Artful Dodger

"Neko no me"

Here's the unredacted tweet:

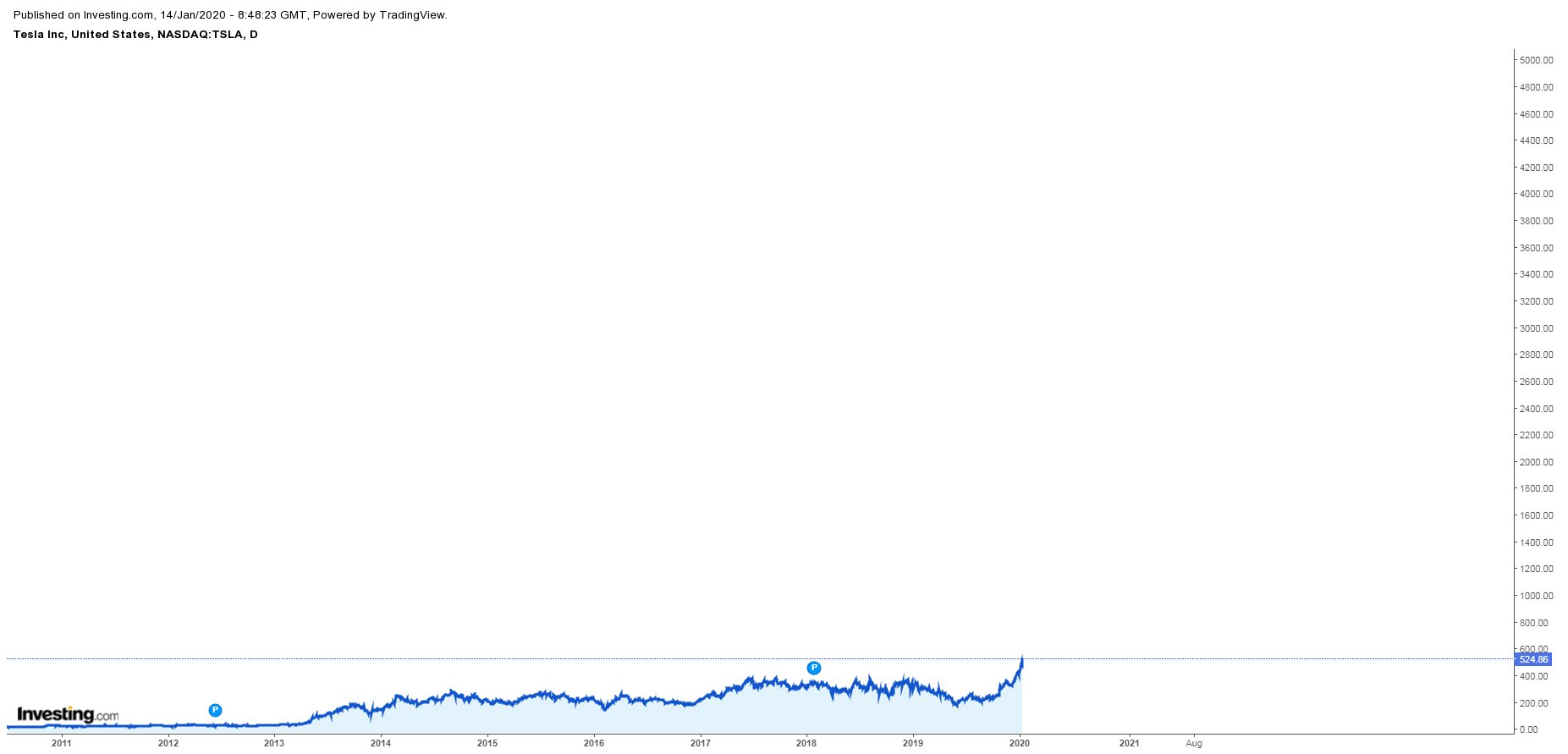

I hope for his sake this shortie doesn't subscribe to the TSLAQ blocklist. These are life-altering decisions, not to be made lightly.

007 on Twitter

"my broker just told me this morning that one of his clients bought $1.2 million worth $300 SHORT TERM PUTS on $tsla and apparently that is all the money the guy has.

"i have a feeling lots of shorts are unfortunately going to lose all their life's savings tryin to short $tsla"

11:39 AM - 28 Jan 2020

"my broker just told me this morning that one of his clients bought $1.2 million worth $300 SHORT TERM PUTS on $tsla and apparently that is all the money the guy has.

"i have a feeling lots of shorts are unfortunately going to lose all their life's savings tryin to short $tsla"

11:39 AM - 28 Jan 2020

I hope for his sake this shortie doesn't subscribe to the TSLAQ blocklist. These are life-altering decisions, not to be made lightly.