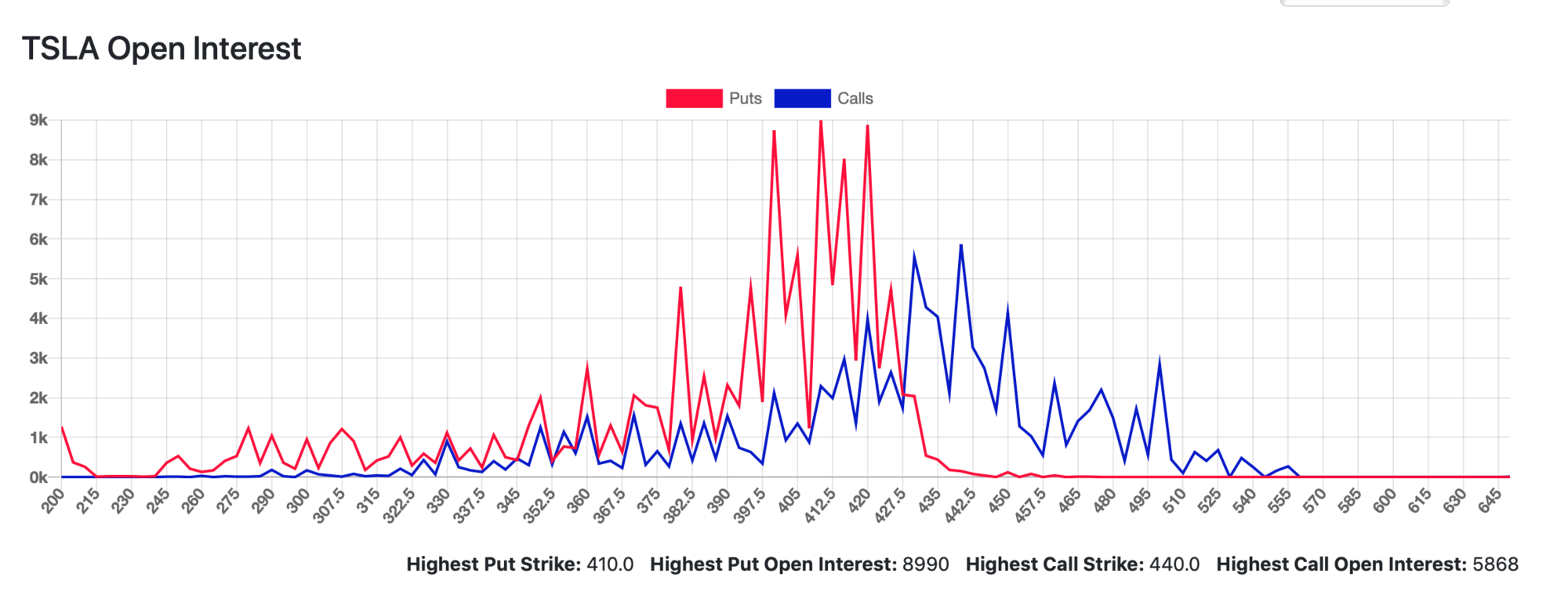

So yeah, $440 today? Or should be just skip that and move straight into the $450's??

Let's see, what's MaxP... Well, I think the algorithms are bust...

Well, well, that's a lot of shitputs being flushed down Spiegel's WC today

But there's gold in them there calls!

Let's see, what's MaxP... Well, I think the algorithms are bust...

Well, well, that's a lot of shitputs being flushed down Spiegel's WC today

But there's gold in them there calls!

TheTalkingMule

Distributed Energy Enthusiast

Macro related due to inflationary or geopolitical concerns.

Call it a market “correction”.

Just feel that’s inevitable - as it always is.

A market correction is indeed inevitable. And it will happen between tomorrow and ten years from now...

Tslynk67

Well-Known Member

Nice try, a-holes!

Ohhhhh, scary!

Ohhhhh, scary!

Last edited:

TheTalkingMule

Distributed Energy Enthusiast

Chickenlittle

Banned

Yes in the infamous statement by Oren Hatch in a senate debate to Ted Kennedy...we’ll drive off that bridge when we get to itCan all you big brains making vague predictions about an eventual correction just enjoy the run first?

