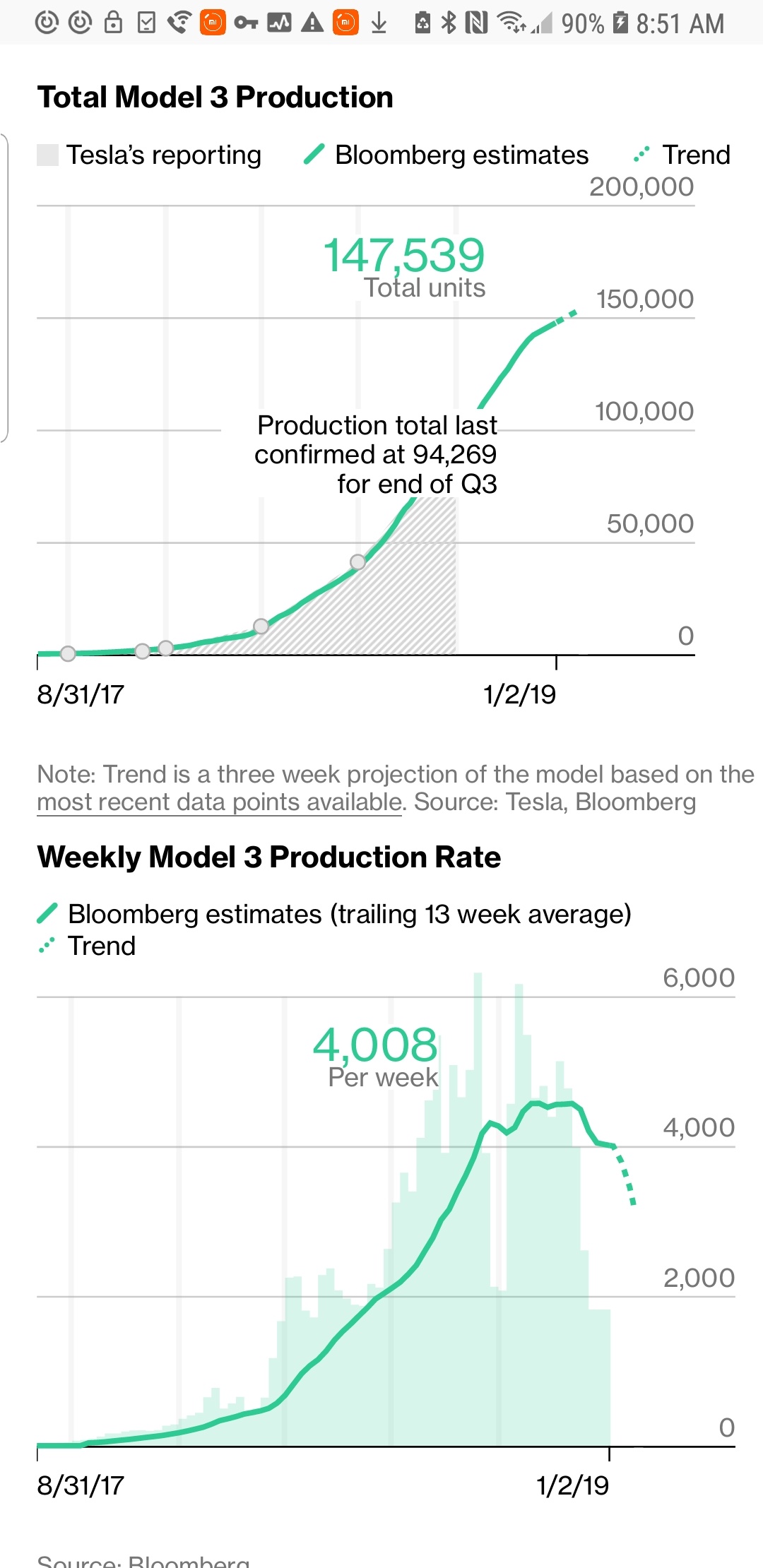

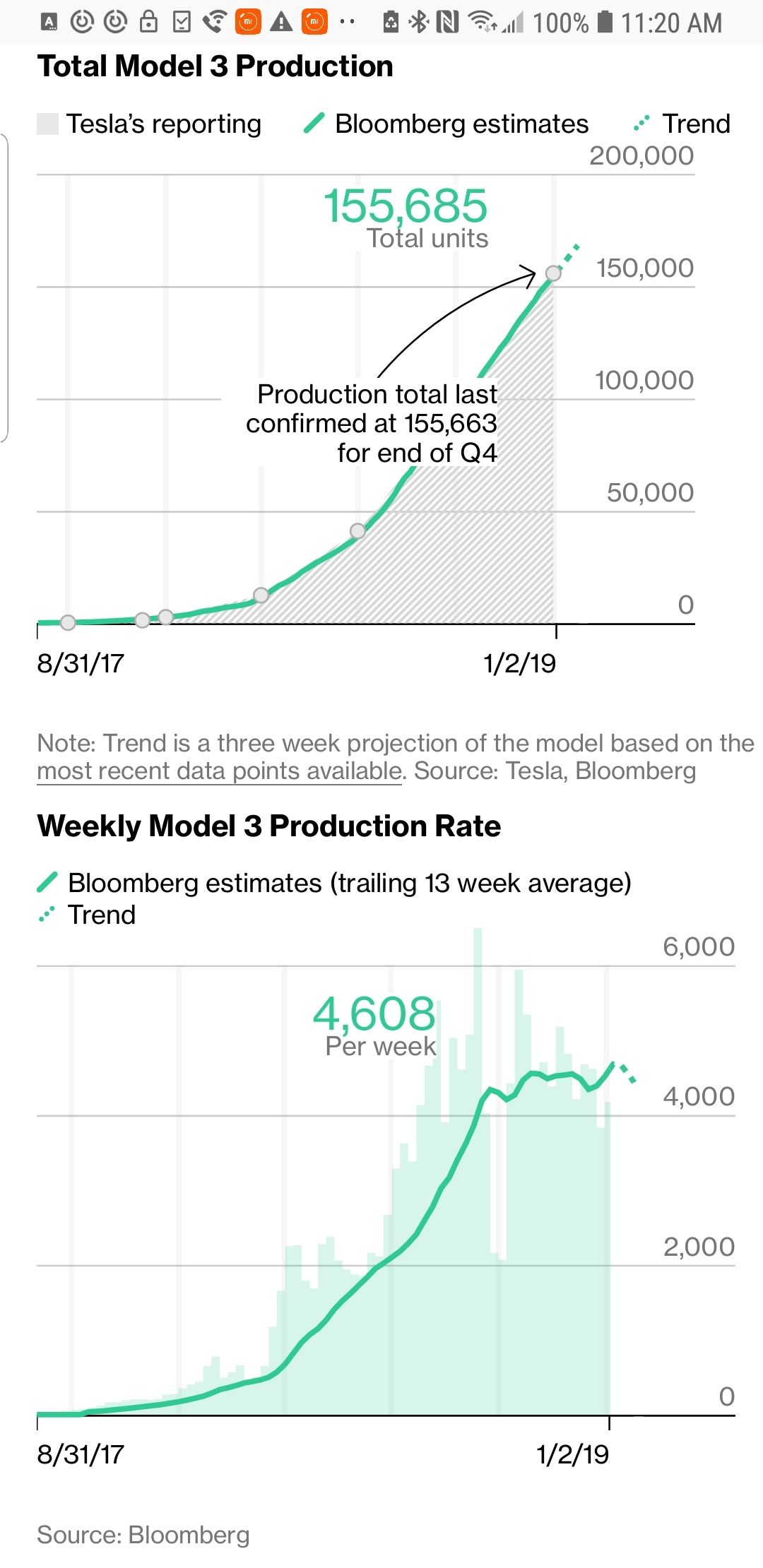

The Bloomberg tracker is a fraud. Analysts and armchair investors point to the Bloomberg estimate and the reported prior accuracy and post bearish estimates. The estimate is really low just up to Tesla's announcement and then revised up the day of to match. Then they claim that they were right all along. If you look at the current page it looks like their model is spot on every time. However, days before the announcement their estimate was way off. I don't know how Bloomberg can condone this kind of activity. Just check reddit or other forums for the estimates prior. They did the same thing in Q3.

From Reddit

level 2

Bartek2858

1 point·

6 days ago

What do you think about Bloomberg Tracker?

Bloomberg estimates ~53500 Model 3 production in Q4. Almost the same as in Q3. Their prediction from 4th December for Q4 was ~60k.

If that ~53k is true then it differs a lot from other predictions.

PS. Bloomberg messed up with Q3 data right after releasing official numbers. They were hugely wrong on daily production but they changed it backwards.

level 3

Teslike

1 point·

6 days ago

My data also suggests less than 53K production for Q4. I use a few different methods and they change between 45,800-53,500. I'm trying to decide on a final estimate.

level 4

Bartek2858

6 points·

5 days ago

Bloomberg did that again. They messed up with tracker again backwards changing their estimates to ~61k (8k difference).

Now there is no evidence that they were estimating much lower values (daily and quarterly) for months.

They are cheating like VW.

-------------------------

and then today Bloomberg has on their site:

Tesla production Bloomberg estimate Difference

2018 Q1 9,766 9,285 -5%

2018 Q2 28,578 27,957 -2%

2018 Q3 53,239 53,457 +0.4%

2018 Q4 61,394 61,113 -0.5%

Source: Tesla, Bloomberg