Sheesh

J

jbcarioca

Guest

Absolutely true! Still, Tesla remains production limited so nothing they are likely to do will satisfy the demand, assuming anything we are saying has any validity. March is always an odd month in the UK because the supply of the 'hottest' models tends to be inadequate to meet the demand from annual turnover. 'Back in the day' London-area luxury dealers planned for the rush, and for the resale rush for year-old cars. I bought one of those myself, and my closest friend does it annually. Tesla will end out in that business too, eventually. I agree, we honestly don't know where the actual BEV demand will be this year other than UP! ...nor can Tesla.That's all true, but this is the first PIK season for the Model 3: different price class, different demography and different rules. I'm not sure Tesla will be able to pin down the magnitude of the spike in PIK demand accurately on the first try, even if they are perfectly aware of everything in advance.

Did not think red was possible with China news today. I expect this to be short lived, shorts wanted to reposition themselves at 435 because they’re dumb, but some profit gathering before the new year. This thing should shoot back up shortly.

StealthP3D

Well-Known Member

It is extraneous information to the value of the investment - but it has an important effect on another important factor in the outcome of your investment: your emotional state.

When sitting on 2,000% gains it's in my experience easier to keep a cool state of mind going forward if your original high risk options investment has already paid as well as a plain TSLA stock purchase would have paid.

Just like the emotional state of other investors is a big factor in the valuation of a company, so is your own emotional state key to the outcome.

The reason I was highlighting how little the cost basis mattered (only matters for tax purposes) was to encourage more effective investment habits. The goal is to become a better, more efficient and more profitable investor and to achieve this fully requires the elimination of emotions that interfere with that process. Therefore it is necessary to jettison emotional baggage that works against those goals.

I'll be the first to admit that human emotion is an investor's worst enemy and that it is very difficult if not impossible for most people to fully divest oneself of them entirely. But the difficulty is not a good excuse to not try. And that is why I also emphasize the importance of changing your attitude towards money. Because love of money (greed) is what leads to the most damaging emotions in terms of being an efficient and profitable investor. Most people put money on far too high of a pedestal, they have an emotional attachment to money, only by eliminating that can the emotions that hold back your performance as an investor be brought under control.

Having said all that, I also recognize that we are all human. To the extent that an investor is not able to control their emotions, they have another option, the option you bring up. These strategies are less than ideal from a pure performance standpoint but they make investing emotionally easier. For example, the ability to dilute your ideal returns by taking earlier profits on some or all potential gains to placate any human weakness the investor has not been able to master yet. There is no financial cost to mastering these emotions but every investor is where they are at. You can't pretend to have mastered your emotions, either you have or you haven't (actually, it's always a matter or the degree to which you have or haven't mastered them). Early profit-taking is one way to ease the emotional strain. But you will be a better investor if there is no emotional strain to ease. Because it reduces investor performance to protect yourself from these emotions. That said, every investor has to make decisions they can comfortably live with. And if the emotions haven't been mastered, they need to be dealt with (not ignored). I'm simply directing them to the ways they can maximize investing efficiency and profits in the long run while living extremely comfortably within their own skin. And to reiterate, the emotions are brought under control not by force of will, but by letting go, by changing your very relationship with money. By no longer being emotionally attached to money. By not putting money on a pedestal. That is how you get more of it. Ironic, eh?

StealthP3D

Well-Known Member

Why would they start deliveries - and the relevant amortisation expense - with one day left in the quarter? It just doesn't make any sense to ding the quarterly margins that way. This is especially true now that Tesla has secured a new loan in China so that production assets can be financed and not lead to a poor cash position.

They must either have a blowout quarter secured, or have some other contractual obligation that is favourable to deliver this year.

Steady as she goes. They are taking a successful page from MSFT's (and many other top-flight companies) playbook. Even though it might seem counter-intuitive, I suspect by spreading deliveries between Q4 and Q1 it helps smooth the quarterly results. Which is a good goal.

One thing is obvious, they are doing it out of choice, not by force. And they are in a far better position to know what is optimal than ANYONE on this forum.

Tslynk67

Well-Known Member

I think we already ascertained that the recent rise is more to do with: realisation of fundamentals, change in sentiment and accumulation of longs/buyers. So all this effort by hedge-funds and shorts manna from heaven and fuel on the fire for near-future gains.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K